[ad_1]

Be part of Our Telegram channel to remain updated on breaking information protection

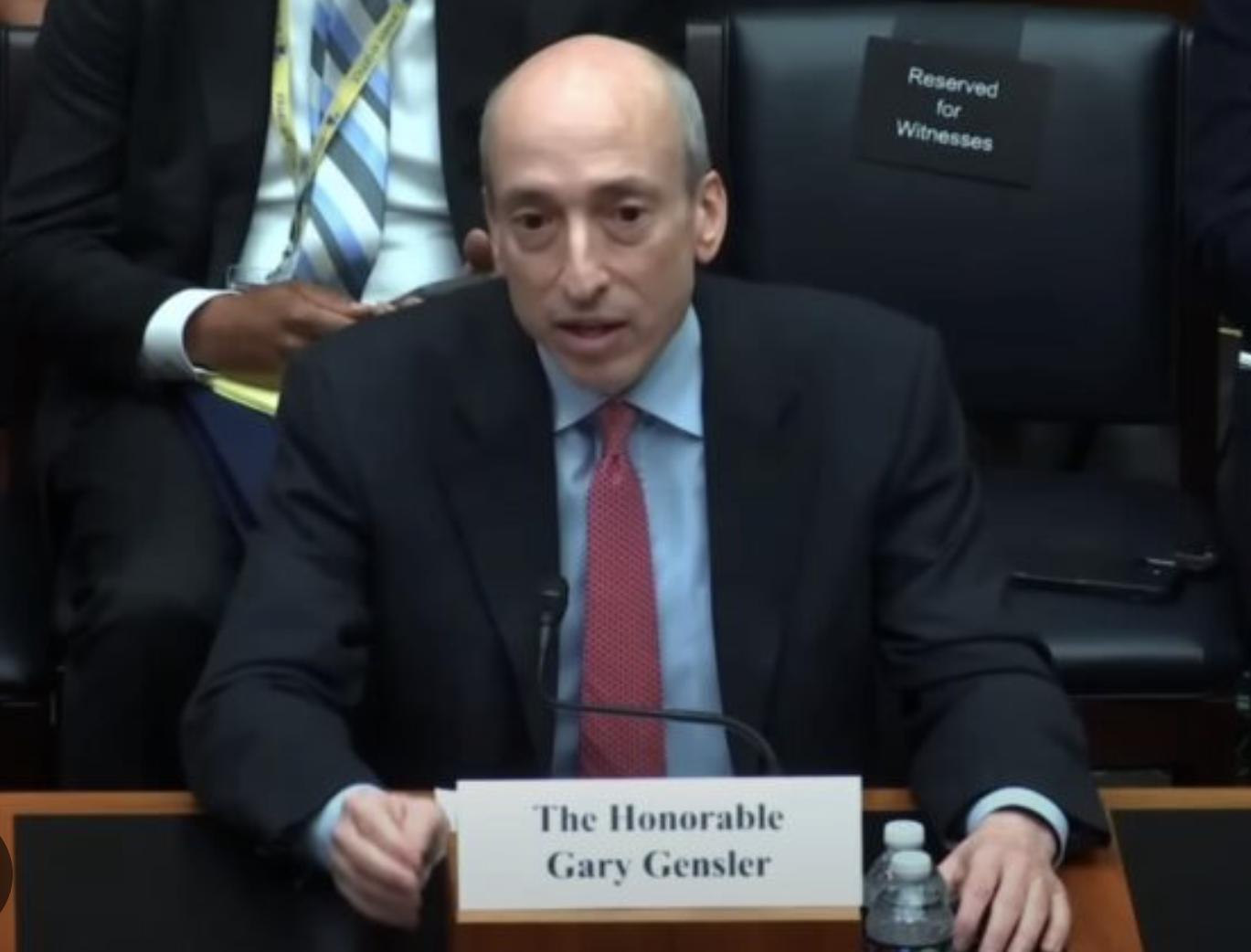

Three committee chairs in the US Home of Representatives have despatched a letter to Gary Gensler, chairman of the US Securities and Alternate Fee (SEC). The letter calls for a extra passable response to a November 1 query relating to the SEC and its chairman’s compliance with recordkeeping necessities.

Concurrently, the Blockchain Affiliation, a lobbying group for the American cryptocurrency business, is advocating that Gensler steps down from implementing rules on the crypto sector. The Affiliation has stated that his public remarks have demonstrated that he lacks objectivity in his evaluation of the issues.

Who’s Gary Gensler and Why Is He Dealing with the Brunt of the Crypto Group?

Gary Gensler presently heads the Securities and Alternate Fee of the US. Gensler was sworn into workplace on April 17, 2021, having been nominated by President Joe Biden in February, after which confirmed by the Senate. Gensler oversees honest, orderly, and environment friendly markets, facilitating capital formation, safeguarding buyers, and fostering public confidence available in the market.

Crypto aficionados have usually referred to Gensler because the “ringleader” of the shambolic SEC response to the business in latest months. Particularly when contrasted to his predecessors, he’s famend for taking a tricky stance on the cryptocurrency enterprise.

Conflicts could come up to the extent that advisers or brokers are optimizing for their very own pursuits in addition to others. Additional, the underlying knowledge utilized in these analytic fashions may very well be primarily based upon knowledge that displays historic biases, affecting honest entry & costs within the markets.

— Gary Gensler (@GaryGensler) June 28, 2023

Whereas many Democrats have backed Gary Gensler in his efforts to close down cryptocurrency exchanges, Gensler has come beneath hearth from Republicans. On June 13, Warren Davidson, a congressman from Texas, launched a invoice known as the SEC Stabilisation Act that might reorganize the company and oust Gensler as chairman.

Take a look at our listing of the perfect AI cryptos to purchase.

Questioning from the Home of Representatives

Jim Jordan, James Comer, and Patrick McHenry, the chairs of the Judiciary, Oversight, and Monetary Companies committees, respectively, had particularly demanded affirmation that the SEC complies with federal recordkeeping and transparency rules, that Gensler and his deputies haven’t used private e-mail accounts to conduct enterprise, and explanations of the company’s definition and utility of “off-channel communications.”

They’ve famous that Gensler’s response to their inquiry didn’t immediately reply to their letter’s necessities. Inconsistencies in Gensler’s publicly obtainable assembly schedules by 2021 have additionally been talked about within the letter.

Along with restating the unique calls for, the brand new letter provides, “If you don’t intend to adjust to any or the entire above requests #1-5, please describe the factual and authorized foundation in your non-compliance.”

The subsequent day, the Blockchain Affiliation revealed a doc saying that Gensler ought to abstain from making selections in regards to the enforcement of digital property, which made Gensler the goal of criticism particularly associated to the cryptocurrency business.

Critique by The Blockchain Affiliation

The Blockchain Affiliation launched a essential assertion within the type of an open letter, speaking in regards to the SEC and Gary Gensler’s inflexible stance, and its detrimental impact on the promising cryptosphere.

“His steadfast view that each one digital property besides bitcoin are securities implies that he can’t method enforcement selections with a good and neutral thoughts,” famous Jake Chervinsky, Chief Coverage Officer of the Blockchain Affiliation, within the open letter about Gensler.

“Within the digital asset area, the SEC has all however deserted its position as a rulemaking physique. Key problems with existential significance to the digital asset business stay unresolved, chief amongst them the query of whether or not and when a digital asset represents a ‘safety’”, the paper notes.

1/ SEC Chair Gary Gensler has wrongly prejudged that each one digital property are securities.

Consequently, federal regulation requires that he recuse himself from all enforcement selections associated to digital property.@MTCoppel and I wrote a paper explaining why 👇https://t.co/xgJ09o4SPS

— Jake Chervinsky (@jchervinsky) June 29, 2023

In line with the assertion, citing a number of speeches made by the SEC chairman, Gensler “has clearly acknowledged his view” that each one digital property aside from Bitcoin are unregistered securities and all digital asset buying and selling platforms are unregistered securities exchanges.

The letter continues, “Due course of requires not solely that company decision-makers act with out bias, but in addition that they keep away from even the looks of bias.” These phrases show Gensler’s prejudgment of “the whole lot aside from Bitcoin,” it notes.

The article additionally reminded that anyone who acquired a Wells notification may ask the SEC or a federal court docket to revoke Gensler’s immunity.

The Blockchain Affiliation’s assertion comes as a follow-up to crypto alternate Coinbase Inc’s discover of intent on Wednesday, asking a court docket to dismiss the SEC’s actions towards its enterprise.

SEC Coming Down on Crypto Exchanges

The US SEC had filed a lawsuit towards Coinbase on June 6 on the grounds that the alternate was utilizing the buying and selling platform as an unlicensed dealer and alternate of monetary property. A day earlier, the SEC had sued Binance.US for a similar causes.

In a press release, Coinbase claimed that the SEC was nicely conscious of the alternate’s operations involving digital property on account of its registration for a public providing in April 2021. When the SEC examined Coinbase’s public providing registration, six of the twelve cryptocurrencies it had deemed securities have been already traded there.

Asserting that the SEC is trying to make sure that monetary markets are honest and efficient, Gensler has defended his technique. He claimed that he’s trying to decrease the price of monetary intermediaries, a method that’s sure to irk many.

Associated

Wall Road Memes – Subsequent Huge Crypto

Early Entry Presale Stay Now

Established Group of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Finest Crypto to Purchase Now In Meme Coin Sector

Crew Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link