[ad_1]

Fast Take

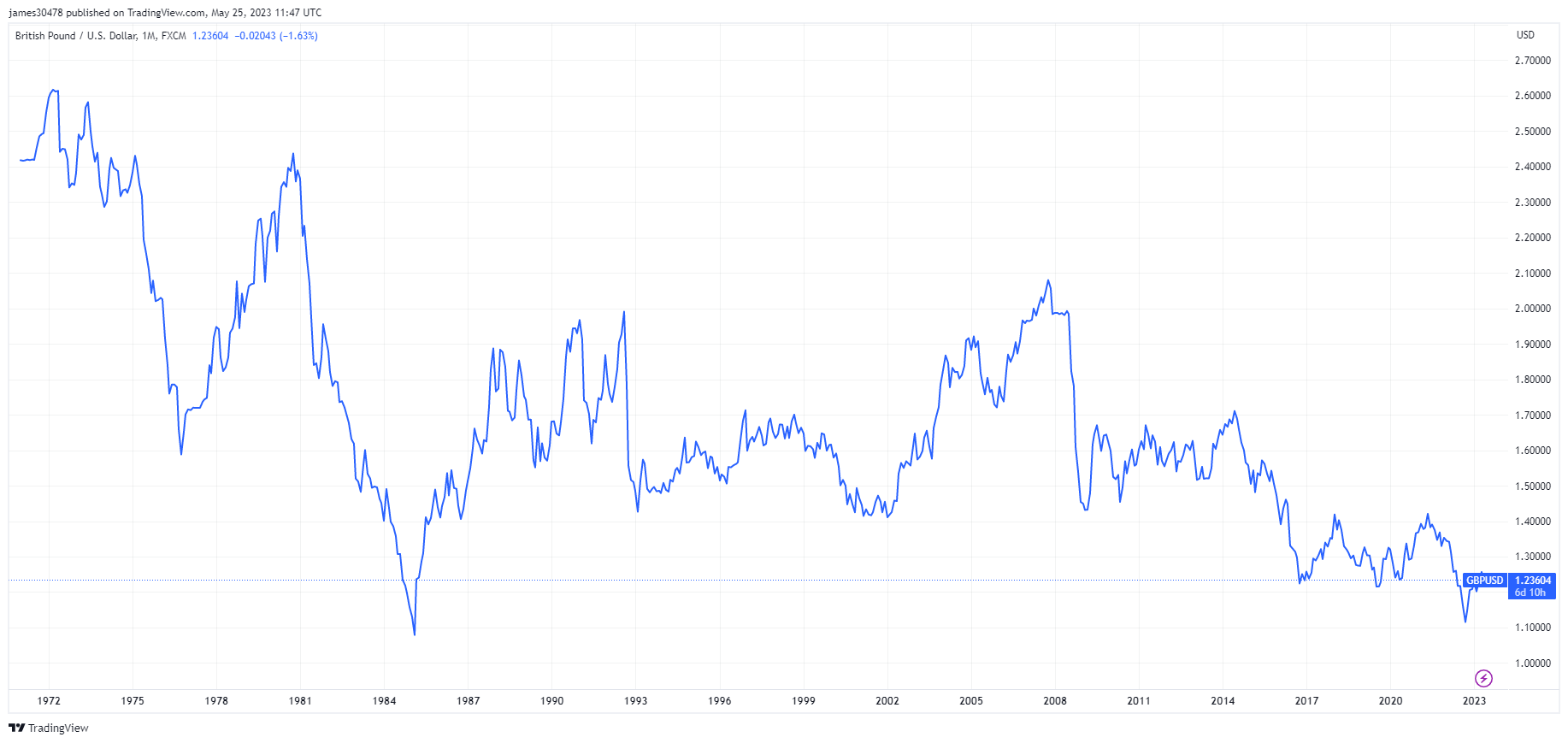

Final October, U.Okay. Prime Minister Liz Truss launched a “mini-budget” that triggered a pension fund disaster. The mini-budget episode despatched shock waves across the UK markets and the GBP to 1.11 towards USD.

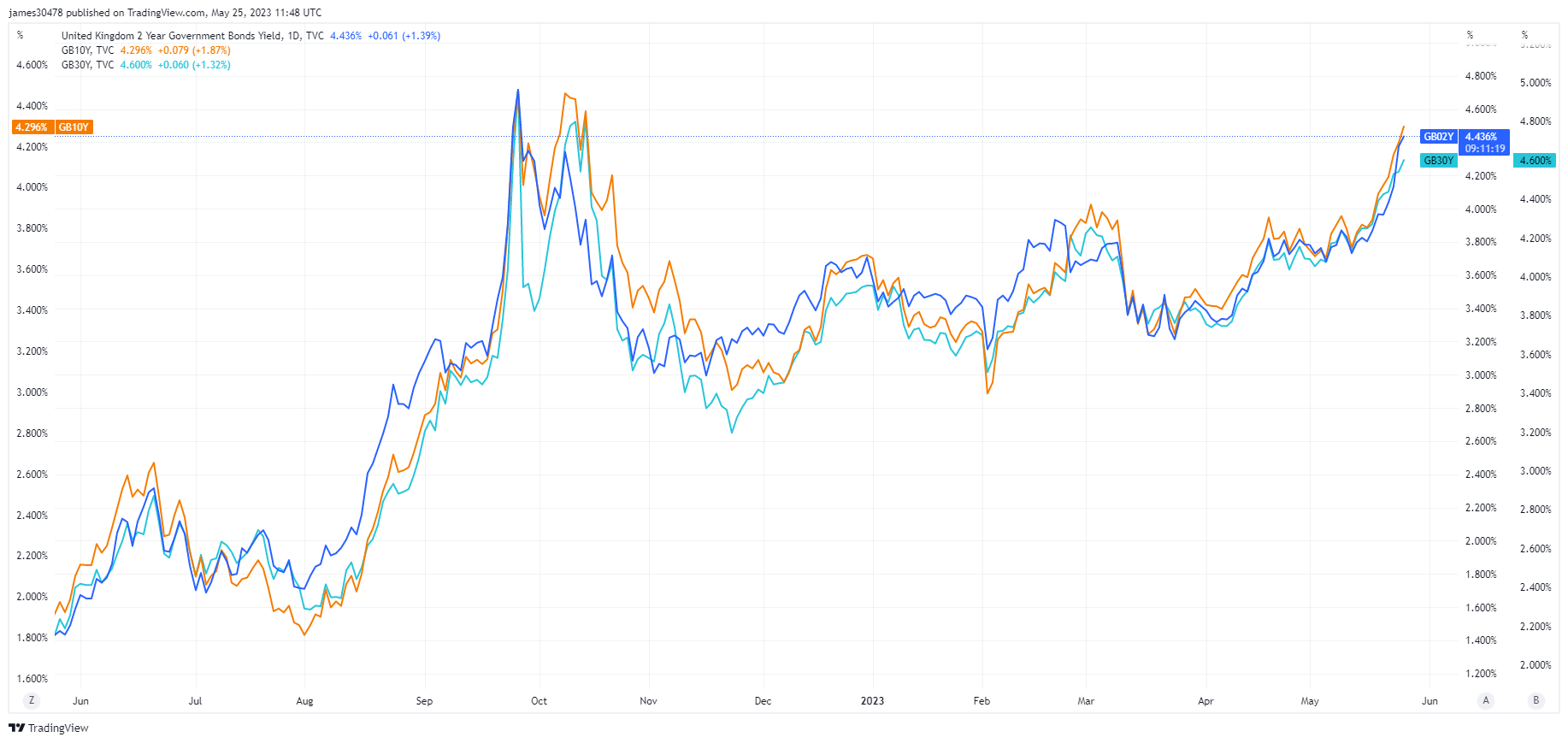

Within the wake of recent inflation numbers yesterday, U.Okay. authorities yields have soared even greater.

As yields soared throughout the curve—particularly on the lengthy finish (30 years)—pension funds went downward.

Based on Bloomberg, pension funds use leverage to steadiness property with liabilities.

Pension funds have a major allocation in the direction of long-end bonds which can be extremely levered, so when the value of the bond drops, they should publish collateral to not be margin known as.

As gilt (authorities bond) costs continued to drop, pension suppliers had been compelled to boost money imminently as the specter of margin name loomed.

The publish UK yields skyrocket to ranges echoing final yr’s pension disaster appeared first on CryptoSlate.

[ad_2]

Source link