[ad_1]

Bitcoin’s sustained worth stage above $30,000 has Brough a few noticeable shift in market habits, notably amongst short-term holders.

Brief-term holders (STHs), or those that have held Bitcoin for lower than 155 days, play an important function in market evaluation. Their habits usually gives insights into market sentiment and potential worth actions.

Sometimes, they’re extra reactive to cost adjustments and have a tendency to purchase or promote based mostly on current market traits. This could result in elevated volatility, as their buying and selling actions could cause sharp worth swings.

As an illustration, when short-term holders begin to hodl, it might probably cut back the sell-side strain out there, doubtlessly resulting in a extra steady worth atmosphere.

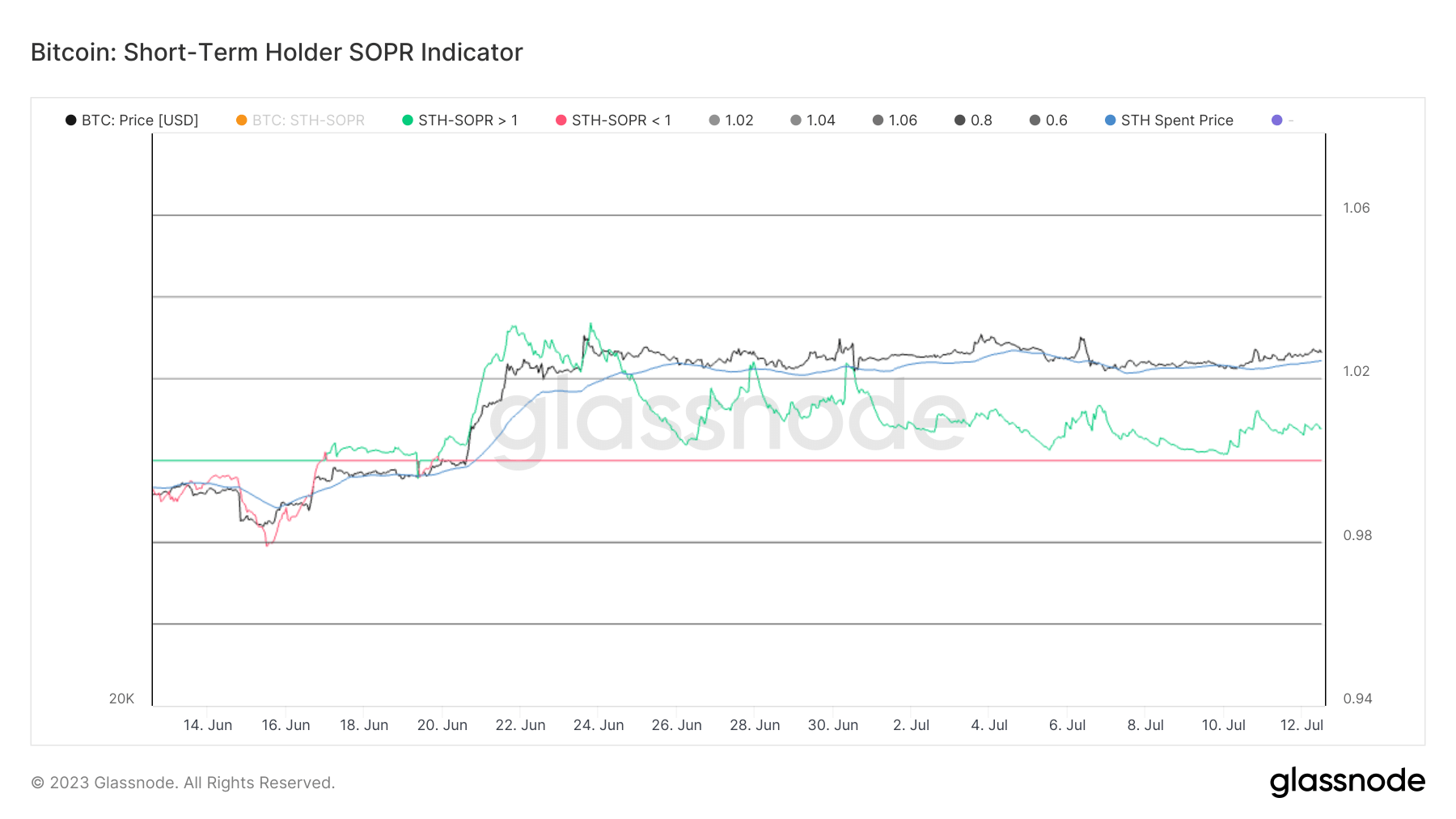

The current surge in Bitcoin’s worth from $26,000 to over $30,000 has put the vast majority of STHs in revenue. That is evident by the Brief-Time period Holder Spent Output Revenue Ratio (STH-SOPR) metric. SOPR is a metric that calculates the revenue ratio of cash moved on-chain, offering insights into whether or not holders are promoting at a revenue or loss. STH-SOPR focuses explicitly on short-term holders.

Since June 20, STH-SOPR has trended above 1, indicating that short-term holders are, on common, transferring their cash at a revenue. The metric peaked at 1.033 on June 21 and has since trended downwards, reaching 1.006 on July 11. This implies that whereas STHs are nonetheless profiting, the revenue margin has decreased.

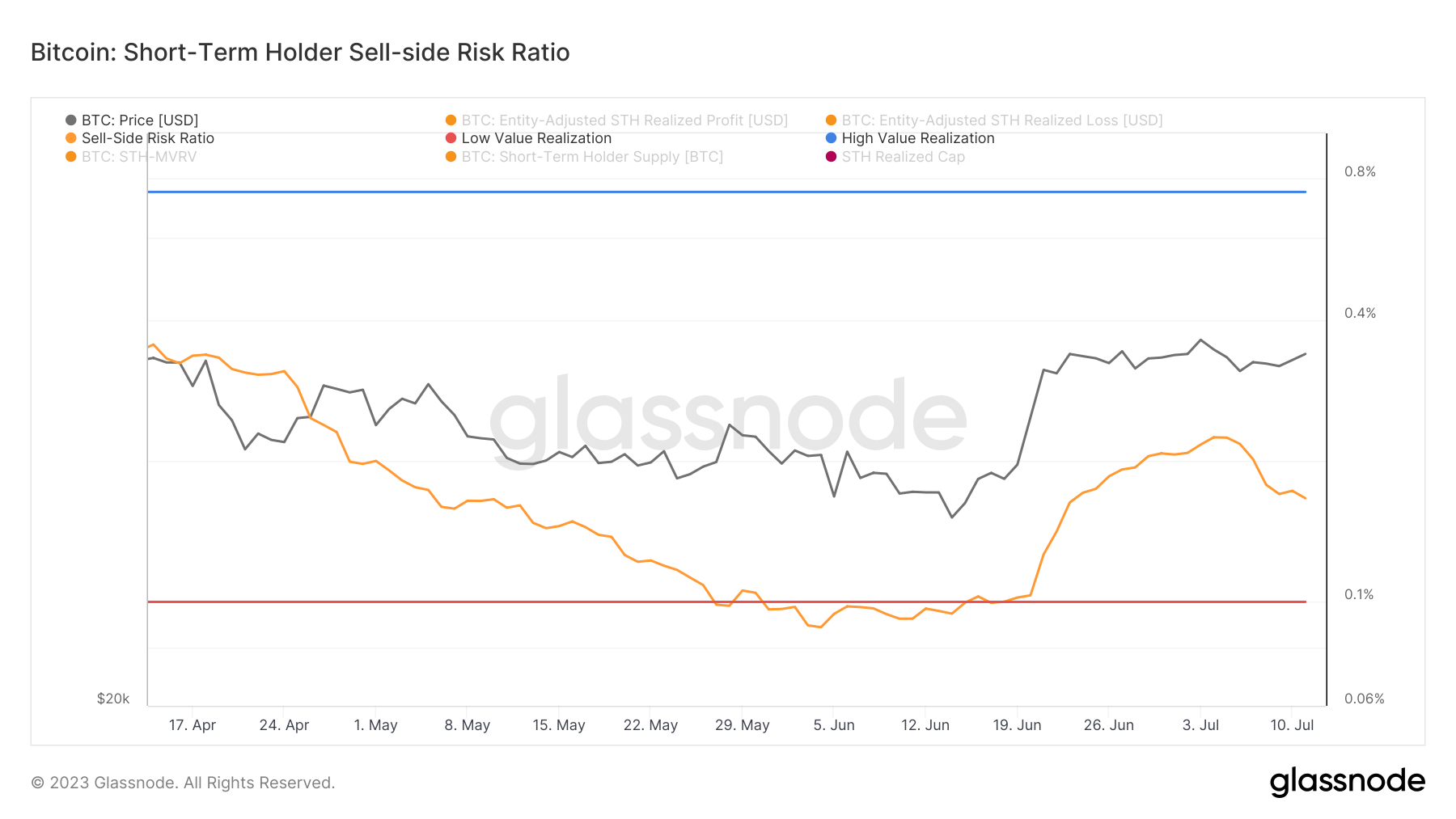

In the meantime, knowledge from on-chain market evaluation platform Glassnode exhibits that the sell-side danger ratio for short-term holders has declined. The sell-side danger ratio quantifies the mixture sell-side danger out there by evaluating the entire USD worth that traders spend every day to the entire short-term holder realized capitalization. Excessive values are sometimes related to heavy profit-taking, whereas low values align with market consolidation phases and bear markets.

The ratio started rising on June 21, peaking on July 5. Since then, the ratio has sharply declined, indicating a lower in sell-side strain from short-term holders.

The mixture of those two metrics paints an attention-grabbing image. Whereas the revenue margin for short-term holders is reducing, so is the sell-side strain. This might recommend that short-term holders are selecting to carry onto their Bitcoin, regardless of the diminishing earnings.

This habits may doubtlessly stabilize the market and create a stable base for future worth will increase.

The publish Why are short-term holders HODLing as an alternative of taking earnings? appeared first on CryptoSlate.

[ad_2]

Source link