[ad_1]

US deficits maintain rising regardless of the economic system rising

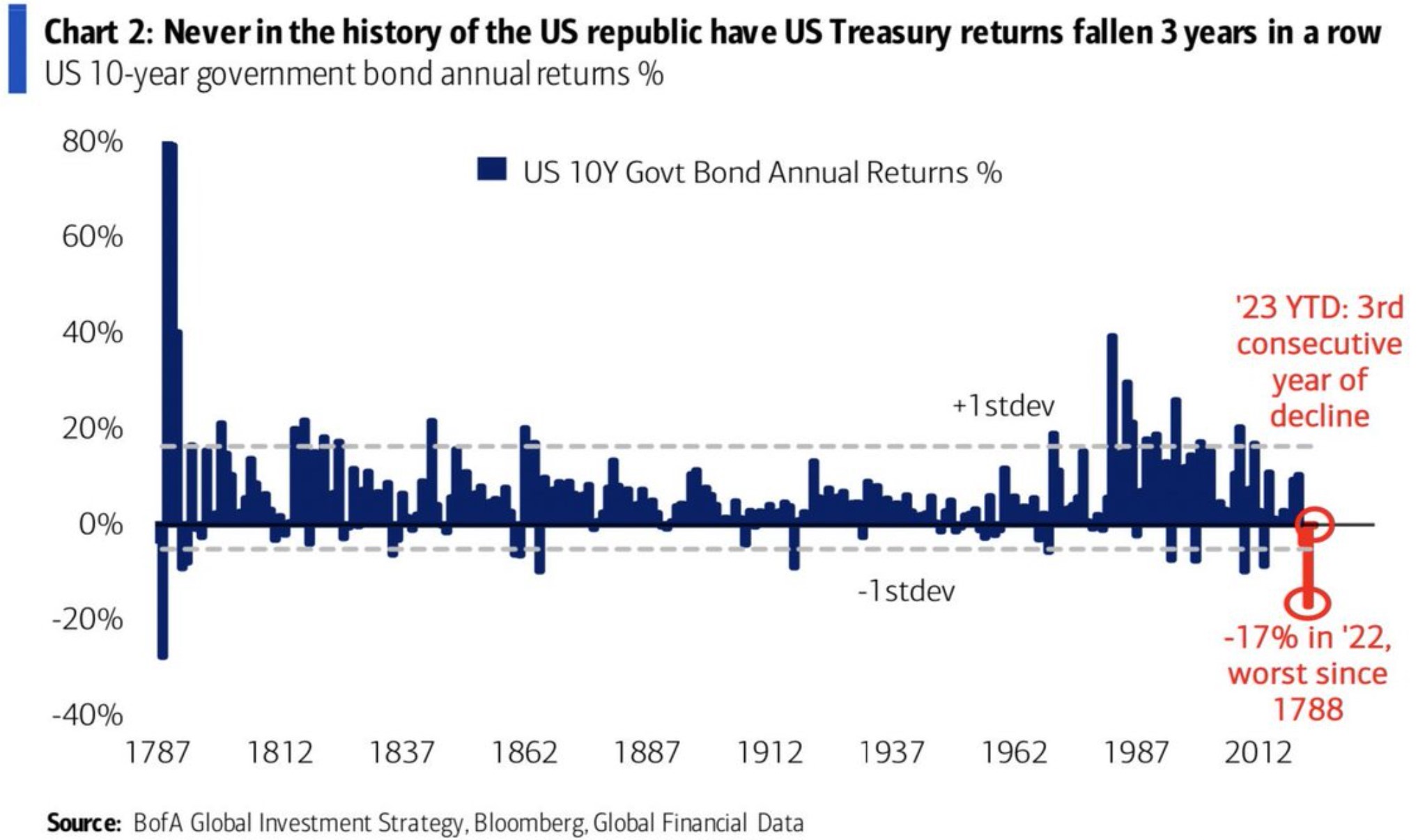

US Treasury returns dropped for the previous three years in a row

A weakening greenback may trigger cryptocurrencies’ subsequent step greater

In earlier articles printed right here, I’ve argued that the following transfer within the cryptocurrency market will seemingly be pushed by the US greenback relatively than crypto-related information. Given the present rate of interest ranges, the surging deficit makes elevating cash tough for the US authorities.

Therefore, one method to make it simpler is to decrease the charges.

The Federal Reserve won’t ever inform market members that charges can’t transfer a lot greater. The second it does that, inflation expectations aren’t anchored anymore.

Nonetheless, one may take time to know what the bond market tells. For the primary time within the historical past of america, US Treasury returns dropped three years in a row.

A vicious circle might spark the US greenback’s weak point

The value of a bond is inversely associated to its yield. Decrease bond costs imply greater yields and a method for bond costs to bounce again is for yields (i.e., rates of interest) to say no.

However the deficit poses an enormous drawback. Deficit spending is likely one of the the reason why bonds underperform.

As a result of deficits surged even because the economic system grew, extra bonds are issued to pay for it. Nonetheless, issuing extra bonds means issuing extra debt, however rates of interest aren’t low anymore as they have been previously years.

Due to this fact, rate of interest bills would improve, offsetting the income collected from promoting the bonds.

One method to clear up this drawback is to let the greenback slip. The place to begin could be a sign that the Fed has already reached the terminal charge.

If the greenback begins weakening, its decline ought to be generalized and now have ramifications for the cryptocurrency market. Due to this fact, if Bitcoin is about to make a transfer greater, one ought to regulate the US deficit and the greenback.

[ad_2]

Source link