[ad_1]

Hong Kong’s Securities and Futures Fee (SFC) has taken a brand new strategy to the crypto trade. This new approach to regulate the nascent sector may benefit the crypto market and convey a brand new wave of capital to the biggest digital property within the ecosystem.

On Monday, Hong Kong made clear its intentions to open the door to crypto buying and selling within the Asian area in what seems to be a totally totally different strategy to the enforcement actions taken by the U.S. Securities and Trade Fee (SEC).

Digital asset market knowledge supplier Kaiko weighed in on the matter in a latest weblog publish, suggesting that Asia seems to be positioning itself on the forefront of the subsequent digital asset revolution by welcoming crypto enterprise. Kaiko Analysis Analyst Conor Ryder stated:

An attractive East might effectively be the subsequent catalyst that propels crypto costs upwards, with some proclaiming that this run has already began, propelled by an Asian-linked token rally.

Why The Sudden Crypto-Pleasant Coverage From Hong Kong?

Why, after a tumultuous 12 months, low costs, and debacles from exchanges and corporations like FTX, are Hong Kong and presumably different jurisdictions loosening the regulatory insurance policies within the area? Kaiko analyst Conor Ryder means that given the “carpet bomb” from the SEC, now’s the proper time for Hong Kong to strike.

The inflow of recent capital into Hong Kong and Asia might imply financial progress for the area and Asian exchanges. Information compiled by Kaiko exhibits that Asian exchanges benefited probably the most from the 2021 bull run. Nonetheless, since China outlawed digital property on the finish of 2021, Asia has considerably lagged behind different areas when Binance’s buying and selling volumes.

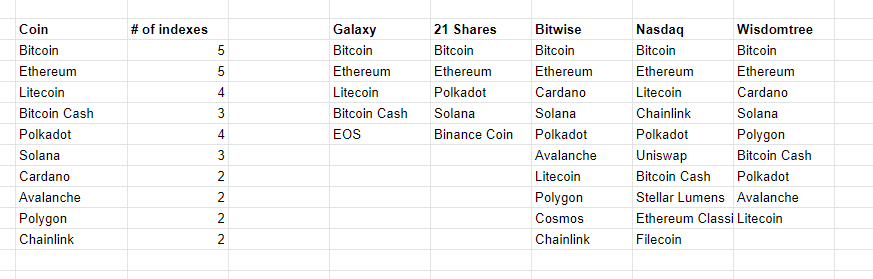

In keeping with the SFC’s proposal, they may permit buying and selling within the “largest cap digital property” included in no less than two accredited indices.

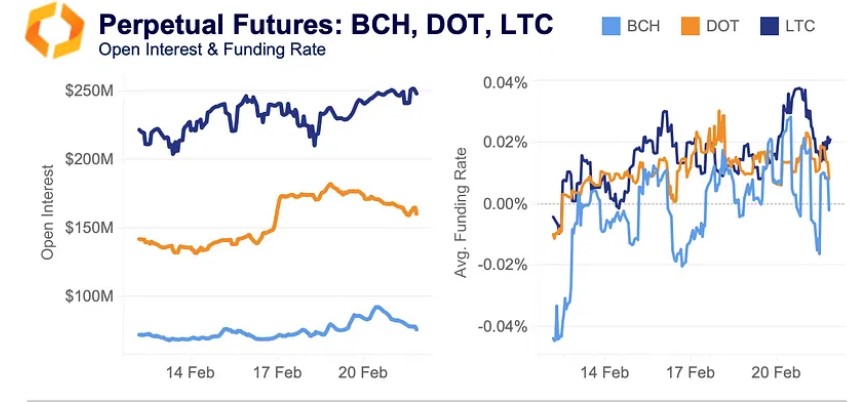

The perpetual futures markets reacted positively to the belief that the listed tokens might see renewed flows from Asia, with open curiosity in Bitcoin Money, Litecoin, and Polkadot rising 15% final week, based on Kaiko Analysis. Funding charges additionally moved positively and have principally held up because the announcement.

The announcement of a brand new regulatory strategy from Hong Kong, with alleged assist from China, might be seen as optimistic for crypto in the long run. Within the meantime, the market continues to be deciding which method costs will go, for a continuation of the crypto winter or a brand new bull market. Conor Ryder concluded:

The timing of the announcement, whereas the SEC cracks down on crypto, seems to be intentional and may very well drive crypto enterprise out of the US and in direction of Asia over time.

The entire market capitalization as of this writing is $1.02 trillion, representing a lower of -3.13% within the final 24 hours. Bitcoin’s market cap is $449 billion, with a 40.33% dominance.

Stablecoin’s market cap is at $137 billion and has a 12.29% share of the overall market cap, based on CoinGecko knowledge.

Featured picture from Unsplash, chart from TradingView.

[ad_2]

Source link