[ad_1]

Arbitrum (ARB), a outstanding governance token within the decentralized finance (DeFi) ecosystem, not too long ago witnessed an honest surge in value following renewed shopping for exercise from a well known DeFi whale deal with.

Massive-scale buyers usually affect market sentiment and may considerably impression the value of a given asset. Nonetheless, because the rally unfolds, questions come up in regards to the sustainability of this upward momentum and its implications for the way forward for Arbitrum.

Whale’s Uncommon Shopping for Exercise Coincides With ARB’s Rally

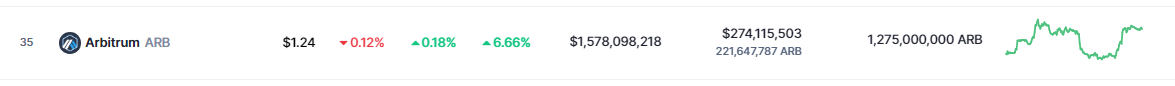

Arbitrum’s (ARB) present value of $1.24 on CoinMarketCap highlights its exceptional efficiency, with a noteworthy 3.4% rally witnessed inside the previous 24 hours, adopted by a powerful seven-day climb of seven%. Apparently, this surge in worth coincided with uncommon shopping for exercise related to famend dealer Andrew Kang’s crypto addresses.

Supply: CoinMarketCap

Notably noteworthy is the truth that Andrew Kang, co-founder of Mechanism Capital, has been making some attention-grabbing actions inside the Arbitrum ecosystem.

Kang put $1 million value of stablecoins into Arbitrum swimming pools and allotted practically 1 / 4 of the funds to the acquisition of RDNT tokens. RDNT is the native token of the DeFi lending platform Radiant Capital.

BTCUSD presently buying and selling at $27,150 on the weekend chart: TradingView.com

After filling his luggage with RDNT, Kang subsequently exchanged his newly acquired tokens and present RDNT reserves for $867,000 value of ARB.

These transactions have been additional adopted by Kang depositing the proceeds into Radiant Capital, the place he borrowed Circle’s USD Coin. These particulars have been revealed by way of knowledge obtained from Lookonchain, a dependable knowledge useful resource.

Looks like Andrew Kang is utilizing leverage to go lengthy $ARB on @RDNTCapital.

Purchase $ARB → Deposit $ARB → Borrow $USDC → Purchase $ARBhttps://t.co/PQwi0Zj9TT pic.twitter.com/afXjeRtTpv

— Lookonchain (@lookonchain) June 2, 2023

A number of Whales Seize Alternative As ARB Worth Improves

Along with Kang’s intriguing shopping for exercise, one other vital participant, identified by the deal with “0xf59b,” has additionally acknowledged the potential in ARB’s upward trajectory. This whale made a strategic transfer by depositing 1.2 million ARB tokens, equal to $1.5 million, into the favored cryptocurrency change OKX.

Whale”0xf59b” lastly waited for the rise of $ARB and deposited 1.2M $ARB ($1.5M) into #OKX half-hour in the past.

He withdrew 1.2M $ARB from #OKX on Might eighth, and the shopping for value could also be round $1.2.https://t.co/cJReZfg007 pic.twitter.com/jFwBRtPUpK

— Lookonchain (@lookonchain) June 2, 2023

This whale’s determination to tug the tokens out from OKX on Might 8 and probably buy them at across the $1.2 mark suggests a deliberate technique of ready for a value enhance earlier than profiting from their holdings. By rigorously timing their actions, this entity sought to maximise their potential features as ARB’s worth climbed.

These current large-scale investments signify a rising optimism surrounding Arbitrum’s Layer 2 resolution, regardless of the challenges it has confronted out there not too long ago. The renewed curiosity from each Kang and the whale behind the deal with “0xf59b” displays a perception within the long-term viability and potential profitability of ARB.

Moreover, these strategic strikes by a number of whales point out a broader sentiment inside the crypto market. Because the Ethereum community step by step recovers from the current drop, there’s a rising expectation of elevated exercise on Layer 2 networks. This anticipation units the stage for a probably bullish cycle for these networks, together with Arbitrum.

(This website’s content material shouldn’t be construed as funding recommendation. Investing includes threat. If you make investments, your capital is topic to threat)

-Featured picture from The Dialog

[ad_2]

Source link