[ad_1]

Be a part of Our Telegram channel to remain updated on breaking information protection

Economists at international funding financial institution JPMorgan shed some gentle on international viewpoints they look ahead to unraveling in 2023 and 2024. Based on them, the chance of United States sliding right into a recession exceeds the opportunity of avoiding one.

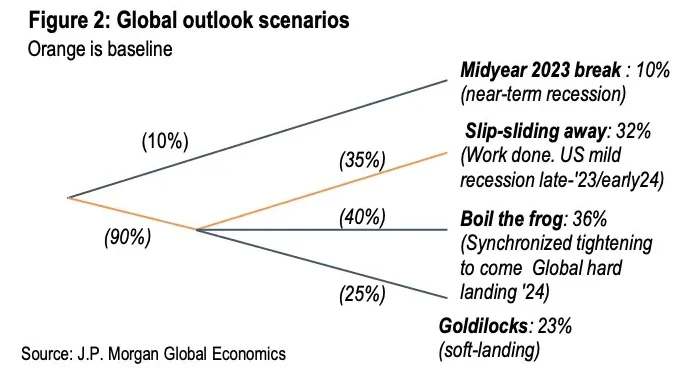

An announcement by Enterprise Insider explains that the funding financial institution offered 4 possible international outlook eventualities wherein the “boil the frog” recession emerged because the justifiable final result.

What’s ‘Boil The Frog’ Recession?

Boiling the frog is a phrase generally used to explain a scenario the place folks fail to behave on a possible downside till it will get extra extreme and finally bubbles over. The agency stated that it’s the almost certainly final result underlining {that a} recession is more likely to occur.

The end result – to which the economists assigned a 36% chance – includes the US toppling into recession identical to the remainder of the worldwide economic system. Aggressive financial tightening insurance policies in response to inflation, which JPMorgan expects to remain persistently elevated, is the chief catalyst to this hitch.

“The Central financial institution aspirations for a smooth touchdown have tempered the tempo of tightening. Nevertheless, hopes for a painless slide in inflation again to focus on are more likely to be dashed, requiring coverage to show sufficiently restrictive to interrupt the again of the growth,” the analysts defined. “Broad-based developed-market tightening factors to a extra synchronized international downturn someday in 2024.”

“Slip-sliding away” recession, which the economists suppose has a 32% likelihood of taking place, is the second most-likely final result. It includes a light US recession from late 2023 to early 2024, as a continuation of the continuing credit score crunch pushes the US right into a downturn whereas different economies worldwide stay resilient.

For now, JPMorgan says the US has a 23% likelihood of a Goldilocks soft-landing state of affairs, the place the economic system avoids a recession altogether. It additionally perceives a ten% likelihood the US will slip into a direct financial downturn in mid-2023.

Shoppers Pressured To Eat Sparingly

Recently, the founding father of Alden Funding Technique, Lyn Alden, stipulated on Twitter how retail gross sales have been getting fairly recessionarily low. It’s an emblem that buyers have began to chop again on their spending to accomodate with the insufferable financial occasions.

1️⃣ @LynAldenContact factors to a potential slowdown within the US economic system. Alden notes that retail gross sales have been declining in current months, and that this could possibly be an indication that buyers are beginning to pull again on their spending. https://t.co/h4H89TREjP

— Crypto Koryo (@CryptoKoryo) Might 23, 2023

For the previous yr, consultants have been flagging the chance of a recession as inflation nudged a 41-year-high prompting the Federal Reserve to lift rates of interest to manage financial progress.

Economist Steve Hanke termed the scenario an “ugly” recession, whereas gold bug Peter Schiff, his counterpart, anticipates a “huge” recession and a extreme monetary disaster.

As well as, Bloomberg’s Intelligence senior commodity strategist, Mike Glone, believes the US economic system is on a path towards a “extreme deflationary recession.” Nevertheless, Blackrock CEO Larry Fink doesn’t foresee a big US recession this yr.

Federal officers have warned that the charges might soar. Furthermore, 74% of market contributors foresee a rate-rise of one other 25 foundation factors in July, thus lifting the Fed funds goal vary to five.25-5.55%.

IMF Raises Pink Flags Over Extreme Monetary System Turmoil

Alternatively, the Worldwide Financial Fund (IMF) barely trimmed its 2023 international progress outlook and warned that extreme monetary system turmoil might slash output to recessionary ranges.

Based on Monetary Asset Information, the World Financial institution and IMF are on a bid to benchmark the current improve in monetary market volatility because the fog world wide financial outlook has thickened.

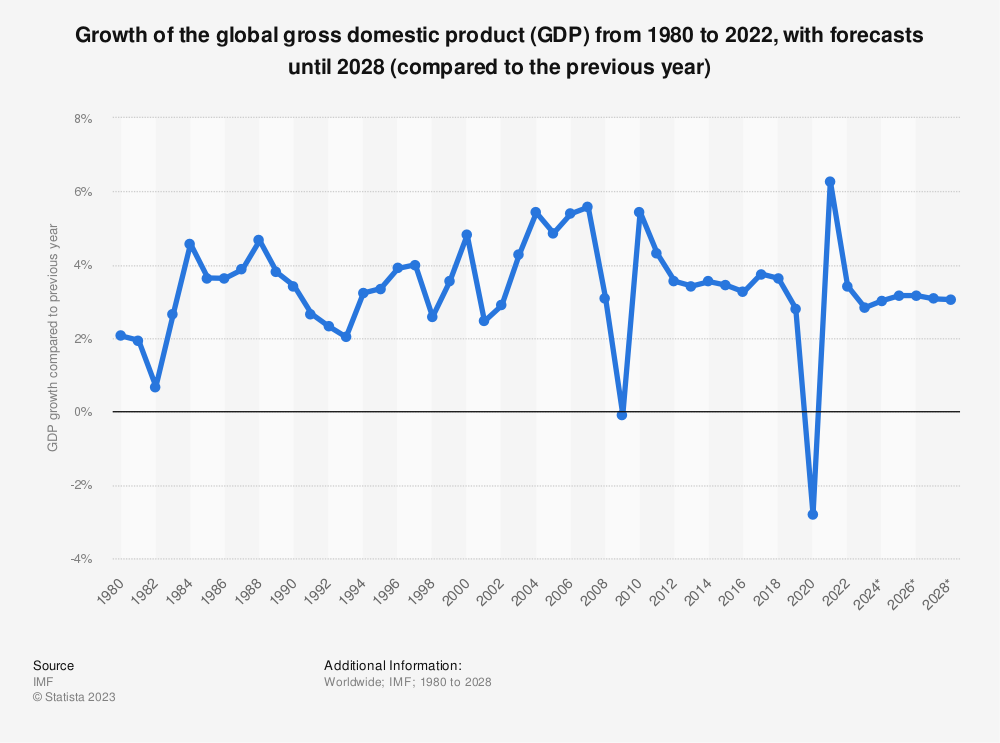

The IMF predicts international actual GDP progress fee to be 2.8% in 2023 and three.0% in 2024, a slowdown from 3.4% in 2022 attributable to tighter financial coverage. The forecasts for 2023 and 2024 have been down by 0.2% attributable to weaker performances in some bigger economies, with expectations of additional financial tightening to battle inflation.

Based on Pierre Oliver Gourinchas, the chief economist on the IMF, financial coverage must deal with worth stability to maintain inflation expectations in test. In a Reuters interview, Gourinchas defined how central banks shouldn’t halt their battle towards inflation due to monetary stability dangers, which look very contained.

In the meantime, a recession in america can be an uncalled-for burden to the cryptocurrency market, which has simply began to get better from a one-and-a-half-year downturn. Bitcoin’s climb to a 12-month excessive barely above $31,000 is testomony to the enhancing macro atmosphere.

Market watchers concern that any sudden change within the present circumstances might result in one other pullback. A recession would, subsequently, exert even higher stress on a market that has needed to endure a number of battering’s not too long ago, together with a crackdown on US-based crypto entities by the Securities and Trade Fee (SEC).

Associated Articles

Be a part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link