[ad_1]

The corporate behind the difficulty of USDT stablecoin, Tether Holdings, has introduced that it’s going to work with a third-party alternate to transform 750 million USDT from Tron to Ethereum ERC20 through a series swap.

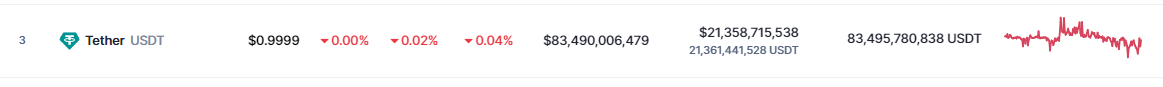

With a present market valuation of $83.37 billion, USDT is by far probably the most worthwhile stablecoin in existence. Stablecoin use has soared over the previous couple of years, and Tether has been working laborious to diversify its reserve holdings in response to the rising want for belief within the community.

To take care of the liquidity of the stablecoin, cryptocurrency alternate Binance mentioned by means of Twitter on Monday that it’s going to prepare a swap of 750 million Tether-Tron token pairs for Tether-Ether. Tether has assured that the general provide of USDT won’t improve or lower on account of this.

After 12pm UTC at this time, #Binance can be swapping 750M USDT-TRX for USDT-ETH instantly with the Tether staff to make sure stablecoin liquidity throughout all chains for our customers.

For those who see any vital actions of USDT from our wallets at this time, that’s why.

Funds are SAFU.

— Binance (@binance) June 12, 2023

Tether Locks On 1:1 USD Anchor

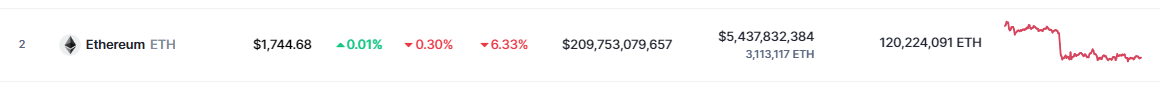

Tether, the preferred stablecoin, strives to maintain a one-to-one alternate fee with the US greenback (USD) always. This token swap will contain Tron, the ninth largest cryptocurrency by market cap at $6.3 billion, and Ether, the second largest cryptocurrency by market cap at $210 billion, after Bitcoin.

By exchanging bitcoin from one blockchain to a different, or “swapping chains,” traders can get entry to all the blockchains that again the digital cash they possess. Their digital belongings can be utilized on different blockchains that help them.

The transfer to rebalance the liquidity base of USDT on Ethereum by shifting from the area of surplus to the area of shortage stays probably the most cheap clarification of the varied theories being put ahead as to why the USDT is being switched.

In the meantime, the heightened regulatory scrutiny of Binance has been detrimental to the alternate, prompting this strategic shift. Binance is now engaged in litigation with the US Securities and Change Fee, highlighting the significance of taking preventative motion in mild of the present regulatory atmosphere.

ETH market cap at the moment at $210 billion. Chart: TradingView.com

Restocking The Ethereum Community Stock

Binance, its CEO Changpeng Zhao, and Binance.US had been all named in a lawsuit introduced by the SEC final week. Binance has been accused of partaking in alleged misleading actions, manipulating buying and selling volumes, diverting person funds, and protecting the identification of these in charge of the corporate in the US a secret.

Tether re-minted $1 billion in USDT on the Ethereum blockchain on Monday, prompting the swap. Tether’s CTO Paolo Ardoino tweeted that the current $1 billion mint was a part of the corporate’s effort to restock its Ethereum Community storage.

In a associated improvement, as of March, each the Tron Basis and its creator, Justin Solar, had been hit with fraud expenses by the SEC. Consequently, Binance USA introduced that it is going to be pulling the digital asset token tron from its alternate.

On the time of writing, Ether (ETH was buying and selling at $1,744, down 6.33% within the final seven days, knowledge from crypto market tracker CoinMarkeCap exhibits. Tether (USDT), however, is painted in crimson, and buying and selling at $0.99.

Supply: CoinMarketCap

Featured picture from The Cryptonomist

[ad_2]

Source link