[ad_1]

Bitcoin buyers are presently experiencing a déjà vu. As has occurred a number of occasions prior to now, the current Tether FUD has as soon as once more marked the native backside for the BTC worth. On the identical time, euphoria and greed have returned to the market. And there are a number of good causes for this.

BlackRock has utilized for a spot ETF and has an insane observe report, Constancy, Citadel & Schwab are launching a crypto alternate, Invesco and WisdomTree have each renewed their Bitcoin ETF functions and Germany’s largest asset supervisor Deutsche Financial institution has utilized for a crypto custody license. Massive cash is unquestionably making its manner into the crypto market after the exhausting crackdown aka Operation Choke Level 2.0 within the US to seize the biggest piece of the pie doable.

What Triggered The Bitcoin And Crypto Value Spike?

One of many driving components behind the value rise within the crypto market is undoubtedly the bullish information surrounding Bitcoin and the potential wave of recent institutional buyers. Bitcoin is as soon as once more setting the pattern for the broader crypto market, which will also be seen in the truth that Bitcoin dominance, the share of BTC’s market capitalization in your entire crypto market, continues to rise.

The metric rose to its highest degree since mid-April 2021 right this moment and presently stands at 51.08%. But, the Bitcoin rally has additionally breathed new life into a number of altcoins. Amongst others, FLOW, CFX and BCH are up 22% within the final 24 hours, adopted by STX with 18%, OP with 17% and INJ with 15%. ETH is up 4.8%.

Nevertheless, it is very important word that the present worth rally will not be primarily resulting from hypothesis by futures merchants. As we reported yesterday, in current weeks BTC whales with property of 1,000 to 10,000 BTC have amassed a complete of 131,6000 BTC price round $3.5 billion from the spot market. And this pattern continues. CryptoQuant CEO Ki Younger-Ju wrote through Twitter:

This isn’t a brief squeeze, however somebody(s) is simply shopping for $BTC so much.

I repeat.

This isn’t a brief squeeze, however somebody(s) is simply shopping for $BTC so much.

The analyst is referring to the hourly brief squeeze ratio indicator. Because the chart under exhibits, the metric has remained comparatively flat in comparison with earlier worth spikes, indicating that there’s extra upside potential if brief positions are squeezed (as soon as once more).

This additionally implies that the spot market had a serious affect on the motion. Typically, the rise can due to this fact be seen as extra sustainable.

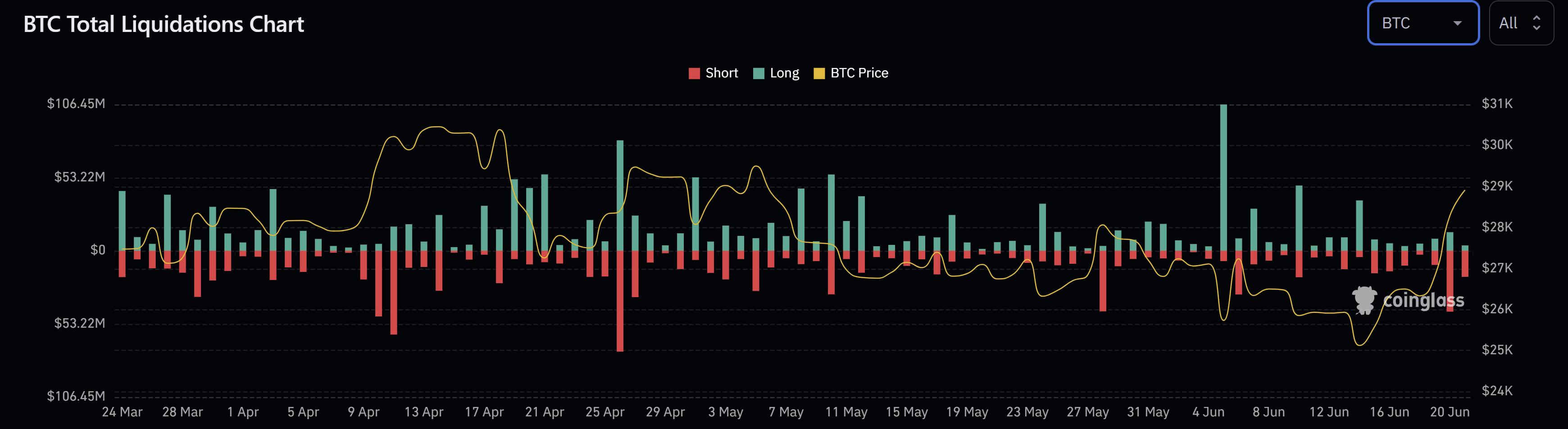

However, it needs to be famous that there was a sure diploma of brief squeeze. Coinglass information exhibits that about $44 thousands and thousands in shorts have been liquidated. The extent is much like that seen on Could 28 this 12 months, when $44 million in BTC shorts have been liquidated and the Bitcoin worth rose by 4.4%.

Vetle Lunde, senior analyst at K33 Analysis, additionally made one other bullish statement concerning the CME futures. “Very bullish motion on the CME,” says Lunde, who defined that CME’s foundation pushed to yearly highs after seeing the biggest relative day by day development in OI since November 9, 2022. “Allocations to the futures ETFs didn’t trigger the expansion, because the lively market participation share elevated from 42% to 51% yesterday,” remarked the analyst.

At press time, Bitcoin was displaying a particularly bullish worth motion. BTC bounced off the 200-day EMA and broke by the downward pattern that endured since mid-April this 12 months.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link