[ad_1]

It’s time for the U.S. to implement clever, progressive, and particular digital asset regulation.

The Securities and Trade Fee’s current expenses towards Coinbase and Binance have introduced the controversy on digital asset classification to a boiling level, and I imagine it demonstrates that the group just isn’t geared up to control digital belongings competently.

Included within the fits are lists of over 15 digital belongings the SEC claims move the Howey Check and are thus securities. With the intention to succeed within the go well with, SEC Chair Gary Gensler instructed CNBC,

“All we’ve got to indicate is that certainly one of [the tokens listed by the exchanges] is a safety and they need to be correctly registering.”

Nonetheless, when reviewing the alleged securities listed by the exchanges, there is no such thing as a point out of the black swan that was the Terra-Luna collapse (save for a passing reference within the Binance go well with.) Binance presently nonetheless lists LUNA in addition to the basic token LUNC, whereas Coinbase listed wrapped LUNA (wLUNA) and nonetheless has it obtainable through the Coinbase Pockets. Terra Luna’s failure worn out tens of billions of {dollars} from the crypto market cap and led to particular person traders dropping enormous quantities of cash.

The SEC additionally invokes tokens buying and selling on FTX as a part of their argument that Coinbase is within the unsuitable. Within the lawsuit, the itemizing of SOL on FTX.US is offered as a part of the proof claiming that Solana is a safety. An virtually equivalent part can also be included within the Binance go well with.

At this level, it’s well-known that FTX and its executives had a really well-known presence on Capital Hill and that SBF and his cohorts established private or working relationships with a number of members of the U.S. authorities, Gensler included. U.S. clients misplaced enormous sums when that change failed, leaving various members of the federal government with an embarrassing observe file of getting snuggled as much as alleged fraudsters and the uncomfortable actuality of getting to disgorge themselves of their substantial marketing campaign donations.

The U.S. has failed on crypto regulation

Coinbase has been publicly requesting steering on digital asset regulation for years. “The SEC is one the place we’ve actually struggled over the previous few years,” acknowledged Coinbase CEO Brian Armstrong in a Twitter Area earlier this 12 months, implying an intransigence at that company not encountered elsewhere.

Armstrong defined that Coinbase had tried to contact the SEC to debate the regulatory panorama to no avail till the SEC particularly requested to go to Coinbase final 12 months. Coinbase had “30 conferences over the past 9 months” with the SEC, which was speculated to culminate in a gathering the place suggestions could be given.

Nonetheless, Armstrong alleged that the SEC canceled the assembly the day earlier than it was speculated to occur and despatched a Wells Discover to Coinbase the next week. 9 weeks later, it sued the change for a number of securities legal guidelines violations.

Digital Property mentions in Congressional Report

Whereas there was a substantial enhance in congressional exercise on digital belongings over the previous few years, with over 1,065 mentions of the time period within the file. However, actual progress on digital asset regulation has been excruciatingly sluggish.

Digital belongings have been first talked about in a Senate listening to from 2000 titled “Utah’s Digital Economic system and the Future: Peer-to-Peer and Different Rising Applied sciences,” during which they have been likened to “databases.”

Digital belongings have been additionally talked about in a 2001 Congressional listening to by the Power and Commerce Subcommittee on Commerce, Commerce, and Shopper Safety. John Schwarz, the President and CEO of Reciprocal, Inc., argued that “securing digital belongings and stopping undesirable digital intrusion is equal to defending private and probably nationwide integrity.”

Whereas Schwarz was speaking about digital information equivalent to mp3 audio and mp4 movies, it’s the first official point out of the time period now making headlines.

The time period was cited sometimes every year till 2019, when digital asset mentions surged to 21, together with the proposed payments, Managed Stablecoins are Securities Act and the Preserve Massive Tech Out Of Finance Act.

By 2022 there have been 598 mentions of the time period “Digital Property,” together with 22 payments, 14 Congressional Hearings, and over 500 mentions in Congressional calendars. This 12 months, in 2023, there have solely been 68 mentions to this point, the congressional calendar assortment being the most important reason behind the drop, falling from 501 to only eight mentions.

Developments in Digital Asset utilization

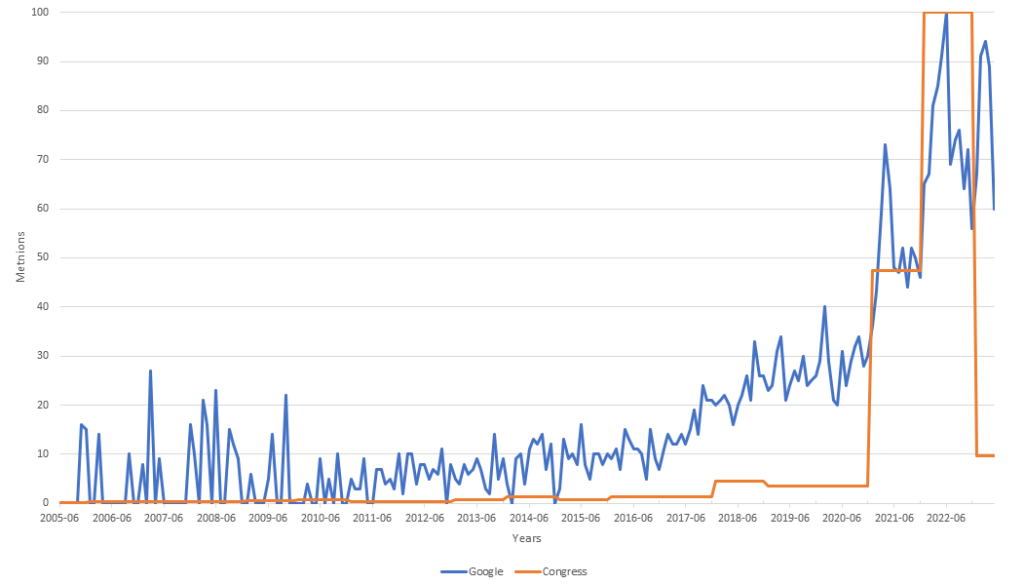

I in contrast the “Digital Property” mentions on Govinfo.gov’s Congressional and Federal databases to the search quantity of the identical time period on Google from 2005 to the current.

The normalized chart beneath reveals curiosity via Google Search selecting up from round 2017, whereas it took till 2020 for the U.S. Authorities to extend using the time period on the file.

Within the chart, the information is scaled to a standard reference level, permitting for straightforward comparability and evaluation of the totally different information units. Notably, there was an excessive decline in mentions on the official public file for “Digital Property” to only 9.7 at a time when Google Search site visitors is above 60.

Curiosity from Google Search appears to have fashioned a double prime, with a peak in 2021 and a decrease excessive at first of 2023. The technical analysts of the world would counsel such a motion is a bearish indicator if this was a inventory or token chart.

Furthermore, curiosity from Congress has merely fallen off a cliff, with mentions falling from 598 in 2022 to only 58 six months into 2023.

Why?

Has dialog on digital belongings been moved off the official public file into again channels and social media? Was the surge in 2022 associated to an pressing have to outline Digital Property?

If that have been the case, then why are firms who’re (publicly) begging for steering on digital asset regulation being sued by the SEC?

Partly two of this three-part function, we’ll discover the implications of the SEC’s actions and discover various approaches to crypto regulation that might profit the trade and its traders.

Observe CryptoSlate on Twitter or be a part of our Telegram channel to be notified when the second half is accessible.

[ad_2]

Source link

_id_b32fb481-53b2-43f3-b9be-7ec7ef356fd6_size900.jpg)