[ad_1]

Gross sales of Donald Trump’s digital collectibles surged following the information of his indictment in New York on Thursday. In the meantime, a report revealed that the marketplace for non-fungible tokens (NFTs) has seen its strongest quarter since early final 12 months, reaching a buying and selling quantity of $4.7 billion, regardless of a weaker March.

Trump NFTs Spike as Former President Will get Indicted

The Official Trump Digital Buying and selling Playing cards have registered a surge in gross sales, in response to knowledge from the NFT market Opensea, following the information that the forty fifth United States President has turn into America’s first head of state, former or incumbent, to face prison expenses.

The sealed indictment by a Manhattan grand jury has over 30 counts associated to enterprise fraud, media reviews unveiled. It comes after an investigation into an alleged hush cash cost scheme involving grownup movie star Stormy Daniels which dates again to the 2016 presidential election.

The NFT assortment was introduced by Trump on social media in December when the primary badge was offered inside hours of launch. The hundreds of tokenized playing cards depict him as absolutely anything masculine, as much as a Superman character.

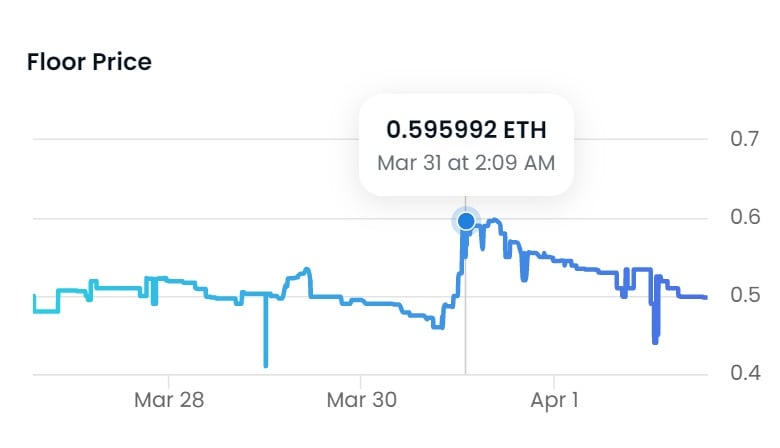

After the indictment, the gross sales elevated effectively over 400% in a day, reaching a quantity of above 90 ETH on Thursday (round $166,000 on the time of writing) and exceeding a ground worth of 0.59 ETH on Friday, March 31, the Opensea stats present. The variety of house owners now nears 14,000 however costs have since returned to extra common ranges.

NFT Buying and selling Quantity Reaches $4.7 Billion in Q1, 2023

In keeping with a report by the worldwide decentralized apps retailer Dappradar, NFTs have had a usually sturdy first quarter this 12 months, regardless of a big slide in gross sales in March. In Q1 of 2023, as a complete, the buying and selling quantity expanded by greater than 137%, to $4.7 billion, which is the best improve for the reason that second quarter of 2022.

Dappradar additionally famous that Q1 was the primary quarter when Opensea didn’t dominate the marketplace for non-fungible tokens. “The NFT market is quickly evolving, with the emergence of recent gamers and altering dynamics,” the authors highlighted.

“We haven’t registered such a proportion since February 2021,” the platform identified in a weblog put up titled “NFT Market Conflict Doubles Buying and selling Quantity in First Quarter,” a reference to the competitors between Opensea and Blur. The latter had over 57% of the market within the first three months of the 12 months, greater than 70% in March.

Do you assume the NFT market will see secure progress within the coming months? Share your ideas on the topics and your predictions within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Koshiro Ok / Shutterstock.com

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any harm or loss precipitated or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link