[ad_1]

Introduction

Defining Fiat Cash

Fiat cash is tender not backed by a tangible asset or commodity like gold or silver. It’s often mandated by governments, however this isn’t at all times the case. The currencies we use for on a regular basis transactions within the trendy period are all examples of fiat cash, such because the U.S. greenback (USD), the euro (EUR), the pound (GBP) or the Chinese language Yuan (CNY).

The time period “fiat” is a Latin phrase meaning “by decree” or “let or not it’s executed,” representing an arbitrary order that displays the issuance of cash as a authorities enactment. Fiat is one type of cash, together with consultant and commodity cash. Whereas fiat cash is available in numerous kinds — bodily banknotes, cash or digital items — consultant cash merely “represents” an intent to pay, like a cheque. Commodity cash has an intrinsic worth derived from the commodity it’s manufactured from; for instance, valuable metals, meals and even cigarettes.

How Fiat Cash Works

The foreign money itself has no intrinsic worth however derives its value from belief within the authorities that points it; it isn’t consultant of one other asset like gold, silver or every other monetary instrument.

Authorities Decree: Fiat cash is asserted by the federal government to be the official foreign money of a rustic and is usually designated as authorized tender. Because of this banks and monetary establishments should regulate their techniques to permit the foreign money to be accepted as a type of cost for items, providers and money owed inside a given nation. There are some exceptions to this rule, with Scotland being the prime instance.

Authorized Standing: Whereby the brand new cash is given the standing of authorized tender, that means it should be accepted as cost throughout the nation. Legal guidelines and laws are established to make sure the right functioning of fiat cash. These laws cowl points akin to counterfeiting, fraud and the general stability of the monetary system.

Acceptance and Belief: The worth of fiat cash relies on the assumption and belief that it may be exchanged for items and providers and the phantasm that it’s going to retain its worth over time. The final acceptance of fiat cash by the general public and its use in on a regular basis transactions are essential for its functioning. Ought to the bulk acknowledge the ability of compounding inflation, they might start to lose confidence within the authorities’s cash.

Central Financial institution Management: Central banks are accountable for sustaining the soundness and integrity of the foreign money. They management and monitor the availability of base cash and regulate it based mostly on financial situations and financial coverage objectives. By managing the cash provide, central banks purpose to keep up value stability and promote financial development.

Central banks have the authority to affect the worth of fiat cash by financial coverage instruments. They accomplish that by adjusting rates of interest, adjusting lending situations and thru new cash creation.

In excessive circumstances, central banks have to concern cash to make sure that there’s an ample movement of cash and notes to permit the economic system to operate correctly. Along with this, money, which in actuality represents a small a part of the full amount of cash circulating in an economic system, a second layer of cash issued by industrial banks is injected into the economic system within the type of financial institution deposits which are out there at any second.

When the federal government creates new cash and will increase the cash provide, inflationary stress arises, which is a typical state of fiat techniques. Though uncommon, excessive situations referred to as “hyperinflation” can also emerge, ensuing within the foreign money shedding worth or turning into nugatory.

How is Fiat Cash Created?

Governments and central banks have a number of strategies for creating new cash and inflating the present provide. The commonest strategies employed are:

Fractional Reserve Banking: Industrial banks are required to keep up solely a fraction of the deposits they obtain as reserves. This reserve requirement allows banks to create new cash by lending out a portion of the deposits. For instance, if the reserve requirement is 10%, a financial institution can lend out 90% of the deposited quantity. As soon as the loaned out cash turns into deposits for different banks which, in flip, maintain again 10% and lend out the opposite 81%; new cash is created.

Open Market Operations: Central banks, such because the Federal Reserve in america, can create cash by open market operations. They buy securities, akin to authorities bonds, from banks and monetary establishments. When the central financial institution buys these bonds, it pays for them by crediting the accounts of the sellers with new cash. Because of this, the cash provide will increase.

Quantitative Easing (QE): Quantitative Easing and Open Market Operations are technically the identical factor. The distinction being that QE started in 2008 and is way bigger in scale than common OMOs and have particular macroeconomic targets to do with development, exercise and lending.

QE is due to this fact sometimes utilized in occasions of financial disaster or when rates of interest are already low. On this strategy, the central financial institution creates new cash electronically and makes use of it to buy authorities bonds or different monetary property from the market.

Direct Authorities Spending: Governments can even launch new cash by merely spending it into the economic system. When the federal government spends on public initiatives, infrastructure or social applications, it successfully injects new cash into circulation.

Traits Of Fiat Cash

In such a context, three important traits are acknowledged as particular to fiat cash, and they’re the next:

Lack of intrinsic worth as a result of it isn’t backed by a commodity or every other sort of economic instrument.Institution by authorities decree, and the federal government additionally controls the foreign money provide.Belief and confidence as the idea of worth. People and companies should belief that fiat cash maintains its worth and acceptability as a medium of trade.

Historic Context and Evolution

seventh Century — China

The Chinese language Tune dynasty was the primary to concern paper cash, the Jiaozi, across the tenth century C.E., though the very first banknote-type instrument was used within the seventh century, through the Tang dynasty (618-907). Throughout this period, retailers would concern some type of receipt of deposit to wholesalers to keep away from utilizing the heavy bulk of copper coinage in massive industrial transactions.

In the course of the Yuan dynasty within the thirteenth century, paper foreign money began getting used as a predominant medium of trade, as was additionally talked about by Marco Polo in “The Travels of Marco Polo.”

seventeenth Century — New France

Within the Canadian colony of New France, the official beaver pelt began to get replaced as a medium of trade by French cash within the seventeenth century. These cash quickly turned scarce as France diminished its circulation within the colonies. When native authorities started having a extreme scarcity of cash, they needed to turn into inventive to pay army expedition troopers, who needed to be remunerated to keep away from the dangers of mutiny.

Enjoying playing cards began getting used as paper cash to characterize gold and silver. They turned extensively accepted by retailers within the colonies till they have been acknowledged as an official medium of trade. Folks didn’t redeem them and as an alternative used them for funds whereas gold and silver have been hoarded. Due to this fact gold and silver have been valued for his or her retailer of worth properties whereas taking part in playing cards utility centered round comfort and danger minimization, an instance of the Nakamoto-Gresham’s Regulation in motion. When fast inflation occurred as a result of excessive prices of the Seven Years’ Conflict, paper cash misplaced almost all its worth in an occasion that may very well be thought of the first-ever recorded hyperinflation.

18th Century — France

In the course of the French Revolution, dealing with incumbent nationwide chapter, the Constituent Meeting issued a paper foreign money referred to as “assignats,” backed by the worth of the properties confiscated from the crown and the Catholic Church.

By 1790, assignats have been declared authorized tender and went by phases of recent issuance with the concept they might be burned on the similar price that the lands securing them have been bought. Decrease denominations have been produced in massive numbers to be able to guarantee extensive circulation. Nonetheless, whereas such measures have been meant to stimulate the economic system, in addition they elevated inflationary pressures and led the assignats to repeatedly lose worth.

By 1793, the political scenario had precipitated with the outbreak of the conflict and the autumn of the monarchy. The Regulation of Most — that had set value limits and punished value gouging to make sure steady meals provide to Paris — was lifted which prompted assignats to lose virtually all worth (hyperinflate) within the following months.

Within the aftermath Napoleon opposed the implementation of every other type of fiat foreign money and the assignats turned memorabilia.

18th to twentieth century

The transition from commodity to fiat cash may very well be established over these two centuries. WWI, the interwar interval and WWII marked profound turbulence and financial disaster worldwide, with many international locations dealing with excessive debt ranges and widespread unemployment. Throughout World Conflict I, the British authorities issued conflict bonds to finance its conflict efforts.

These have been primarily loans taken from the general public, with the promise of compensation with curiosity after the conflict. Such conflict bonds have been solely one-third subscribed, which led to the creation of “unbacked” cash. Many different nations adopted go well with and utilized the identical measures to finance their very own conflict efforts.

The Bretton Woods financial system agreed upon in 1944 was established to offer stability in worldwide monetary transactions and promote financial development. The U.S. greenback was denominated as the worldwide reserve foreign money and linked different main currencies to the greenback by mounted trade charges. The Worldwide Financial Fund and the World Financial institution have been additionally based to facilitate worldwide financial cooperation and supply monetary help to member international locations.

In 1971, U.S. President Richard Nixon introduced a sequence of financial measures that turned referred to as the Nixon shock. Essentially the most impactful of those measures was the cancellation of the direct convertibility of the U.S. greenback to gold, which successfully ended the Bretton Woods system.

The Nixon shock marked a shift in direction of a floating trade price system, the place currencies fluctuate freely based mostly on provide and demand. It had important implications for world foreign money markets, the worldwide financial system and the worth of all items and providers. (A few of these distortions might be considered on the web site wtfhappenedin1971.com.)

The Transition From The Gold Customary To Fiat Cash

The gold commonplace was the financial system previous to WWI, the place a rustic’s foreign money was backed by gold. Governments held important gold reserves to again their currencies, and people might trade their paper cash for gold at a set price. This technique supplied stability and confidence within the foreign money’s worth, because it was instantly linked to a tangible asset.

From the beginning of WWI there was step by step a transition from the gold commonplace to fiat cash, the place currencies have been not backed by a particular amount of gold however as an alternative derived their worth from authorities regulation and public belief.

Varied elements led to the shift within the financial system, together with the necessity for a extra versatile financial coverage to handle financial challenges successfully. The gold commonplace restricted governments’ means to manage the cash provide, rates of interest and trade charges, as they have been tied to mounted gold convertibility. Moreover, the initially decentralized commodity was troublesome to move, retailer and safe, so it turned centralized by goldsmiths and later banks, leaving its destiny topic to the whims of governments.

By the late twentieth century, most international locations had totally adopted fiat financial techniques. Governments and central banks took accountability for managing the cash provide, setting rates of interest and trying to stabilize their respective economies, though a long-term financial safety might by no means be assured.

Fiat Cash In The World Economic system

The Function Of Central Banks

Within the world fiat financial system, the function of central banks is essential within the implementation of financial coverage. They use numerous instruments — akin to setting rates of interest — to affect financial situations, stabilize costs and promote financial development.

They’re typically accountable for issuing and managing the nationwide foreign money, regulating the cash provide, guaranteeing the supply of an ample amount of foreign money and sustaining its integrity and stability. Nonetheless, by manipulating charges and the cash provide, central banks have profound influences on folks and enterprise, making it onerous to plan for the long run.

Central banks typically have the authority to oversee and regulate industrial banks and different monetary establishments inside their jurisdiction. They set prudential laws, conduct financial institution examinations and oversee the soundness and security of the banking system to assist keep monetary stability and defend depositors and shoppers.

Additionally they act as lenders of final resort to offer liquidity and emergency funding to banks and monetary establishments that will face monetary misery or liquidity shortages.

Affect On Worldwide Commerce And Change Charges

As a nationwide foreign money, the fiat greenback considerably impacts worldwide commerce and trade charges, being probably the most extensively accepted medium of trade that facilitates the shopping for and promoting of products and providers between international locations. Its ease of use simplifies transactions and promotes financial integration throughout borders.

Moreover, trade charges mirror the worth of 1 foreign money relative to a different and are influenced by a variety of things, together with rates of interest, inflation charges, financial situations and market forces. Modifications in trade charges influence the competitiveness of exports and imports, influencing commerce flows and the steadiness of funds.

Fiat Cash And Financial Crises

Fiat cash techniques are vulnerable to financial crises because of extreme cash creation, poor fiscal administration or monetary market imbalances. Unsustainable insurance policies can result in inflation, foreign money devaluation and asset bubbles, leading to financial downturns and crises.

To face such penalties, central banks take measures akin to reducing rates of interest and rising the cash provide to stimulate financial development throughout a downturn. Whereas these measures can enhance financial exercise and asset costs, they will additionally result in speculative bubbles and unsustainable enlargement. When these bubbles burst, they will set off recessions and typically depressions.

Hyperinflations are uncommon, however they’ve occurred in some instances of fiscal mismanagement, political instability or extreme financial disruptions — notable examples embody Weimar Germany within the Nineteen Twenties, Zimbabwe within the 2000s and extra not too long ago, Venezuela. Hyperinflation is a fiat phenomenon that happens when costs enhance by 50% inside one month.

All through historical past, it has occurred “solely” 65 occasions, in accordance with the Hanke-Krus analysis; nevertheless, it shouldn’t be underestimated as its penalties have been catastrophic and have destroyed international locations’ economies and societies prior to now.

Properties Of Fiat Cash

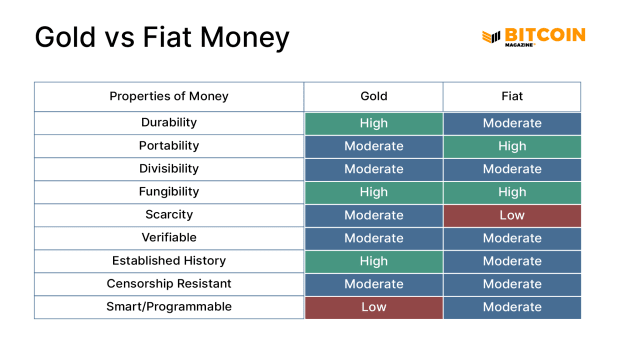

Fiat cash is superb for on a regular basis transactions, but it surely’s a poor retailer of worth in comparison with commodity cash like gold. Whether or not fiat is healthier than gold is subjective, and in some respects, it’s. Nonetheless, it has launched its drawbacks because it scores poorly towards crucial properties akin to shortage, which many would argue is a deadly flaw.

Professionals Of Fiat Cash

The implementation of fiat cash has produced some benefits, particularly in relation to gold, as highlighted right here:

Ease of use: Fiat cash is extra sensible for on a regular basis transactions because of its portability, divisibility and broader acceptance. It’s handy for a variety of financial actions, from small purchases to massive industrial transactions.Decrease prices and dangers: It eliminates the prices and dangers related to storing and securing bodily commodities like gold. It reduces the necessity for buying and safeguarding massive gold reserves.

Professionals for Governments

Better flexibility in financial coverage: Governments and central banks can regulate the cash provide, rates of interest and trade charges to answer financial situations and promote stability. This flexibility allows them to mitigate financial downturns, management inflation and handle foreign money fluctuations, that are notable options of the fiat system.Prevention of gold drain: Authorities measures to safeguard their gold reserves and forestall the outflow of gold from the nation turn into pointless. Sustaining an ample provide of gold was essential for the foreign money’s stability below the gold commonplace. Sovereign management: Fiat cash presents governments and central banks larger flexibility in managing financial coverage to handle financial challenges and promote stability. They’ll regulate rates of interest, management the cash provide and deal with trade charges to answer financial situations and promote stability.

Cons Of Fiat Cash

Although fiat cash has widespread drawbacks, it turned the predominant type of cash globally primarily because of benefits when it comes to flexibility, comfort and adaptableness to advanced financial techniques. Nonetheless, sustaining efficient financial governance and guaranteeing belief and confidence within the foreign money are crucial to mitigate the potential disadvantages related to fiat cash.

Inflationary and hyperinflationary dangers: Fiat cash techniques are susceptible to inflationary pressures and have been the reason for all hyperinflations in historical past. The costs of products and providers are perpetually rising in fiat techniques, but it surely’s as a result of worth of foreign money items reducing. Lack or lack of intrinsic worth: In contrast to commodity-based cash like gold, fiat cash doesn’t have inherent or intrinsic worth. Its worth is derived solely from the belief and confidence positioned within the issuing authorities and the soundness of the financial system. This reliance on belief could make fiat cash vulnerable to lack of confidence throughout financial or political uncertainty.Centralized management, authorities dependence and manipulation: Fiat cash techniques are topic to centralized management by governments and central banks. Permitting flexibility in financial coverage opens the way in which for manipulation and mismanagement. Poor coverage selections, political interference and lack of transparency can result in misallocation of sources, foreign money devaluation and monetary instability. Centralized entities are additionally inclined to make use of censorship and confiscation.Counterparty danger: Fiat cash depends on the credibility and stability of the issuing authorities. In instances the place governments face financial or political challenges, there’s a danger of default or lack of confidence within the foreign money. This may result in foreign money devaluation, capital departure and even foreign money crises.Potential for abuse and corruption: Techniques might be vulnerable to abuse and corruption, primarily when there’s a lack of transparency and accountability in financial administration. Unscrupulous practices, akin to cash laundering, illicit transactions or political manipulation of the cash provide, can undermine the foreign money’s integrity and erode public belief. Such approaches might produce the Cantillon impact, the place adjustments in an economic system’s cash provide trigger the redistribution of buying energy amongst folks, altering the relative costs of products and providers which ends up in the misallocation of scarce sources.

Learn Extra >> How Fiat Cash Broke The World

The Finish Sport

Limitations Of Fiat In The Fashionable Age

It may very well be argued that fiat as soon as served a objective as gold failed to fulfill the postwar world’s calls for. Equally, present situations point out that we’re reaching one other inflection level, whereby fiat is not geared up for the digital age.

Although fiat has digitized monetary transactions, the reliance on digital platforms and techniques introduces cybersecurity dangers. Hackers and cybercriminals have a tendency to focus on digital infrastructure and authorities databases, trying to breach safety measures, steal delicate info or perform fraudulent actions. These dangers threaten the integrity of digital fiat cash techniques and the belief positioned in them.

Privateness constitutes one other concern. On-line fiat cash transactions go away a digital path, elevating apprehension about privateness and surveillance. Amassing and utilizing private monetary information can produce privateness dangers and doubtlessly misuse delicate info.

Synthetic Intelligence and bots current one more problem, which may very well be solved by introducing non-public keys and microtransaction charges. With out addressing such challenges, the fiat system shall be left behind with new on-line publishing monetization alternatives which are transferring past the normal promoting mannequin.

Moreover, fiat can not maintain the acute effectivity that code-driven digital currencies can present, together with fast settlement. Centralized techniques will at all times depend on intermediaries to approve transactions that should undergo totally different layers of authorizations earlier than being confirmed, typically taking days or perhaps weeks to resolve. Bitcoin transactions can take as little as 10 minutes to turn into irreversible.

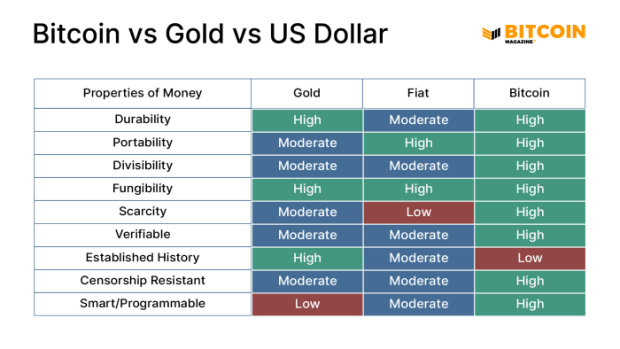

The Rise Of Bitcoin

Moreover its transaction finality, bitcoin presents a number of benefits over fiat within the digital age. Decentralization, SHA-256 encryption and the proof-of-work consensus mechanism mix to create an immutable ledger. Its restricted provide makes it inflation-proof, the right retailer of worth and medium of trade, because it appreciates sufficiently to be adopted as a unit of account.

Bitcoin is sensible cash, programmable, not confiscatable and has all of the properties that make it the perfect asset to avoid wasting and a very good medium of trade for retailers who need fast settlements.

Furthermore, being a digital foreign money, bitcoin possesses an optimum functionality to leverage the effectivity of AI for duties like fraud detection and danger assessments inside its providers. It encompasses the advantageous traits of gold, akin to its restricted provide, whereas additionally embodying the divisible and transportable nature of fiat foreign money. Moreover, it introduces novel properties tailor-made to go well with the necessities of the digital period.

Within the coming years the transition from fiat cash to bitcoin will characterize the following evolution of cash. The 2 financial techniques will co-exist for the time obligatory for the world’s inhabitants to adapt to the very best cash humanity has ever skilled. Within the meantime, we’ll probably proceed to spend our nationwide currencies and retailer bitcoin, as bitcoin has the required properties to retailer worth by time. This can proceed till the worth of Bitcoin far exceeds the worth of nationwide currencies, upon which era retailers will refuse to simply accept the inferior cash.

Continuously Requested Questions

How Does Fiat Cash Differ From Commodity Cash?

Fiat cash relies on belief within the authorities; commodity cash is backed by a bodily asset like gold.

What Currencies Are Not Fiat?

At present, all currencies being utilized by governments are fiat currencies. El Salvador is the exception, because it has carried out a twin foreign money system of bitcoin and fiat.

What Components Can Have an effect on The Worth Of Fiat Cash?

Some examples embody a scarcity of belief within the authorities that points foreign money, uncontrolled cash printing, unsustainable financial insurance policies arrange by central banks and political (in)stability.

How Do Central Banks Regulate The Worth Of Fiat Cash?

By way of rate of interest changes, open market operations like shopping for or promoting authorities securities (bonds) within the open market and reserve necessities for banks. Capital controls to handle foreign money volatility, keep stability or stop extreme inflows or outflows of funds might disrupt the home economic system and influence the worth of fiat cash.

[ad_2]

Source link