[ad_1]

Over the previous few weeks, the worth of Tron (TRX) has skilled an upward motion. Nonetheless, it has struggled to interrupt via a vital resistance stage for a major time period.

Within the final 24 hours, TRX noticed a 1% improve, whereas on the weekly chart, it recorded a 3% achieve. The bullish momentum has been maintained since surpassing the $0.68 value stage. The technical outlook suggests a possible shift in direction of bullish affect.

Demand and accumulation indicators have proven enchancment within the day by day timeframe. Whereas Tron has managed to withstand the broader market sentiments affecting different altcoins, it stays weak to fluctuations within the Bitcoin value.

To maintain its day by day good points, it’s essential for TRX to surpass the quick resistance stage. Failure to take action could end in a reversal of its upward development. The rise within the TRX market capitalization signifies that demand has began to revisit the market.

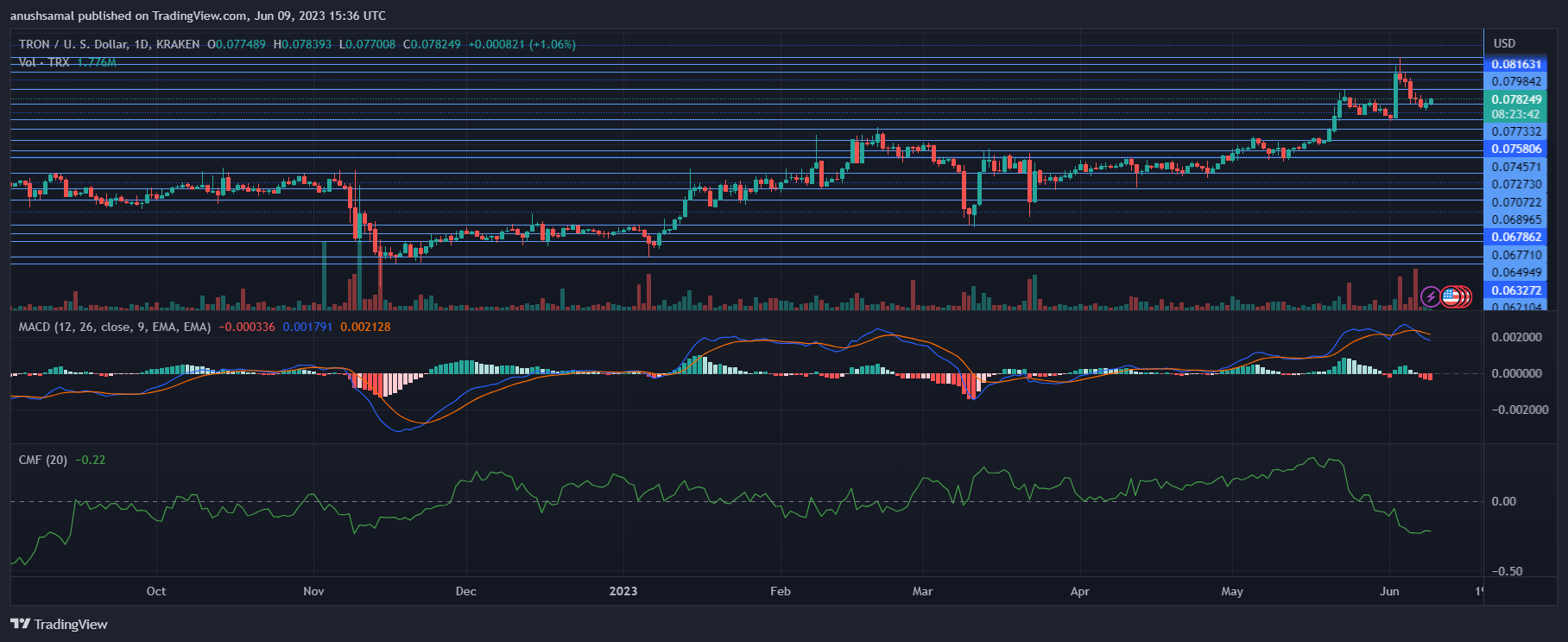

Tron Worth Evaluation: One-Day Chart

On the time of writing, Tron (TRX) was buying and selling at $0.078. The altcoin confronted overhead resistance at $0.079, and a profitable transfer above this stage would probably propel TRX above the $0.080 mark. Nonetheless, whether it is rejected at $0.079, the coin might expertise a major decline.

It’s price noting that TRX has beforehand confronted rejection on the $0.083 stage, which is able to function an necessary resistance. On the draw back, the closest assist for Tron is positioned at $0.074.

If TRX fails to carry above this assist stage, it could drop additional to $0.068. The buying and selling quantity of TRX within the final session was inexperienced, suggesting that consumers have began to determine management over the worth.

Technical Evaluation

Following a interval of decreased investor curiosity earlier this month, Tron (TRX) is presently displaying indicators of restoration by way of demand on the day by day chart. The Relative Energy Index (RSI) signifies that consumers are exerting dominance available in the market, as it’s above the half-line. This implies a constructive sentiment and elevated shopping for strain.

Moreover, the worth of TRX has moved above the 20-Easy Transferring Common (SMA) line, indicating that consumers are answerable for the worth momentum available in the market.

This additional helps the notion that purchaser dominance is prevailing. To maintain this purchaser momentum, it’s essential for TRX to interrupt previous the $0.079 resistance stage. If TRX efficiently surpasses this stage, it could proceed its upward motion

Opposite to rising demand, TRX has maintained promote indicators on the day by day chart based mostly on the Transferring Common Convergence Divergence (MACD) indicator.

The MACD histogram shaped crimson bars, indicating promote indicators for the altcoin. This implies a possible decline in value if TRX fails to maneuver above the quick resistance stage.

Moreover, the Chaikin Cash Circulation (CMF), which measures capital inflows and outflows, is under the half-line. The upcoming buying and selling periods might be essential for TRX to find out its future route.

Featured Picture From UnSplash, Charts From TradingView.com

[ad_2]

Source link