[ad_1]

Fast Take

Stablecoin demand appears to be like extraordinarily weak — particularly on this present market setting.

Patrick Hansen from Circle believes the stablecoin demand is rising. Nevertheless, the information signifies that this isn’t the case.

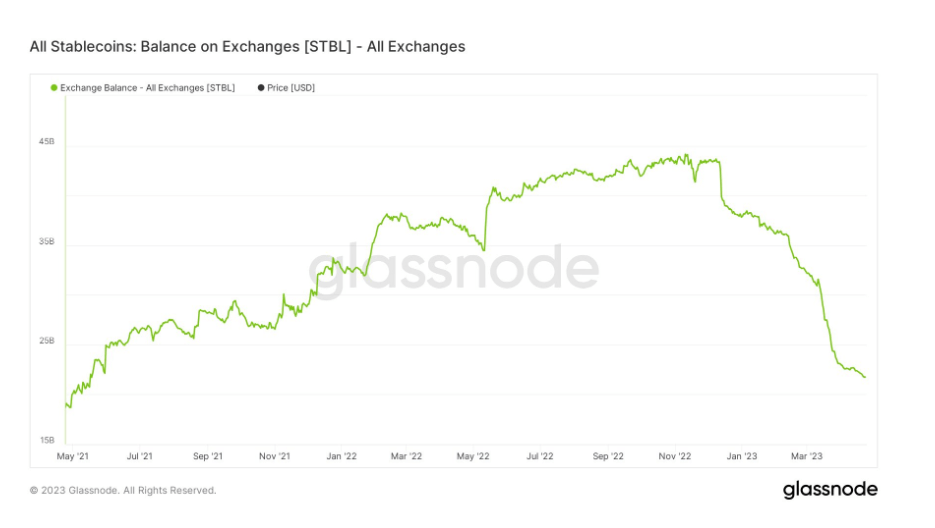

Stablecoin stability on exchanges has dropped significantly from its peak in November 2022. From $44 billion to below $22 billion — which has both been transformed for fiat or Bitcoin.

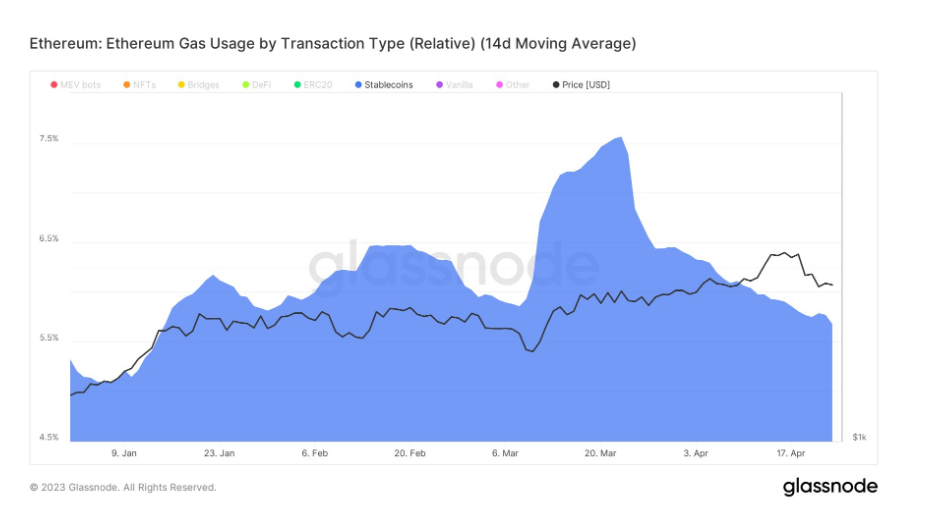

Subsequent, gasoline utilization on Ethereum for Stablecoins has additionally significantly dropped for the reason that SVB collapse in March. This represents simply 6% of the whole gasoline utilization from 7.5%.

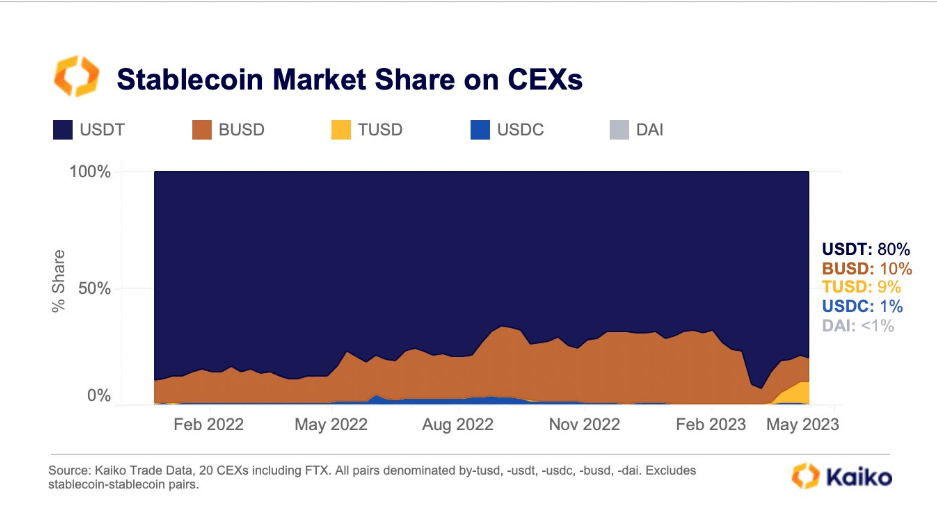

Whereas based on Kaiko analysis, TUSD now accounts for 10% of worldwide stablecoin commerce quantity on centralized exchanges. Practically all this quantity is from the BTC-TUSD pair on Binance — which has zero charges.

The submit The shocking reality behind stablecoin demand: A steep drop contradicts business expectations appeared first on CryptoSlate.

[ad_2]

Source link