[ad_1]

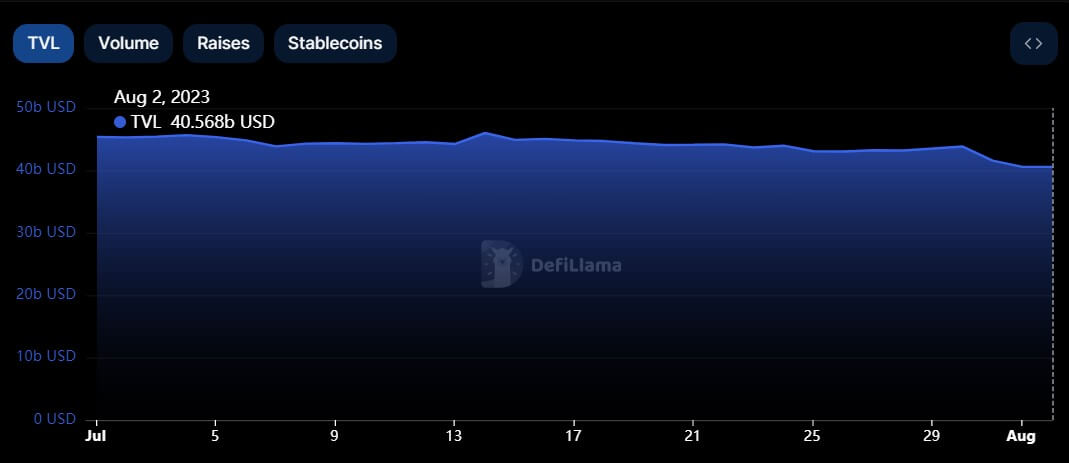

Within the final three days, the DeFi sector has seen an 8% decline within the whole worth of locked property (TVL), falling to $40.31 billion, as per DeFiLlama information.

As of July 30, DeFi tasks TVL stood at $43.81 billion however witnessed a pointy decline after malicious gamers attacked a number of Curve (CRV) swimming pools on July 31. Following the assault, crypto buyers started withdrawing their property, totaling over $3 billion, throughout completely different protocols as contagion fears emerged.

Curve and Convex dominate losses

In response to DeFiLlama information, two DeFi protocols—Curve Finance and Convex Finance—account for about two-thirds of the drop, with their TVLs falling by greater than $1 billion every over the last three days.

Curve and Convex, two of essentially the most outstanding DeFi protocols within the crypto market, have a major relationship, on condition that Convex allows customers to faucet into liquidity and generate earnings from Curve’s stablecoin swimming pools.

At their peak, the protocols had a mixed TVL of greater than $40 billion as they attracted tens of millions of customers to the sector.

In the meantime, the decline was not restricted to those two protocols as others, together with UniSwap (UNI), Aave (AAVE), and others, additionally noticed losses following the incident. Nonetheless, DeFiLlama information reveals these platforms have posted gentle recoveries from the autumn over the last 24 hours.

Lenders are pulling liquidity

The TVL decline can be attributed to lenders pulling their liquidity from DeFi platforms because the uncertainty within the business continues to unfold.

As a direct response to “mitigate contagion dangers,” Auxo DAO, a decentralized yield-farming fund, introduced it had “promptly eliminated” all its place on Curve and Convex.

In addition to that, Curve Finance founder Michael Egorov has about $100 million in loans on completely different DeFi platforms backed by 427.5 million CRV (47% of whole CRV provide), prompting fears of unhealthy debt ought to CRV’s value drop beneath a sure threshold.

In response to crypto analysis firm Delphi Digital, the dimensions of Egorov’s place might doubtlessly set off knock-on results throughout a serious a part of the DeFi ecosystem.

DeFi platforms like Aave have already skilled vital withdrawals due to these fears. The platform is seeing a surge in borrowing charges and rates of interest, intensifying the liquidation threat for customers with excellent loans.

In the meantime, Egorov has bought CRV to buyers and establishments through OTC offers to repay the debt and stop liquidation.

[ad_2]

Source link