[ad_1]

The NFT market crash of 2022 is without doubt one of the most heavily-debated matters of the yr and for a very good motive. The identical market that was the discuss of the city in 2021 has seen a stunning downfall in 2022.

However why did the NFT market crash? May we predict it sooner? How will we get well from a crypto crash that shook the trade? On this put up, we’ll reply all of these questions and extra. Nonetheless, with a view to perceive the NFT market crash, we should return to the roots:

The NFT Market – Sturdy Beginnings

Though the primary NFT dates again to 2014, it wasn’t till 2017 that CryptoPunks, Uncommon Pepes, and different Ethereum collections sparked curiosity amongst tech fans. The actual NFT increase started in 2021, when large names IRL confirmed curiosity out there. Essentially the most memorable instance is Christie’s public sale home, which bought a Beeple NFT for $69 million.

The remainder is historical past. By the top of 2021, the NFT market had exploded, and types like Gucci and D&G launched their collectibles. This rollercoaster of occasions was topped by the primary metaverses launched too. In fact, every part confirmed up out there’s worth.

The Most Costly NFTs Ever Offered

Keep in mind that $69M Beeple NFT purchased by Christie’s? Nicely, it’s nonetheless some of the costly collectibles ever offered. Nonetheless, the enduring web3 artist Pak dethroned him in December 2021 along with his NFT “Merge,” promoting for $91.8 million.

The record additionally contains CryptoPunks, their costliest NFT promoting for $23.7M (extra particulars in our information on the costliest NFTs). Notably, the NFT “Clock” with $52.7, an NFT elevating funds for WikiLeaks’ founder’s authorized battle in opposition to US extradition.

In 2021, the month-to-month NFT gross sales amassed over $500,000, which implies a single factor: traders have been betting all of it on this market. And sadly, a few of them remorse it now.

Patrons Lose Hundreds of thousands within the NFT Market Crash

Whereas the NFT market’s worth decreased in February 2022, most finance consultants agree that the crash started within the yr’s ultimate quarter. Naturally, everyone was affected – however some influencers really took the toughest hits!

The very best instance is Logan Paul, whose Azuki NFT purchased for $623k is now price $10 (that’s lower than one burger, we all know). Equally, Steve Aoki’s Doodles NFT (bought for $346,ooo) is now price lower than $42,000.

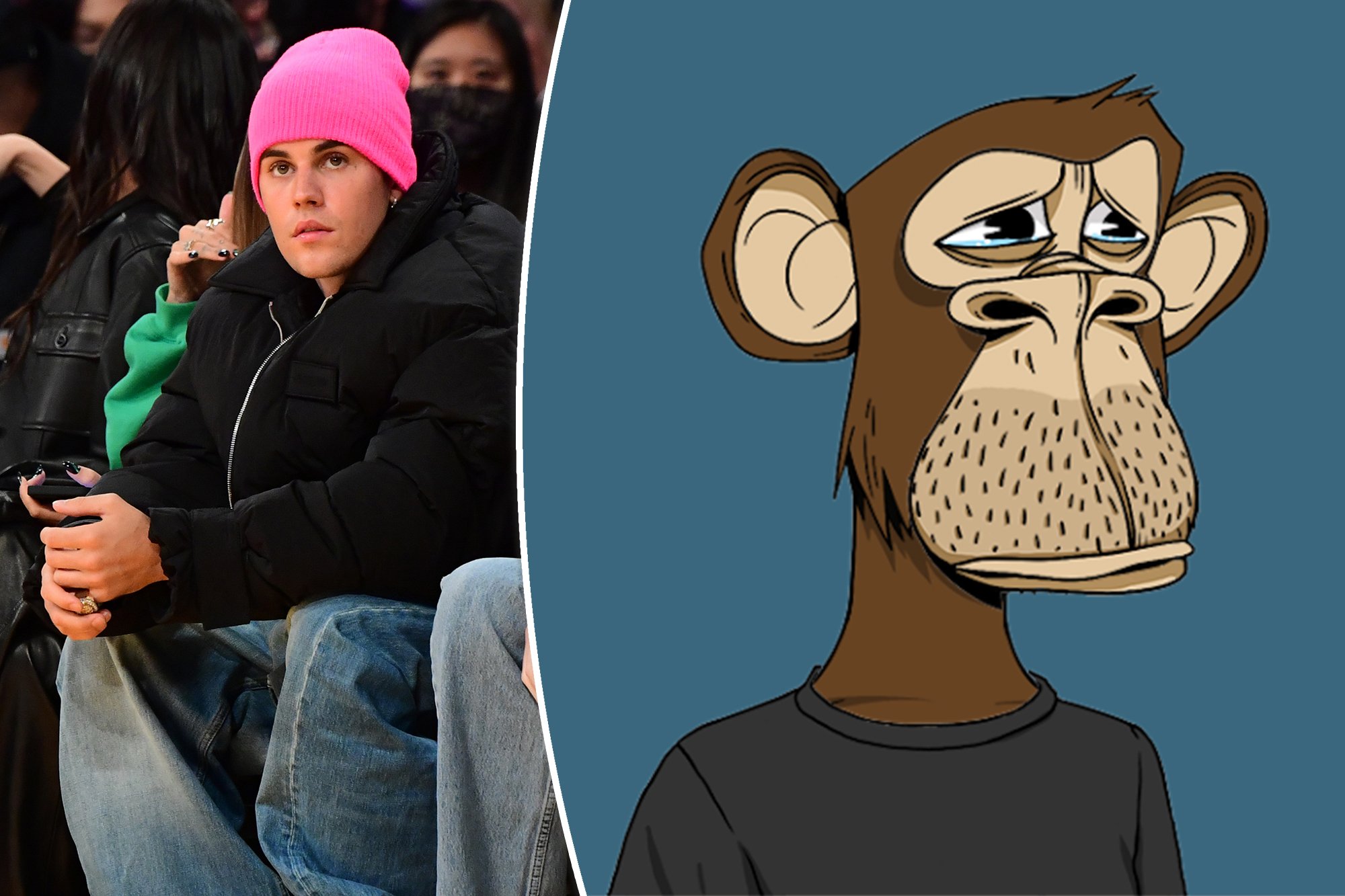

Snoop Dogg additionally misplaced over $300k with a CryptoPunk purchased for $1.1M, now price about $688k. The preferred loss, although, is Justin Bieber’s Bored Ape Yacht Membership NFT which went from $1.31M to a stunning $59,090.

These numbers advised collectors one factor: the NFT market crash was actual. However why did it occur?

So, Why Did the NFT Market Crash?

With a purpose to perceive why the NFT market crashed, we’ll have to research three commonsense causes:

Issue One: Market Saturation

Earlier than the 2021 NFT increase, solely a handful of web3 initiatives have been traded. Because the collectors’ curiosity out there exploded, so has the variety of initiatives. For instance, over 1.5 million NFTs have been traded in a single month in 2021.

From music to gaming belongings and visible artworks, there are tens of various kinds of NFTs constructed on completely different blockchains. This unimaginable enlargement got here with a value, too: market saturation. In different phrases, the overwhelming quantity of NFTs out there reached (and even surpassed) the collectors’ wants and calls for.

Issue Two: Crypto and NFT Scams and Fraud

When persons are prepared to speculate thousands and thousands of {dollars} right into a market with out rules, hackers inevitably present up – and that’s exactly what occurred with NFTs. Shortly after the NFT increase, folks misplaced their belongings or cash in a single day after accessing malicious hyperlinks or falling totally free mint NFT scams. As the primary Discord hacks appeared, not even neighborhood chats have been secure anymore.

Positive, crypto detectives resembling ZachXBT have been searching down scammers for years, however that’s barely sufficient to make the NFT area actually secure. This motive has satisfied many collectors to cease investing in new initiatives or to go away the NFT area for good.

Issue Three: Collapse of Huge Techniques

Many large web3-related methods contributed to the NFT market’s quick enlargement – and their collapse has affected the trade. Let’s take, for instance, FTX, one of many largest crypto exchanges thus far. The platform’s house owners filed for chapter in late 2022, allegedly as a result of an absence of liquidity and lots of withdrawals (though scams could also be guilty too).

In Could 2022, the Terra blockchain’s crypto cash TerraUSD and LUNA collapsed. The 2 currencies misplaced virtually 99% of their worth, and traders misplaced greater than $60 million. These two occasions and comparable collapses have set the muse for the NFT market crash.

Issue 4: How the World at Giant Impacts NFTs and Crypto

The worldwide financial state of affairs impacts each market worldwide, and NFTs aren’t any exception. Because the world was slowly recovering from the COVID pandemic, the US economic system slowed drastically in 2022. Many monetary consultants even thought-about the potential for getting into a recession – a state of affairs that will have an effect on the worldwide economic system too.

One other consequence of the pandemic was inflation. In 2022, the European Union recorded the very best inflation degree: 9.2%. Such knowledge inevitably modified NFT traders’ and creators’ roadmap or spending habits.

Now, just one query stays…

Can We Get better From the NFT Market Crash? (be certain that that is hopeful)

The bear market has taken its toll on everyone within the web3 area, be it NFT whales, artists, or collectors. Whereas some misplaced thousands and thousands of {dollars}, others misplaced the prospect to develop.

Nonetheless, the identical knowledge that confirmed the NFT market crash additionally exhibits a light-weight on the finish of the tunnel. Yuga Labs, the leaders of the NFT area, contributed to 30% of all Ethereum NFT buying and selling quantity in a single month. Its progressive video games like Dookey Sprint attracted new collectors and inspired customers to speculate out there.

The brand new NFT market Blur had the identical influence too. This zero-fee platform reported a 120% enhance in month-to-month buying and selling quantity, surpassing its competitor OpenSea. Shortly after launch, {the marketplace} amassed over $100 million in weekly NFT gross sales.

To conclude, the NFT market is undoubtedly right here to remain. By doing our personal analysis as common, we are able to stop NFT scams and make smart long-term investments that transcend the ups and downs of the trade.

All funding/monetary opinions expressed by NFTevening.com are usually not suggestions.

This text is instructional materials.

As all the time, make your individual analysis prior to creating any form of funding.

[ad_2]

Source link