[ad_1]

Treasury payments, generally known as T-bills, are short-term securities issued by the U.S. authorities. They’re basically IOUs, with the federal government promising to pay again the face worth of the invoice upon its maturity. The yield on a Treasury invoice represents the return an investor will obtain by holding the invoice till maturity. Yields transfer inversely to bond costs; when bond demand will increase, costs rise, yields fall, and vice versa.

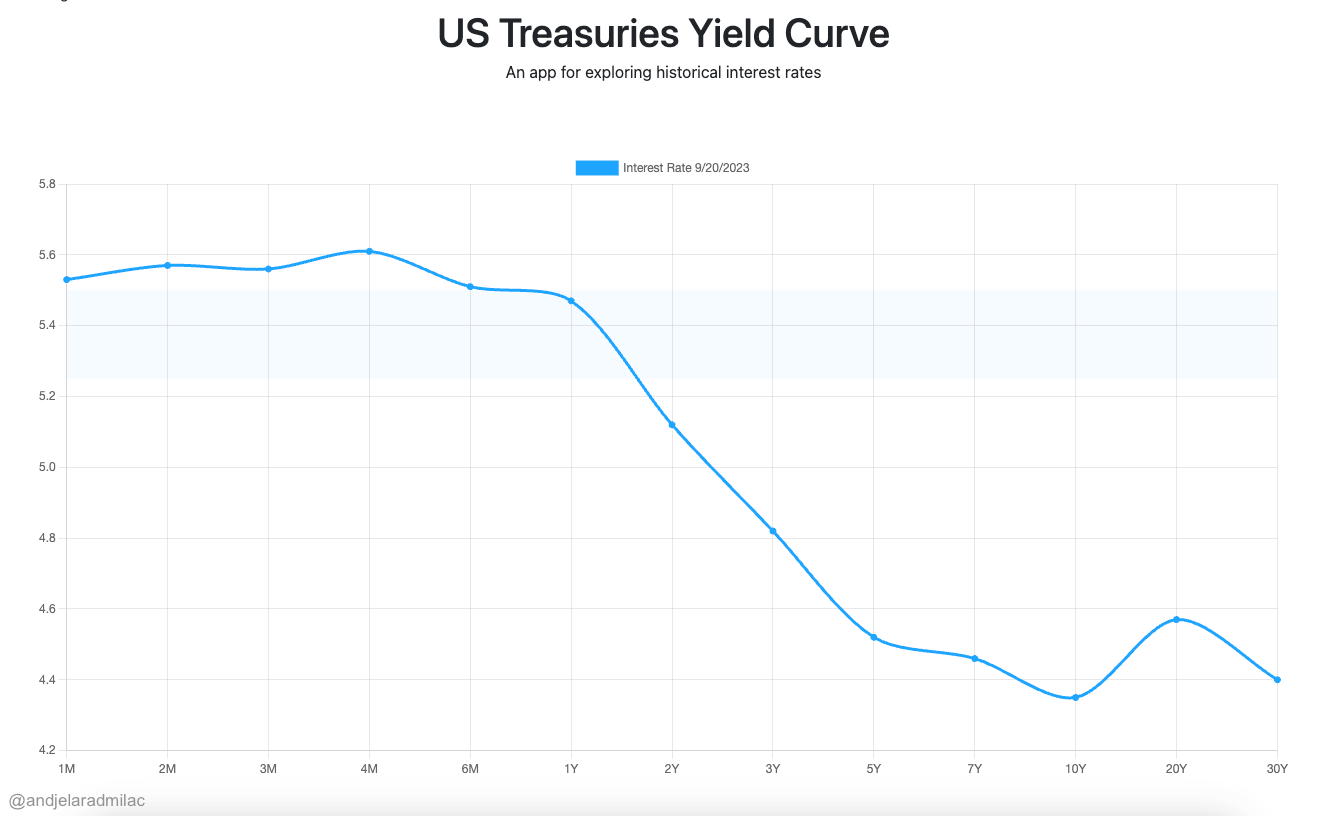

The yield curve, a graphical illustration of yields throughout totally different maturities, is an important market indicator. A standard yield curve slopes upward, indicating greater yields for longer-term bonds in comparison with shorter-term ones. This displays the extra threat traders take when lending cash over an prolonged interval.

The Federal Reserve’s stance performs a pivotal function in influencing Treasury yields. Current selections and bulletins from the Fed have indicated a hawkish tilt, with potential rate of interest hikes on the horizon. Financial indicators, equivalent to inflation charges, unemployment figures, and GDP progress, additionally play an element in figuring out yields. On the worldwide entrance, geopolitical tensions, commerce dynamics, and world financial well being can sway U.S. Treasury yields.

Current information signifies that yields on almost all Treasury payments have surged to multi-year highs:

3-Month Treasury Invoice: The present yield stands at 5.47%, which has seen a rise of 4 foundation factors up to now month and a major rise of 221 foundation factors over the previous 12 months.

6-Month Treasury Invoice: The yield is at present at 5.52%. During the last month, it has risen by 3 foundation factors and has surged by 164 foundation factors year-over-year.

12-Month Treasury Invoice: It has a yield of 5.47%, with a rise of 10 foundation factors within the final month and an increase of 142 foundation factors from the earlier 12 months.

2-Yr Treasury: The yield is at 5.15%. It has seen a rise of 17 foundation factors up to now month and has grown by 113 foundation factors over the past 12 months.

5-Yr Treasury: Presently, the yield is 4.62%, with a month-over-month enhance of 16 foundation factors and a year-over-year rise of 86 foundation factors.

10-Yr Treasury: The yield stands at 4.48%. It has grown by 14 foundation factors within the final month and has seen an increase of 95 foundation factors from the earlier 12 months.

30-Yr Treasury: The present yield is 4.53%, with an 8 foundation level enhance up to now month and a major progress of 102 foundation factors year-over-year.

DURATION

YIELD

1-MONTH BASIS POINT INCREASE

1-YEAR BASIS POINT INCREASE

3 Month

5.47%

+4

+221

6 Month

5.53%

+3

+164

12 Month

5.46%

+9

+142

2 Yr

5.14%

+15

+110

5 Yr

4.62%

+16

+86

10 Yr

4.48%

+15

+96

30 Yr

4.55%

+10

+104

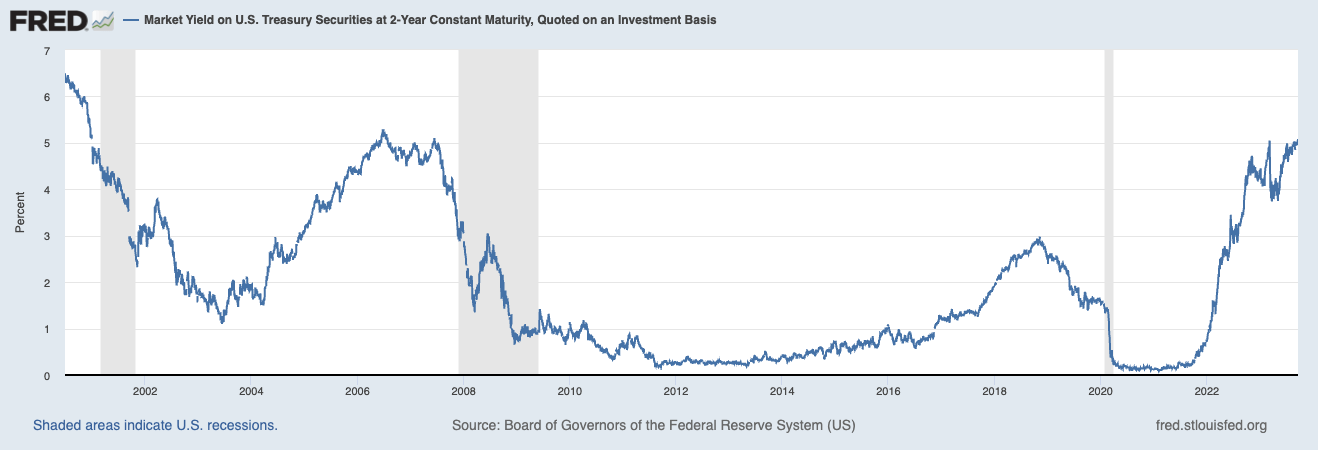

The two-year Treasury word is uniquely positioned within the monetary panorama, typically serving as a barometer for short-to-medium-term financial expectations. Its shorter period makes it extra delicate to modifications within the Federal Reserve’s financial coverage and anticipated shifts in rates of interest. When the Federal Reserve alerts potential charge hikes or adopts a hawkish stance, the 2-year yield can react extra swiftly than longer-dated bonds.

This sensitivity makes the 2-year Treasury a essential indicator for traders making an attempt to gauge the economic system’s route and the central financial institution’s subsequent strikes. The latest important enhance within the 2-year Treasury yield underscores its function as a bellwether for imminent financial and coverage shifts.

Rising Treasury yields is usually a double-edged sword for the crypto market, significantly Bitcoin. On one hand, as conventional investments like bonds change into extra engaging attributable to greater yields, traders would possibly pivot away from riskier property like cryptocurrencies. Then again, some view Bitcoin as a hedge towards inflation, and if rising yields point out inflationary pressures, it may bolster Bitcoin’s enchantment.

The submit U.S. Treasury yields surge to multi-year highs appeared first on CryptoSlate.

[ad_2]

Source link