[ad_1]

Because the eagerly anticipated Federal Open Market Committee (FOMC) assembly approaches, the monetary world is abuzz with hypothesis in regards to the potential implications for Bitcoin and crypto. Tomorrow, on Wednesday, July twenty sixth, at 2 pm EST, the FOMC will announce its rate of interest determination. As standard, Federal Reserve (Fed) chair Jerome Powell will face the media at 2:30 pm EST.

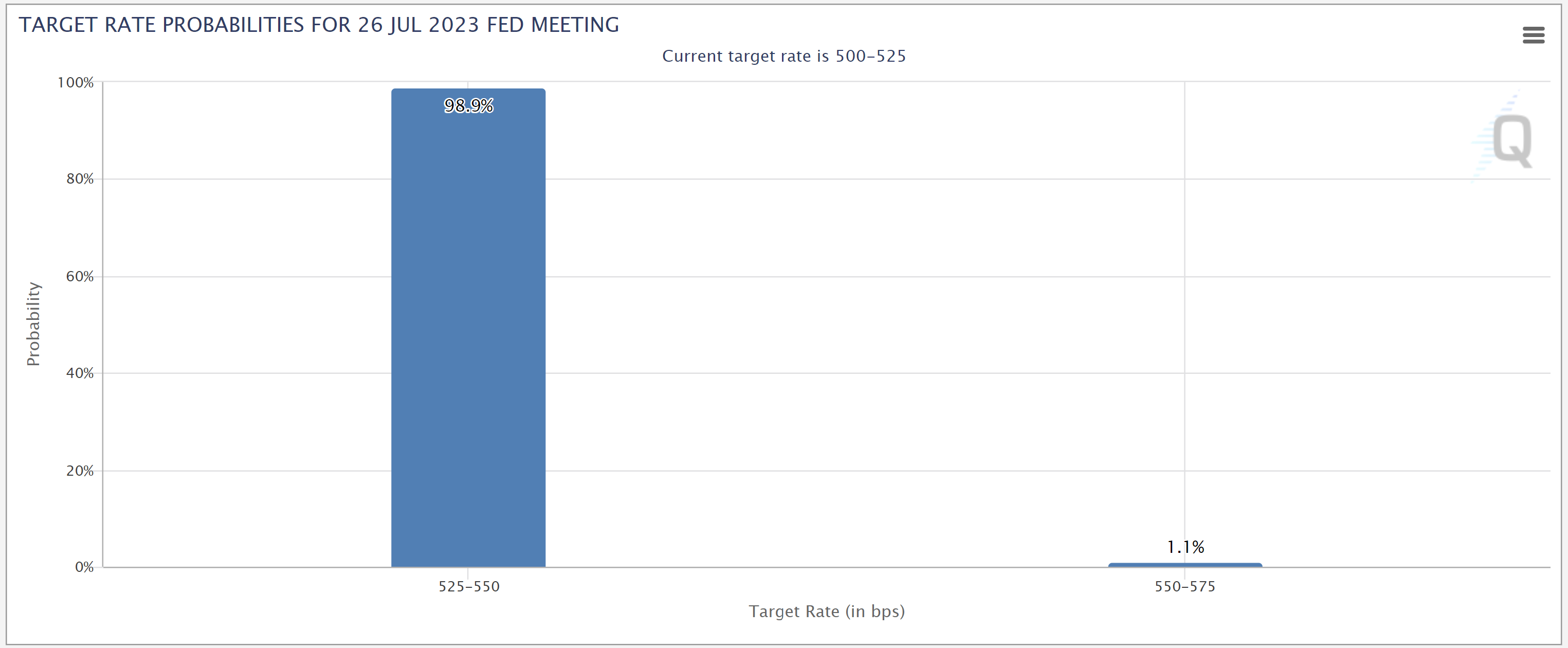

Based on the CME FedWatch software, the vast majority of the market is anticipating a 25 foundation level enhance (99.8%). Nonetheless, the true intrigue lies in what comes after this transfer and whether or not it marks the top of the speed hike cycle.

After tomorrow’s determination, the market expects the Fed to maintain the important thing rate of interest excessive for an extended time frame. A primary fee minimize might are available in March 2024 on the earliest, if not in Could.

Tomorrow is #FOMC day, anticipate volatility. #Bitcoin #Crypto

98.9% chance of a 25 bps hike by the Fed.

Market expects the Fed to maintain the important thing rate of interest excessive for an extended time frame. A primary fee minimize might are available in March ’24 on the earliest, if not in Could. pic.twitter.com/C8wscv6BMd

— Jake Simmons (@realJakeSimmons) July 25, 2023

Implications For Bitcoin And Crypto

For the previous 16 months, the U.S. Federal Reserve has been grappling with inflation whereas climbing rates of interest to ranges not seen in 20 years. However all indicators level to a doable finish of the tightening cycle. The market is firmly anticipating the 0.25 bps hike to a spread of 5.25 to five.5% would be the final.

In the meantime, Bitcoin and crypto have skilled a interval of relative immunity to macroeconomic occasions and fee hike speculations within the first seven months of the yr. Nonetheless, buyers have to be conscious that such circumstances may not final indefinitely.

On Monday, the Bitcoin worth retraced to $29,000 help degree. Seemingly, market contributors have been cautious within the lead-up to the FOMC’s July assembly, conscious that the FOMC assembly can have a profound influence.

In June, Fed Chairman Jerome Powell hinted at the opportunity of additional fee hikes this yr, with some committee members advocating for 2 extra will increase. The market now anxiously awaits the end result of this assembly to establish the central financial institution’s future coverage stance.

Nonetheless, elements reminiscent of declining inflation in america and a weaker labor market strengthen the market expectations. The beforehand skyrocketing inflation, which led to the tightening cycle, has proven indicators of abating. June’s Shopper Value Index (YoY) information revealed a decline in inflation to three.0% from 4.0%. The core fee fell from 5.3% in Could to 4.8% in June. Each declines had been stronger than beforehand anticipated. Remarkably, the core fee is now buying and selling beneath the extent of the US federal funds fee, which was fairly uncommon within the final 20 years.

The extended energy of the US labour market has lengthy been the largest headache for the Federal Reserve due to the imbalance between provide and demand. On the peak of this imbalance, there have been two job openings for each obtainable employee, which drove up wages accordingly. As demand and provide method equilibrium, job creation numbers have declined. Additionally, there are even early indications of declining shopper spending.

So, what does all of this imply for Bitcoin and crypto buyers? As at all times, it’s important to method the market with a balanced perspective. Whereas BTC and cryptocurrencies have proven resilience within the face of conventional financial occasions, they aren’t completely insulated from bigger macroeconomic tendencies.

Buyers ought to carefully monitor the FOMC’s rate of interest determination and Jerome Powell’s subsequent statements. Any indicators in regards to the future fee hike cycle might have repercussions for each the standard in addition to Bitcoin and crypto markets, triggering an extra sell-off.

At press time, the market continued to indicate indecision. BTC was buying and selling at $29,200.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link