[ad_1]

Knowledge exhibits Bitcoin has been caught in a traditionally tight 14-day vary just lately, one thing that has decompressed into massive strikes previously.

Bitcoin 14-Day Vary Has Been Extraordinarily Slender Not too long ago

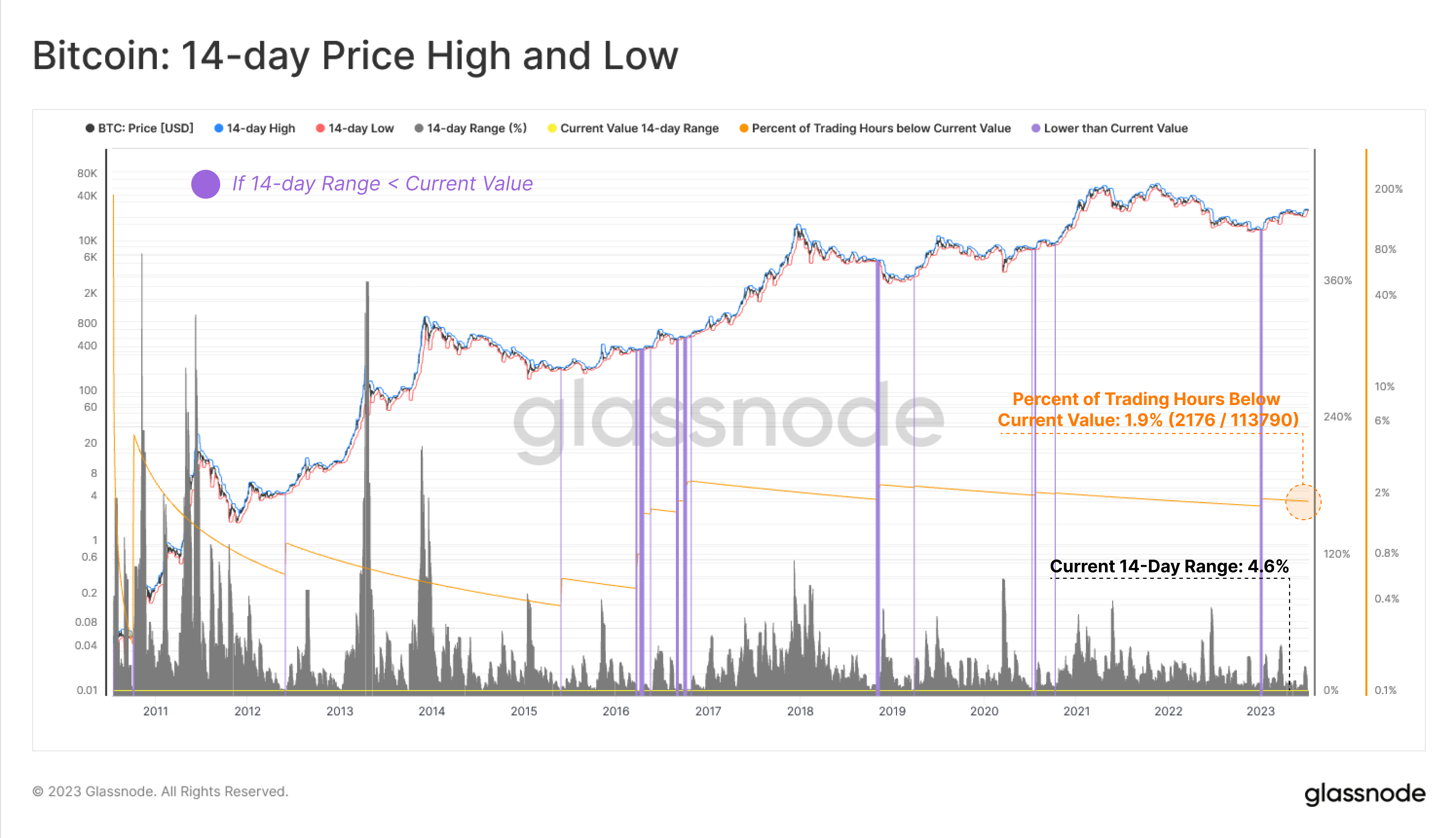

Based on information from the analytics agency Glassnode, the 14-day vary has solely been narrower than now throughout lower than 2% of the cryptocurrency’s total buying and selling life. The “14-day vary” right here refers back to the proportion distinction between the highest and backside recorded within the Bitcoin worth through the previous two weeks.

This indicator can inform us about how unstable the asset’s worth has been just lately. When its worth is excessive, it signifies that the coin has noticed a considerable amount of fluctuation inside the final fourteen days, and thus, the worth has registered excessive volatility.

However, low values of the metric indicate the cryptocurrency hasn’t been that unstable as its worth has moved by solely a low proportion through the previous couple of weeks.

Now, here’s a chart that exhibits the pattern within the Bitcoin 14-day vary over all the historical past of the asset:

Appears like the worth of the metric has been fairly low in latest days | Supply: Glassnode on Twitter

As highlighted within the above graph, the Bitcoin 14-day vary is presently at a price of simply 4.6%, which signifies that the native excessive and low inside the previous two weeks have differed by simply 4.6%.

That is an especially low worth when in comparison with what has usually been the norm for BTC. Within the chart, Glassnode has additionally marked the cases the place the indicator has noticed even decrease values than proper now.

As may be seen from the purple bars, there have solely been only a few occurrences the place Bitcoin has traded inside a narrower vary. By way of the numbers, solely 2,176 hours within the lifetime of the asset have registered decrease values of the metric, that are equal to about 1.9% of all the buying and selling lifetime of the oldest cryptocurrency.

An attention-grabbing sample has traditionally adopted at any time when the indicator has recorded such low values of the 14-day vary. From the graph, it’s seen that Bitcoin has often succeeded in these intervals of extraordinarily low volatility with a violent transfer.

This violent transfer may be in the direction of both course, as each crashes and rallies have adopted a slender vary. Although, curiously, nearly all of these strikes have been in the direction of the upside.

The most recent incidence of this sample was manner again in January, proper earlier than the present rally initially began. It might seem that again then as effectively, the tight vary exploded into a pointy upwards transfer.

If historical past is something to go by, the present low values of the 14-day vary could imply that one other sharp Bitcoin transfer could also be more likely to happen within the close to future. And naturally, if priority is to contemplate, such a transfer could also be extra possible to be in the direction of the up course.

BTC Value

On the time of writing, Bitcoin is buying and selling round $30,900, up 1% within the final week.

BTC seems to be surging | Supply: BTCUSD on TradingView

Featured picture from André François McKenzie on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link