[ad_1]

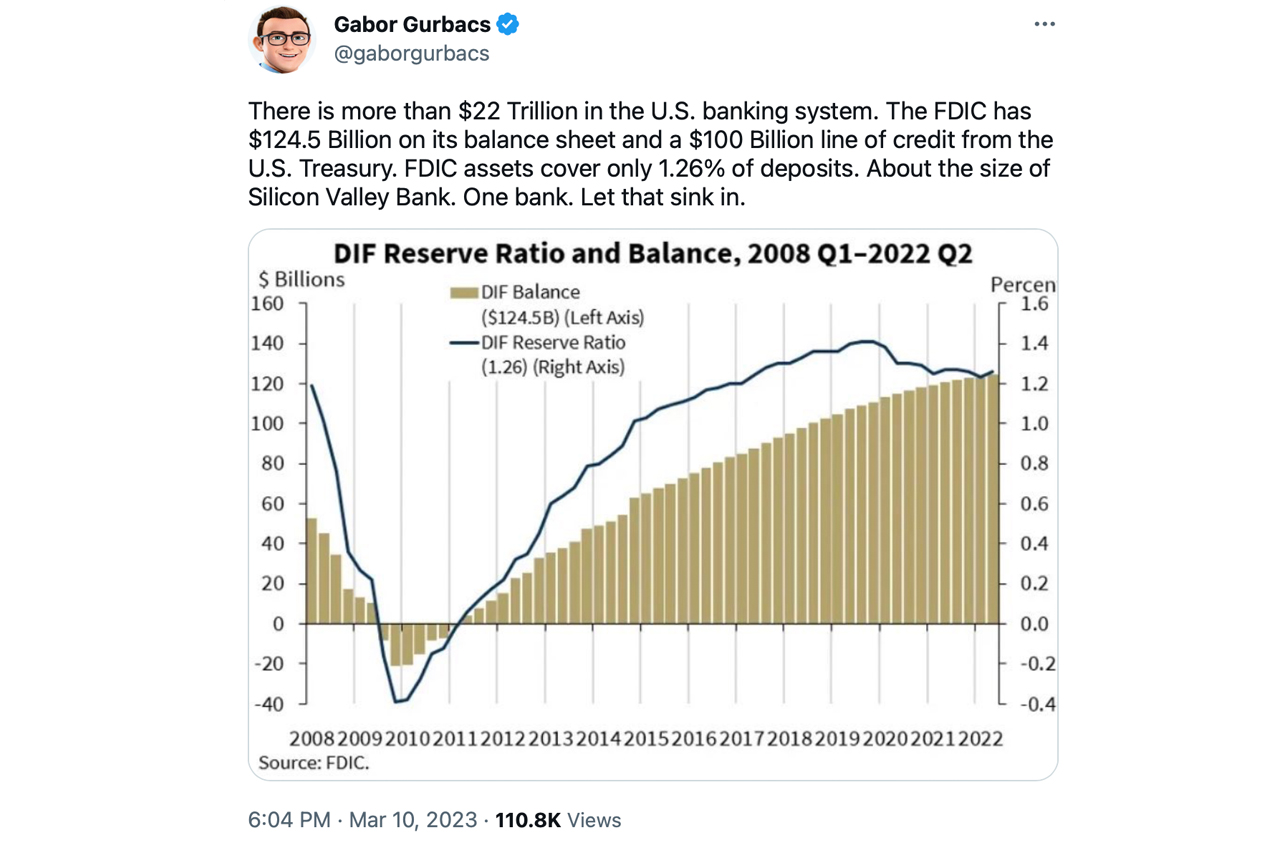

Silicon Valley Financial institution (SVB) has turn into the focus after its collapse prompted the U.S. Federal Deposit Insurance coverage Company (FDIC) to close the financial institution down on Friday. It was the most important U.S. financial institution failure since 2008, and numerous alleged catalysts have been pointed to. Some imagine enterprise capitalists prompted a financial institution run, whereas others blame the U.S. Federal Reserve’s charge hikes. Economist and gold bug Peter Schiff mentioned on Friday that the U.S. banking system would expertise extra hassle forward. He and a number of other speculators imagine that these monetary establishments maintain mountains of long-term treasuries.

Requires SVB Intervention as Market Observers Predict Bigger Monetary Collapse within the U.S.

Over the previous week, two U.S. banking establishments, Silvergate Financial institution and Silicon Valley Financial institution (SVB) failed. SVB’s collapse was the most important banking failure since Washington Mutual (Wamu) in 2008, which was blamed on increasing branches too rapidly and holding huge quantities of subprime mortgages lent to so-called unqualified patrons.

Earlier than its collapse, Wamu held $188.3 billion in deposits, whereas SVB is estimated to have misplaced round $175.4 billion in deposits. Nonetheless, whereas SVB’s deposits on the finish of December 2022 had been $175.4 billion, clients tried to take away $42 billion on Thursday alone. It’s protected to say that SVB’s demise was so much sooner than Wamu’s collapse on the finish of 2008.

Simply days earlier than its collapse, SVB tried to strengthen its stability sheet by saying the necessity to elevate $2.25 billion. The financial institution additionally offered its available-for-sale (AFS) bond portfolio for $21 billion, leading to a $1.8 billion loss from the sale. SVB is well-known for banking tech startups and enterprise capital (VC) cash, and a few market observers imagine that these purchasers prompted a financial institution run.

“This was a hysteria-induced financial institution run brought on by VCs,” mentioned Ryan Falvey, a fintech investor at Restive Ventures, in an interview with CNBC on Friday. “That is going to be remembered as one of many final instances of an business reducing off its nostril to spite its face,” he added.

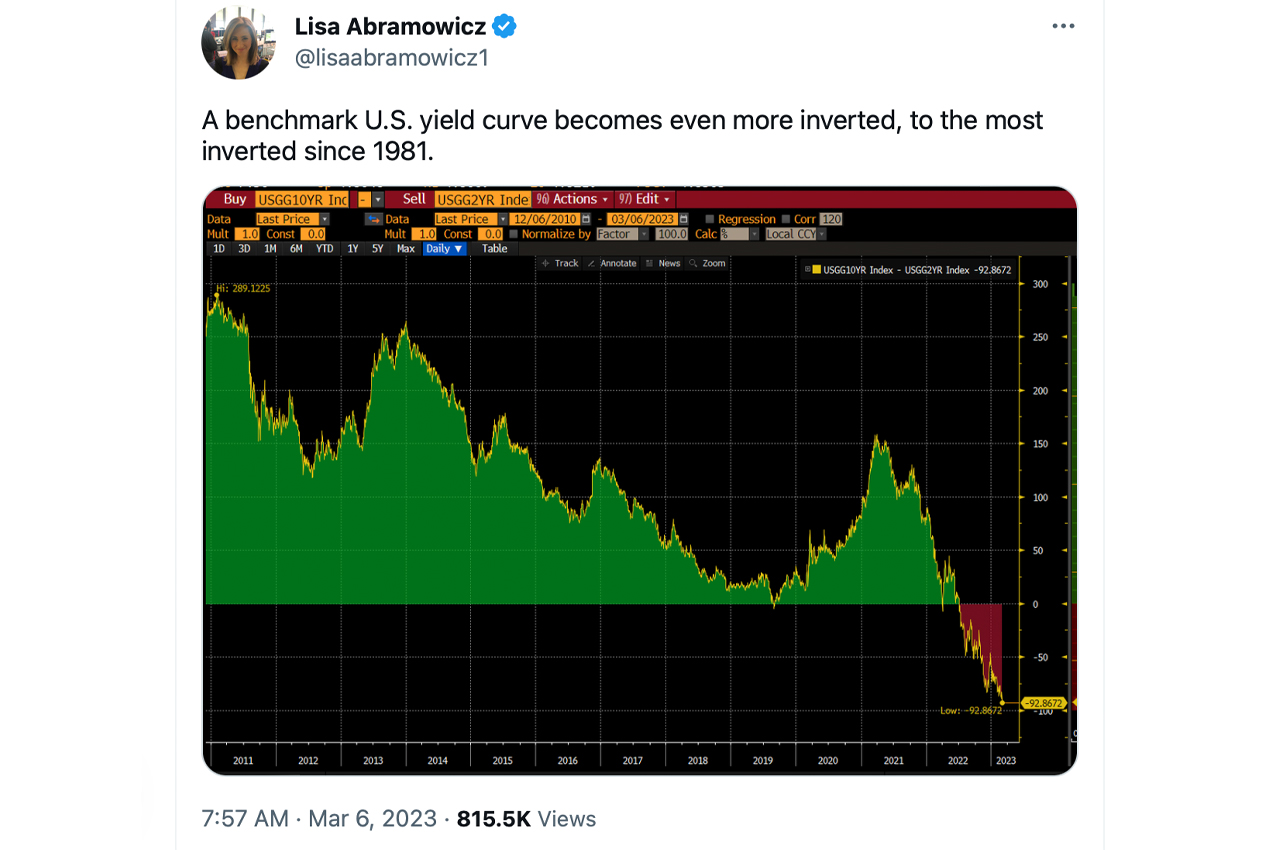

Different analysts and market observers are blaming the illogical inverted yield curve that lengthy and short-term Treasuries are going through in the present day, in addition to the U.S. Federal Reserve charge hikes. Soona Amhaz, founder and managing associate at Volt Capital, mentioned: “The open secret is that technically most U.S. banks are bankrupt proper now, as they’re all sitting on long-duration treasuries which can be underwater in a 4% rate of interest surroundings.”

Economist and gold bug Peter Schiff shares an analogous view to Amhaz, anticipating a a lot bigger monetary collapse in america. “The U.S. banking system is on the verge of a a lot larger collapse than 2008. Banks personal long-term paper at extraordinarily low-interest charges,” Schiff acknowledged. He continued:

They’ll’t compete with short-term Treasuries. Mass withdrawals from depositors searching for increased yields will lead to a wave of financial institution failures.

Craft Ventures govt David Sacks took to Twitter, calling on Powell to intervene and forestall a potential contagion. “The place is Powell? The place is Yellen? Cease this disaster NOW,” Sacks tweeted. “Announce that every one depositors will probably be protected. Place SVB with a Prime 4 financial institution. Do that earlier than Monday’s opening, or there will probably be contagion and the disaster will unfold.”

Billionaire and Galaxy Digital founder Mike Novogratz additionally weighed in, expressing shock that the Fed would let depositors lose cash in Silicon Valley Financial institution. “Are all banks going to be handled like hedge funds? Looks like a coverage mistake,” Novogratz acknowledged. Shapeshift founder Erik Voorhees ridiculed the decision for Fed intervention on Twitter, stating, “Fiat is fragile.”

SVB’s points have impacted the crypto financial system, notably the stablecoin financial system backed by fiat reserves. Circle disclosed that it had $3.3 billion of money supporting usd coin (USDC) trapped within the financial institution, inflicting USDC to unpeg from the U.S. greenback parity. As of 10:30 a.m. on March 11, 2023, USDC is buying and selling for $0.912 per unit. This unpegging has additionally led to 5 different stablecoins shedding their pegs. Moreover, on Saturday, Coinbase, Binance, and Crypto.com quickly suspended USDC trades and conversions.

What do you consider the opinions surrounding the SVB failure? Share your ideas within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any harm or loss prompted or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link