[ad_1]

Metaversal is a Bankless publication for weekly level-ups on NFTs, digital worlds, & collectibles

Pricey Bankless Nation,

Because the NFT ecosystem continues to evolve and zero- or low-fee marketplaces hold coming to the fore, many creators are going through decrease royalty funds from their secondary gross sales.

The problem, then, is producing sustainable income streams on this new atmosphere the place royalties more and more go unpaid.

The excellent news right here is that there are a number of methods that NFT creators can use to compensate for these downtrending royalty revenues.

On this article, I’ll share 4 such avenues that creators can flip to with a purpose to higher place themselves on this altering panorama of NFT royalties.

-WMP

🙏 Sponsor: Kraken — essentially the most trusted and safe crypto change on the planet✨

As DCinvestor has defined earlier than, NFTs are greatest understood as “permissionless, censorship-resistant bearer property.” In different phrases, NFTs are decentralized digital issues that may be moved immediately between people with out interference from centralized intermediaries.

Because the NFT house has been grappling with the current downtrend in royalty funds, which these days has been pushed largely by the NFT market warfare between Blur and OpenSea, various approaches — like blocking transfers, burning tokens of non-royalty paying holders, and market blocklists — have been put forth as potential methods to stem the declining revenues.

The issue with the approaches talked about above is that they’re all centralizing methods that eat away at that basic worth proposition of NFTs, i.e. being decentralized bearer property.

All that mentioned, although, NFT creators nonetheless have a variety of choices to think about in the case of compensating for downtrending royalties. Listed here are 4 more and more go-to avenues you’ll need to bear in mind.

The primary and most elementary strategy a creator or assortment workforce can contemplate right here is holding a few of their NFT venture’s provide again for themselves.

The concept? As a venture grows, this retained provide can later be used for main gross sales, whether or not that’s in drip-like vogue over time for additional funding or abruptly like Larva Labs’s Mach 2022 sale of its CryptoPunk provide to Yuga Labs as a part of a wider IP deal.

There are two common variations of this tactic, which is holding again unminted provide (suppose mint-on-demand collections like Chromie Squiggles, of which +250 NFTs can nonetheless be minted for particular events out of the gathering’s 10k max provide) or holding again minted provide (e.g. Larva Labs minted the primary 1,000 NFTs from the CryptoPunks good contract and bought from that batch over time).

After all, simply because a venture retains a few of its provide for itself doesn’t imply it may well’t attempt to rake in royalties too, downtrending as they might be these days.

For instance, the creators of Terraforms took the 0% royalties strategy and simply opted for holding again unminted provide for later main gross sales and to align themselves long-term with their group, however in distinction when goblintown.wtf workforce did its free mint in Could 2022 they retained 1,000 NFTs and began with a 7.5% royalty on secondary gross sales (They’ve since moved to their very own bespoke market the place a 5% royalty is enforced.)

Within the NFTfi scene, there’s a rising wave of NFT automated market maker (AMM) protocols that creators or collections can present NFTs to with a purpose to earn buying and selling charges from swaps.

The gist, then, is {that a} venture can add its NFTs to a liquidity pool (liquidity offering, a.ok.a. LPing) after which earn a lower each time folks purchase or promote via the workforce’s liquidity. An attention-grabbing benefit of this technique is that it permits a workforce to earn revenues from their NFTs with out conducting main gross sales.

For instance, the Sappy Seals workforce acquired 50 of its personal NFTs after which began LPing with these NFTs on sudoswap in August 2022. Since then, the workforce’s earned many hundreds of {dollars}’ price of income courtesy of buying and selling charges. Different initiatives which have used this LPing technique with related success embrace Primarily based Ghouls, Finiliar, and Allstarz.

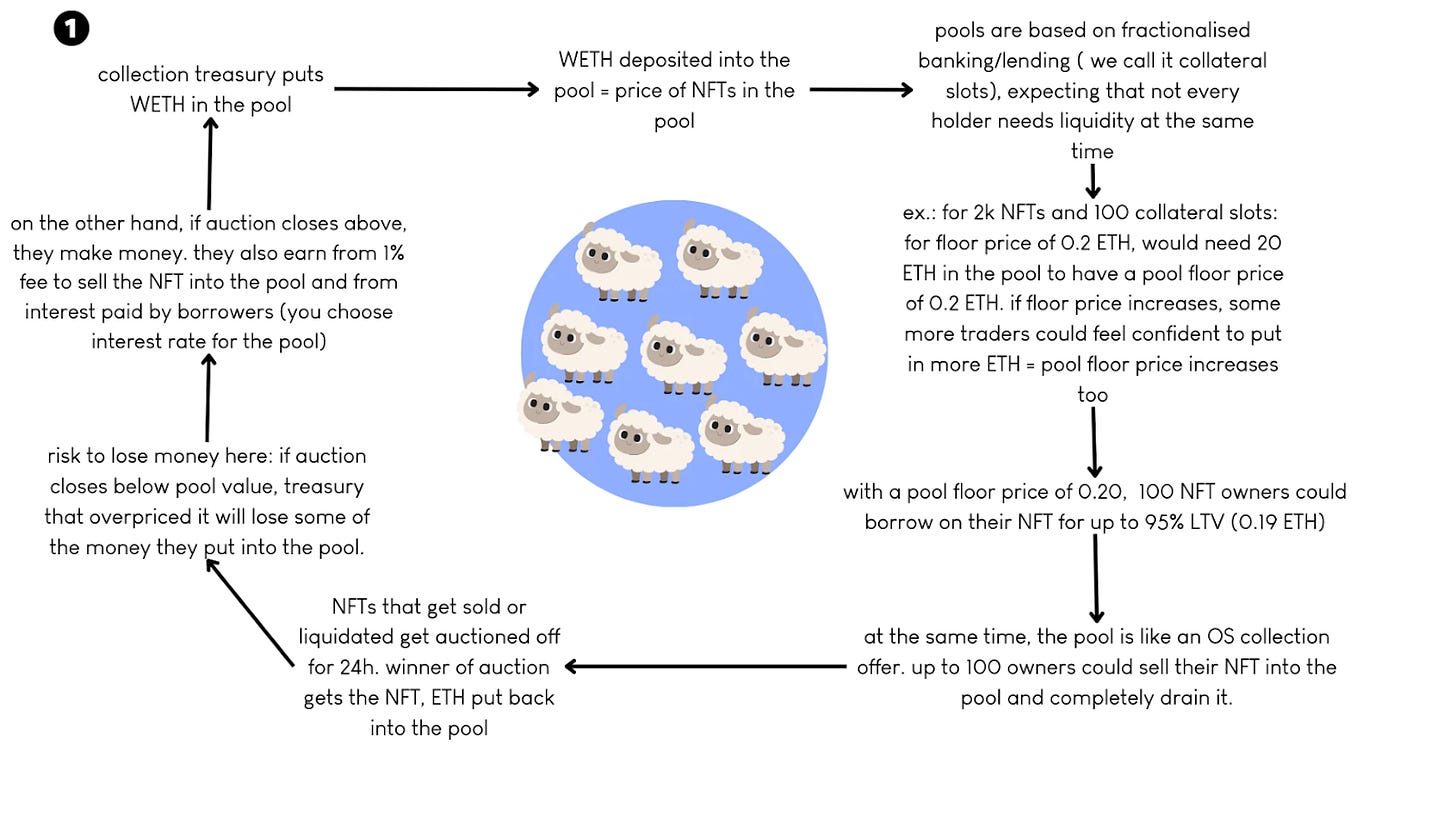

One other extra superior variation of this strategy that we haven’t seen simply but is LPing in an Abacus spot pool. Abacus is a brand new NFT appraisal protocol centered on pricing NFTs. The workforce has proposed a brand new means of NFT LPing that entails a venture linking a few of its treasury funds to its personal liquidity pool on Abacus with a purpose to generate revenues and precisely worth all of the NFTs within the pool. Be taught extra about this idea right here.

Generally once you want one thing completed, you’ve acquired to do it your self. Within the up to date NFT market scene, initiatives that wish to implement royalties are more and more rolling out their very own native marketplaces and focusing exercise there with a purpose to draw trades away from Blur, OpenSea, and so forth. the place royalties are presently unreliable.

Luckily, NFT infra initiatives like Reservoir are making it more and more simple for creators and collections to deploy their very own customized, royalty-friendly marketplaces with aggregated NFT listings.

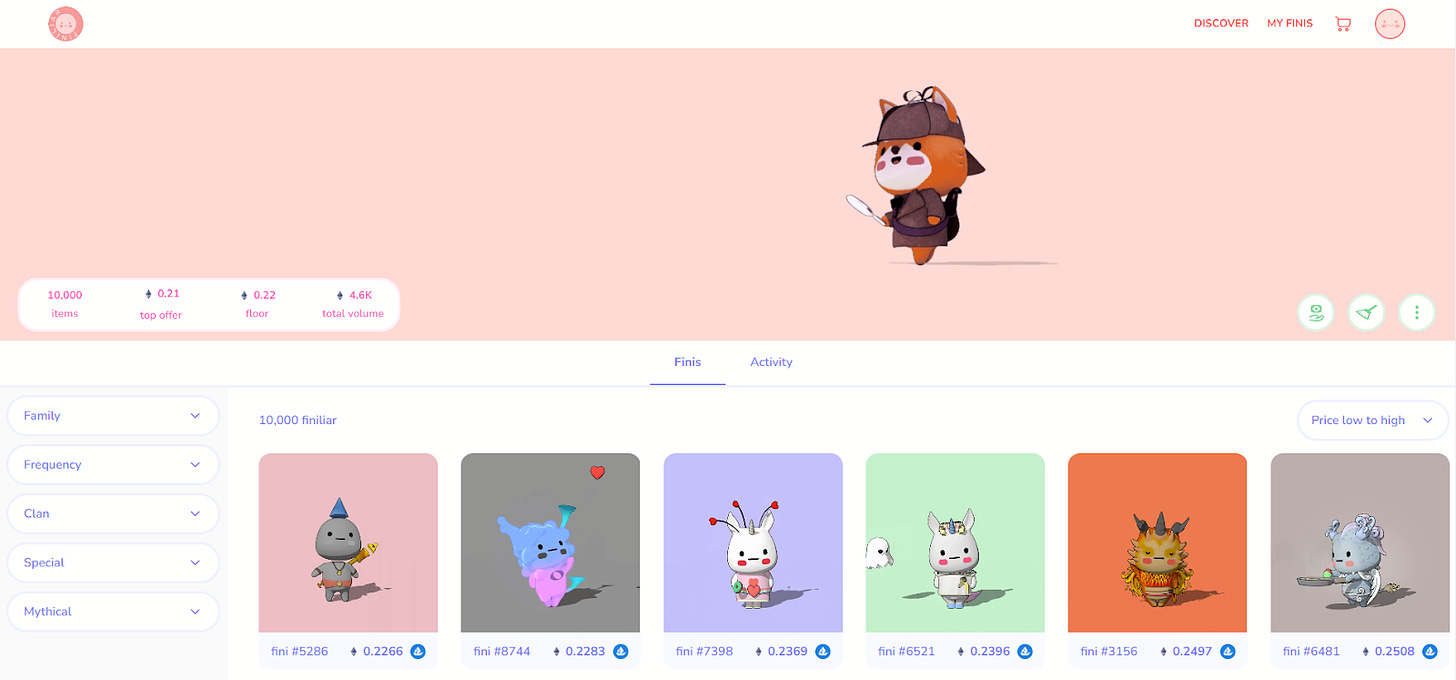

As an illustration, Finiliar is one such assortment that makes use of Reservoir to underpin its native market system on finiliar.com. They’ve arrange the frontend how they like, after which Reservoir takes care of the entire precise market actions underneath the hood so to talk.

Simply because royalties are typically downtrending in NFTs these days doesn’t imply we’ve to desert all hope for them. The truth is, one strategy out there is to double down on royalties by immediately incentivizing them.

There’s various alternative ways this incentivization could be completed. Possibly an NFT workforce makes use of an indexer system to determine all of their collectors who’ve honored royalties over the previous yr after which rolls out distinctive perks for these pro-royalty collectors, like allowlist spots, NFT airdrops, token-gated chats, leaderboard competitions, and extra.

This avenue is attention-grabbing as a result of it may well readily be used with different approaches above (e.g. holding again provide, focusing consideration to a DIY market), and it steers NFT holders towards being extra lively and useful group members!

Examine your choices: should you’re working by yourself NFT venture, contemplate how to achieve this evolving royalties panorama!

Study MetaMask x Unity: see my earlier write-up on MetaMask’s arrival within the Unity Asset Retailer!

William M. Peaster is an expert author and creator of Metaversal—a Bankless publication centered on the emergence of NFTs within the cryptoeconomy. He’s additionally just lately been contributing content material to Bankless, JPG, and past!

Subscribe to Bankless. $22 per mo. Contains archive entry, Interior Circle & Badge.

Kraken NFT is constructed from the bottom as much as make it one of the safe, easy-to-use and dynamic marketplaces out there. Energetic and new collectors alike profit from zero gasoline charges, multi-chain entry, fee flexibility with fiat or 200+ cryptocurrencies, and built-in rarity rankings. Be taught extra at Kraken.com/nft

👉 Go to Kraken.com to study extra and open an account at present.

Not monetary or tax recommendation. This text is strictly instructional and isn’t funding recommendation or a solicitation to purchase or promote any property or to make any monetary selections. This text shouldn’t be tax recommendation. Discuss to your accountant. Do your individual analysis.

Disclosure. From time-to-time I’ll add hyperlinks on this publication to merchandise I take advantage of. I’ll obtain fee should you make a purchase order via one in all these hyperlinks. Moreover, the Bankless writers maintain crypto property. See our funding disclosures right here.

[ad_2]

Source link