[ad_1]

Bitcoin has continued to wrestle just lately as its worth continues to be within the low $29,000 degree. Right here’s what on-chain knowledge says about if a rebound is probably going or not.

What Does Bitcoin On-Chain Knowledge Say About The Asset’s Close to-Time period Outlook?

Bitcoin has stagnated just lately because the cryptocurrency’s worth has didn’t hold any important strikes going. Even the newest decline within the asset has been indecisive, as the worth didn’t take lengthy to fall again to a sideways motion. Underneath these situations, it’s pure that traders could also be questioning when the asset may get away of this consolidation.

Associated Studying: Quant Explains How These Indicators Have an effect on Ethereum Worth

Current on-chain knowledge from Santiment sheds mild on the underlying metrics associated to the asset, which can include hints about the place the cryptocurrency’s worth may very well be heading subsequent.

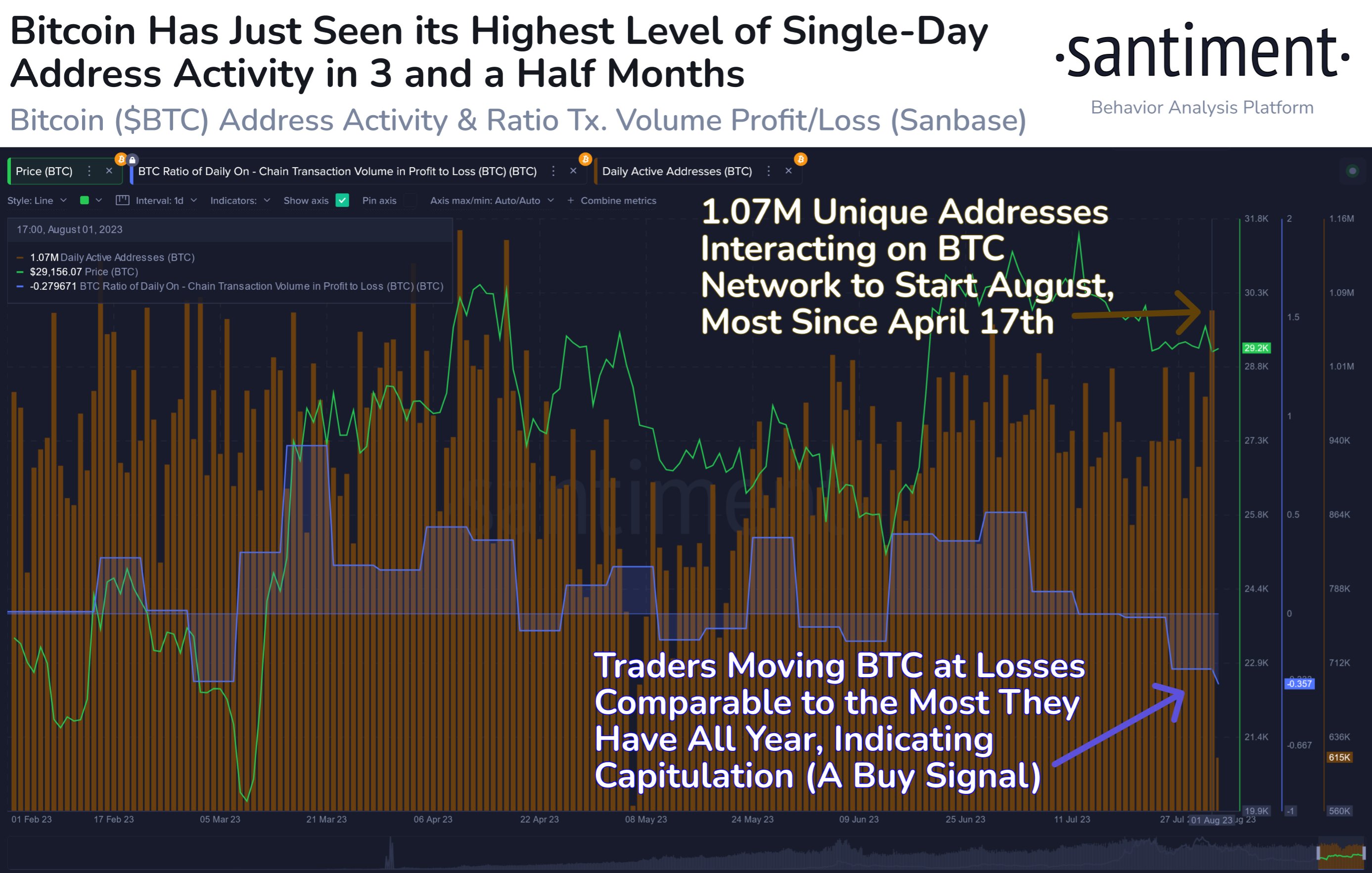

First, here’s a chart that exhibits the information for 2 of the Bitcoin indicators which might be of curiosity right here:

The pattern within the lively addresses and ratio of quantity in revenue to loss | Supply: Santiment on X

As you possibly can see within the above graph, there are two indicators of relevance right here: the “each day lively addresses” and the “ratio of on-chain transaction quantity in revenue to loss.”

The previous of those naturally retains observe of the full variety of distinctive addresses on the Bitcoin blockchain which might be collaborating in some type of transaction exercise on the community.

From the chart, it’s seen that this metric has noticed a big spike just lately, suggesting {that a} excessive variety of addresses have turn into lively. Typically, a lot of addresses making transfers on the chain implies {that a} excessive quantity of customers are making use of the chain proper now.

The present worth of the metric means that greater than one million addresses have been lively just lately, which is the very best that the indicator has been because the center of April. Such a rise in utility suggests that there’s a great amount of curiosity within the coin in the intervening time.

Now, the opposite metric right here measures the distinction between the profit-taking and loss-taking volumes on the Bitcoin community. As is seen within the graph, this indicator has a unfavorable worth at present, which suggests that almost all of the promoting available in the market is going on at some loss.

These unfavorable ranges of the metric are related in scale to these noticed again through the March plunge. Traditionally, bottoms within the worth have turn into extra possible to kind when traders are capitulating like this, because the cash of the weak fingers are picked up by the sturdy fingers in such intervals.

If a rebound transfer does come up from this capitulation, then its timing could also be preferrred, as a excessive quantity of lively addresses can imply the presence of a lot of merchants who might help gas the transfer.

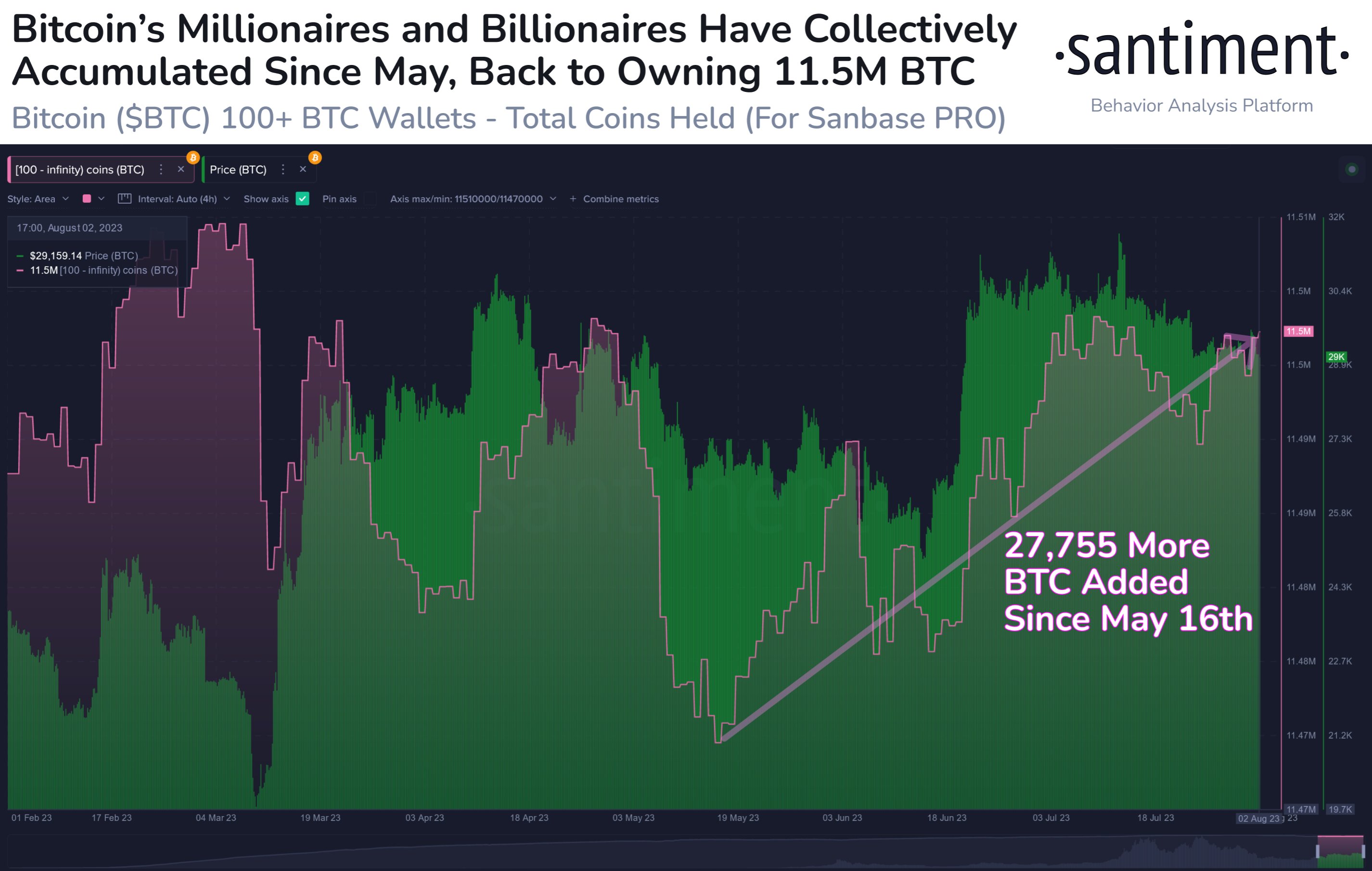

Moreover, the Bitcoin millionaire and billionaire addresses have additionally been behind the asset just lately, as they’ve added 27,755 BTC to their holdings since Might.

The worth of the metric has been trending up just lately | Supply: Santiment on X

Based mostly on these components, it’s not laborious to consider {that a} rebound within the cryptocurrency’s worth may happen within the close to future, though it could solely be a short-term transfer.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $29,100, down 1% within the final week.

BTC has continued to maneuver sideways | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Santiment.internet

[ad_2]

Source link