[ad_1]

The large progress in hash fee has some speculating on who’s behind such a large enhance, plus an replace of public bitcoin miners.

The article under is an excerpt from a current version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Hash Charge On The Transfer

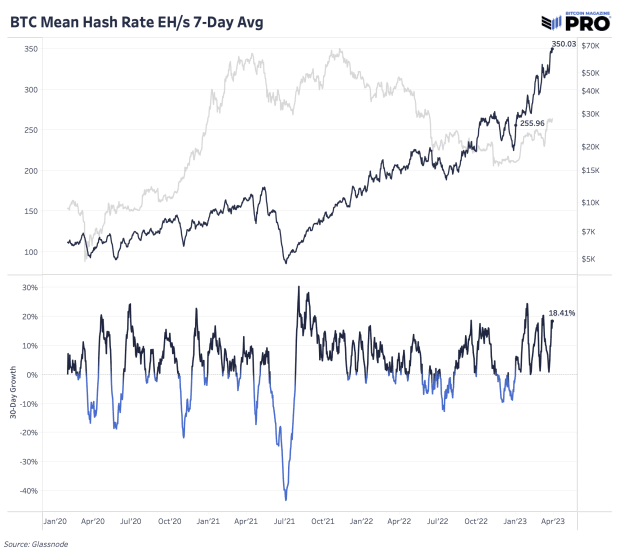

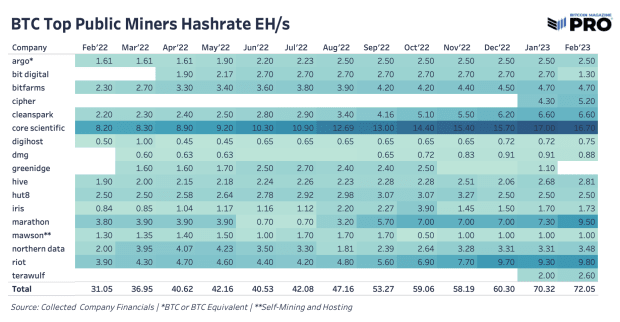

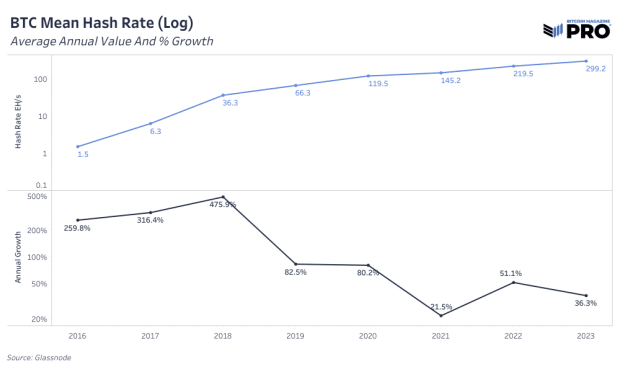

The Bitcoin community hash fee is on the transfer this yr, now at an all-time excessive of 350 EH/s and up 36.7% YTD. Hash fee has been following the surge in value, which is the possible results of extra machines coming on-line at a extra worthwhile value level. In 2022, there was quite a lot of unused, newer stock of ASICs that sat idle at decrease bitcoin costs and have now made their manner onto the community as public miners continued to develop, most noticeably in corporations like Marathon Digital Holdings, Riot Platforms and Cipher Mining Applied sciences.

The surge in hash fee is a results of longer-term funding and enlargement choices that are actually materializing after a time lag. As famous, some miners stored their machines on the sidelines whereas the bitcoin value was decrease and fewer worthwhile to mine. One other chance, based on an evaluation from Miner Magazine, suggests a excessive share of miner rig imports into the U.S. in January might have performed a big position within the enlargement of hash fee. These shipments have since slowed down, which can point out an upcoming interval of cooling off after this current hash fee progress. Estimating the breakdown and contributions of things on why precisely the hash fee is rising is all the time layered in nuance.

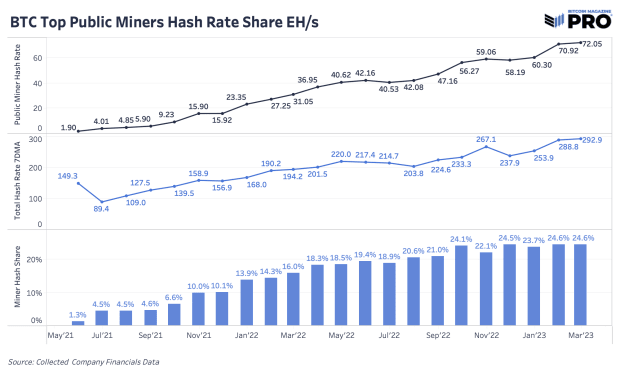

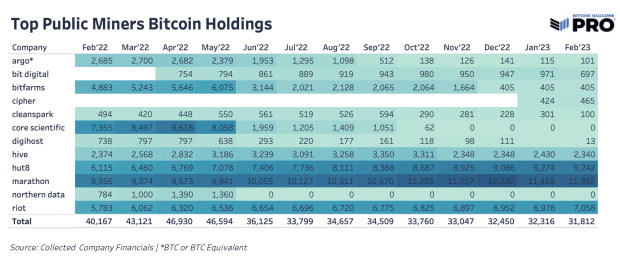

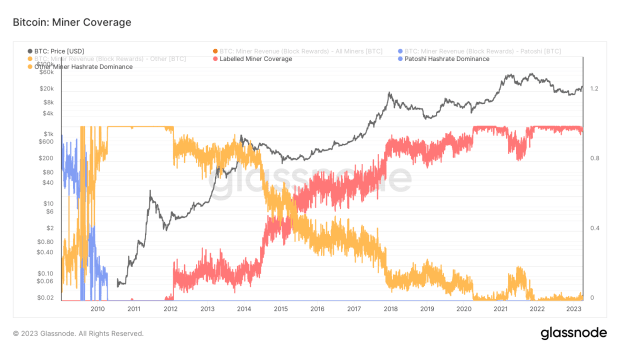

Hash fee in combination continued to steadily rise over the previous couple of months whereas bitcoin holdings continued to say no. After we use the reported numbers for public miners’ hash fee on the finish of February, the 292 EH/s on the finish of February and the 350 EH/s on-line right now, we conclude that public miners make up someplace between 20% to 25% of whole community hash fee on a given day. That’s possible a low estimate contemplating there are some smaller public miners we’re not monitoring and public miner information is launched periodically.

Many are opining on hash fee hitting all-time highs almost day after day (when utilizing numerous transferring averages to account for variability), however this degree of progress isn’t out of the norm for bitcoin on a historic foundation — though it’s fairly spectacular as absolutely the degree of hash fee reaches numbers virtually unfathomable just a few brief years in the past.

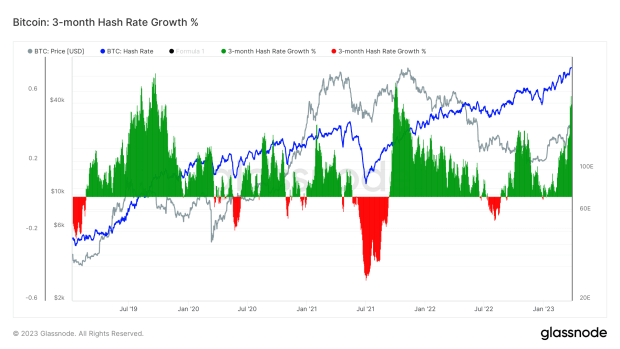

Three-month hash fee progress is at a staggering 53%. There are solely two occasions that may evaluate: the 2021 post-China-ban growth in mining after which in 2019, when there was huge progress in community hash fee after new hash fee lastly got here on-line after the orders had been fulfilled from the earlier bull market in 2017 and infrastructure was constructed out.

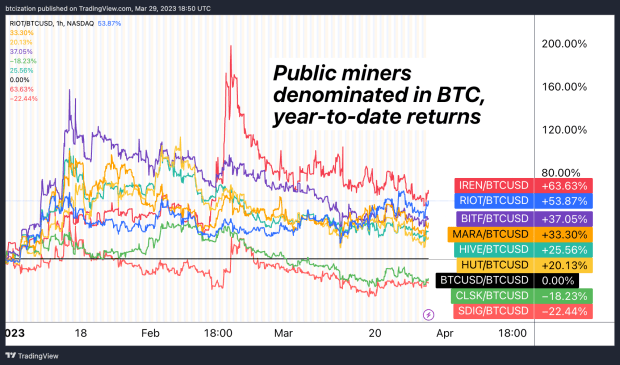

Whereas most mining shares have outperformed bitcoin by a large margin in 2023, this could typically be attributed to 2 somewhat easy components:Mining equities are far more unstable than bitcoin resulting from numerous components, together with:

1. Mining equities are far more unstable than bitcoin resulting from numerous components, together with:

Public equities buying and selling at a a number of of future money flows (sat flows anybody?).Potential steadiness sheet leverage.ASICs and different operational infrastructure being priced as bitcoin derivatives.A lot smaller market capitalizations, much less international entry to capital, extra illiquidity.

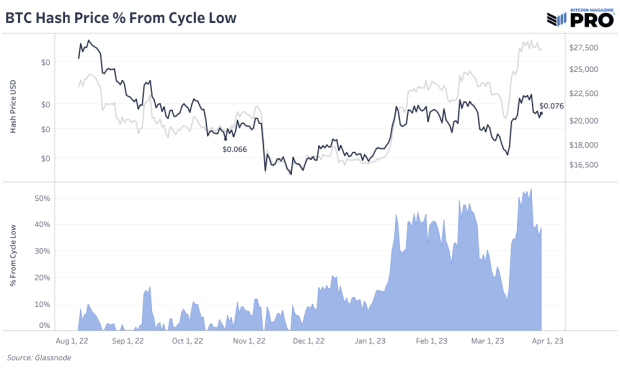

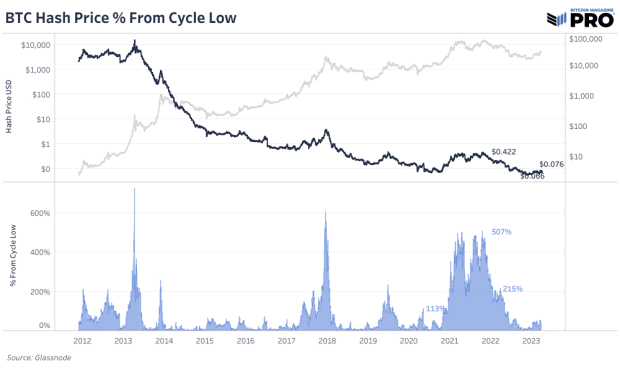

2. Because the begin of the yr, value progress has exceeded hash fee progress, that means hash value has risen. In our mining updates, we regularly revisit our over-simplified framework for bitcoin mining investing:

Hash value bull market = Bitcoin miners outperform bitcoin.Hash value bear market = Bitcoin miners underperform bitcoin.

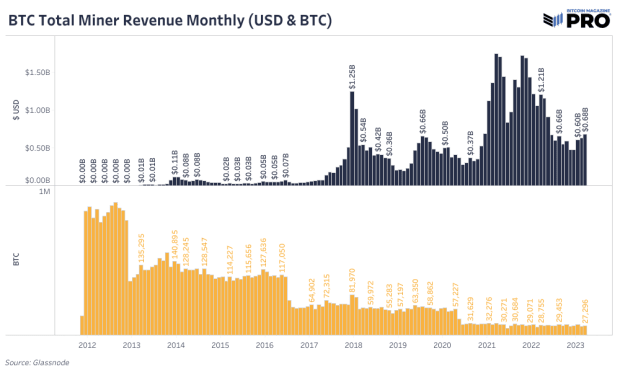

We use hash value as a easy gauge for funding into the mining market as a result of empirical actuality that mining income will proceed to fall (in bitcoin phrases) as a result of asymptotic provide issuance of bitcoin, coupled with mining problem that continues to soar because of corresponding hash fee progress. Attributable to these dynamics, bitcoin efficiency must be adjusted towards the relative progress in hash fee. For particular person corporations, it is very important measure their relative hash fee towards community hash fee and mining problem.

The efficiency of miners denominated in bitcoin carefully correlates to the rise in hash value from cycle lows.

Hash value lows are the default within the bitcoin business. Beneficial properties in chip effectivity and a bitcoin trade fee that continues to development greater on a very long time horizon implies that miner income per terahash continues to development decrease. It is a function, not a bug, nevertheless it makes bitcoin mining an extremely tough business to take a position capital into due to its cutthroat nature.

Remaining Notice:

There was hypothesis concerning the current bounce in hash fee, with some on social media pontificating a couple of potential operation on the nation state degree. Evidently, we’re skeptical of a few of these theories. Almost 100% of the present whole hash fee is mining in identifiable mining swimming pools. If a nation state mining operation was being deployed at scale, it’s possible they might function in a sovereign mining pool or one attributed to a particular nation outdoors the US, whereas many mining swimming pools are made up of miners from all all over the world. This evaluation might show incorrect later down the road, and we will probably be greater than keen to confess our misjudgment, however this current progress doesn’t appear to be a nation state primarily based on the info we’re observing.

A extra easy clarification for why the bitcoin hash fee seems to be going parabolic in current months is that many individuals merely overlook to set their charts to logarithmic scale.

That concludes the excerpt from a current version of Bitcoin Journal PRO. Subscribe now to obtain PRO articles instantly in your inbox.

Related Articles:

State Of The Mining Trade: Public Miners Outperform BitcoinPRO Market & Mining Dashboards 3/23/2023State Of The Mining Trade: Survival Of The FittestTime-Based mostly Capitulation: Bitcoin Volatility Hits Historic Lows Amid Market ApathyThis Time Isn’t Completely different: Miners Are Greatest Danger Going through Bitcoin Market In Repeat of 2018 CycleHash Charge Hits New All-Time Excessive: Implications For Mining Equities

[ad_2]

Source link