[ad_1]

Crypto brokers are on-line platforms that act as intermediaries between patrons and sellers of cryptocurrencies, permitting them to simply commerce digital belongings. These platforms present a user-friendly interface that permits merchants to entry a wide range of cryptocurrency markets. Some provide a variety of cryptocurrencies to select from, they usually typically permit for straightforward conversion between completely different cash.

Normally, crypto brokers provide Contracts for Distinction (CFDs), which permits merchants to invest on the value actions of cryptocurrencies with out really proudly owning them. On this listicle, we’ll be exploring the highest 15 crypto brokers and inspecting their options and advantages in an effort to make an knowledgeable determination on which platform is best for you.

What are CFDs?

CFDs are usually supplied by brokers and can be utilized to commerce a wide range of belongings, together with shares, commodities, and cryptocurrencies. While you commerce a CFD, you basically enter right into a contract with the dealer. The contract specifies the distinction between the value of the underlying asset on the time the contract is opened and the value on the time the contract is closed. If the value of the underlying asset will increase throughout this era, the dealer will make a revenue. Conversely, if the value of the underlying asset decreases, the dealer will incur a loss.

This type of buying and selling permits merchants to make the most of each upward and downward value actions out there and to make use of leverage, which implies that they’ll management a bigger place with a smaller quantity of capital. Nonetheless, this additionally implies that losses might be amplified, so it’s necessary to commerce cautiously.

CFDs are sometimes utilized by merchants as a approach to hedge their positions out there or to invest on short-term value actions. They will also be used to realize publicity to belongings that will be tough or costly to personal straight, corresponding to sure commodities or worldwide shares.

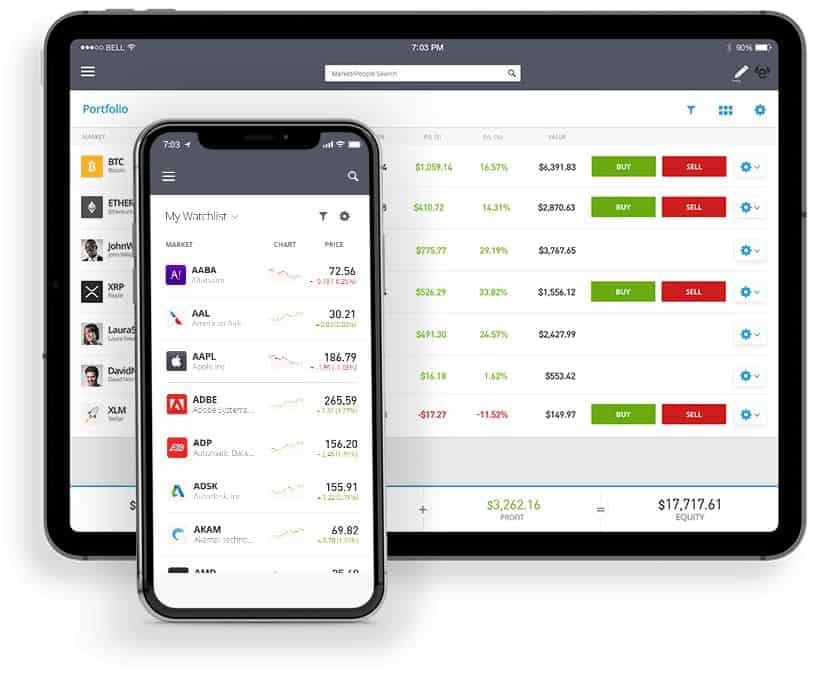

eToro

eToro is a well-liked multi-asset brokerage agency that permits buyers to commerce a wide range of monetary belongings, together with cryptocurrencies. Its crypto brokerage companies permit merchants to entry over 60 digital belongings, corresponding to Bitcoin, Ethereum, Litecoin, and extra. The platform additionally permits customers to simply convert between completely different cash. Its user-friendly interface and social buying and selling options make it a well-liked selection for each newbie and skilled merchants.

One in all eToro’s distinctive options is its social buying and selling platform, which permits customers to observe and duplicate the trades of different profitable merchants. This may be helpful for buyers who’re new to the crypto market and wish to be taught from extra skilled merchants.

Execs:

Person-friendly platform with a variety of belongings to commerce, together with cryptocurrencies.CopyTrader characteristic permits customers to routinely copy the trades of profitable buyers on the platform.Regulated by monetary authorities, together with the FCA and CySEC.

Cons:

Excessive charges in comparison with different crypto brokers.Restricted vary of cryptocurrencies accessible for buying and selling.Restricted performance for superior merchants, corresponding to the flexibility to set customized stop-loss and take-profit ranges.

Uphold

Uphold is a digital cash platform that permits customers to purchase, promote, and maintain numerous belongings, together with cryptocurrencies. The platform provides a user-friendly interface and helps a variety of cryptocurrencies, together with Bitcoin, Ethereum, Litecoin, and extra. Uphold additionally permits customers to change cryptocurrencies with fiat currencies, such because the US greenback and Euro, in addition to different belongings like gold and silver.

The platform serves 184+ international locations throughout 200+ currencies (conventional and crypto) and commodities with frictionless overseas change and cross-border remittance for members all over the world. Since launching in 2015, Uphold has powered greater than US$4+ billion in transactions.

Execs:

Affords over 250 cryptocurrencies, together with fashionable choices like Bitcoin, Ethereum, and Litecoin, in addition to lesser-known altcoins.Helps a number of funding choices, together with financial institution transfers, credit score/debit playing cards, and numerous cryptocurrencies.Fee-free buying and selling for cryptocurrencies.

Cons:

Customers might expertise slower processing occasions for transactions and transfers in comparison with different crypto brokers.Restricted assist for fiat currencies past USD.

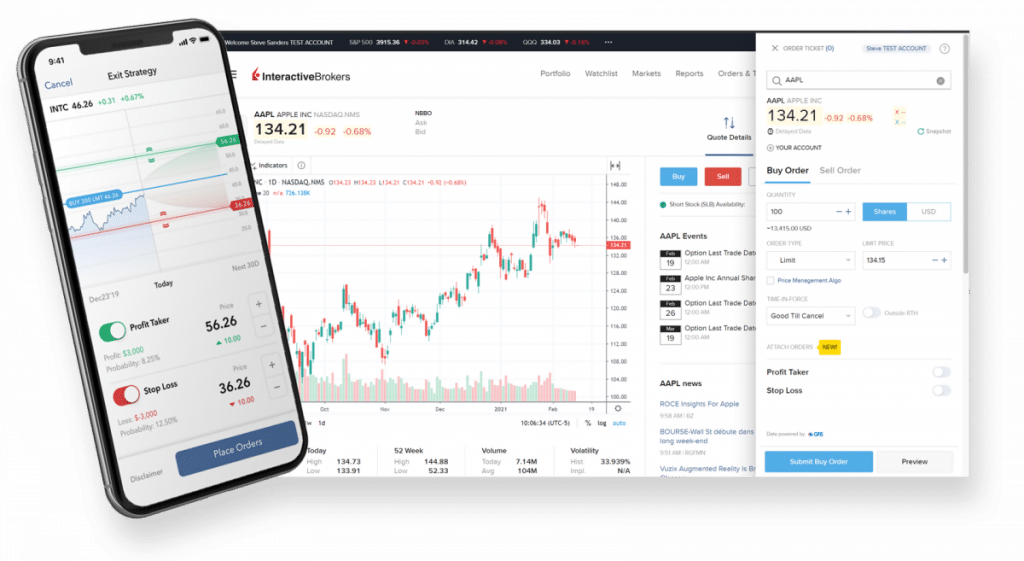

Interactive Brokers

Interactive Brokers is a well-liked brokerage agency that provides a variety of funding companies, together with entry to numerous cryptocurrency markets. The corporate is understood for its low buying and selling charges and superior buying and selling instruments, making it a well-liked selection for knowledgeable buyers. With crypto custody and commerce execution supplied by Paxos Belief Firm, Interactive Brokers provides entry to Bitcoin, Bitcoin Money, Ethereum, and Litecoin.

One of many foremost benefits of utilizing Interactive Brokers for cryptocurrency buying and selling is the low charges. The corporate prices a fee of simply 0.12% of the entire commerce worth, with a minimal fee of $1.50 per commerce. Moreover, the platform’s superior buying and selling instruments, together with customizable charts and real-time market information, make it a well-liked selection for knowledgeable merchants.

Execs:

Cons:

Requires a minimal account stability of $10,000.Not for newbie buyers.Entry to a restricted vary of cryptocurrencies.

TradeStation

TradeStation is a well-liked on-line brokerage platform that provides a variety of funding merchandise, together with shares, choices, futures, and cryptocurrencies. The platform is understood for its superior buying and selling instruments and options, making it a favourite amongst energetic merchants and buyers.

The platform’s cryptocurrency providing supplies entry to among the hottest digital belongings, together with Bitcoin, Ethereum, Litecoin, and Bitcoin Money. Customers can commerce these belongings on TradeStation’s user-friendly platform, which incorporates real-time information, customizable charting instruments, and superior order sorts.

Execs:

A variety of funding merchandise accessible, together with shares, choices, futures, and cryptocurrencies.Aggressive pricing for buying and selling commissions and costs, with numerous pricing plans accessible to suit completely different buying and selling types and desires.

Cons:

Will be overwhelming for inexperienced persons and will take a while to get used to.The performance and options of its cell app are restricted in comparison with the desktop platform.Restricted vary of cryptocurrencies supplied.

iTrust Capital

iTrustCapital provides a safe and controlled resolution for people seeking to spend money on cryptocurrencies and valuable metals utilizing their retirement accounts. It provides 28 cryptocurrencies, together with fashionable ones like Bitcoin, Ethereum, Avalanche, and extra.

The platform operates on a no-custody mannequin in order that it by no means takes management of shopper belongings, borrows towards them, leverages them for revenue, or permits its custody suppliers to take action. As an alternative, it makes use of a regulated, state-chartered belief firm to carry self-directed IRAs and custody of shopper belongings, making certain that the platform adheres to trade requirements and laws. Final January, iTrust Capital raised $125 million in Sequence A.

Execs:

Affords a self-directed IRA that permits customers to spend money on cryptocurrencies with out the necessity for a custodian.Doesn’t take custody of person assetsUser belongings are saved with third-party institutional storage suppliers and controlled, state-chartered belief corporations.

Cons:

Affords a restricted number of cryptocurrencies.For US shoppers solely.

IFC Markets

IFC Markets provides a crypto brokerage service that permits merchants to invest on the value actions of cryptocurrencies corresponding to Bitcoin, Ethereum, and Litecoin. The platform supplies a variety of buying and selling devices, together with crypto CFDs and forex pairs involving cryptocurrencies.

The crypto brokerage service is built-in with IFC Markets’ different choices, permitting merchants to diversify their portfolios throughout a number of asset courses, together with foreign exchange, commodities, and indices. The platform additionally supplies entry to a variety of buying and selling instruments, together with technical evaluation indicators and customizable charts. IFC Markets’ crypto brokerage is regulated by the British Virgin Islands Monetary Providers Fee, making certain a stage of oversight and safety for merchants.

Execs:

Affords a various vary of buying and selling devices, together with cryptocurrencies, foreign exchange, shares, and commodities.Offers a wide range of buying and selling platforms, together with the favored MetaTrader 4 and 5.Affords versatile account sorts with completely different buying and selling situations to cater to the wants of various merchants.

Cons:

Eightcap

Primarily based in Australia, Eightcap is a regulated on-line buying and selling dealer that gives entry to over 100 cryptocurrencies, together with Bitcoin, Ethereum, Litecoin, and Ripple, amongst others. Eightcap permits shoppers to commerce CFDs on crypto by its MetaTrader 4 and MetaTrader 5 platforms. The dealer provides aggressive spreads and leverage of as much as 1:30 for retail shoppers.

The brokerage provides quick and safe deposits and withdrawals by numerous fee strategies, together with credit score/debit playing cards, financial institution transfers, and e-wallets. It additionally ensures the security of shoppers’ funds by segregating them from its operational funds and utilizing superior encryption know-how to guard shoppers’ private and monetary info.

Execs:

Aggressive pricing and low spreads.A number of buying and selling platforms accessible, together with MT4 and MT5.Good number of tradable devices, together with cryptocurrencies.

Cons:

Restricted instructional assets for inexperienced persons.No damaging stability safety.Restricted buyer assist accessible on weekends.

Avatrade

AvaTrade is a regulated brokerage that provides CFD buying and selling in numerous markets, together with cryptocurrencies. With a sturdy and intuitive platform, merchants can entry a variety of instruments and options to investigate markets and execute trades with ease.

Concerning its crypto brokerage companies, AvaTrade provides a variety of fashionable cryptocurrencies, together with Bitcoin, Ethereum, Ripple, Litecoin, and Bitcoin Money. Merchants also can commerce crypto towards fiat currencies such because the US greenback, euro, and Japanese yen. The platform supplies superior charting instruments, real-time market information, and a variety of technical indicators to assist merchants make knowledgeable buying and selling choices. AvaTrade additionally provides aggressive spreads and leverage as much as 1:20 for crypto buying and selling.

Execs:

Affords a variety of buying and selling platforms, together with MetaTrader 4, MetaTrader 5, and AvaTradeGO, appropriate for various ranges of expertise and preferences.Has a variety of instructional assets, together with webinars, tutorials, and eBooks, to assist merchants enhance their information and expertise.

Cons:

Affords solely over 50 cryptocurrencies.Excessive minimal deposit requirement of $250.Excessive inactivity charges and in a single day financing charges.

Assume Markets

Established in 2010, Assume Markets provides CFD buying and selling on foreign exchange, indices, valuable metals and cryptocurrency. Along with its big selection of economic markets, ThinkMarkets provides a crypto brokerage service the place merchants can entry the cryptocurrency market with aggressive spreads and deep liquidity. Merchants can speculate on the value actions of varied cryptocurrencies corresponding to Bitcoin, Ethereum, and Litecoin utilizing leverage.

The crypto buying and selling platform is built-in into the ThinkTrader platform, offering merchants entry to real-time market information and superior buying and selling instruments. ThinkMarkets’ crypto brokerage additionally provides a safe pockets for merchants to retailer their digital belongings.

Execs:

Emphasis on buying and selling schooling and monetary literacy.24/7 buying and selling.A number of charting instruments, information feeds, and financial calendars

Cons:

Restricted fee choices for deposits and withdrawals.Restricted cryptocurrency choices.No commission-free buying and selling choices for cryptocurrencies.

Admiral Markets

Admiral Markets is a dealer that gives merchants with the chance to interact in contracts for distinction (CFD) product buying and selling throughout numerous markets, together with shares, indices, commodities, foreign exchange, bonds, and cryptocurrencies.

The brokerage provides eight crypto choices, together with Bitcoin, Ethereum, Bitcoin Money, Sprint, Ripple, Monero, ZCash, and Litecoin, priced towards their USD valuation. Regardless of its comparatively small crypto choices, the marketplace for these merchandise is extremely liquid, with an expansion of round 1%. Merchants can apply leverage of as much as 1:2, whereas skilled merchants can commerce with as much as 1:5 leverage.

Execs:

Regulated by the FCA.Merchants can apply leverage.Extremely liquid.

Cons:

Solely provides eight cryptocurrencies.Costs a price for opening and shutting trades.

IC Markets

One more Australia-based CFD buying and selling platform, IC Markets allows its shoppers to commerce on a number of cryptocurrencies, corresponding to Bitcoin, Ethereum, Polygon and Polkadot, amongst others. The corporate provides aggressive spreads and low commissions to its merchants.

IC Markets’ cryptocurrency CFD buying and selling platform permits merchants to invest on the value actions of varied cryptocurrencies with out proudly owning the underlying asset. Because of this merchants can simply go lengthy or brief on the cryptocurrency market, making it potential to revenue from each rising and falling costs. The platform provides excessive leverage, which permits merchants to extend their market publicity with a comparatively small preliminary funding.

Execs:

Affords a variety of buying and selling devices, together with cryptocurrencies.Low spreads and commissions for buying and selling.Affords numerous buying and selling platforms, together with MetaTrader and cTrader.

Cons:

Restricted instructional assets for newbie merchants.Doesn’t settle for shoppers from some international locations, corresponding to america.Restricted deposit and withdrawal choices in comparison with different brokers.

Plus500

With subsidiaries within the UK, Cyprus, Australia, Israel, Seychelles, Singapore, Bulgaria, Estonia, america and Japan, Plus500 is a well-liked on-line buying and selling platform that provides a variety of economic devices, together with cryptocurrencies. It provides CFDs on a number of cryptocurrencies, together with Bitcoin, Ethereum, Litecoin, Cardano and extra.

Merchants can purchase or promote these cryptocurrency CFDs, relying on their market expectations. The platform provides aggressive spreads on cryptocurrency CFDs and with as much as 1:2 leverage beginning with as little as €100 €.

Execs:

Licensed and controlled by the Estonian Monetary Supervision and Decision Authority.Affords round the clock devoted customer support in a number of languages.Funds are stored in segregated financial institution accounts in accordance with regulatory necessities.

Cons:

A restricted vary of cryptocurrencies for buying and selling.Doesn’t assist the favored MetaTrader 4 platform, which might be an obstacle for knowledgeable merchants.

WeBull

Webull is a commission-free on-line brokerage that provides buying and selling companies for a wide range of monetary devices, together with cryptocurrencies. The platform helps greater than 40 cryptocurrencies and customers can commerce Bitcoin (BTC), Ethereum (ETH), Bitcoin Money (BCH), Litecoin (LTC), and Dogecoin (DOGE) on its platform. Shopping for and promoting cryptocurrencies might be finished on the platform with a low minimal requirement of $1. The settlement course of is immediate, which implies that the funds are instantly accessible for buying and selling.

Webull additionally supplies complimentary real-time information, customizable charts, and indicators to maintain up with the cryptocurrency market. These instruments and analysis assets can be found on the platform, enabling merchants to trace and analyze the efficiency of various cryptocurrencies. The customizable charts and indicators permit merchants to tailor their evaluation to their buying and selling technique.

Execs:

Low minimal for cryptocurrency buying and selling at $1.On the spot settlement, making certain funds are all the time accessible for buying and selling.Complimentary real-time information, customizable charts, and indicators to maintain up with the crypto market.

Cons:

Restricted cryptocurrency choice in comparison with different brokers.No assist for transferring cryptocurrency to an exterior pockets.

Caleb & Brown

An Australia-based agency, Caleb & Brown provides buyers a personalised crypto service the place they’ll communicate to their dealer anytime. It additionally provides entry to cryptocurrencies like XRP and Theta that aren’t accessible on sure U.S. exchanges.

With a deal with safety, the crypto brokerage solely offers its customers entry to their tokens. Customers can commerce over 250 crypto belongings whereas working with a private cryptocurrency dealer who may help make knowledgeable funding choices.

Execs:

Entry to a private crypto dealer.Solely customers have entry to their tokens.24/7 international buyer assist.

Cons:

Not a lot info on how buyers can commerce on-line.

Alpaca

Alpaca is a crypto buying and selling platform that permits customers to commerce by API and the Alpaca internet dashboard. Because of this customers can commerce cryptocurrencies at any time of day, seven days every week, with the frequency of their selecting. As of November 18, 2022, cryptocurrency buying and selling is simply open to pick out worldwide jurisdictions and several other supported US areas.

With over 20 distinctive crypto belongings accessible throughout 48 buying and selling pairs. At present, buying and selling pairs are primarily based on BTC, USD, and USDT, with plans so as to add extra belongings and buying and selling pairs. Alpaca additionally provides free restricted crypto information, in addition to a sophisticated limitless paid plan. Moreover, customers can now entry wallets on the internet dashboard by way of the Crypto Transfers tab, which helps transfers for Bitcoin, Ether, Solana, and USDT (ERC20), however eligibility for this service relies on residency and relevant jurisdiction.

Execs:

Customers can commerce cryptocurrencies at any time of day, seven days every week.Affords over 20 distinctive crypto belongings throughout 48 buying and selling pairs and free restricted crypto information.

Cons:

Requires a sure stage of technical experience to commerce by API.Wallets are solely accessible to customers who’re eligible primarily based on residency and relevant jurisdiction.Not for inexperienced persons.

Crypto brokers cheatsheet

100,000.01 – 1,000,000 0.15% * Commerce Worth

1,000,000 0.12% * Commerce Worth

Minimal per order USD 1.75, however not more than 1% of Commerce Worth

Low fee.– Requires a minimal account stability of $10,000.– Not for newbie buyers.– Entry to a restricted vary of cryptocurrencies.TradeStationMaker: 10 – .35percentTaker: .11 – .60%– A variety of funding merchandise accessible, together with shares, choices, futures, and cryptocurrencies.– Aggressive pricing for buying and selling commissions and costs, with numerous pricing plans accessible to suit completely different buying and selling types and desires.– Will be overwhelming for inexperienced persons and will take a while to get used to.– The performance and options of its cell app are restricted in comparison with the desktop platform.– Restricted vary of cryptocurrencies supplied.iTrust Capital1% transaction price for the shopping for and/or promoting of cryptocurrencies– Affords a self-directed IRA that permits customers to spend money on cryptocurrencies with out the necessity for a custodian.– Doesn’t take custody of person belongings– Person belongings are saved with third-party institutional storage suppliers and controlled, state-chartered belief corporations.– Affords a restricted number of cryptocurrencies.– For US shoppers solely.IFC MarketsInformation unavailable– Affords a various vary of buying and selling devices together with cryptocurrencies, foreign exchange, shares, and commodities– Offers a wide range of buying and selling platforms, together with the favored MetaTrader 4 and 5– Affords versatile account sorts with completely different buying and selling situations to cater to the wants of various merchants– Restricted regulatory oversight in comparison with another brokers– Not for inexperienced persons.EightcapInformation unavailable– Aggressive pricing and low spreads.– A number of buying and selling platforms accessible together with MT4 and MT5.– Good number of tradable devices together with cryptocurrencies.– Restricted instructional assets for inexperienced persons.– No damaging stability safety.– Restricted buyer assist availability on weekends.AvatradeNone– Affords a variety of buying and selling platforms, together with MetaTrader 4, MetaTrader 5, and AvaTradeGO, appropriate for various ranges of expertise and preferences.– Has a variety of instructional assets, together with webinars, tutorials, and eBooks, to assist merchants enhance their information and expertise.– Affords solely over 50 cryptocurrencies.– Minimal deposit requirement of $250.– Excessive inactivity charges and in a single day financing charges.Assume MarketsSwap ($) = Quantity * Swap Fee (pips) * Pip Worth * Variety of nights = 1200.01*3=$0.6Spread ($) = Unfold in pips * Pip Worth * Quantity = 1,7000.011=$17Cumulative Prices ($) = Swap + Unfold = 0.6+17=$17.6Cumulative Prices (%) = (Cumulative Prices / Whole Funding) * 100 = (17.6/22,532.18)*100= 0.08percentCumulative Impact of Prices on Return (with out charges) = (Revenue / Whole Funding) * 100 =(2425.13/22,532.18) *100=10.76percentCumulative Impact of Prices on Return (with charges) = ((Revenue + Cumulative Prices) / TotalInvestment) * 100 = ((2,425.13+17.6)/22,532.18)*100=10.84percentReduction of revenue = Cumulative Impact of Prices on Return (with charges) – Cumulative Effectof Prices on Return (with out charges) = 10.84%-10.76%=0.08%– Emphasis on buying and selling schooling and monetary literacy.– 24/7 buying and selling.– A number of charting instruments, information feeds, and financial calendars.– Restricted fee choices for deposits and withdrawals.– Restricted cryptocurrency choices.– No commission-free buying and selling choices for cryptocurrencies.Admiral MarketsInformation unavailable– Regulated by the FCA.– Merchants can apply leverage.– Extremely liquid.– Solely provides eight cryptocurrencies.– Costs a price for opening and shutting trades.IC MarketsNo fee on Customary accounts however as an alternative applies an expansion markup of 1 pip above the Uncooked inter-bank costs acquired from our liquidity suppliers.

IC Markets Uncooked Unfold account reveals the uncooked inter-bank unfold acquired from its liquidity suppliers. On this account, it prices a fee of $7 per normal lot spherical flip.

– Affords a variety of buying and selling devices together with cryptocurrencies.– Low spreads and commissions for buying and selling.– Affords numerous buying and selling platforms together with MetaTrader and cTrader.– Restricted instructional assets for newbie merchants.– Doesn’t settle for shoppers from some international locations corresponding to america.– Restricted deposit and withdrawal choices in comparison with different brokers.Plus500None– Authorised and controlled by the Estonian Monetary Supervision and Decision Authority.– Affords round the clock devoted customer support in a number of languages.– Funds are stored in segregated financial institution accounts, in accordance with regulatory necessities.– A restricted vary of cryptocurrencies for buying and selling.– Doesn’t assist the favored MetaTrader 4 platform, which might be an obstacle for knowledgeable merchants.WeBullA 100bps markup is constructed into the value of the crypto you’re shopping for/promoting.– Low minimal for cryptocurrency buying and selling at $1.– On the spot settlement, making certain funds are all the time accessible for buying and selling.– Complimentary real-time information, customizable charts, and indicators to maintain up with the crypto market.– Restricted cryptocurrency choice in comparison with different brokers.– No assist for transferring cryptocurrency to an exterior pockets.Caleb & Brown5% on all trades– Entry to a private crypto dealer.– Solely customers have entry to their tokens.– 24/7 international buyer assist.Not a lot info on how buyers can commerce on-line.Alpaca0.125 – 0.50% relying on 30-day buying and selling quantity– Customers can commerce cryptocurrencies at any time of day, seven days every week.– Affords over 20 distinctive crypto belongings throughout 48 buying and selling pairs and free restricted crypto information.– Requires a sure stage of technical experience to commerce by API.– Wallets are solely accessible to customers who’re eligible primarily based on residency and relevant jurisdiction.– Not for inexperienced persons.

FAQ

What ought to I take into account when selecting a crypto dealer?

Contemplate safety, status, charges, buying and selling platforms, and buyer assist. Search for a dealer with monitor report and a robust safety system to guard your funds. Be sure that to analysis the dealer’s price construction and the buying and selling platforms they provide, and select a dealer that gives high quality buyer assist.

How do crypto brokers earn money?

They usually earn money by charging charges on trades or by taking an expansion on the shopping for and promoting value of cryptocurrencies. They could additionally earn cash by different companies, corresponding to providing margin buying and selling or incomes curiosity on person deposits.

Are crypto brokers regulated?

It varies by jurisdiction. Some international locations have applied laws to supervise the operation of crypto brokers, whereas others have but to take action. Analysis the laws in your jurisdiction and select a dealer that operates in compliance with these laws.

Can I take advantage of a crypto dealer to purchase cryptocurrencies with fiat forex?

Many crypto brokers provide the flexibility to purchase cryptocurrencies with fiat forex. Nonetheless, the provision of this service might rely upon the dealer and the jurisdiction through which they function. There can also be charges related to shopping for cryptocurrencies with fiat forex, so remember to analysis the dealer’s price construction earlier than making a transaction.

What are the dangers of utilizing a crypto dealer?

Potential dangers embody hacking or theft, market volatility, and shedding your funding. Some brokers will not be respected or might have interaction in fraudulent actions. To attenuate these dangers, it’s necessary to decide on a good dealer with robust safety measures, to grasp the dangers related to buying and selling cryptocurrencies, and to solely make investments funds that you may afford to lose.

Conclusion

With the flexibility to simply convert between completely different cash and the choice to commerce Contracts for Distinction (CFDs), these crypto brokers provide a number of advantages for these seeking to enter the world of cryptocurrency buying and selling.

Then again, needless to say CFD buying and selling does include dangers, and merchants ought to rigorously take into account their funding goals and danger tolerance earlier than coming into into any trades. It’s additionally important to make use of a good dealer and to grasp the phrases and situations of the CFD contract earlier than making any trades.

Learn extra:

[ad_2]

Source link