[ad_1]

Fast Take

With Ethereum’s Shapella improve due in a matter of hours, the market is ripe with hypothesis about its results on ETH’s worth.

The Shapella improve is a mixed identify for 2 upgrades – the Shanghai improve, implementing modifications to Ethereum’s execution layer, and the Capella improve, implementing modifications to Ethereum’s consensus layer.

Amongst a number of minor upgrades to fuel charges, Shapella’s significance lies in its capability to permit customers and validators to entry their staked ETH.

Validators may have two choices in terms of withdrawing their staked ETH — partial and full.

Partial withdrawal

The Shanghai improve permits validators to withdraw solely a portion of their ETH stake and scale back their validator steadiness to the required 32 ETH.

The surplus steadiness that may be partially withdrawn is roughly 1.137 million ETH, price round $2.1 billion at press time. That is the surplus validator steadiness that isn’t required to take part in Ethereum’s Proof-of-Stake consensus mechanism.

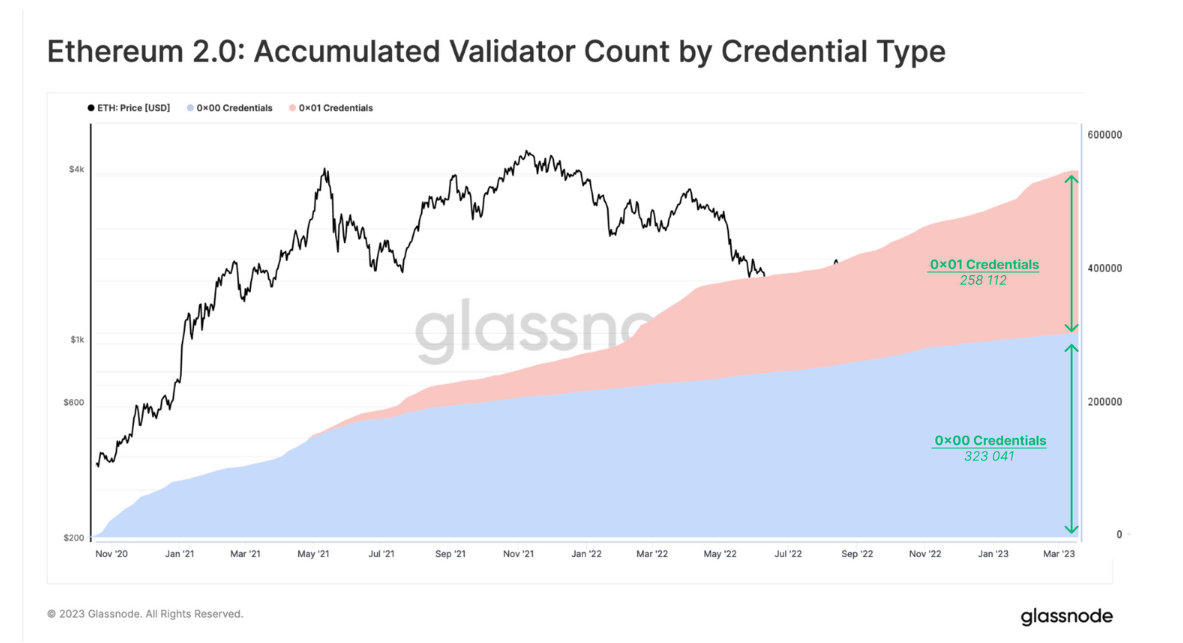

Nonetheless, solely validators with a withdrawal credential oxo1 are in a position to partially withdraw their stake. CryptoSlate evaluation confirmed that that is roughly 44% of validators in a position to withdraw round 276,000 ETH.

Full withdrawal

Full withdrawals contain closing your complete validator down so as to get well the stake steadiness.

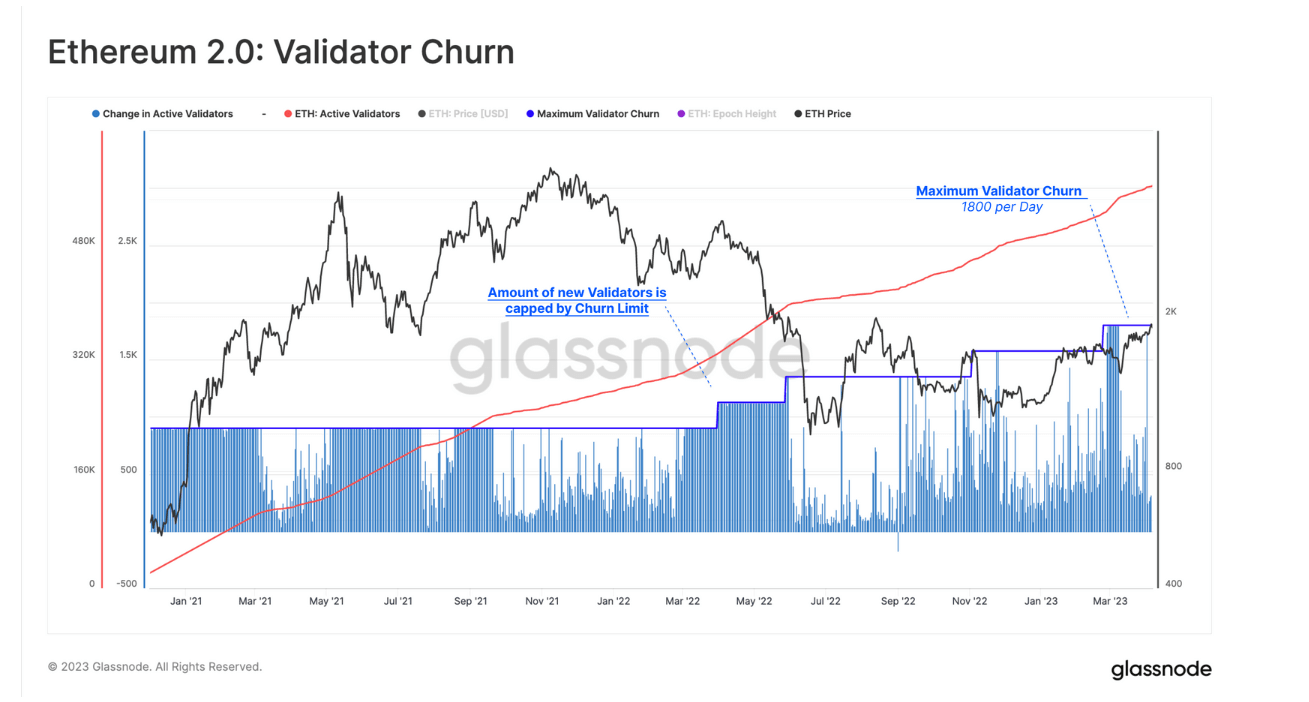

Because the Ethereum community is determined by a steady set of validators, solely a most of 1,800 validators may be totally withdrawn day by day. The restrict is predicated on a churn specification of 8 validators per epoch, for 225 epochs per day.

This mechanism permits as much as 57,600 ETH, price round $109 million at press time, to totally withdraw per day.

In accordance with the most recent estimates from Glassnode, round 170,000 ETH, price $323 million at press time, may very well be offered within the days following the Shanghai improve. Glassnode’s worst-case state of affairs sees a most of 1.54 million ETH that may very well be offered this week, price simply over $2.93 billion.

The publish Worst-case state of affairs might see as much as 1.54M ETH changing into liquid after Shanghai improve appeared first on CryptoSlate.

[ad_2]

Source link