[ad_1]

After you obtain bitcoin, you’ll must retailer it in a safe digital pockets. This information helps you perceive what a pockets is and the way there are totally different wallets to fit your wants.

A pockets is the place you sometimes retailer your bitcoin after buy, similar to a bodily pockets is used to maintain your money and playing cards.

When you perceive bitcoin and are prepared to purchase it, earn it or obtain it as cost in change for items and providers, you need to arrange a pockets in order that your counterpart has a digital deal with to ship the bitcoin to.

Your pockets should even be safe and strong for storing your bitcoin. These days, there are many digital wallets to select from and this information gives complete info that can assist you make the proper alternative.

Wallets will be hardware-based or software-based, will be downloaded on a cellular system, on a pc desktop or saved on paper by printing a QR code that permits entry to the non-public keys.

WHAT IS A BITCOIN WALLET

A bitcoin pockets is an digital system that permits you to ship, obtain and entry your funds, just like how a conventional pockets shops your banknotes or cash. In distinction with a bodily pockets, a bitcoin pockets doesn’t retailer precise cash however the non-public key — cryptographic knowledge — that proves possession and provides entry to the precise cash that’s held on the blockchain.

Dropping the non-public key or having it stolen is a Bitcoiner’s worst nightmare as a result of it means the funds are misplaced. For this reason securing this cryptographic knowledge is the very first thing you have to do if you purchase or obtain bitcoin. Your non-public key is also misplaced by means of hacking, phishing, pc malfunctions or the lack of the system itself.

In mild of what occurred to Celsius, Voyager, Three Arrows Capital and FTX in 2022, once they misplaced all their prospects’ bitcoin by means of poor enterprise practices, resulting in their bankruptcies, the case for self-custody couldn’t be stronger. Whereas these bankruptcies have been a tough tablet to swallow for the cryptocurrency business, they weren’t Bitcoiners’ first rodeo with bankrupt exchanges, for the Mt. Gox hack in 2014 led to the preliminary motion of “not your keys, not your cash,” which has continued to this present day.

Bitcoiners usually consult with themselves as sovereign people. To be a sovereign particular person, you should take self-custody of your BTC. To do that, you should study wallets.

WHY USE A BITCOIN WALLET

“Not your keys, not your cash” is a robust Bitcoin mantra, that means in case your pockets doesn’t offer you unique entry to your non-public keys, you don’t truly personal bitcoin. As an alternative, a 3rd social gathering — like an change — will maintain it for you similar to a financial institution retains custody of your cash.

Bitcoin was created to supply an alternative choice to the banking system so your pockets will provide you with monetary sovereignty with out intermediaries, safety from rehypothecation and the flexibility to retailer your wealth safely.

Bitcoin teaches you to take private duty on your cash, leading to you storing your BTC safely and spending it properly. One of many first issues you should study whereas exploring this path is how wallets work.

HOW DO WALLETS WORK

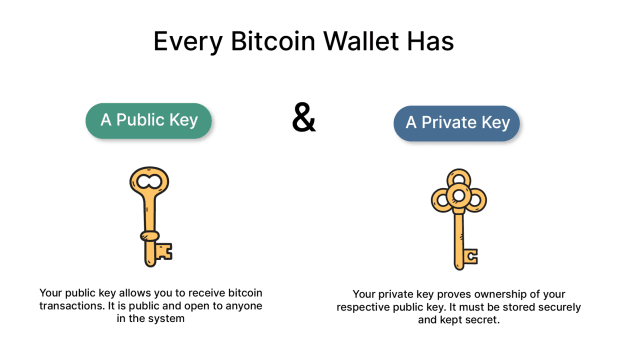

The Bitcoin timechain — also called a blockchain — is a shared public ledger the place all bitcoin worth transfers are carried out by means of bitcoin wallets. The pockets’s non-public key’s your go-ahead to make use of your cash, the authorization and verification that you’re the rightful proprietor of the bitcoin in your pockets. It’s just like the password that permits you to enter your on-line banking.

Non-public keys are 256 digits lengthy, making them impractical for storing, transacting and securing your cash. For this reason they’re protected in a bitcoin pockets that can routinely activate them for transacting, in pair with a public key.

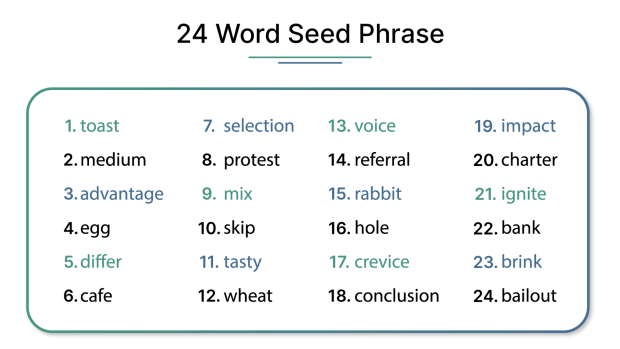

While you create your bitcoin pockets, a seed or restoration phrase is routinely generated to retrieve your funds in case you lose entry to your non-public key. A seed, mnemonic or restoration phrase is a succession of 12 or 24 phrases that might be used to generate any Bitcoin key you have to ship and obtain bitcoin.

Such pockets setup is homogeneous throughout the board, however totally different wallets exist to fulfill numerous necessities and preferences.

There are numerous sorts of bitcoin wallets, relying in your necessities. Try to be conscious that all of them current some degree of threat — particularly custodial wallets that third events management. We really helpful that you simply comply with the steering under to keep away from expensive errors and threat shedding your funds:

Don’t use a pockets that doesn’t offer you restoration knowledge.Don’t use a paper pockets until you’re a complicated person and acknowledge the dangers concerned.Giant quantities of bitcoin ought to ideally be saved in multisig wallets.Keep in mind to arrange restoration directions on your heirs.

DIFFERENT TYPES OF WALLETS

Cell wallets

Cell wallets are apps like Bitcoin Pockets and BlueWallet. They’re handy moveable instruments offering a QR code for fast face-to-face transactions. Some even use near-field communication (NFC), permitting customers to faucet their telephones towards the service provider terminal with out offering ID verification.

They arrive with vital dangers as they’re the least safe, given how straightforward it’s to lose your cellular system. You possibly can nonetheless restore your pockets on a brand new telephone for those who maintain the non-public keys; nonetheless, on account of their on-line reliance, you may lose entry on account of hacks that may result in shedding your funds. Because of this, they’re greatest really helpful for small transactions and will not be appropriate for storing giant quantities of bitcoin.

Utilizing two-factor authentication (2FA) for further safety, ideally an authenticator app like Google Authenticator, makes the pockets much less susceptible to hacks or sim-swap assaults.

Net wallets

Net-based wallets are often exchange-based wallets like BitGo or Blockchain.com that allow you to retailer your bitcoin and make transactions. They’re thought-about scorching wallets as a result of they’re on-line web sites that want an energetic web connection.

Customers’ non-public keys are saved on the supplier’s server, which makes them extremely susceptible to hacks or confiscation if one thing goes unsuitable with the change. It’s extremely really helpful to keep away from storing nearly all of your bitcoin in a scorching pockets.

Desktop wallets

Desktop wallets, like Atomic Pockets and Electrum — one of many unique bitcoin net wallets, round since 2011 — are open-source packages that may be downloaded in your pc and retailer your non-public keys in your onerous drive.

Whereas they’re typically safer than cellular or net wallets since you aren’t trusting third events to carry your cash, they’re nonetheless susceptible to hacks by means of an web connection.

Chilly Storage wallets

Chilly storage wallets are any type of pockets that stay on a tool that isn’t linked to the web. Offline connection protects the pockets from any type of internet-based assault.

{Hardware} wallets and paper wallets are your typical chilly storage options. There’s additionally deep chilly storage, which is any chilly storage pockets buried deep within the floor, secured in a vault or any such technique in order to make sure your bitcoin is significantly extra inconvenient to entry than it in any other case could be.

{Hardware} wallets

{Hardware} wallets are bodily units, like USB drives, that retailer your non-public keys offline. They don’t seem to be linked to the net and are often thought-about very safe since pc viruses or on-line hacks can’t assault them.

Setting them up requires some technical abilities, however the producer often offers a step-by-step information that’s straightforward to comply with. Attempt the pockets with little cash first to achieve expertise and really feel safer working a transaction. Solely load it with bitcoin as soon as you might be assured sufficient to switch vital cash.

At all times be sure you’re buying the {hardware} pockets from an unique producer like Ledger, Trezor or COLDCARD, as faux wallets retrieved in marketplaces like Amazon or eBay will steal your bitcoin.

Paper wallets

Paper wallets are additionally thought-about chilly storage, requiring you to retailer your non-public keys offline on a bit of paper that you simply print out as a QR code. These will be rapidly scanned so as to add the keys to a software program pockets to make a transaction.

They’re hardly ever used these days as a result of abundance of options, however they’re very safe since no hacker can entry and steal the passwords. They’re additionally very non-public since there can’t be any dissemination of private knowledge on the web.

Multisig wallets

A multisig pockets would require a couple of non-public key to signal and authorize a bitcoin transaction, including an additional degree of safety. It signifies that numerous folks, typically two out of three (or three out of 5), should approve a transaction limiting the probabilities {that a} hack or theft occurs, which single-signature wallets are extra susceptible to expertise.

The transaction is finalized as soon as the required signatures approve it. There’s no hierarchical order among the many signatures required; solely the variety of signatures per setup is required.

WHAT TO CONSIDER WHEN CHOOSING A WALLET

Bitcoin-only Pockets or Multicurrency Pockets

Each cryptocurrency pockets will allow you to retailer bitcoin, however just some bitcoin wallets will allow you to retailer cryptocurrencies aside from bitcoin. If you’re centered on sound cash with no distractions from different cryptocurrencies, contemplate the choices we offer right here and simply deal with a safe bitcoin-only pockets that grants you management over your non-public keys.

Analysis Pockets’s Fame

Bitcoin Journal endeavours to offer you tutoring on essentially the most trusted and dependable bitcoin wallets in circulation; nonetheless, loads of materials on the web gives you a transparent understanding of the totally different wallets and their status. Software program engineer and Bitcoin advocate Jameson Lopp, for instance — who can also be CTO and co-founder of main self-custody answer Casa — offers among the most dependable and complete academic materials associated to Bitcoin on his private web site.

Analysis Pockets Backup Choices

It could by no means be confused sufficient that backing up your pockets needs to be a precedence. The elemental restoration possibility you’ve gotten is to again up your non-public keys securely by writing down and storing your pockets seed phrase in a secure bodily location that you simply keep in mind.

By no means do that on-line, not even on the cloud or your pc, the place your funds are all the time in danger that hackers may steal them.

Analysis Key Administration

Non-public key administration is a vital part of your pockets; consider how your checking account is protected and also you’ll get the thought. Study in case your non-public key has an automated cloud backup or a handbook one; in case your pockets helps you to retailer your keys externally or on the identical system because the pockets software; if a number of impartial keys handle it.

Perceive the aim of your pockets

Think about what’s most necessary to you when selecting your pockets:

Comfort: do you want a pockets for every day transactions, for cellular use or buying and selling?Safety: this could all the time be your precedence, no matter a kind of pockets.Anonymity: some wallets are extra privacy-focused than others. Wasabi Pockets & Joinmarket supply excessive ranges of privateness.Lengthy-term investing: A pockets to retailer bitcoin as a long-term funding.Gifting: a pockets like Opendime which is appropriate for giving bitcoin as a present with out revealing the non-public key.

HOW TO SET UP A WALLET

Establishing a bitcoin pockets is less complicated than it sounds and most units are user-friendly and appropriate for newcomers. Most often, it’s straightforward to comply with the system’s directions as you undergo the method. Nonetheless, under you could find the everyday process of organising a pockets:

Obtain and set up the software program, cellular or desktop pockets from the supplier’s web site solely. You’ll must comply with the producer’s directions to arrange a {hardware} pockets.Use the system’s directions; they’re often straightforward to comply with. When you obtain the app or the software program, you’re sometimes prepared to make use of it.Safe your non-public key by writing down your restoration phrase, to be able to restore your pockets must you ever want to take action;Switch solely a small quantity of bitcoin first to get some pockets follow.

Learn Extra >> Tips on how to arrange a Bitcoin pockets

Safety dangers when utilizing a Bitcoin pockets?

Bitcoin wallets are a well-liked strategy to retailer and use your bitcoin. Nonetheless, like all digital units, they’re inclined to safety dangers. A few of the commonest safety dangers related to bitcoin wallets embody the next:

Theft: If somebody features entry to your pockets, they’ll steal your bitcoin. So maintain your pockets(s) in a safe and secure place always.Coercion: you could be bodily coerced handy over your stack (that is known as a $5 wrench assault), which can be averted with multisig and chilly storage options. Hacking: bitcoin wallets will be hacked, which may consequence within the theft of your bitcoin. Hacking can happen in several methods, together with phishing and brute power assaults.Malware: Bitcoin wallets will be contaminated with malware, that are programmed to steal your bitcoin. So guarantee your Working System is clear and virus free.

Probably the most safe strategy to retailer your bitcoin is to make use of a {hardware} pockets together with a multisig answer. That is the strategy you need to take for almost all of your bitcoin or people who you plan to HODL for an extended period.

Tips on how to make your pockets safer

When a financial institution holds your cash in your behalf, the financial institution is liable for defending it so that you don’t should be involved about the specter of a theft, hearth, flooding or any type of loss.

While you personal bitcoin and you are taking private duty for safeguarding it, you develop into your personal financial institution and also you inherit the identical issues that any financial institution supervisor or financial institution safety skilled would have. The onus falls on you, and also you alone, to guard your wealth.

Fortunately, there are lots of choices obtainable to us within the type of wallets which assist us safe our funding. Some wallets safeguard your bitcoin greater than others, so it’s important to do your analysis earlier than selecting one. Listed here are additional measures you may take to make your pockets safer.

Retailer your seed phrase safely

If you wish to maintain your seed phrase secure, it’s important to retailer it in a safe place. You possibly can take a couple of easy steps for extra peace of thoughts: you may maintain it on a bit of paper, in a cryptographically safe secure or on a metallic plate like those supplied by Coldbit or Blockplate.

Hold it hidden from others, and don’t inform anybody your seed phrase. Cut up the seed phrase in two for additional safety and maintain them separate. Be artistic together with your Bitcoin safety, so long as you keep in mind the place and how you can get well your funds!

Add twenty fifth phrase

When organising your pockets, the system recommends you safely retailer your seed phrase, which is often a collection of 24 phrases. Some wallets permit an extra phrase, the aim of which is to additional encrypt your root seed. In case your 24 phrases are compromised, the particular person holding these phrases will unknowingly want the twenty fifth phrase to be able to entry your root keys. This answer buys you the time to swap wallets, ought to you have to.

Use a multisig system

Utilizing a multisig system is without doubt one of the greatest safeguards on your bitcoin. There are two sorts of multisig options: hosted — like Casa and Unchained, that maintain the non-public keys for you — and unhosted the place you inherit full management, and every model has their benefits and downsides.

Decoy passphrase

A decoy passphrase is a system used to guard password databases, permitting hackers to consider they’ve cracked the file, solely to be given legitimate credentials which don’t present entry to the non-public keys. Cybercriminals will nonetheless be capable of crack that file; nonetheless, the passwords they’ll get again are faux or decoy passwords.

Use a couple of pockets

Utilizing a couple of pockets and spreading your funds throughout them could cut back the possibilities of shedding all of your funds from one level of failure. Be sure to apply all the safety measures mentioned above to your entire units to strengthen their accessibility.

Entry from a safe pc

Cut back your pc’s possibilities of being hacked and your funds stolen through the use of a tool solely devoted to bitcoin administration. It’s value it, as overused computer systems are extra liable to choose up malware, significantly these with weak OS safety.

Use together with a full node

Utilizing your pockets with a full node represents the final word safety measure you would take to safe your funds. Furthermore, working a full node strengthens the community, benefiting all Bitcoin customers.

Utilizing a node protects you towards fraudulent actions: no rule breaker can have an effect on your funds because you’re utilizing a decentralized device that permits you to act in a trustless surroundings. Be certain that your light-weight pockets permits you to configure how to connect with your personal full node.

INHERITANCE PLANNING

No person likes to consider leaving this world or being incapable of managing their cash in the future; nonetheless, you might have questioned what occurs to your bitcoin if you die? In case you’re managing your personal Bitcoin keys, you’ll must plan how you can cross them on to your heirs.

Proudly owning your personal keys and being your personal financial institution already requires a big degree of duty and interested by your succession too is perhaps discouraging for some. The very first thing you need to do is speak to your solicitor and create a will, in order that the executor can cross down the data of what you plan to do together with your BTC.

There are sometimes two methods of coping with the inheritance of your bitcoin, though they each require some authorized help for peace of thoughts:

Handbook technique: You’re possible the educated particular person on this material, so along with the non-public keys, you’ll must cross on to your heirs the directions explaining what to do with the non-public keys. The keys needs to be saved with trusted relations, a authorized staff or ideally a mixture of each. It’s advisable to not present full entry to anybody social gathering, to make sure no social gathering ever has full management or untimely management. Paid for service: Service suppliers like Casa, can work with you to create an inheritance plan that enables your heirs to entry your bitcoin on the proper time, with the assistance of a authorized and technical staff that may unlock the funds on your beneficiaries.

You can even discover quite a lot of helpful recommendations on planning inheritance processes in a guide known as “Crypto Asset Inheritance Planning,” written by American legal professional and entrepreneur Pamela Morgan, with the technical supervision of Bitcoin educator Andreas Antonopoulos.

FREQUENTLY ASKED QUESTIONS

The place can I purchase a {hardware} pockets?

At all times purchase your bitcoin pockets from essentially the most safe supply, which is the system producer or the official vendor. By no means purchase from marketplaces like Amazon or eBay, because the system could also be compromised — even when it seems new — and your funds could also be stolen. It’s all the time greatest to spend extra and safe your funds than remorse not going the secure strategy to purchase a model new pockets.

What’s the greatest Bitcoin pockets for worldwide folks?

Most bitcoin wallets can be found worldwide as a result of they’re open-source and decentralized units. Wallets like Electrum, Blockstream Inexperienced or the {hardware} sorts can be found to obtain or purchase from most nations; subsequently, selecting one of the best worldwide pockets means selecting essentially the most appropriate system on your wants.

How a lot does a Bitcoin pockets value?

Most cellular or net wallets are free. Nonetheless, if you wish to spend money on chilly storage, the associated fee can vary from $60 for a Ledger Nano S to over $200 for the additional safe Trezor Mannequin T.

How do I arrange a bitcoin pockets with no ID?

Most bitcoin wallets don’t require ID verification. When shopping for a {hardware} pockets, you should present particulars to obtain the system. It’s endorsed to make use of artistic methods to avoid dispatch of your bodily deal with and even your title, e mail and phone quantity.

For instance, the least you are able to do is present a generic supply deal with of a retailer close to you (or not) that might obtain the pockets as a service. You possibly can even alter your title barely, however the retailer could ask for proof of id, so maintain that in thoughts.

How lengthy wouldn’t it take to crack a Bitcoin pockets?

The excellent news is that for those who use all of the talked about measures, it is going to be almost unattainable to crack your bitcoin pockets. In case you use an internet or cellular pockets in what’s known as scorching storage, your funds are in danger. In case you’re utilizing scorching storage, be sure you use essentially the most strong password attainable.

It’s been calculated {that a} four-digit pin code takes as little as 5 milliseconds to crack, whereas the longer your password is, the higher. Twelve random letters would take two centuries to crack with in the present day’s know-how.

Can regulation enforcement seize a bitcoin pockets?

Sure, they’ll. Although it is determined by the kind of pockets and the safety precautions taken.

Scorching wallets or wallets hosted by centralized service suppliers are the best threat, as regulation enforcement companies may simply crack a bitcoin scorching pockets or persuade a centralized service supplier to supply entry to the non-public keys to freeze — or seize — your bitcoin.

A chilly pockets system might be seized by authorities however, until you present them with the non-public keys, the password and restoration seed, that system is ineffective they usually gained’t have your bitcoin.

A multisig pockets, as an alternative, is once more your greatest safety towards seizure as a result of, even below coercion, you wouldn’t be capable of present the total set of keys to entry your bitcoin. That is very true in case your keys are saved in separate areas or held by totally different entities.

Learn Extra >> Bitcoin privateness and safety information

What occurs If I neglect my pockets password?

A pockets password will be retrieved or reset. It’s the non-public key you have to be cautious to maintain safe always, as for those who neglect it or lose entry to it, you could lose your funds.

IN CONCLUSION

Your wealth is at stake for those who don’t shield your bitcoin and strong, safe and non-custodial wallets are the way in which to do it.

Typically, small quantities of bitcoin will be saved wherever for those who’re trying to commerce or spend them. Nonetheless, for extra appreciable quantities, multisig wallets in chilly storage, used with a full private node is the final word degree of safety you may present to your bitcoin.

Bitcoin wallets have been within the highlight not too long ago with governments, just like the EU, making an attempt to ban them or at the very least restrict their privateness and autonomy from third events. Whereas Bitcoin can’t be banned or censored, its decentralization and sovereignty might be compromised by persecutory actions enacted by authorities.

With every part that’s been taking place within the cryptocurrency business for years, from a regulation standpoint to prison actions, change hacks and so forth, Bitcoin is widening the hole with “crypto” and discovering its personal moral stance supported by firms which can be solely concerned with its financial soundness.

It’s by no means been extra necessary to take private duty and custody of your bitcoin significantly, and studying how you can safe it’s that little further effort that must be made to scale back the chance of parting from essentially the most highly effective asset you’ve ever held.

[ad_2]

Source link