[ad_1]

The Bitcoin worth motion has been caught in a decent vary for weeks resulting in the bottom volatility ranges in years. A current report hints at a possible breakout from the present vary, however which facet can be favorable by the potential spike in volatility?

As of this writing, Bitcoin trades at $28,950 with sideways motion within the final 24 hours. Over the earlier seven days, the BTC’s worth noticed a slight downtick recording a 2% loss. Different tokens within the prime 10 by market cap are underperforming, with many seeing double-digit losses on low timeframes.

The Final Time The Bitcoin Value Noticed Low Volatility

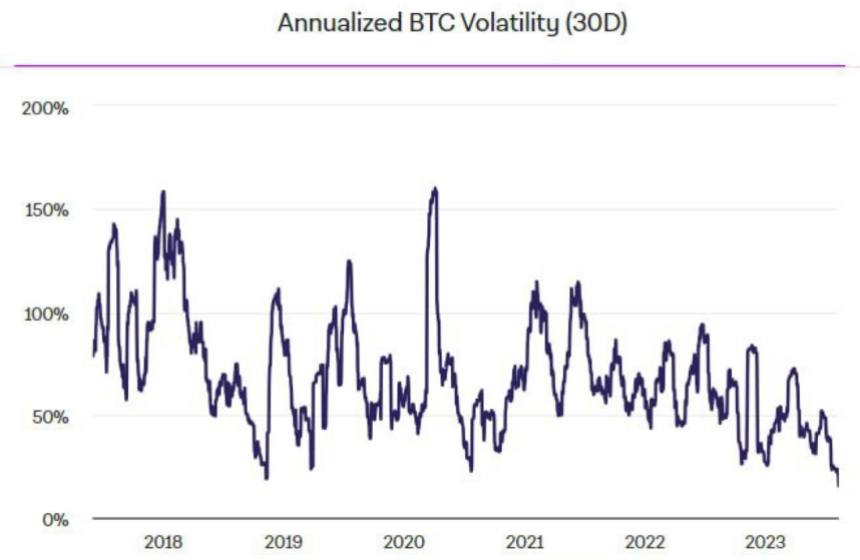

As seen within the chart under, supplied by buying and selling desk QCP Capital in a report, annualized volatility for BTC reached important ranges seen for the primary time in over 5 years. The metric final stood at these ranges from late 2018 to 2019.

The chart above additionally exhibits that volatility fluctuated from the low to the yearly excessive in a cycle that prolonged for 2019. At the moment, Bitcoin and the crypto market have been popping out from a protracted bear market that, as at the moment, left merchants and market members in shambles and with virtually no urge for food for danger.

QCP Capital famous that from 2018 to 2019, the macroeconomic panorama dominated the Bitcoin worth motion. At the moment, the US Federal Reserve (Fed) hiked rates of interest, however the COVID-19 pandemic, which operated as a catalyzer, compelled it to reverse.

The latter occurred from late 2019 to 2020, when the convenience in macroeconomic situations allowed Bitcoin to soar to a brand new all-time excessive. Thus, the buying and selling desk believes {that a} catalyzer is required to push the value motion again to life:

The final time buying and selling was this compressed, it was in the course of the crypto winter of 2018 and 2019, and it took a change within the macro atmosphere to revive the market once more.

Nevertheless, they famous that the break of the present low volatility atmosphere isn’t “imminent.” Nevertheless, the upcoming resolution on a Bitcoin spot Change Traded Fund (ETF) within the US may function as a catalyzer, bringing BTC to its subsequent resistance degree at round $34,000, however persistence remains to be required.

QCP Capital concluded:

Will there be a pointy rally that takes us to the 34k resistance – just like the prior 3 times which kissed the help trendline this 12 months? We expect it may nonetheless be one other quiet few weeks earlier than we discover out.

Cowl picture from Unsplash, chart from Tradingview

[ad_2]

Source link