[ad_1]

Uniswap (UNI) has emerged as a formidable drive inside the cryptocurrency house, showcasing a powerful progress of twenty-two% in current weeks.

As one of many main decentralized exchanges (DEX) constructed on the Ethereum blockchain, Uniswap has gained widespread recognition for its progressive method to facilitating peer-to-peer token swaps.

With its distinctive automated market maker (AMM) mannequin and emphasis on consumer empowerment, Uniswap has grow to be a go-to platform for merchants and liquidity suppliers alike.

The numerous surge in UNI’s worth begs the query: does it have sufficient gasoline to climb larger?

Uniswap Optimism Incentives Contributes To UNI Rally

A current UNI report has highlighted that Uniswap’s incentives on the Optimism community (OP) have generated various outcomes with regards to liquidity and the decentralized finance (DeFi) sector.

Whereas the effectiveness of those incentives might have assorted, the worth of UNI has demonstrated a robust bullish development on the charts.

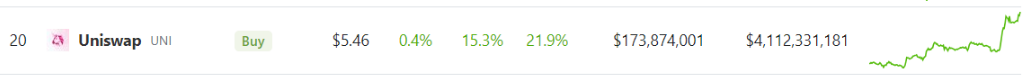

Over the previous 24 hours, UNI has skilled a major rally, with its value reaching $5.46 on CoinGecko, marking a powerful 15.3% enhance.

UNI value hits the 15.3 mark. Supply: Coingecko

Moreover, within the span of the final seven days, UNI has likewise demonstrated outstanding progress, surging by practically 22%. These substantial value good points point out a optimistic market sentiment surrounding UNI and counsel the potential for additional upward motion.

UNI value motion within the final seven days. Supply: Coingecko

Affect Of Decreased UNI Provide On Exchanges

On-chain information evaluation has unveiled a major drop in Uniswap’s provide on exchanges throughout early June, adopted by a interval of sideways motion from mid-June onwards. This information means that the promoting stress on UNI has eased within the brief time period, as the quantity of UNI being moved to centralized exchanges (CEX) for offloading has decreased.

The lower in UNI provide on exchanges implies that holders have gotten much less inclined to promote their tokens within the rapid time period. This discount in promoting stress might have optimistic implications for the worth of UNI, as a decrease provide obtainable for buying and selling might create a extra favorable supply-demand dynamic.

UNI market cap at the moment at $3.13 billion on the each day chart at TradingView.com

Moreover, the sideways motion of UNI on exchanges signifies a possible shift in market sentiment. Traders and merchants could also be adopting a extra long-term method to holding UNI, contemplating the potential for additional value appreciation or the need to take part within the governance and staking mechanisms supplied by Uniswap.

#UNI is one among my small pockets, investing about $5,000. however who is aware of, this may give 10x or 50x sooner or later. What attracted me to this coin is its max provide of 1B, verify coingecko data, and it’s a utility. Therefore it satisfies funding standards. #uniswap pic.twitter.com/FX6PZzAi50

— Prof. Smalltimer (@RJinvestcoin) June 25, 2023

This shift in UNI provide and buying and selling habits highlights the evolving dynamics inside the Uniswap ecosystem. With lowered short-term promoting stress and a possible enhance in long-term holding, UNI’s value stability and upward potential could also be bolstered.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing includes threat. Once you make investments, your capital is topic to threat).

Featured picture from Alamy

[ad_2]

Source link