[ad_1]

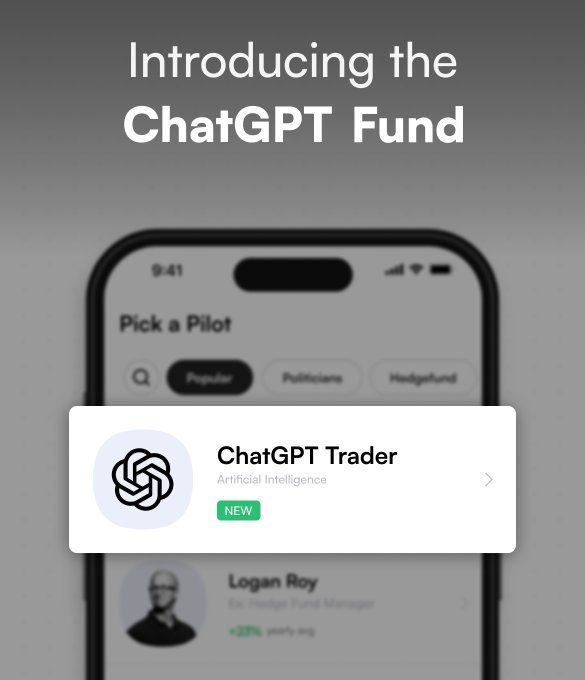

The newest pattern in monetary markets is a $3 million problem launched by Twitter customers, with ChatGPT pitted towards the hedge funds in a novel battle of the bots. Thus far, 1,500 folks have joined the problem, and now a further million {dollars} are being deployed with ChatGPT on autopilot. As the thrill builds, many questions have arisen about how ChatGPT can efficiently problem the hedge funds and outperform the markets.

The primary problem was to get ChatGPT to behave in a monetary context. To attain this, the builders of the deep learning-based algorithm jailbroke it so it might have the ability to parse inventory information articles and establish related developments. To get probably the most present knowledge and insights, the builders provided ChatGPT with up-to-date macroeconomic data, comparable to GDP, unemployment price, inflation price, rates of interest, and housing market indicators. To investigate particular person shares, the builders extracted the newest information articles for all listed shares with a market cap larger than $300 million, then analyzed the headlines and extracted favorable or unfavorable sentiment with the assistance of the ChatGPT API.

Lastly, the builders purchased the highest 20 shares, utilizing weekly or month-to-month averages, and carried out their evaluation to purchase and maintain them for roughly three days earlier than repeating their automated course of.

The initiative has so far been very profitable, with over 3 million {dollars} raised. As pleasure builds to see who will come out forward, traders and spectators alike eagerly await the result of the ChatGPT problem, hoping the brand new approach will beat the hedge funds and redefine the way forward for automated buying and selling. Within the meantime, individuals are left to easily eat popcorn and watch the bots do battle.

Lately, a research of public markets revealed by researchers on the College of Florida discovered that buying and selling fashions based mostly on ChatGPT can generate returns of as much as 500% over a 20-year interval, a stark distinction to the S&P 500 ETF, which returned -12% over the identical interval. The analysis workforce used sentiment evaluation of reports headlines to construct a buying and selling mannequin, and the outcomes confirmed that ChatGPT demonstrated superior efficiency in comparison with different sentiment evaluation strategies. Moreover, the efficiency of the GPT-4 rating was increased than that of the GPT-3, whereas the GPT-3 was discovered to have the next general return.

These outcomes present that using complicated language fashions to make monetary selections might help forecast inventory market returns extra precisely and improve the efficiency of quantitative buying and selling methods. The analysis additionally confirmed that predicting inventory market returns is especially helpful for small shares, suggesting there could also be market inefficiencies that present arbitrage alternatives. Sooner or later, AI will probably develop into a cornerstone of inventory market prediction, and this research has laid a marker demonstrating the accuracy and dispersion of returns from such fashions.

In April, Bloomberg introduced the creation of BloombergGPT, a large synthetic intelligence mannequin. The mannequin will enhance present monetary NLP duties like information classification, sentiment evaluation, entity recognition, and question-answering. It’s being educated on all kinds of economic knowledge. It’s anticipated to open up new choices for organizing knowledge, comparable to letting customers navigate the astounding volumes of information in Bloomberg Terminal. The mannequin already performs higher than comparable-sized open monetary pure language processing fashions. The enterprise is raring to leverage BloombergGPT to boost present NLP procedures whereas additionally arising with recent concepts for how one can use this mannequin to please prospects.

Learn extra about AI:

[ad_2]

Source link