[ad_1]

Be part of Our Telegram channel to remain updated on breaking information protection

Within the fast-paced and unpredictable universe of crypto, one typically encounters a deluge of forecasts and predictions. These predictions, whether or not optimistic or grim, typically span a large spectrum and are made with various levels of certainty. However Steve, a recognized YouTuber from CryptoCrewUniversity, takes a distinct strategy. By meticulously dissecting Bitcoin’s previous and current habits, he affords intriguing insights into what may lie forward.

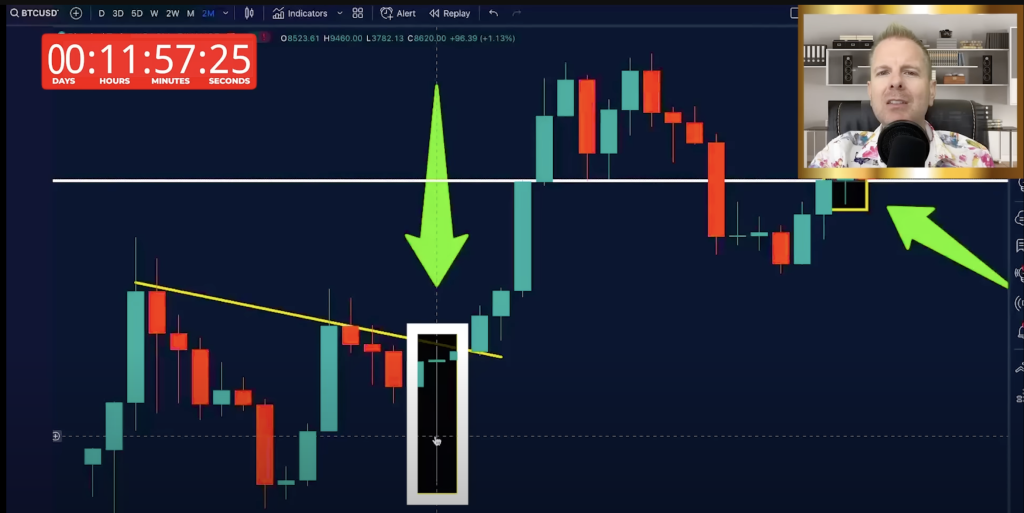

By way of an in-depth examination of Bitcoin’s two-month and two-week charts, Steve seeks to attract out patterns which might be simply missed by informal observers. He believes that understanding the historic context of Bitcoin’s habits is invaluable. It’s like studying the diary of an entity, every entry revealing a bit extra about its nature. One of many pivotal moments Steve zeroes in on is from March 2020. At this juncture, Bitcoin showcased a major sample referred to as the ‘dragonfly doji’ on its two-month chart. For the uninitiated, this signaled a development reversal that was on the horizon.

However of all of the intricate particulars Steve reveals, the plain emphasis he locations is on the significance of the $29,000 stage. This isn’t simply an arbitrary quantity. Repeatedly, this value level has manifested its significance, appearing as each a strong help when costs fall and a formidable resistance after they rise. It’s like Bitcoin’s personal gravitational heart, pulling it again each time it strays too far.

The mainstream discourse surrounding Bitcoin is dominated by two main narratives: the bullish believers who envision Bitcoin hovering to unprecedented heights and the bearish pundits who predict its downfall. Steve’s evaluation, nonetheless, throws a spanner in these works. He suggests a possible state of affairs the place Bitcoin may eschew each extremes, settling as a substitute right into a part of sideways motion for a substantial interval. This perception immediately challenges each camps and their firmly held beliefs.

Steve’s analytical strategy doesn’t simply cease with development patterns. He additionally dives into instruments just like the pi cycle indicator to glean extra from the info. In accordance with his analysis, if Bitcoin breaches the important crimson line of this indicator, a descent to the inexperienced stage is believable, which may peg Bitcoin at an approximate value of $18,000. On the flip facet, sustaining above the crimson line would imply that these lows stay a distant chance.

Piecing collectively his many observations, Steve postulates a possible state of affairs for Bitcoin’s trajectory within the upcoming months. He believes Bitcoin’s motion may oscillate between $30,000 and $48,000, unlikely to exceed this higher cap.

Steve’s central message is evident: whereas particular person opinions and predictions are aplenty, and infrequently conflicting, charts and information provide an goal, unbiased lens. They distill the noise and supply a clearer perspective on potential trajectories.

So when is it time to get again into Bitcoin? Steve makes use of a robust indicator referred to as, which he says accurately predicted the start of each bull market cycle. Extra particularly, when the crimson line crosses above the orange line, that’s when it is going to be time to go in, and go in massive. Presently, the crimson line continues to be beneath the orange line, nevertheless it’s transferring ever nearer to it.

Associated Information

Wall Avenue Memes – Subsequent Massive Crypto

Early Entry Presale Reside Now

Established Neighborhood of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Greatest Crypto to Purchase Now In Meme Coin Sector

Crew Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link