[ad_1]

The DeFi ecosystem has lengthy promised customers enhanced safety and the liberty to take part in numerous monetary actions with out the intervention of exterior authorities, equivalent to banks. Nevertheless, current issues about vulnerabilities inside DeFi protocols threaten to undermine these guarantees.

One explicit vulnerability that has garnered vital consideration is Miner Extractable Worth (MEV). MEV has sparked discussions amongst builders and merchants primarily as a result of it exploits an inherent functionality of DeFi protocols.

This vulnerability poses vital dangers to the rising adoption of DeFi as a result of it basically erodes belief when unsuspecting customers uncover they’ve been taken benefit of.

This text comprehensively explores the idea of MEV, the way it works, and the implications it holds for the crypto neighborhood if left unaddressed.

What Is Miner Extractable Worth (MEV)?

MEV, brief for “Miner Extractable Worth,” refers back to the extra worth miners can entry from transaction charges and block rewards in a blockchain community or DeFi protocol.

In a blockchain community using a Proof-of-Work (PoW) consensus mechanism, while you provoke a transaction, your transaction particulars are briefly saved in a “mempool.” These transactions stay within the mempool till a miner contains them in a block.

Subsequently, nodes validate these blocks earlier than they’re added to the blockchain. Node operators and block producers are rewarded with a fraction of the transaction charges for performing these roles.

Nevertheless, sure miners have found a technique to extract extra revenue than they might usually obtain. They accomplish this by manipulating the order of transactions inside a block, both by including or eradicating transactions whereas they’re within the mempool. This extra worth is what we seek advice from as MEV.

Regardless of some networks transitioning from PoW to Proof-of-Stake (PoS) programs, the place validators assume the roles miners held in PoW, mempools live on. Consequently, the manipulation of the mempool to extract “MEV” stays attainable. This is the reason the time period MEV has advanced to tackle a brand new title: “Maximal Extractable Worth.”

How Does Miner Extractable Worth (MEV) Truly Work?

Understanding MEV requires a primary grasp of the roles performed by block producers, whether or not they’re miners or validators.These gamers are vital in preserving blockchain networks safe and operational. Their duties embody confirming transactions and appending them to the community as linked information “blocks.”

Block producers are chargeable for including new information into the blockchain. They accumulate consumer transaction information and set up it into blocks that change into a part of the blockchain. The important thing determination of which transactions to incorporate of their blocks is as much as these block producers.

For block producers to profit from MEV, they select transactions primarily based on their potential profitability. They prioritize sure transactions and organize them strategically to maximise income. This may end up in further earnings via alternatives like arbitrage or on-chain liquidation.

Throughout peak durations, when the mempool is flooded with transactions, customers are prepared to pay increased charges to get their transactions processed quicker. Block producers trying to benefit from MEV have a tendency to pick transactions with excessive charges, as that is the first technique to improve their earnings. Consequently, transactions with decrease charges might face delays in being included in a block.

In easy phrases, that is how MEV works. Miners and validators use numerous methods to make the most of MEV whereas performing their roles on the blockchain community. A few of these methods embody front-running, back-running, and sandwiching.

Entrance-Working

Entrance-running is a method the place a miner locations their very own transaction earlier than one other one in a block to earn more money. Miners do that after they anticipate vital transactions on a decentralized change (DEX) and need to profit from potential value adjustments. This tactic is called Miner Extractable Worth (MEV), and miners use it to keep away from shedding cash when mining cryptocurrencies. Latest analysis exhibits that front-runners could make plenty of revenue via MEV and sometimes compete to maximise their features.

Again-Working

Again-running entails miners looking the mempool for transactions, like token swaps, that they will revenue from. As soon as they discover a worthwhile pair, they shortly purchase tokens from that pair earlier than others. This fashion, they get precedence over others when the transactions are validated. Then, they maintain onto these tokens till their worth will increase, permitting them to promote for a revenue.

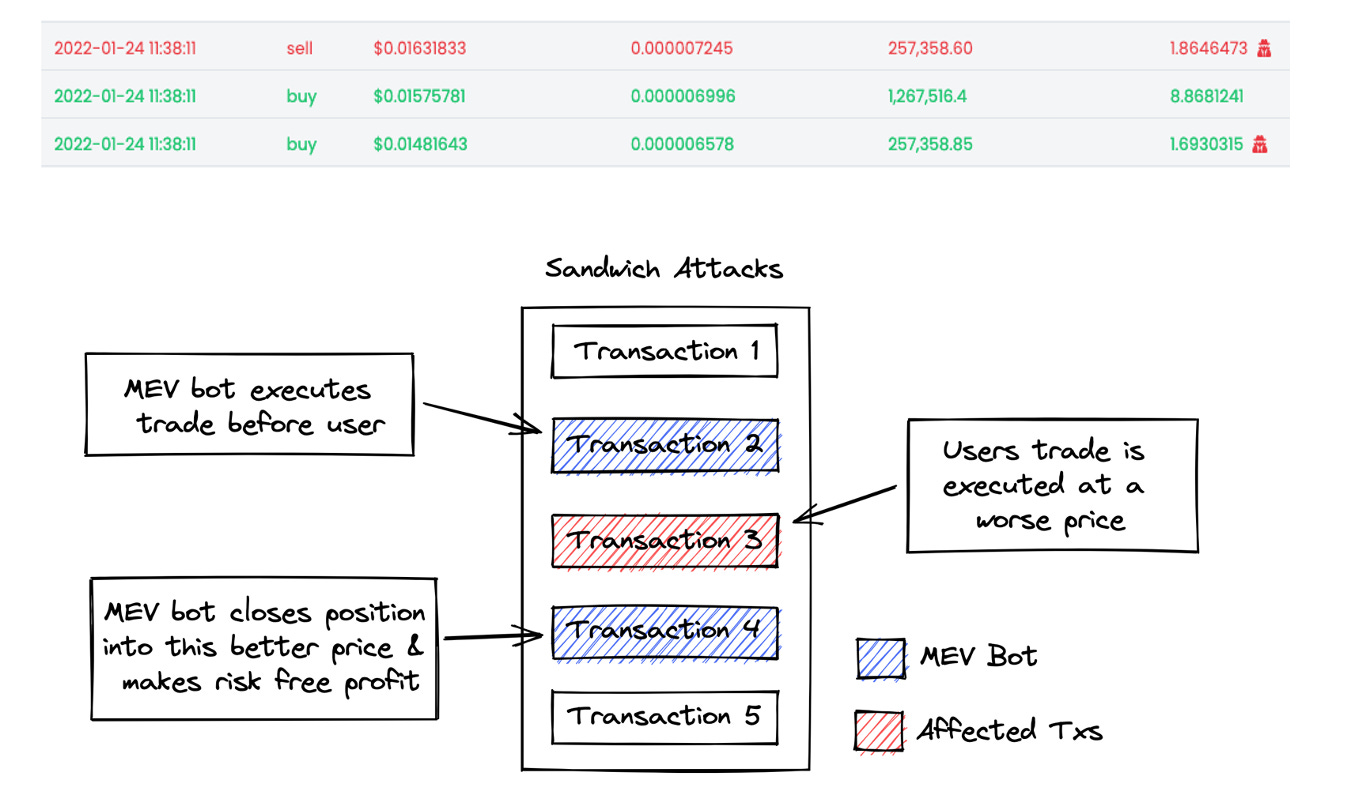

Sandwiching

Sandwiching is a mix of each front-running and back-running strategies. Miners who use this methodology spot transactions earlier than they occur and cleverly “sandwich” their very own buy-and-sell transactions round them. This will increase the fuel payment for the transaction, immediately incomes them a revenue with out further prices.

Malicious actors use sandwich assaults on unsuspecting individuals in DEXes, inflicting value slippages from which they revenue.

The Impression of MEV on the Crypto Trade

MEV comes with its complexities and drawbacks. Whereas there are debatable advantages to it, there are additionally extremely detrimental results on the crypto trade as a complete.

The thought of influencing transaction order for revenue has given rise to a large number of MEV bots, which repeatedly scan the blockchain in quest of alternatives to take advantage of. Their operational scope spans from arbitraging value variations throughout decentralized exchanges (DEXs) to effectively resolving unfavourable mortgage positions.

In some extraordinary instances, they even play a task in mitigating safety breaches.

Nevertheless, the extraordinary competitors amongst these MEV bots, as every strives to outdo the opposite in securing profitable alternatives, can result in community congestion and exorbitant transaction charges.

Whereas these controlling the bots might discover this financially rewarding, merchants and different individuals typically bear the brunt of their actions. These bots steadily undermine the ideas of a good and equitable buying and selling atmosphere, instantly impacting the consumer expertise by diminishing the worth of trades.

In April 2023, a white hat hacker found a vulnerability in SushiSwap’s RouterProcessor2 contract and efficiently accessed 100 Ethereum (ETH) from a consumer’s funds. Performing in good religion, the hacker expressed a willingness to return the funds upon contact. Sadly, swift actions by MEV bots undermined efforts to safe the platform.

These bots duplicated the assault by deploying contracts earlier than the vulnerability may very well be absolutely patched, leading to a lack of roughly $3.3 million (1800 ETH). Regardless of intensive restoration efforts, not all of the misplaced funds have been returned to the affected consumer.

The cruel actuality is that so long as transactions are prioritized inside blocks primarily based on transaction charges, there’ll all the time be instances of MEV exploitation.

As we’ve got witnessed, this dynamic has each constructive and unfavourable implications for the blockchain ecosystem as a complete. Subsequently, addressing these issues thoughtfully and proactively is essential to make sure that the promise of DeFi stays intact and that customers can proceed to get pleasure from its quite a few advantages.

It’s price noting that researchers are actively growing options to cut back or solely stop MEV exploitation by creating protocols for cheap transaction ordering. A few of these options embody Offchain Labs’ Abritrum, ChainLink’s Honest Sequencing Service, and Automata Community’s Conveyor.

Implementing these options will assist keep the integrity and advantages of DeFi, enabling customers to get pleasure from its potential with out the danger of MEV exploitation. Finally, extra customers might be inspired to totally embrace DeFi with out issues about unfair benefits or manipulations.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein must be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of economic loss. All the time conduct due diligence.

If you need to learn extra articles (information reviews, market analyses) like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

“Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”

[ad_2]

Source link