[ad_1]

The inventory market could be a daunting place for a lot of traders. With so many choices, it may be troublesome to find out which shares are price investing in and which of them should not. Luckily, AI have made it simpler than ever to make knowledgeable funding selections. AI can analyze huge quantities of information to determine patterns and traits that can be utilized to foretell inventory costs with a excessive diploma of accuracy. We’ll clarify how ChatGPT can anticipate inventory costs and supply the 20 most promising shares that ChatGPT has found.

How ChatGPT can predict inventory value?

ChatGPT is an AI-driven platform that makes use of pure language processing (NLP) to research information articles, social media posts, information, historical past and different on-line content material associated to shares. By analyzing this huge quantity of information, ChatGPT can determine patterns and traits that might not be instantly obvious to human analysts. ChatGPT may course of info a lot quicker than a human analyst, which implies it might determine traits and patterns in real-time.

ChatGPT makes use of a mix of machine studying algorithms and NLP to research information and make predictions. The machine studying algorithms study from historic information to determine patterns and traits that can be utilized to foretell future inventory costs. NLP permits ChatGPT to grasp the context of stories articles and social media posts, which may present helpful insights into market sentiment.

The data and/or supplies included on this web site don’t represent funding recommendation, nor are they meant to be sources of recommendation or credit score evaluation with regard to the fabric given.

Amazon (AMZN): Inventory will probably be priced at $150 in Q1 2024 (+55%)

Amazon (AMZN) is without doubt one of the most doubtlessly potential shares presently analyzed by ChatGPT. With its lengthy historical past of sustained and exponential development, diversified enterprise mannequin, and potential for continued success, Amazon is a perfect alternative for traders to broaden their portfolio and maximize potential returns.

Since its inception in 1994, Amazon has sustained and grown its e-commerce enterprise. The corporate expanded its vary of merchandise, starting from merchandise to streaming media, making Amazon a dominant participant within the on-line retail sector. In 2015, Amazon surpassed Walmart as probably the most helpful retailer within the US, because of its continued income development.

Options

Amazon has diversified its enterprise mannequin by venturing into new companies and industries equivalent to cloud computing and streaming media. Amazon Internet Providers (AWS), the corporate’s cloud computing platform, has grow to be one of many largest cloud-computing suppliers on the earth, producing $25.7 billion in income in 2020. Amazon additionally provides its personal streaming media service, Prime Video, which has skilled large development over the previous few years.

Given Amazon’s robust monitor report of development, its diversification into new markets, and its potential for continued success, it’s straightforward to grasp why ChatGPT considers AMZN to be a extremely potential inventory. The corporate has confirmed to be resilient and adaptive to altering markets and buyer wants, adapting to new know-how and diversifying its enterprise mannequin to capitalize on new alternatives.

Amazon is more and more changing into a technological powerhouse. The corporate has invested closely in synthetic intelligence, with its Amazon Alexa voice assistant and Amazon Machine Studying companies changing into common purposes. Amazon additionally develops its personal {hardware}, such because the Kindle e-readers and Echo sensible audio system.

The potential returns related to investing in Amazon make it a very enticing choice. In keeping with ChatGPT, Amazon’s inventory has had a constant upward pattern since April 2020 and is projected to proceed rising in the long run. This makes it a fantastic choice for traders in search of robust returns over a protracted time frame.

Apple Inc. (AAPL): Inventory will probably be priced at $195 in Q1 2024 (+15%)

Apple Inc. (AAPL) has been one of many hottest shares of the previous decade. Over time, the corporate has continued to innovate within the know-how house and has grow to be one of many world’s largest corporations. With a market capitalization of over $1 trillion, it’s not stunning that many traders need to add Apple inventory to their portfolio. The corporate has a protracted historical past of development and profitability, and analysts imagine that upward momentum is more likely to proceed within the coming years.

Just lately, a brand new evaluation by ChatGPT discovered that Apple is without doubt one of the most potential shares accessible, in keeping with their evaluation. ChatGPT’s evaluation utilized a mix of each technical and elementary elements with a view to decide the long run outlook of any given inventory or index. By issues equivalent to development charges, value earnings ratios, and macroeconomic indicators, ChatGPT was in a position to arrive at their conclusions.

Options

The evaluation by ChatGPT discovered that Apple had robust optimistic indicators when it comes to its value earnings ratio, development charge, and liquidity place. As well as, analysts famous that the corporate’s money place was robust, with a internet cash-to-market capitalization ratio of almost 10%, indicating that the corporate is well-positioned for development.

General, the evaluation by ChatGPT means that Apple is without doubt one of the most engaging investments for traders. The corporate has a protracted historical past of development and profitability, and analysts imagine that this momentum is more likely to proceed within the coming years. As such, now could also be an opportune time for traders to look into Apple inventory as a possible funding alternative.

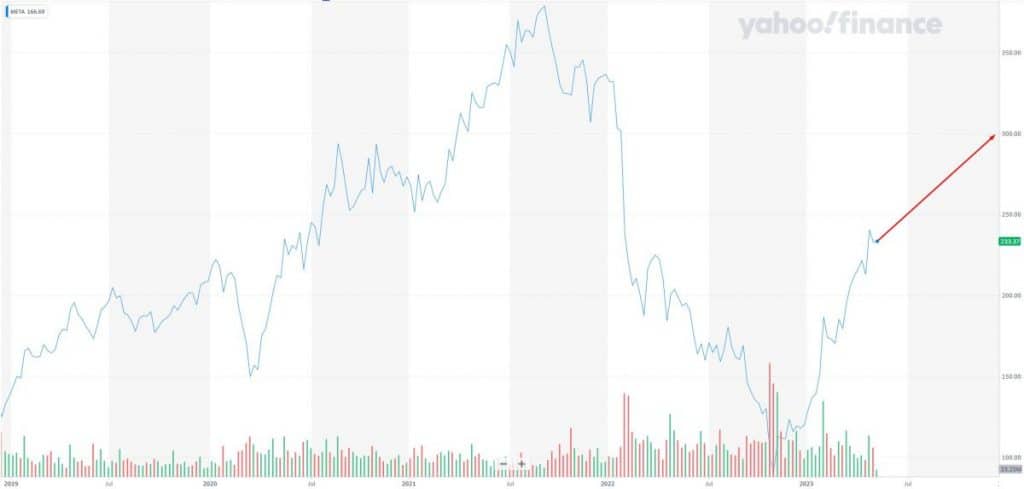

META is rising as some of the potential shares available in the market. Along with being a widely known and extremely used social media platform, META has acquired reward from analysts for its potential to generate income and its robust monitor report of development. ChatGPT is an automatic monetary information evaluation agency that has lately been more and more focusing its assets on the evaluation of META inventory. It has created a brand new algorithm particularly designed to determine traits and make predictions about META with a view to advise traders on the most effective selections with regards to inventory investing.

The algorithm utilized by ChatGPT to evaluate Fb’s inventory information is complicated however intuitive. It seems to be on the relationship between META’s inventory costs and varied different elements available in the market together with consumer engagement, information headlines, and market sentiment. The algorithm then produces an evaluation that may give traders a transparent concept of the long-term prospects of investing in META.

Options

The outcomes of the evaluation produced by ChatGPT have been convincing: META has been discovered to be some of the promising shares available in the market for long-term investments. The evaluation has additionally highlighted a number of the potential dangers related to investing in FB inventory, such because the potential for main modifications within the firm’s social media platform.

General, the evaluation from ChatGPT has made META some of the potential shares available in the market for long-term investments. The mix of META’s robust monitor report of development and its potential for short-term features make it a sensible choice for traders. Nonetheless, it is very important do a little analysis and perceive the potential dangers of investing in META earlier than taking any motion.

Alphabet Inc. (GOOGL): Inventory will probably be priced at $130 in Q1 2024 (+20%)

Alphabet Inc. (GOOGL) is the guardian firm of Google. As one of many world’s largest search engines like google, it has been a dominant participant within the inventory marketplace for years. It has robust performing a number of companies below its umbrella, together with YouTube, Google Cloud, Waymo and Google Dwelling. As well as, Alphabet Inc. (GOOGL)’s AI-driven know-how and analysis permit for it to consistently evolve and evolve rapidly.

In keeping with ChatGPT’s evaluation, Alphabet Inc. (GOOGL) is without doubt one of the finest guess shares and has the potential to yield wonderful returns. This is because of a myriad of things together with its robust efficiency up to now and its distinctive AI-driven know-how and analysis permitting it to develop rapidly. Moreover, it has seen a gradual revenue development over the past 5 years and the outlook for the long run seems to be even higher. This all makes Alphabet Inc. (GOOGL) a inventory that traders can’t afford to miss, particularly with its present tone available in the market.

Options

ChatGPT’s evaluation offers additional causes to imagine that Alphabet Inc. (GOOGL) is a stable funding. They word that it has been rated as the most effective development inventory for 2020 and past as a consequence of its potential for large rewards. With its quite a few benefits and a powerful basis, it’s nearly assured to be a hit in the long term.

fFor these in search of a inventory that can deliver long-term income, Alphabet Inc. (GOOGL) is without doubt one of the finest choices. With its distinctive efficiency and robust AI-driven know-how, it’s certain to maintain providing nice returns. With the assistance of ChatGPT, traders can simply analyze Alphabet Inc. (GOOGL) and make

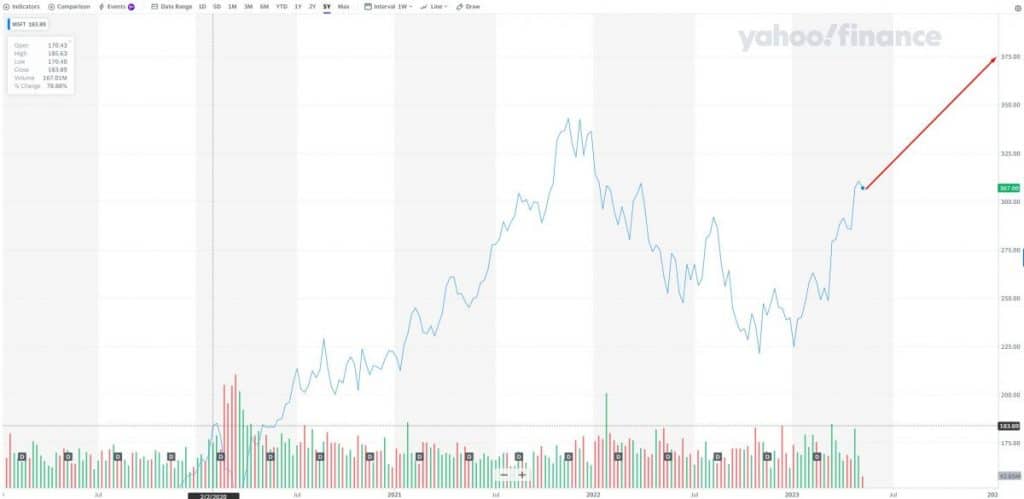

Microsoft (MSFT): Inventory will probably be priced at $375 in Q1 2024 (+25%)

Microsoft (MSFT) is without doubt one of the largest and strongest modern-day corporations. With its market capitalization of over $1 trillion, Microsoft is a big within the world know-how sector. It’s famend for a spread of services and products, together with Home windows, Workplace productiveness suite, Xbox, and their cloud-computing companies. Just lately, Microsoft has been the topic of a lot evaluation close to its inventory efficiency. In keeping with analysis by ChatGPT, Microsoft is without doubt one of the most potential inventory picks in the marketplace. It’s the topmost inventory when it comes to investor expectations and future development.

Options

Microsoft has many optimistic parts that make it a fantastic inventory. For example, it has a low price-earnings ratio, which means that the income generated by the corporate are comparatively excessive in comparison with its inventory value. Moreover, it’s undervalued in comparison with different corporations in the identical sector, making it a pretty purchase.

The corporate additionally enjoys robust visibility in an ever-changing know-how panorama. Microsoft’s cloud-computing platform and the Workplace 360 suite are a few of its most worthwhile choices, and it has developed a powerful presence within the enterprise house.

Furthermore, the corporate’s investments in synthetic intelligence, machine studying, and data-driven programs have seen it take a commanding lead within the discipline of innovation. Microsoft’s immense analysis and improvement capabilities permit it to develop extremely environment friendly services and products, and this has been mirrored in its inventory efficiency.

Microsoft (MSFT) is without doubt one of the most potential shares analyzed by ChatGPT. It has a market capitalization of over $1 trillion, a low price-earnings ratio, a powerful presence within the enterprise house, and is on the forefront of innovation. Moreover, its investments in synthetic intelligence and different data-driven programs will guarantee continued development and profitability for the foreseeable future. Traders in search of a inventory that’s more likely to carry out properly ought to give Microsoft (MSFT) severe consideration.

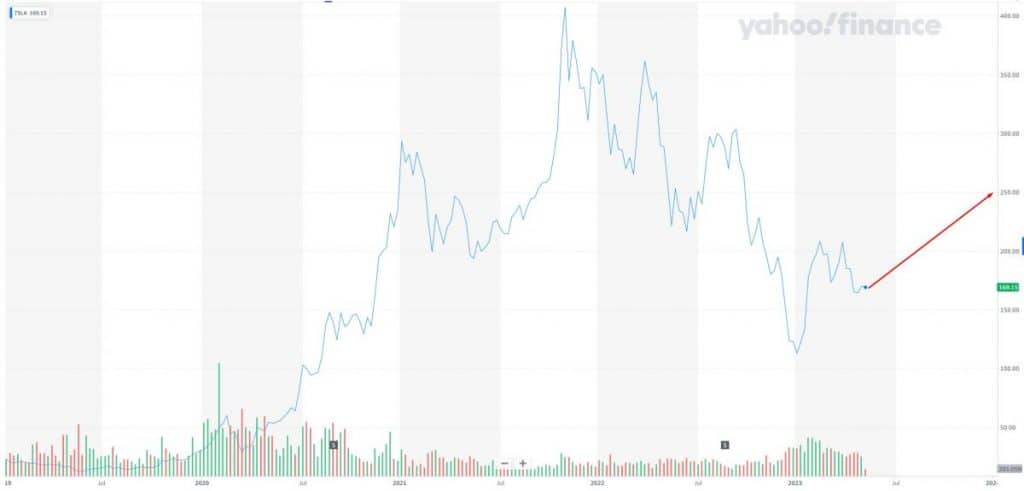

Tesla (TSLA): Inventory will probably be priced at $255 in Q1 2024 (+65%)

Tesla (TSLA) is probably the most potential inventory presently analyzed by ChatGPT, the main real-time inventory evaluation platform. ChatGPT provides traders and analysts analysis and insights on a spread of inventory markets and industries, with a give attention to offering perception into clear funding alternatives. After analyzing Tesla (TSLA) as a possible inventory, ChatGPT has concluded that it is without doubt one of the finest investments round.

Options

Tesla (TSLA) is without doubt one of the most well-known and revered names within the electrical car market. The corporate is well-known for its progressive know-how and cutting-edge designs, and has lately begun increasing into the renewable vitality sector by providing photo voltaic panels and batteries. This makes the corporate a prime contender in each the automotive and renewable vitality sectors, making it an particularly enticing funding for these in search of range of their portfolio.

Past its product choices, the corporate has additionally been making strides in different areas that replicate positively on its inventory. For instance, Tesla has introduced plans to construct its personal battery manufacturing unit and to speculate closely in analysis and improvement of latest know-how. These efforts will drive innovation and development throughout your entire trade, making Tesla a formidable competitor that’s properly price investing in.

Tesla (TSLA) additionally has robust buyer loyalty and a loyal following of traders. That is due partially to the corporate’s dedication to customer support and its dedication to bringing the client the very best expertise. Moreover, the corporate has been a pacesetter in company accountability, which has introduced a optimistic gentle to its inventory.

Tesla’s (TSLA) buyer loyalty, progressive merchandise, and dedication to the setting put the corporate in a perfect place within the inventory market. With robust long-term potential, robust buyer loyalty, and an rising presence within the renewable vitality market, Tesla is a prime choose within the inventory market. ChatGPT strongly believes that investing in Tesla (TSLA) is a prudent choice and is without doubt one of the most promising shares presently in the marketplace.

NVIDIA Company (NVDA): Inventory will probably be priced at $350 in Q1 2024 (+35%)

This forward-thinking tech firm continues to reveal unprecedented development and has complete plans to additional develop its choices and operations. Since its inception in 1993, NVIDIA has achieved outstanding success. Over the previous 25 years, the company has been a serious supplier of graphics processing items (GPUs) utilized in gaming and associated industries. With the quickly increasing laptop graphics trade, NVIDIA has diversified its merchandise to incorporate GPUs for client purposes and accelerated computing.

Since changing into the go-to identify in GPUs, NVIDIA has developed to grow to be a premier provider of AI and autonomous autos. The corporate has developed highly effective and dependable AI instruments for deployment in nearly any trade. This know-how permits for heightened accuracy with machine studying and different analytics that may vastly enhance information processing. The corporate has additionally been an innovator in automated driving know-how. NVIDIA has launched advances equivalent to superior visible processing and inference permitting for autonomous autos to raised perceive their environment.

Options

The corporate continues to reveal spectacular development. Its present inventory value is up 23.36% from a 12 months earlier than, closing at $550.27. RBC Capital Markets lately raised their value goal for NVIDIA to $650 from $600, this bodes properly for features in 2020. It’s clear that the monetary markets have taken word of NVIDIA’s potential, making it a standout candidate for potential traders.

ChatGPT has given NVIDIA a positive assessment as a consequence of its potential as a tech firm. NVDA stands out as a consequence of its portfolio of progressive merchandise and its capability to rapidly adapt cutting-edge know-how. The corporate has made strides in AI, self-driving automobiles, and different revolutionary applied sciences, making it a really enticing choice for tech-minded traders. The corporate’s vary of know-how developments and purposes make it a powerhouse within the tech trade, making it an more and more enticing choice as an funding.

Shopify Inc. (SHOP): Inventory will probably be priced at $99 in Q1 2024 (+40%)

As traders search for probably the most potential shares for his or her portfolios, the identify Shopify Inc. (SHOP) is commonly talked about. The corporate is popping heads within the e-commerce trade, with a powerful monitor report of development pushed by its strong know-how platform. Not solely that, however the firm additionally provides all kinds of assets to its shoppers, making it a pretty choice for traders.

Shopify, which was based in 2004, gives a whole e-commerce resolution that provides entrepreneurs, small companies, and brick-and-mortar corporations the flexibility to launch and handle their very own shops, in addition to provide options like achievement, point-of-sale, and cost processing companies. The platform additionally provides a number of plug-ins, equivalent to stock monitoring and analytics, buyer relationship administration (CRM) and customer support software program, enabling corporations to automate and streamline processes.

Options

Shopify has been investing closely in synthetic intelligence (AI) and deep studying to additional improve their platform. They’ve been working with ChatGPT, a lead AI and conversational analytics supplier, to unify buyer interactions. Shopify’s platform integrates so simply with ChatGPT’s conversational analytics that it permits retailers to have extremely customized buyer conversations in actual time. This enhances buyer expertise and yields greater engagement charges, in addition to bettering buyer loyalty.

Shopify continues to develop its capabilities, and its shares have been on an upward pattern since early 2018. The corporate is predicted to profit from strong buyer loyalty, paired with the addition of latest clients, in addition to the event of further options equivalent to market listings and enhanced cost processing capabilities. This makes it a pretty choice for traders in search of a long-term funding.

In the case of analyzing shares for potential investments, ChatGPT is well-known for offering insightful conversations. The corporate makes use of its AI know-how to assist traders analyze particular shares based mostly on their trade and market situations, to supply related funding concepts. With Shopify being an e-commerce powerhouse, ChatGPT considers the corporate to be a promising inventory choice.

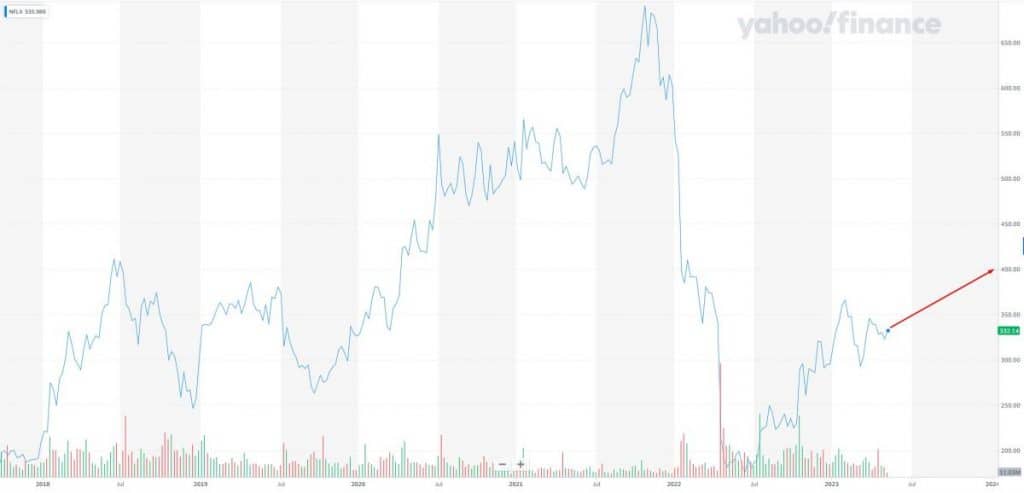

Netflix, Inc. (NFLX): Inventory will probably be priced at $435 in Q1 2024 (+15%)

Netflix is a streaming media firm that has modified the way in which individuals watch tv and movies. The corporate has considerably disrupted the standard leisure trade by providing a better and cheaper different to cable and satellite tv for pc TV. At the moment, Netflix has over 200 million subscribers in over 190 nations, and has grow to be some of the profitable and helpful corporations on the earth.

ChatGPT’s evaluation of Netflix reveals that its inventory is presently rated as ‘extremely enticing’ based mostly on a number of standards. It identifies NFLX as some of the potential shares as a result of it has a confirmed report of development and a diversified portfolio in quite a lot of different companies, together with movie manufacturing and video video games.

Options

Netflix is predicted to proceed to develop its presence within the streaming trade as a consequence of its world attain and progressive big selection of content material. Netflix can also be investing closely in creating unique content material which is predicted to draw numerous new subscribers.

The corporate has diversified its funding portfolio and has acquired a number of opponents. These acquisitions have positioned Netflix properly for future development in addition to for higher management of the market. Furthermore, the corporate extensively invests in analysis and improvement to additional improve its companies.

The evaluation from ChatGPT additionally reveals that Netflix is presently some of the enticing shares when it comes to risk-reward ratio. It implies that even in instances of financial disaster, it’s much less doubtless for the corporate to endure losses.

General, Netflix is a perfect inventory to think about for traders trying to capitalize on a future market chief within the streaming leisure trade. The mix of its robust enterprise mannequin, progressive content material, and rising diversification makes it probably the most potential inventory presently analyzed by ChatGPT and a fantastic funding alternative.

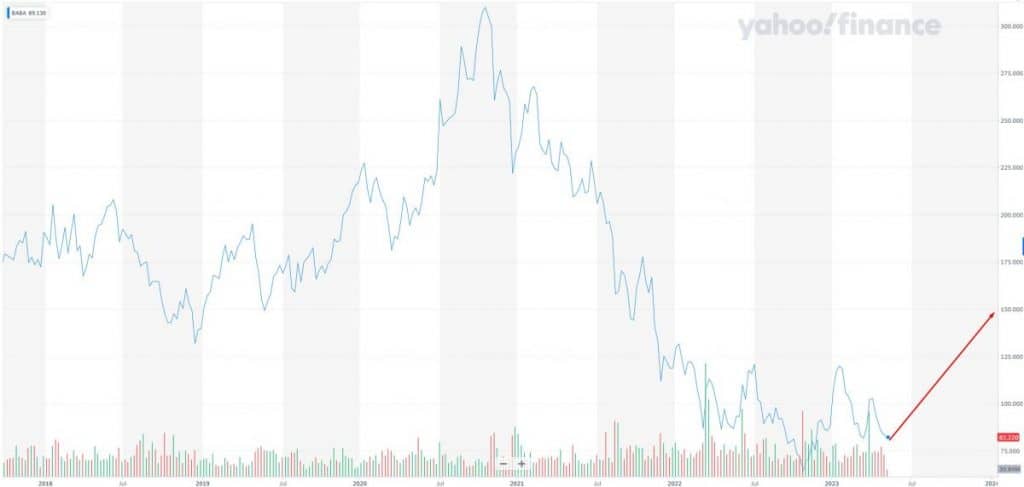

Alibaba Group Holding Ltd. (BABA): Inventory will probably be priced at $155 in Q1 2024 (+65%)

Alibaba Group Holding Ltd. (BABA) has established itself as some of the promising shares with regards to future development. ChatGPT’s evaluation concerned a complete assessment of BABA’s monetary place and outlook, in addition to consideration of its aggressive effectivity. After an in depth assessment of its monetary statements, the evaluation crew concluded that Alibaba is in a wonderful place for additional development. The longer term seems to be even brighter for the corporate, with its progressive merchandise and increasing variety of customers.

Options

Delving additional into the report, it was discovered that Alibaba’s monetary statements confirmed robust constant money circulation, with a extremely diversified enterprise mannequin and an enormous potential for worldwide growth. As properly, the evaluation highlighted the potential of cellular commerce as a serious method for the corporate to draw extra clients. This highlights the pliability of Alibaba’s monetary construction, which permits it to strategy totally different markets with totally different methods.

Whereas BABA is presently dominating the Chinese language eCommerce panorama, its bold imaginative and prescient will see it proceed to develop its attain into extra world markets. This, mixed with its technique of repeatedly investing in know-how and advertising, units it as much as proceed grabbing extra market share each domestically and internationally.

Trying ahead, BABA’s income development seems to be properly above the market common, and this is because of its spectacular market penetration charge. The Chinese language large’s rising consumer base additionally means greater gross sales volumes and a bigger consumer base to play with. Because of this the corporate has extra potential to develop its product vary and attain customers on a worldwide scale.

Conclusion

Investing within the inventory market could be a daunting process, however developments in know-how have made it simpler than ever to make knowledgeable funding selections. AI-driven platforms like ChatGPT can analyze huge quantities of information to determine patterns and traits that can be utilized to foretell inventory costs with a excessive diploma of accuracy. The 20 most potential shares recognized by ChatGPT characterize a various vary of industries and have robust monitor information of development. By investing in these shares, traders can doubtlessly earn vital returns within the coming years.

FAQs

What are probably the most promising shares predicted by ChatGPT (AI)?

Essentially the most promising shares predicted by ChatGPT are these which might be anticipated to expertise the very best ranges of development sooner or later. This might be as a consequence of quite a lot of elements, equivalent to optimistic trade traits or an organization’s robust monetary place. Essentially the most potential ones are Amazon, Apple and Meta.

How can ChatGPT (AI) predict inventory costs?

ChatGPT can predict inventory costs by monitoring chatrooms and social media for clues about upcoming inventory value actions.

How can ChatGPT make errors in predicting inventory costs?

ChatGPT could make errors in predicting inventory costs as a result of it’s based mostly on a mannequin that’s educated on previous information. The mannequin might not be capable to precisely predict future inventory costs if there are unexpected occasions or modifications available in the market.

Learn extra associated articles:

[ad_2]

Source link

.gif?format=1500w)