[ad_1]

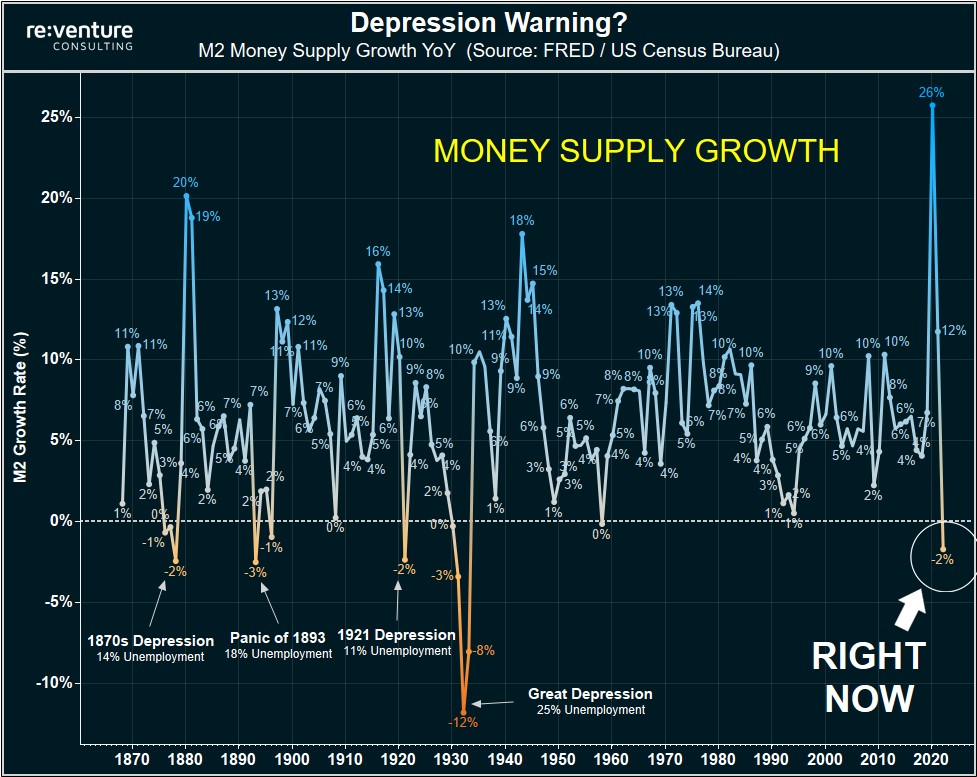

Through the Covid-19 pandemic, central banks such because the U.S. Federal Reserve loosened fiscal and financial coverage. Now, these similar monetary establishments are seemingly participating in quantitative tightening (QT) practices. In accordance with Nick Gerli, CEO and founding father of Reventure Consulting, “the cash provide is formally contracting.” This has solely occurred 4 occasions within the final 150 years. Gerli warns that each time it happens, a despair takes place with double-digit unemployment charges.

The Contraction of Cash Provide and its Affect on the Financial system

A number of market analysts and economists are unsure about the way forward for the economic system, whereas many imagine issues will quickly worsen resulting from important inflation and failures in central planning. When the Covid-19 pandemic hit, the U.S. authorities and plenty of different nation-states worldwide financed trillions of {dollars} in debt to maintain the economic system. The debt has grown to colossal ranges, and plenty of imagine it might sink a number of Western economies. Speculators insist that it will hurt the greenback and that solely onerous belongings will survive the fallout.

In a latest interview on the 2023 BMO Metals, Mining, & Essential Minerals Convention, Rob McEwen, govt chairman of McEwen Mining, stated, “Laborious belongings will enhance in worth because the greenback drops in relative worth to different currencies as a result of governments are irresponsible. They steal from their residents by printing extra cash and borrowing in methods they shouldn’t … Have a look at the quantity of debt many of the Western world has proper now; it’s huge.”

On March 8, 2023, Nick Gerli, CEO and founding father of Reventure Consulting, warned that the cash provide is contracting. ‘The cash provide is formally contracting,’ Gerli stated Wednesday. This has solely occurred 4 earlier occasions within the final 150 years, and every time, a despair with double-digit unemployment charges adopted.

The Reventure govt insists that when the cash provide contracts whereas inflation rises, it creates a “nasty mixture” as a result of there are fewer {dollars} obtainable to pay for greater costs, finally resulting in a deflationary crash.

Gerli added:

That is precisely what occurred within the despair of 1921. (NOT the Nice Melancholy). This occurred after WWI and the Spanish Flu. The place there have been years of excessive inflation/cash provide development. After which…WHAM. 11% Deflation and the unemployment price skyrocketed. All it took was a -2% contraction within the cash provide in 1921 to trigger that deflationary despair.

The Reventure govt famous that there has already been a 2% contraction in 2023. Gerli says that this implies that ‘the resilience of our economic system and the present inflation may not be as sturdy as folks suppose.’ Nonetheless, Gerli admits that there’s nonetheless a major amount of cash circulating within the monetary system in 2023, with the cash provide being about 35% greater than it was pre-pandemic, at $21 trillion. Regardless of this, historical past reveals that just a bit nudge and despair and deflation might mount.

“[The] historic file is evident: Depressions/Deflation don’t want a ‘linear’ lower in cash provide to happen— It simply must be somewhat bit. 2-4% contraction YoY — After which issues happens,” Gerli added.

Gerli thinks that persons are too targeted on price hikes and never taking note of quantitative tightening (QT) practices and the cash provide. He thinks that on the present tempo, the cash provide will shrink extra whereas recession fears are mounting and inflation continues to persist. “That’s the way you get a system meltdown and a deflationary despair,” Gerli confused. The Reventure govt added {that a} deflationary despair in 2023-24 is “not a assure.” As a result of governments are watching diligently, there’s a chance they may “try and print cash once more, ship stimulus checks, and re-ignite inflation/economic system,” based on Gerli.

What do you suppose the federal government ought to do to deal with the doable contraction of the cash provide and the specter of deflationary despair? Share your ideas within the feedback under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss induced or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link