[ad_1]

In a vital growth for the monetary markets, the US Greenback Index (DXY) has surged to its highest degree since March, marking a pivotal second for Bitcoin and the broader crypto sector. The DXY, which gauges the Dollar’s efficiency in opposition to a basket of six main currencies, has prolonged its features above the 104.000 mark previously 4 day, reaching a five-month peak at 104.907. At press time, the DXY was buying and selling at 104.773.

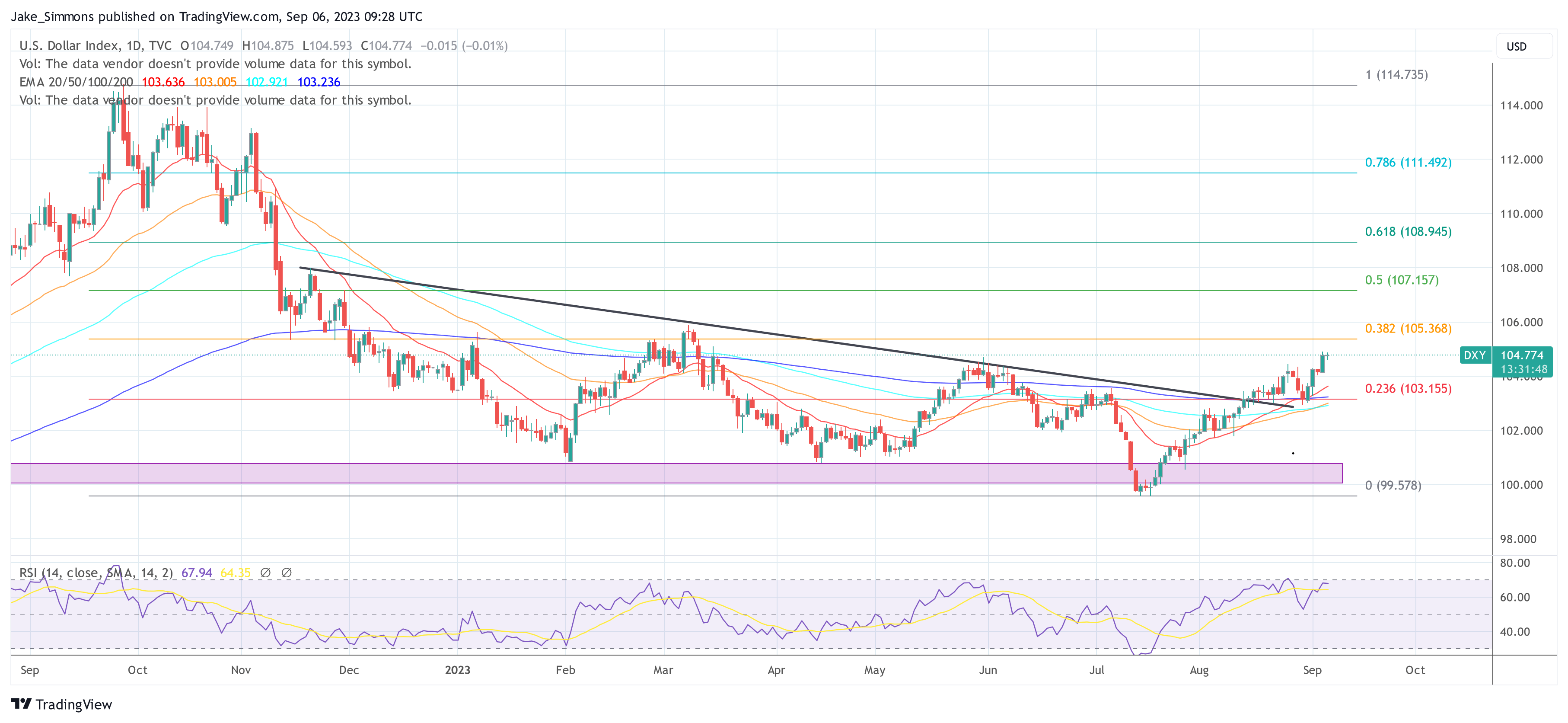

From a technical standpoint, the DXY has exhibited a bullish bias, particularly after surpassing the 200-day Transferring Common (DMA) on Thursday final week. For the DXY to solidify its bullish stance, it must surpass the year-to-date (YTD) excessive of 105.882, which might then carry the 106.000 mark into focus. Surpassing this degree may set the stage for the DXY to problem the November 30 day by day excessive of 107.195 and doubtlessly rally in the direction of March’s 21 excessive of 107.993.

Nonetheless, on the flip aspect, if the DXY had been to dip beneath 104.538, it may set off a correction, concentrating on the 200-DMA (presently at $103.326). Within the quick time period, whereas the DXY stays bullish, it should breach the 38.2% Fibonacci retracement degree at $105.368.

Famend macro analyst Henrik Zeberg weighed in on the DXY’s trajectory, predicting that DXY bulls shouldn’t get too excited, “I simply love this BEARISH – bullish transfer in DXY. Let the DXY Bulls get overly excited! Precisely what is required for the reversal. 106.0 – 106.3 (is vital).”

How Will Bitcoin Reply To DXY’s Energy

The inverse correlation between Bitcoin and the DXY has been a subject of curiosity lately. With the DXY’s latest surge, considerations are mounting about potential downward stress on Bitcoin and crypto within the short-term. Some analysts imagine that one other uptick within the greenback may push Bitcoin in the direction of the $23.500 mark, particularly given the comparatively low ranges of open curiosity (OI) and quantity for BTC.

Glassnode founders Yann Allemann and Jan Happel supplied insights into Bitcoin’s outlook, noting, “Mid-term outlook: Favorable danger/reward, however short-term, unsure ($25.8k – $26.8k). Attainable draw back ($23.8k – $24.8k) because of bearish development. Indicators of bottoming: RSI bullish divergence, fading volatility. […] We’re near the underside, however the surroundings remains to be unstable.”

Elaborating on the present market circumstances, they added, “We’re in an unstable surroundings. Look ahead to the dip or purchase the breakout. Bitcoin Threat Sign close to extremes. $25.8k – $26.8k is No Man’s Land. The mid-term danger/reward is favorable for BTC and crypto.” Furthermore, they predict that Bitcoin will backside out in mid-September when the DXY reaches its high, setting Bitcoin and crypto up for a stellar October.

At press time, BTC value remained stagnant beneath $27,800.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link