[ad_1]

On-chain knowledge exhibits the Chainlink whales have deposited $350 million of the asset into exchanges, an indication that could possibly be bearish for LINK’s value.

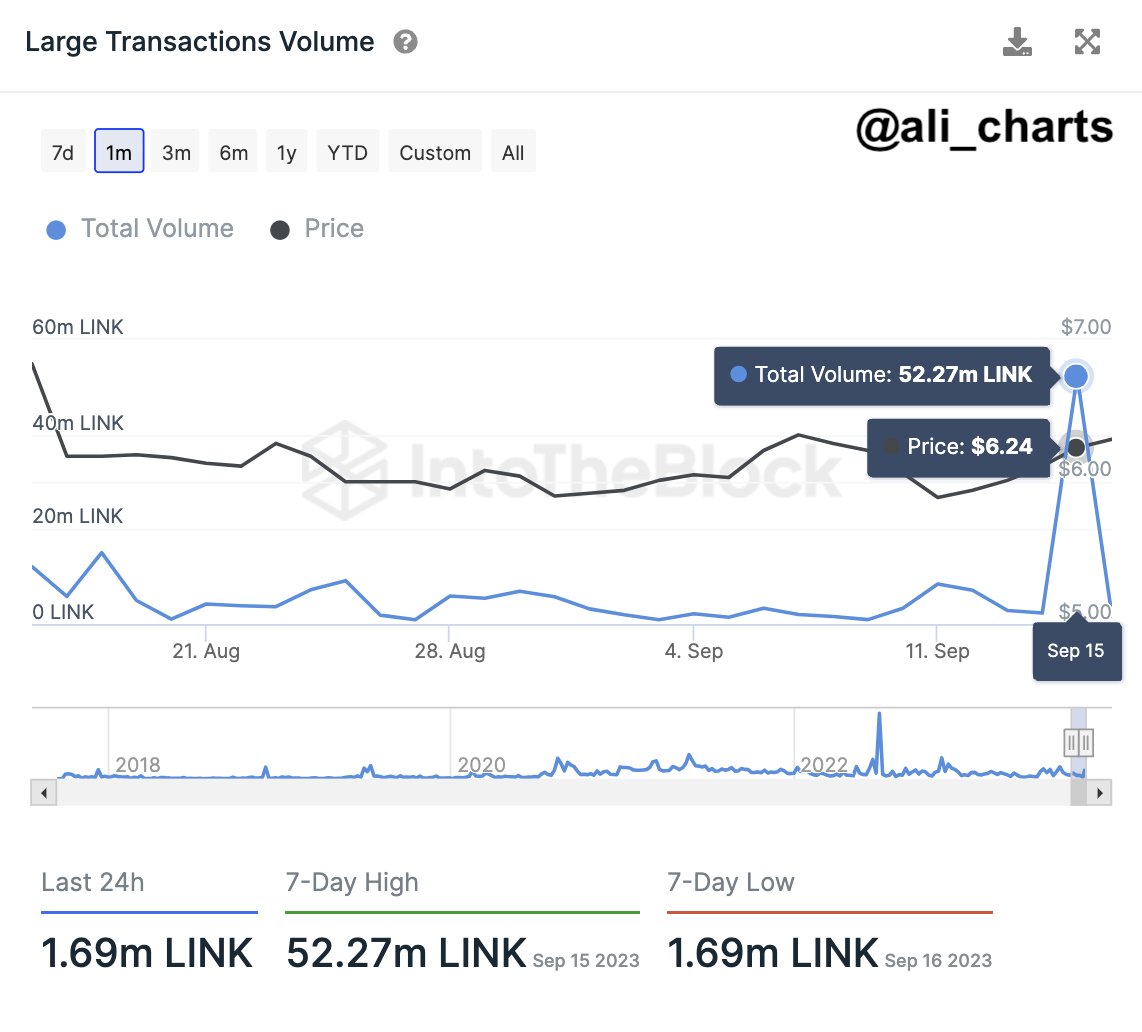

Chainlink Giant Transactions Quantity Has Spiked Just lately

As identified by analyst Ali in a put up on X, LINK has not too long ago noticed a burst of exercise on its community. The indicator of curiosity right here is the “giant transactions quantity,” which measures the mixture quantity of Chainlink being moved in transfers price a minimum of $100,000 in worth.

Usually, the one buyers who make such giant transactions frequently are the whales and institutional buyers, so this indicator can present us with hints concerning the whole exercise that these holders are displaying proper now.

When the worth of this metric is excessive, it implies that the big gamers available in the market are shifting round a excessive variety of tokens presently. This will suggest that these buyers are collaborating in shopping for or promoting available in the market, though it could possibly’t level at which of the 2 the holders are doing precisely.

However, low values that suggest these humongous holders are remaining on standby, probably as a result of they don’t have a lot curiosity within the cryptocurrency in the intervening time.

Now, here’s a chart that exhibits the pattern in Chainlink’s giant transaction quantity over the previous month:

The worth of the metric appears to have been fairly excessive not too long ago | Supply: @ali_charts on X

As displayed within the above graph, Chainlink’s giant transaction quantity noticed an enormous spike only in the near past. Throughout this spike, whales and different giant entities moved practically 52.3 million LINK (price about $350 million on the present alternate charge) on the blockchain in a single day.

As talked about earlier than, this indicator alone can’t inform us whether or not these buyers have been shopping for or promoting with these transactions; it solely tells us that they have been energetic.

Ali, nonetheless, has revealed that these transfers have been in truth in direction of centralized exchanges, that means that these buyers had deposited their cash into the wallets of those platforms.

Usually, one of many foremost explanation why buyers could switch to those exchanges is for promoting functions, so these deposits is usually a signal that the whales have been gearing up for a selloff.

To this point, although, Chainlink hasn’t felt any bearish impact from these transactions, and in reality, the value has gone the alternative manner.

LINK Has Damaged The $6.7 Mark With A Sturdy 8% Surge

Through the previous day, Chainlink has loved some sharp bullish momentum as its value has now gone above the $6.7 stage. With its good points of 8%, LINK is by far one of the best performer among the many prime property by market cap.

The worth of the asset has shot up within the final 24 hours | Supply: LINKUSD on TradingView

It’s attainable that if the whales had certainly made the deposits for distribution, the market would have been capable of take up the promoting strain simply wonderful. One other potential state of affairs, nonetheless, can be that these humongous holders had solely made the transfers prematurely, ready for the proper alternative to tug the set off.

Naturally, within the latter state of affairs, this newest surge wouldn’t have the ability to final too lengthy, as these whales going by with their selloff would offer a serious impedance to the value.

Featured picture from Vivek Kumar on Unsplash.com, charts from TradingView.com, IntoTheBlock.com

[ad_2]

Source link