[ad_1]

Bringing the S&P 500 on-chain

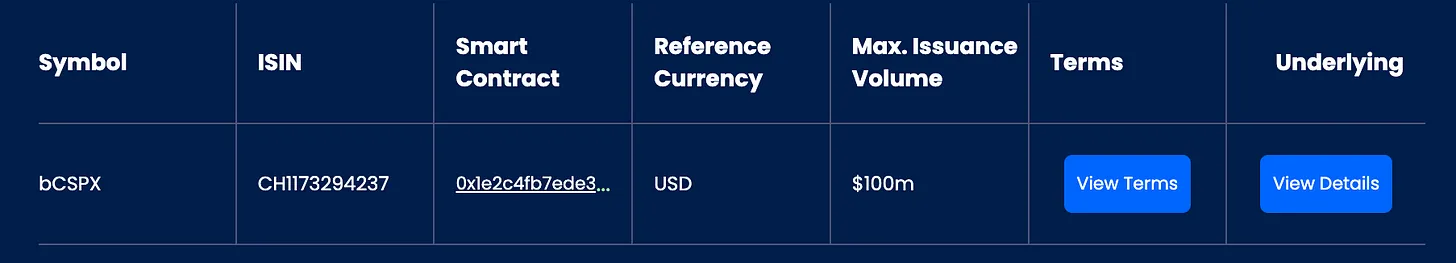

bCSPX token particulars

bCSPX token particulars

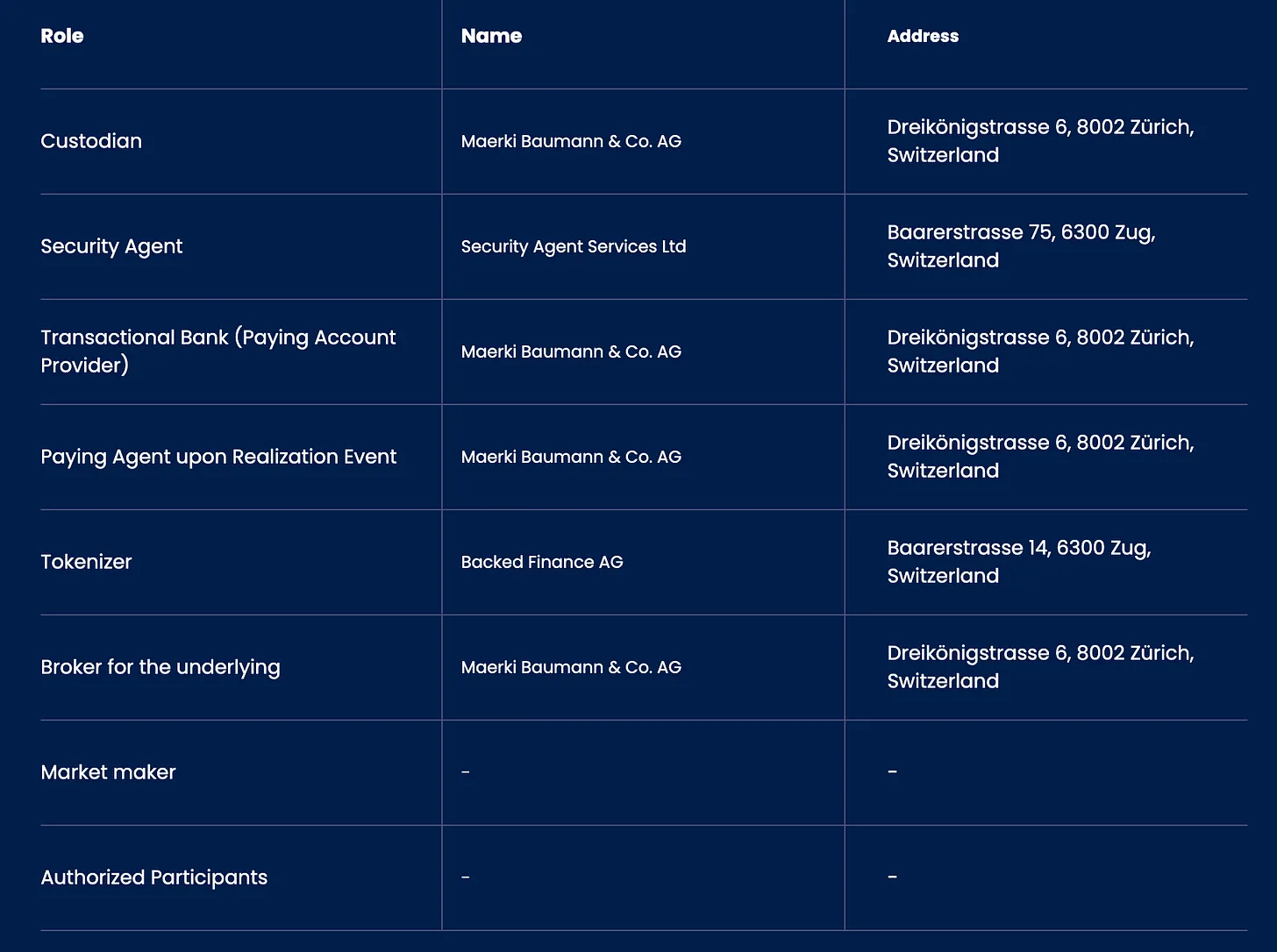

The charges taken by the underlying investor are said as as much as 0.5% of {the marketplace} of the underlying ETF. Because the underlying is an everyday ETF, it is counting on conventional monetary markets asset infrastructure together with its dealer, safety agent and custodian.

Conventional monetary service suppliers assist the bCSPX token

Conventional monetary service suppliers assist the bCSPX token

While this goes towards the thought of a totally native DeFi asset, this playbook is more likely to be essentially the most viable method to driving widespread adoption of DeFi expertise in finance.

A brand new distribution platform for TradFi

There’s already a mess of platforms providing asset tokenisation companies, however what we have now but to see is the supply of public market securities on blockchains. Public blockchains are successfully a brand new distribution platform for these belongings. At present, retail buyers must undergo a dealer to entry them, be {that a} dealer within the conventional sense or a fintech platform corresponding to RobinHood.

There are two beneficiaries of this:

Firstly, any belongings which are out there on a public blockchain have a world attain. We have seen how transformative entry to stablecoins corresponding to USDC is within the developed world, and the identical may occur with securities too. Enabling anybody globally to carry an ETF monitoring the S&P 500 significantly democratises entry to monetary merchandise.

Secondly, the programmable nature of blockchain belongings will create many new alternatives for innovation. What’s there to cease builders from creating self-managing composable portfolios of equities or ETFs which are managed completely through sensible contracts?

We have seen lots of the world’s largest manufacturers and artists embrace NFTs to offer a brand new channel to interact with their prospects and followers. Issuing totally collateralised belongings on public blockchains is an equal alternative for the monetary companies trade.

On the present time, organisations corresponding to Circle and Backed are positioning themselves for offering the companies to convey completely different monetary belongings on-chain. If we put regulatory hurdles apart, is there a motive why exchanges couldn’t probably supply such merchandise to retail buyers?

Given the success of stablecoins in DeFi, it’s logical that one thing related will emerge for securities. The place those who acquire vital traction are belongings that bridge the outdated world and the brand new. They do not declare the standard monetary world as utterly damaged however as a substitute discover methods to bridge it with the brand new.

That is good for customers, as the present belief and relationships which were established might be leveraged to onboard new customers to those blockchain-enabled belongings, relatively than merely declaring the present antiquated. We have to decrease the boundaries to entry for sure monetary merchandise and established entities corresponding to banks and exchanges are well-placed to supply this.

Parallels with the world extensive net

This has parallels with what we noticed with the world extensive net. When the net began out, it was merely a repository for data, there wasn’t a transparent path to monetisation for a lot of corporations. Nevertheless, as extra customers have been onboarded and the instruments for participating with web sites (browsers) develop into extra acquainted, we noticed corporations establishing their net presences because it turned one other mechanism they may attain their prospects through.

Smartphones and app shops additionally performed a component right here, however the level was that the web enabled corporations to streamline their relationships with prospects and in the end companies moved from offline to on-line.

With on-chain totally collateralised securities and decentralised exchanges, issuers have the chance to supply belongings on to buyers bypassing conventional brokers and funding platforms. This considerably streamlines a few of our trendy monetary infrastructure.

Wholesale finance

The mannequin supplied by Circle and Backed is solely a distribution channel for currencies and ETFs. It does not in any manner affect or modify the belongings they signify. They’re monetary merchandise made out there on blockchains. Whereas it is not simply retail buyers accessing crypto markets, I believe it is truthful to contemplate a lot of these merchandise as being retail targeted.

They’re underpinned by belongings which are managed in wholesale monetary markets, and precisely how blockchain will influence these, remains to be much less sure.

Web applied sciences have been embraced inside wholesale finance through non-public networks, with strict onboarding controls. Web sites and apps have been primarily embraced for retail focussed monetary merchandise. It’s doable that we’ll see the identical factor occur with blockchains, the place wholesale networks stay on permissioned blockchain rails, with retail choices made out there through public blockchain rails.

Trusting public networks

Blockchain expertise will probably be used all through monetary market infrastructures, however will probably be difficult for bigger nations to prioritise constructing on high of public networks because of the decentralised belief that they implement.

As an alternative, public blockchain networks might find yourself serving as a mutual belief layer for bridging between completely different jurisdictions for personal networks. Whether or not it performs out this fashion stays to be seen.

Nevertheless, within the nearer time period, we will begin seeing much more monetary securities exhibiting up on-chain, and it will assist catapult the TradFi trade onto web3.

[ad_2]

Source link