[ad_1]

Inside the final 24 hours, Bitcoin and all the crypto market are experiencing a slight downturn, leaving traders questioning in regards to the causes behind this dip. Bitcoin briefly rose to $31,009 earlier than falling to 30,254 inside a couple of hours. Ether (ETH) rose to over $1,900, solely to drop again to $1,868.

CPI Information And The Anticipation Of A Charge Hike

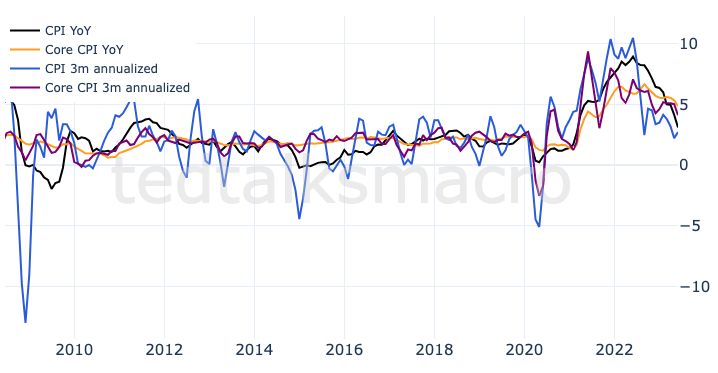

One essential piece of the puzzle lies within the current Shopper Value Index (CPI) knowledge. Yesterday’s CPI knowledge for June was a constructive shock because the headline CPI year-over-year (YoY) fell to three.0%, coming in beneath expectations of three.1%. Much more encouraging was core CPI YoY which dropped to 4.8%, surpassing market expectations of 5.0%.

Nevertheless, this didn’t considerably alter the market’s view on the upcoming charge hike resolution by the Federal Reserve on the finish of the month. In accordance with the CME FedWatch Software, the market nonetheless expects a 25 bps hike by the Fed on the subsequent assembly on July 25-26 with a 93% chance. Famend macro analyst Ted (@tedtalksmacro) is within the minority that believes there received’t be one other charge hike. Ted shared the chart beneath and wrote:

3m annualized core CPI now working at October 2021 ranges. The development is the Fed’s pal. Arduous to see one other hike this month.

Different analysts, nevertheless, consider that the core Private Consumption Expenditures Value Index (PCE) is extra necessary for the Fed. In the latest launch of FOMC minutes, PCE is talked about ten instances in contrast vs. three mentions of CPI. The Fed’s favored inflation gauge for June won’t be launched till 28 July.

US Authorities Promoting Bitcoin

Nevertheless, you will need to observe that following the constructive inflation knowledge, conventional markets had been setting new highs. The S&P500 rose by 0.74% yesterday and recorded its highest degree since April 2022. In the meantime, Bitcoin nonetheless might’t sustainably break $31,000 in its sixth try.

The rationale was probably the information that the US authorities is transferring 9,800 BTC linked to the notorious Silk Highway market. The information broke shortly after the discharge of the CPI and drastically dampened sentiment. Prior to now, information that the US authorities is transferring and presumably promoting a few of its Bitcoin all the time triggered extreme worth drops. Yesterday’s drop can nonetheless be thought-about average and an indicator of market power.

To date, there may be solely hypothesis in regards to the US authorities’s plans. It’s identified that the US intends to liquidate the seized BTC holdings. The final time this occurred was in March. Again then, 9,861 Bitcoin had been offered. Nevertheless, the transfers might additionally solely be used to restructure the BTC holdings.

In all probability the explanation #Bitcoin couldn’t rally regardless of the constructive CPI shock (SPX +0.83%). 👇 https://t.co/93iiWlHNvm

— Jake Simmons (@realJakeSimmons) July 12, 2023

BTC Caught In Vary

Moreover, the market exercise itself is enjoying a big function. Merchants actively interact in methods resembling longing on the backside and shorting on the prime of the present Bitcoin vary. As analyst Skew aptly places it, “Most are enjoying the vary effectively, hedging close to vary highs & flipping lengthy round vary lows.”

This buying and selling habits creates a dynamic atmosphere the place short-term worth actions will be influenced by the actions of merchants looking for to capitalize on market volatility. Skew added:

BTC Combination CVDs & Delta nonetheless a really by-product pushed market with lack of spot participation but = chop chop. Respectable lengthy sweep round $30.2K + demand between present worth & $30K. May see a take revenue or quick protecting bounce a while later immediately.

At press time, the BTC worth was at $30,431 and remained comfortably within the buying and selling vary between $29,800 and $31,300.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link