[ad_1]

The self-sovereignty supplied for customers of digital property is among the many advantages provided by this know-how. Customers could be custodians of their very own property with out the necessity for an middleman. Giving individuals this selection is a cornerstone of digital currencies resembling bitcoin, because it removes the long-held dependence on state-controlled fiat financial currencies.

The place will web3 property reside?

This may be simply illustrated by the FTX debacle. FTX didn’t use a separate custodian for its buyer property. SBF’s Alameda Analysis was capable of dip into these buyer funds because it noticed match, as buyer property have been saved by the FTX trade. Now anybody can see that this can be a horrible technique to run a enterprise, and most enterprise house owners would attempt to all the time do proper for his or her prospects. However had there been a custodian within the combine, SBF would not have been capable of gamble with buyer funds on this method.

The problem confronted by many crypto exchanges with the SEC’s newest proposed laws is that it is stating that crypto exchanges can not put on a number of hats. I.e. Coinbase cannot run each a crypto trade and supply the custody service for its customers. It would not be allowed to supply each providers within the US to institutional buyers. That is problematic for firms like Coinbase and can pressure them to work with a devoted custodian to service US prospects. For non-US jurisdictions, this should not be a problem and their different entities Coinbase Custody Worldwide, Ltd., or Coinbase Germany GmBH will little question proceed to serve them.

As we have seen with different areas of coverage, stopping crypto firms from turning into certified custodians is heavy-handed. Many of those custody provides have emerged from a necessity that these exchanges confronted with respect to their very own custody necessities, which couldn’t be met by current corporations. That being stated, separating crypto asset custody from buying and selling operations is sensible, and is how our current monetary market infrastructure works.

Blockchain and DLT know-how do make it easy for an trade to be each custodian and trade, in contrast with conventional securities. However this doesn’t suggest it is the very best method. Separating buyer property ought to be required for any agency providing digital asset buying and selling. These embracing self-custody of crypto property and dealing with native decentralised functions resembling decentralised exchanges or marketplaces have already got this. These providers are non-custodial — you do not have to switch property out of your pockets so as to use them. The best way wherein they work together with property is automated by way of the sensible contract code underpinning them.

People are fallible, machines much less so. Fashionable monetary market infrastructures and laws exist to guard end-users towards single factors of failure within the establishments which offer buying and selling, fee, clearing, custody and reporting providers.

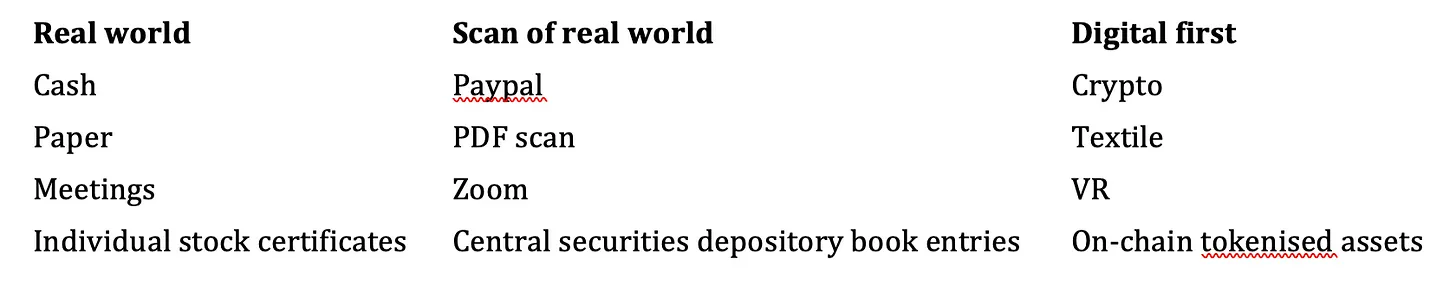

Crypto is a digital-first model of cash (though not true e-cash as offline funds should not doable). However the kind that digital-first securities will take and the best way wherein customers embrace them en masse is much less clear.

In TradFi, central securities depositories such because the DTCC preserve guide entries demonstrating possession of digital securities held by people and firms. This was the unique digitisation of economic merchandise.

We all know with blockchain know-how, the evolution of that is some kind of tokenised asset, with a lot of the infrastructure providers supplied by the underlying blockchain. However a point of separation between these liable for issuance and buying and selling might effectively emerge as these providers scale. In spite of everything, you would not essentially need Uniswap to supply issuance and buying and selling providers. There’ll probably must be some separations of duty between completely different core web3 infrastructure service suppliers on this method.

We might discover as soon as we attain this inflection level the place the issuance and buying and selling of native digital securities is normalised, that the infrastructure behind the scenes to service them has advanced considerably too. Nonetheless, within the meantime, anybody wishing to difficulty, make investments or commerce with digital securities by way of a conventional middleman is prone to want to take action in a way that mirrors our current monetary service rails.

Due to this fact the legislative setting is prone to proceed to evolve on this course, so any corporations making an attempt to do issues in another way are prone to come below some regulatory scrutiny and want to arrange accordingly.

[ad_2]

Source link