[ad_1]

On-chain information reveals that whales and new wallets are scooping extra Maker (MKR), which appears to be propping the token, fanning demand. As of September, MKR is likely one of the top-performing tokens, including roughly 120% in three months from June 2023 lows.

When writing, MKR is altering palms above $1,300 and inching nearer to July 2023 highs. Notably, MKR is up 14% prior to now week of buying and selling, driving market cap above $1.27 billion and buying and selling quantity by 36% on the final day.

Whales And Contemporary Wallets Shopping for Maker (MKR)

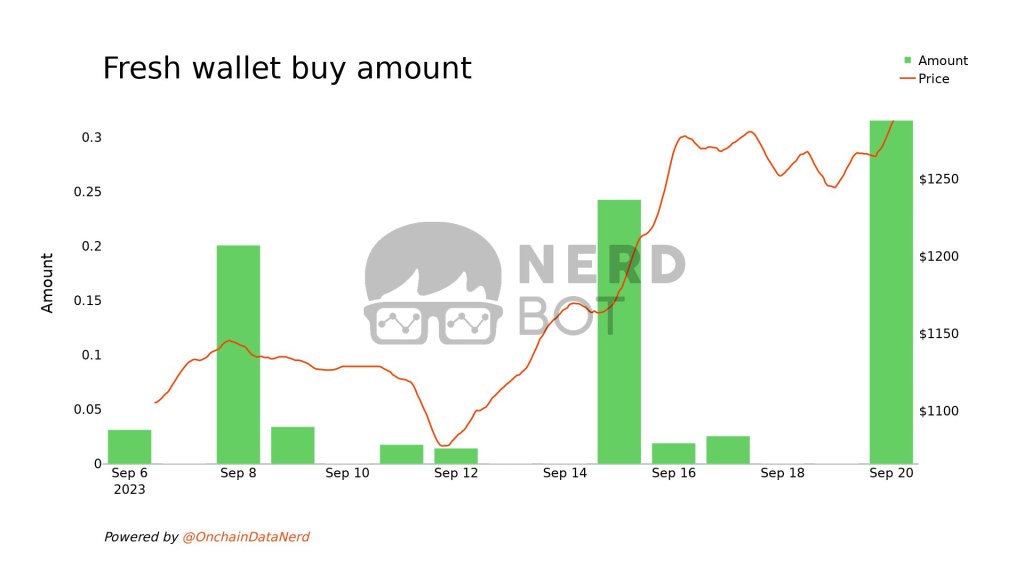

Trackers notice that within the final week of buying and selling, a whale, “0xad0”, purchased 1261 MKR value $1.62 million at a median worth of $1,290. Furthermore, trying on the tendencies, whale and recent pockets actions have been heightened over the earlier week. With extra accumulation, the token has been monitoring greater in tandem.

Parallel information from Lookonchain confirms this improvement, particularly from early September. Earlier this month, a whale offered $1.13 million of Ethereum and acquired an equal quantity in MKR on Binance.

This transaction comes a day after one other entity moved $12.3 million of MKR from Binance. Nonetheless, whereas whales seem like loading up extra MKR, Vitalik Buterin, the co-founder of Ethereum, offered his stash of MKR for ETH on September 2.

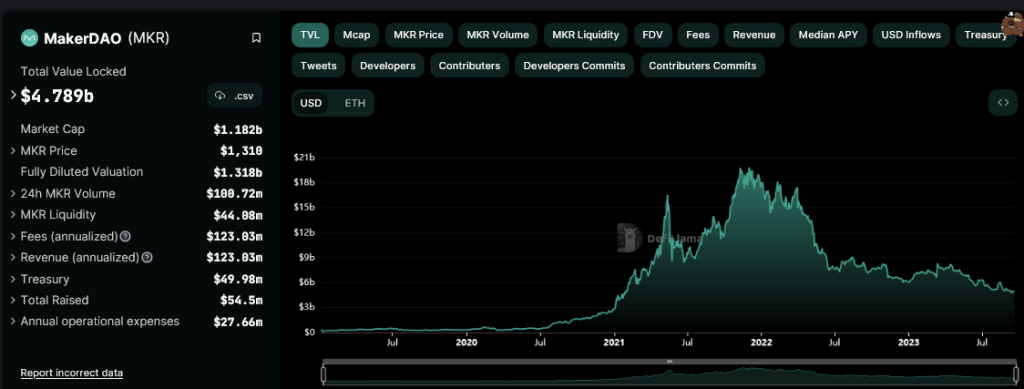

Maker Finance is a decentralized lending and borrowing platform on Ethereum. As of September 20, the protocol had a complete worth locked (TVL) of over $4.8 billion, in accordance with DeFiLlama. Extra information exhibits that the platform held $109.56 million of MKR, its native token, and completely different stablecoins value $49.58 million.

DAI Yield Rising, New Burning Construction Applied Fueling Bulls

MakerDAO, a decentralized autonomous group (DAO), manages DAI, an algorithmic stablecoin that passes yield to the holder. Holders of MKR, the native token of Maker, can even vote on proposals.

Following the temporary USDC depegging in March 2023, the DAO lowered its reliance on the USDC, a centralized fiat-backed stablecoin. In early August, the neighborhood additionally voted to quickly improve the DAI Financial savings Fee (DSR) from 3.19% to eight%, incentivizing customers to mint DAI by way of the Spark Protocol.

In addition to modifications to the DSR, MakerDAO additionally launched an improved sensible burn mechanism the place collateralized debt positions (CDPs) to again circulating DAI might be closed freely with out inflicting stablecoin shortages out there. On this new association, circulating MKR could be purchased and burned impartial of CDP closure, permitting the protocol to be extra versatile in mild of market modifications.

Nonetheless, with this, each burning lowered circulating provide, which has supported costs as worth motion revealed.

Function picture from Canva, chart from TradingView

[ad_2]

Source link