[ad_1]

What’s the “prime” for an immutable cash that turns into the usual for humanity? Why it’s time to get off zero.

That is an opinion editorial by Luke Broyles, a Bitcoin content material creator.

How a lot bitcoin does it take to get wealthy and fund your way of life? How little bitcoin does it take to guard your self towards inevitable inflation, financial institution runs and fiat demise? Are you “too late” to Bitcoin? What would a 1% allocation do?

These are questions that newbies and veterans of Bitcoin alike ask themselves and one another and, oftentimes, there isn’t a transparent reply.

Let’s present a strong framework to reply that query.

There Is No ‘Prime’ For An Immutable Cash Normal

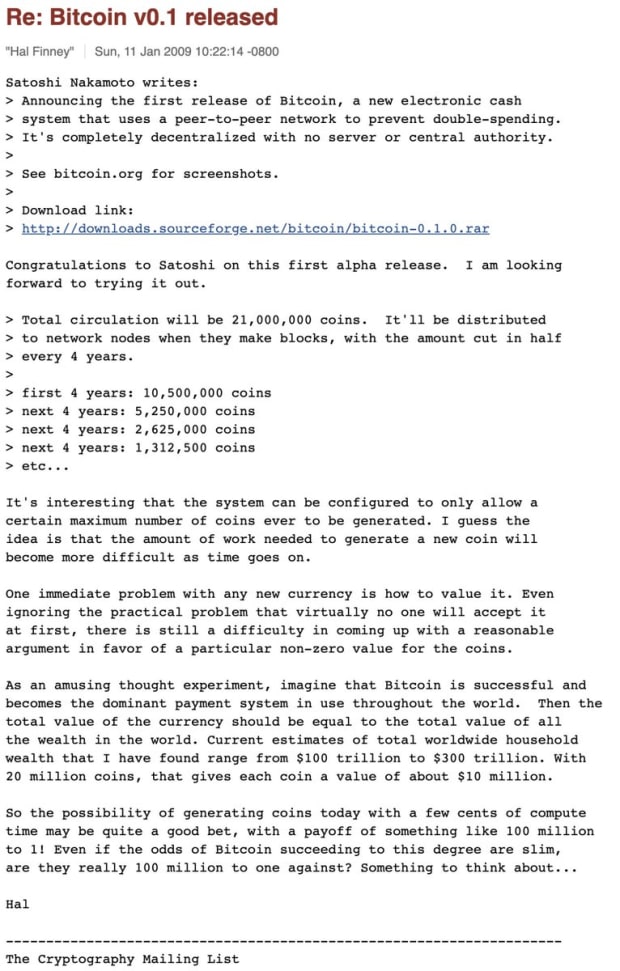

January 2009 was BTC’s first worth prediction. Hal Finney predicted that bitcoin may change into the global-dominant cost system, or $10 million per coin (Finney’s calculation could be nearer to $40 million right this moment). However bitcoin wouldn’t surpass $1.00 till April 2011… Over two full years later.

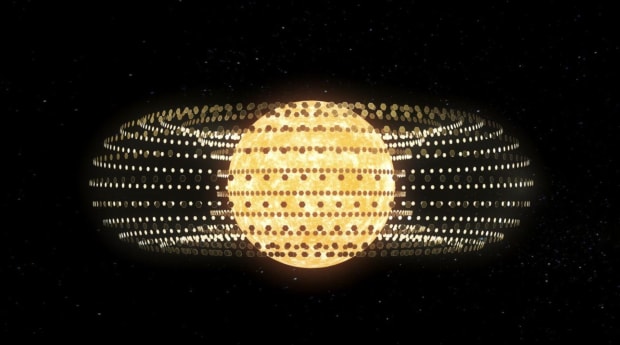

What Finney understood is that upon the invention of good cash all world wealth would inevitably consolidate into it. Henry Ford, Nikola Tesla and others additionally foresaw this.

A closed (financial) system inevitably absorbs all open (productiveness) techniques. Cash is the expertise that costs every thing else inside its personal ledger. There isn’t a “prime” worth prediction for an immutable financial commonplace of the human race, the usual.

It’s About Buying Energy, Not Value

So, a greater approach to consider bitcoin’s worth shouldn’t be in worth, however in buying energy. Overlaying a share of financial inventory with a given quantity of productiveness (or financial worth) is a greater technique to predict the cash’s worth. It’s value noting that in a finite ledger, wealth inequality as we all know it right this moment does the reverse as we anticipate right this moment (a subject for one more time).

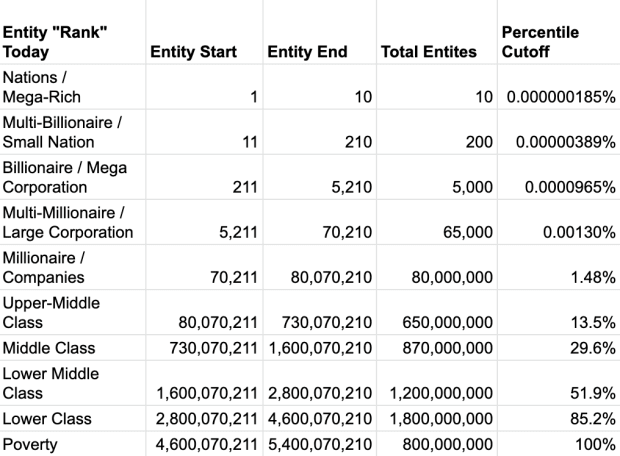

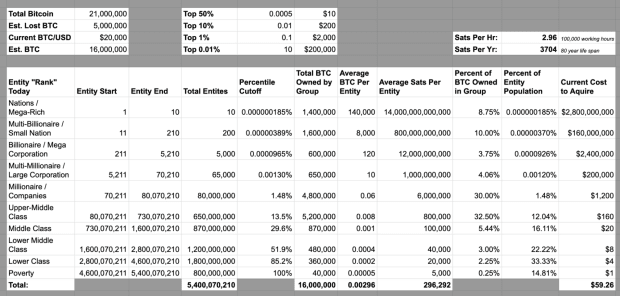

First, let’s make clear “entities.” We have now 10 arbitrary “teams,” loosely based mostly on right this moment’s wide-ranging estimates of mega-rich entities to these in poverty.

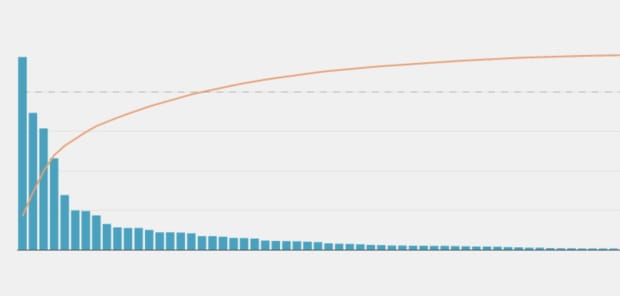

Second, we have now to account for what is usually attributed to the “Pareto precept”: The overwhelming majority of productiveness is created by the minority of individuals, and the overwhelming majority of that productiveness is created inside the minority of that minority.

Third, we should account for the financial inventory to fill into our matrix. It’s typically mentioned there’ll “solely be 21 million bitcoin,” nevertheless this isn’t true. Accounting for misplaced bitcoin, there may simply be decrease than 16 million.

Once we loosely observe a Pareto distribution and right this moment’s present ranked distribution of entities, the under is what we get. Fascinating outcomes. Michael Saylor, the U.S. authorities and some choose others have change into Bitcoin’s 10 “mega wealthy” entities already.

Moreover, a mean individual right this moment is extra affluent than a twentieth century billionaire was. Subsequently, if Bitcoin merely survives… as little as 800,000 sats may buy a way of life sooner or later way more luxurious than an upper-middle class way of life right this moment, since bitcoin is definitely reflecting the actual prosperity beneficial properties of the globe.

Let’s go additional. There are solely simply over two million bitcoin left on exchanges and slightly below two million left to be mined. Let’s take a hyper-bullish situation and assume there are solely 4 million BTC to be distributed, not 16 million. If we do the mathematics right here, issues solely get extra absurd.

On this situation, as little as $14.81, $100, or 75,000 sats (in the suitable time horizon) might be actually life altering to an individual or firm of the longer term.

What if world wealth and prosperity will increase tenfold? What if the worldwide inhabitants will increase by two billion? What if one other two million bitcoin are misplaced? What if a nation-state begins secretly stacking, and one other three million bitcoin are held? What if a multi-billionaire tomorrow allocates 20% of their wealth to bitcoin, to soak up 100,000 BTC off the market? What if firms sooner or later make use of billions of AI bots to create productiveness to struggle over the remaining BTC? What if simply two of those situations happen?

What if in just a few centuries power firms don’t burn coal or depend on fission, however mine asteroids, use fusion and start building of a Dyson swarm? Based mostly on our mannequin, what if these future firms have complete steadiness sheets of 10 to 1,000 BTC? How does one worth that?

An entity promoting the rights to photo voltaic actual property or buying and selling a contract to an asteroid appears insane to us. Mock as we might, we have now much less in frequent with the longer term than the previous.

Are You Too Late?

So, are you too late? Completely not.

A closed financial system is designed to by no means be too late for anybody, regardless of how a lot or little productiveness they’ve. When people promote rights to the solar or different celestial our bodies within the photo voltaic system, it’s virtually sure to be offered in alternate for bitcoin. Cease considering you might be “too late.” It is absurd.

The query is: What do you do with this info? Should you’re a USD millionaire in 2023, you don’t have any excuse to not purchase 0.06 BTC. At $20,000 per BTC, this 0.12% allocation may save your portfolio. If Bitcoin survives, ultimately this 0.12% will likely be extra helpful than the opposite 99.88% of your portfolio. Even higher, allocate 1% for 0.5 BTC since inventory markets transfer 1% in a day. You should purchase your “BTC insurance coverage” with only a day’s volatility.

Not a USD millionaire? You haven’t any excuse to not purchase $100 of bitcoin (0.005 BTC as of this writing) and lock it down… simply in case. You spend that a lot on insurance coverage on an unlikely occasion, why not spend it on a possible occasion? Most will not, as a result of understanding BTC is accepting many uncomfortable truths.You will quickly understand that allocating 1% places your different 99% at increased danger as you suck liquidity out of the fractional-reserve Ponzi.

The longer Bitcoin survives, the decrease its danger and the upper its upside. It’s designed to be a greater financial savings device as a operate of time. Personally, I feel my 16 million mannequin is simply too bearish and the 4 million mannequin is simply too bullish (for now).

Both approach, the highest-risk allocation to bitcoin is 0%. Both bitcoin is trending towards zero, or every thing else is. There isn’t a third possibility.

Thanks, everybody, to your concepts. Hold sharing that Bitcoin sign, and get off zero if you’re nonetheless on it.

This can be a visitor put up by Luke Broyles. Opinions expressed are completely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

[ad_2]

Source link