[ad_1]

Intro

With The Shanghai/Capella improve quickly approaching, there’s plenty of dialogue about Ethereum Staking Withdrawals and what this implies for the Ethereum ecosystem as a complete.

So how do withdrawals work? What are widespread misconceptions about this course of? And what are the implications of enabling Ethereum stakers to withdraw their locked-up ETH? You’ll discover solutions to those questions and extra on this article.

The Beacon Chain

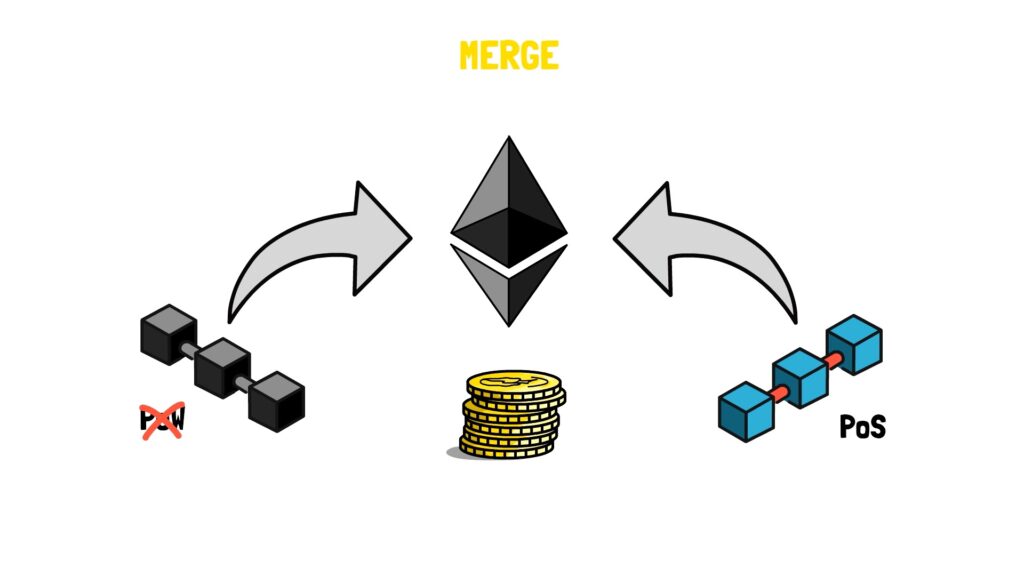

Let’s begin with understanding how we bought right here and why staking withdrawals weren’t enabled when Ethereum moved from proof-of-work to proof-of-stake.

The transition to PoS occurred over a number of steps to minimise the variety of massive adjustments occurring on the similar time. This strategy was important, particularly for a longtime community settling trillions of {dollars} of worth per yr.

Probably the most important steps had been:

-the launch of the Beacon Chain

-the Merge

The launch of the Beacon Chain in 2020 created the inspiration for the transition by making a separate PoS consensus layer, working alongside the Ethereum PoW chain.

Launching the Beacon Chain earlier allowed for the buildup of sufficient ETH to safe the community earlier than settling real-value transactions. It additionally allowed the testing of the brand new PoS consensus mannequin for an prolonged interval with actual funds at stake.

The early community individuals dedicated hundreds of thousands of ETH to safe the Ethereum PoS community regardless of realizing they wouldn’t have the ability to withdraw their ETH till a lot later.

The subsequent massive step, the Merge, united the PoS consensus layer with the execution layer. This allowed for lastly shifting off PoW and sustaining just one canonical chain – Ethereum – now secured by hundreds of thousands of staked ETH.

The Merge was by far the biggest change ever to Ethereum. As a result of nature of the improve, It needed to occur with none downtime.

To minimise threat, the scope of The Merge was decreased, and no different options, outdoors of the PoW to PoS swap, had been included as a part of the improve.

The largest “reduce” that needed to be carried out impacted withdrawals, which turned the main target of the upcoming Shanghai/Capella improve.

Withdrawals

Staking withdrawals, because the title suggests, will permit stakers to withdraw their locked-up ETH.

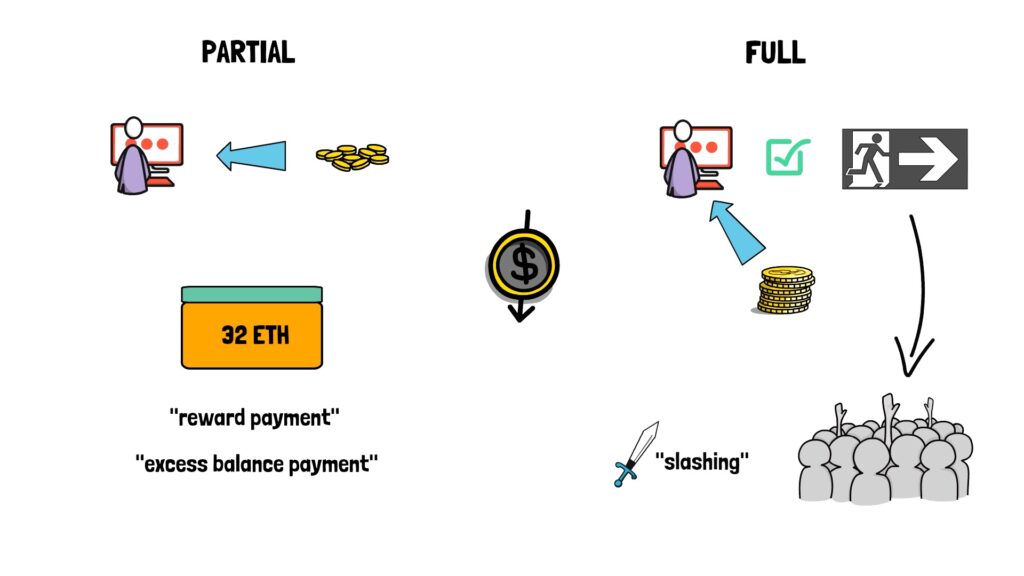

Earlier than we get any additional, let’s outline two varieties of withdrawals: “partial” and “full”.

A “partial” withdrawal occurs when the validator withdraws their gathered rewards. That is an additional steadiness on prime of the utmost efficient steadiness of 32 ETH. A “partial” withdrawal will also be known as a “reward cost” or “extra steadiness cost”.

In distinction, a “full” withdrawal occurs when the validator has accomplished the method of exiting, and the complete steadiness is withdrawn. This happens solely when the validator exits the system both voluntarily or by being forcibly eliminated in a course of known as “slashing”.

As soon as enabled, staking withdrawals might be robotically distributed each few days. We’ll clarify the small print of this course of later.

Moreover, the withdrawal course of initiates on the consensus layer, so no transaction price is required at any of the steps.

In an effort to begin withdrawing their staking rewards, a validator must present their withdrawal tackle solely as soon as.

Given withdrawals have an effect on each the consensus and execution layers of Ethereum, each components of the community have to be up to date. Shanghai is the title of the execution layer improve containing withdrawals, that are laid out in EIP-4895, and Capella is the title of the counterpart consensus layer improve, which might be activated on the similar time.

These two upgrades are typically additionally known as Shapella.

Now, let’s see how withdrawals work underneath the hood.

Mechanics

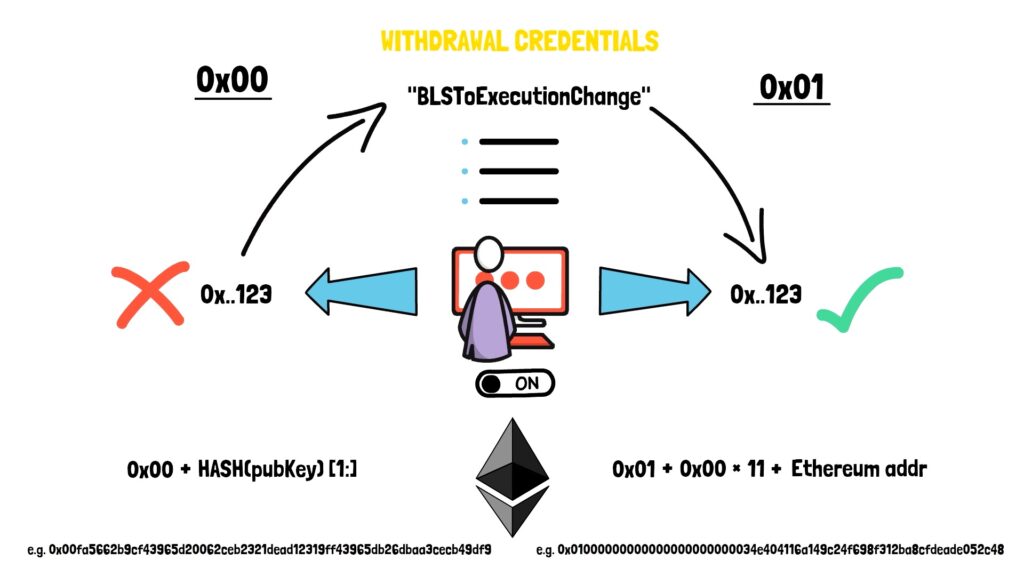

Within the Ethereum ecosystem, every validator has a corresponding index quantity. As well as, additionally they have two varieties of withdrawal credentials outlined as both 0x00 or 0x01.

0x00 signifies {that a} explicit validator doesn’t have an related withdrawal tackle. These credentials are derived because the hash of the BLS public key with its first byte swapped out with a zero byte therefore the title.

In distinction, 0x01 implies that a validator supplied their withdrawal tackle. These withdrawal credentials are represented as 0x01 adopted by 11 bytes of zeros, then a selected Ethereum tackle.

In an effort to allow withdrawals, validators with 0x00 credentials might want to signal a “BLSToExecutionChange” message. This might be attainable after the Capella improve.

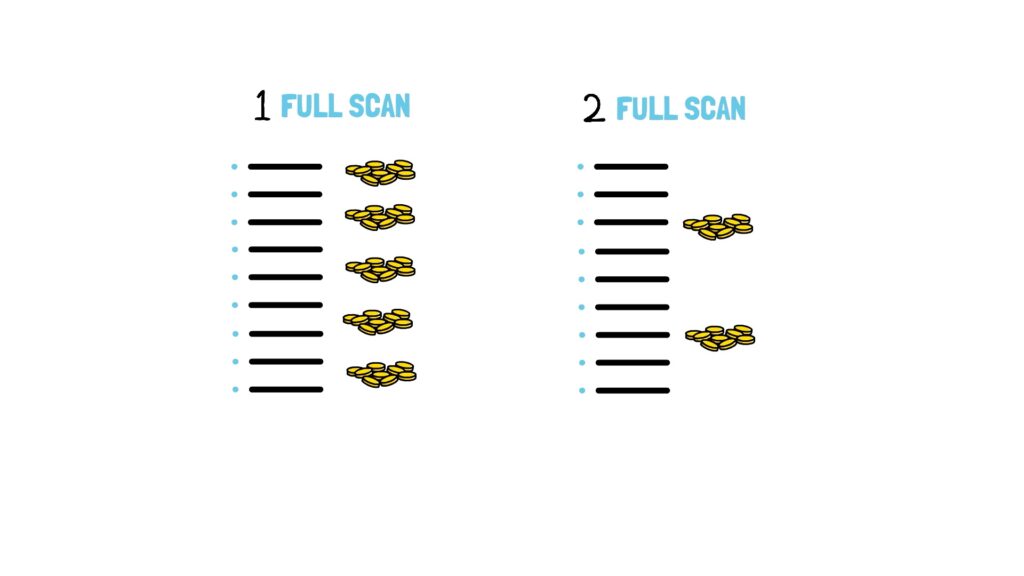

As soon as withdrawals are enabled, a validator proposing a block will scan linearly by way of validator indices to seek out the primary 16 validators with 0x01 credentials who both:

-have a steadiness that exceeds 32 ETH (accrued validator rewards)

-are “withdrawable” (have totally exited validator set)

The linear search stops after both discovering 16 validators to match these standards or after 16,384 iterations. The algorithm remembers the index at which the search stopped, so the subsequent validator proposing a block can resume from that index. After attending to the final index, the algorithm begins from the start – index 0.

A superb analogy right here can be an analogue clock the place the hand on the clock factors to the hour, progresses in a single route, doesn’t skip any hours, and ultimately wraps round to the start once more after the final quantity is reached.

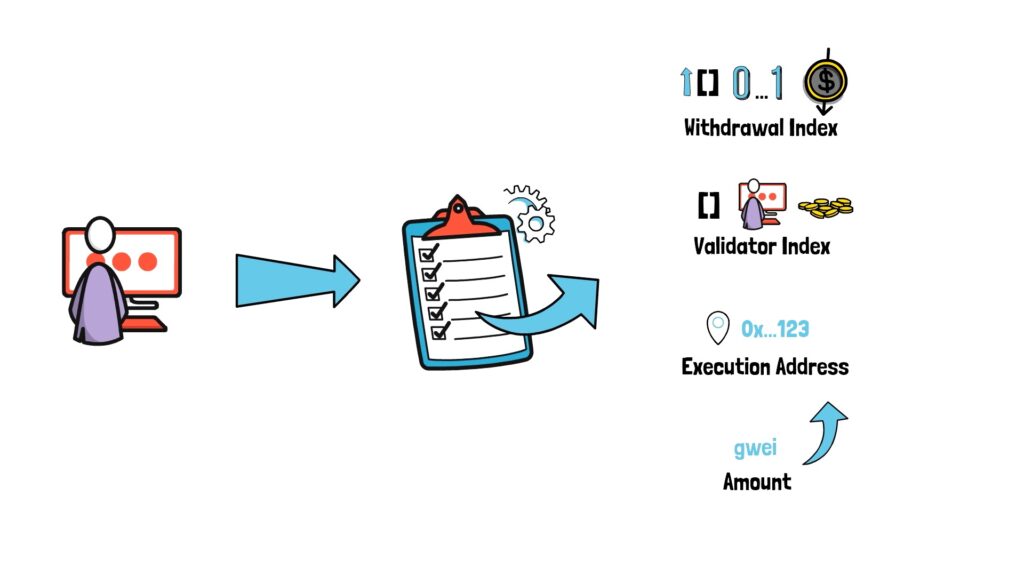

After the scan is accomplished, the validator creates a listing of withdrawals to be included of their execution payload.

Every merchandise on the checklist comprises the next:

“WithdrawalIndex” – a monotonically rising index, ranging from 0, that increments by 1 per withdrawal to uniquely determine every withdrawal

“ValidatorIndex” – the index of the validator whose steadiness is being withdrawn

“ExecutionAddress” – the ETH tackle on the execution layer the place the withdrawal needs to be despatched

“Quantity” – the quantity, in gwei, to be despatched to “ExecutionAddress”

When constructing or processing a block, Execution Layer shoppers will apply these withdrawals on the finish of a block. As talked about earlier, processing withdrawals don’t compete with consumer transactions for block area.

With a most of 16 withdrawals that may be processed in a single block, there needs to be a most of 115,200 withdrawals processed per day (assuming no missed slots).

As we will see, the design of withdrawals is straightforward but extraordinarily sturdy.

Now, it’s time to debate some widespread misconceptions in the case of withdrawals.

Misconceptions

The primary false impression states that, when processing withdrawals, there’s a distinction between a “full” and a “partial” withdrawal by way of precedence or ordering.

Each “full” and “partial” withdrawals occur when the linear scan over the validator set reaches a validator’s index. The one distinction is that within the case of “full withdrawals”, a validator should depart the exit queue and attain the “withdrawable_epoch” earlier than the linear scan can decide it up.

One other false impression is that customers will lose their rewards if they don’t present a withdrawal tackle which isn’t true. In case a validator forgets to offer a withdrawal tackle, their ETH rewards is not going to be despatched to the void as soon as withdrawals are enabled. As an alternative, the scan will skip validators who haven’t supplied their withdrawal addresses.

Additionally, it’s essential to keep in mind that the withdrawal tackle can’t be modified, and it’s set solely as soon as. Subsequently, stakers have to be extraordinarily cautious when organising the withdrawal tackle, making certain they’ve full possession of the tackle supplied.

There’s additionally plenty of hypothesis in the case of withdrawals. One value mentioning is the idea that stakers will withdraw plenty of ETH from the Ethereum ecosystem as soon as the withdrawals are enabled. The stronger model of this argument additionally assumes that this may destabilise the PoS consensus mechanism.

Though we can’t totally predict how a lot ETH might be withdrawn over time, there are a number of essential counterarguments.

First, most stakers are early Ethereum adopters who had been courageous sufficient to stake when it was nonetheless unsure when the withdrawals can be enabled. Many stakers have expressed their want to proceed staking to assist the community and to proceed incomes ETH-denominated rewards.

Secondly, to make sure that the PoS consensus mechanism and the energetic set of validators stay steady, Ethereum carried out a withdrawal queue for all validators wishing to exit. This queue limits the variety of validators that may depart the ecosystem concurrently.

It’s value mentioning that the primary withdrawal scan will withdraw plenty of gathered rewards – mainly for the reason that inception of the Beacon Chain. Nonetheless, the next ones will course of a a lot smaller quantity of ETH.

There are additionally some essential implications in the case of withdrawals.

Implications

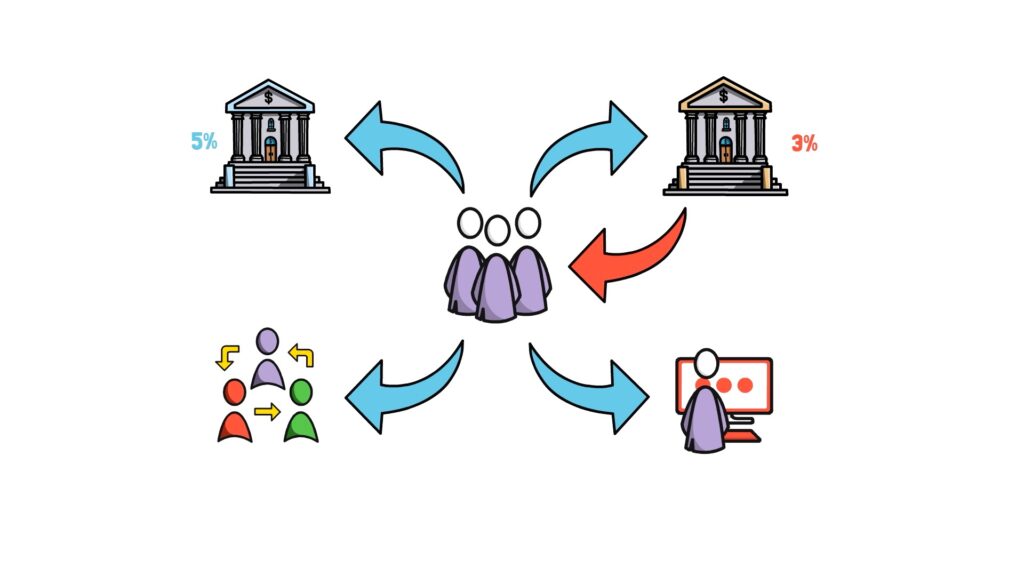

First, enabling withdrawals will create an open, two-sided staking movement.

At present, the staking movement is one-sided; ETH can solely movement into the community and by no means exit it.

Apparently, enabling withdrawals might incentivise much more folks to stake as they may know they’ll all the time withdraw their ETH if wanted for one thing else.

Stakers who don’t run their validators and stake with a centralised staking supplier will have the ability to change their supplier to a distinct one. So, for instance, they’ll withdraw their funds from a supplier that gives a decrease staking charge to a different supplier which presents a greater charge or transfer from a centralised supplier to a decentralised one, and even run their very own validator!

Withdrawals may even influence liquid staking derivatives comparable to Lido, RocketPool and others. For instance, liquid staking cash comparable to stETH or rETH had a historical past of briefly dropping their peg to the worth of ETH throughout market turbulences. Nonetheless, with the two-sided staking movement, any important discrepancy of their peg can be shortly arbitraged away.

Early adopters in liquid staking and centralised staking captured a overwhelming majority of the market as they didn’t have a lot competitors. Nonetheless, the market share of those incumbent gamers might see a serious change as soon as withdrawals are enabled, particularly in the event that they don’t provide a aggressive charge.

The flexibility to shift freely between staking suppliers will profit the ETH staking market.

Abstract

Enabling staking withdrawals is among the most anticipated upgrades to Ethereum.

It will likely be extraordinarily essential to ensure this modification is executed easily. In an effort to assist with testing, validators may have a number of devnets and testnets accessible to run by way of the method and iron out any potential points earlier than going reside on the mainnet.

Withdrawals are one more enchancment bringing Ethereum one step additional in the direction of constructing a sustainable, safe and decentralised future.

Shapella improve is predicted to happen within the first half of 2023.

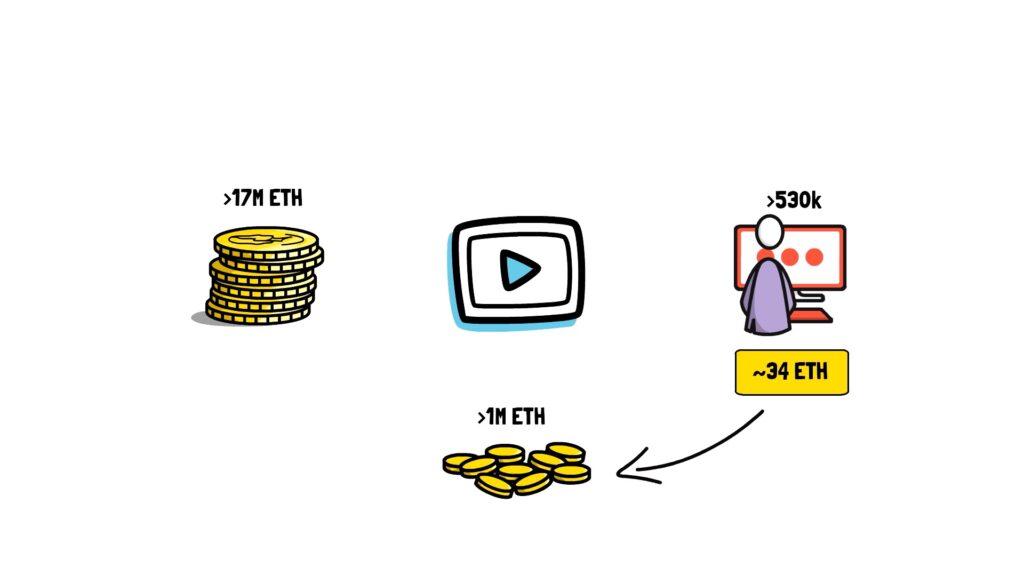

On the time of writing this text, The Beacon Chain gathered over 17M ETH throughout over 530k validators. A median steadiness for a validator is simply above 34 ETH, which suggests over 1m ETH in gathered rewards. It will likely be attention-grabbing to see how withdrawals will have an effect on these numbers.

So what do you consider Ethereum enabling staking withdrawals? Remark down beneath.

If you happen to loved studying this text, test Finematics on Youtube and Twitter.

[ad_2]

Source link