[ad_1]

April 17, 2023

The next submit incorporates a overview of a group Discord dialog from the spartan-council channel concerning tokenomics.

Particular weblog submit incoming! A few weeks in the past there was an intensive group dialogue within the spartan-council channel of the Discord about tokenomics, collateral, and so on. It was dropped at our consideration that it is perhaps useful to a few of our readers to overview this dialog, and we agree. So let’s get into it.

As a short background, SNX is the one collateral that may at the moment be staked within the Synthetix protocol. This drives worth to SNX stakers, since they’re rewarded for providing up their collateral to backstop the community.

One of many challenges of SNX being the one accepted staking collateral is a really actual ceiling being placed on scalability, for the reason that financial bandwidth is finally constrained by the market capitalization of SNX. Community exercise can be constrained by staking participation, which is normally between 60% and 80% and varies based mostly on market circumstances. We are able to recall that in a earlier incentive program, sUSD briefly traded close to $1.10 because of the liquidity constraint.

Nevertheless, provided that many features of the protocol are being reimagined in V3, a possibility is introduced to transform tokenomics surrounding the SNX token as nicely.

Because the macro panorama in crypto continues to shift away from centralized exchanges, the potential of this could possibly be very enticing if the scaling points are labored out. Including different, extra liquid staking collateral would alleviate a number of the constraints, however there are in fact execs and cons. That is the place the Discord dialog is available in…

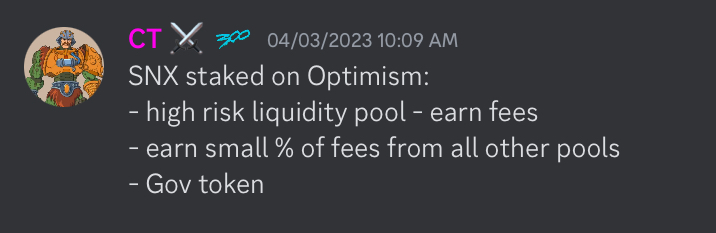

Let’s begin with a remark from CT, who was discussing the worth proposition of SNX with SynthaMan and synthquest:

CT’s considerations had been that customers is not going to have an interest within the token if it doesn’t supply any worth past governance. Synthquest introduced up the likelihood that one other protocol might fork V3, not supply a token, after which distribute all the charges to LPs (stakers), which might be far more fascinating for LPs.

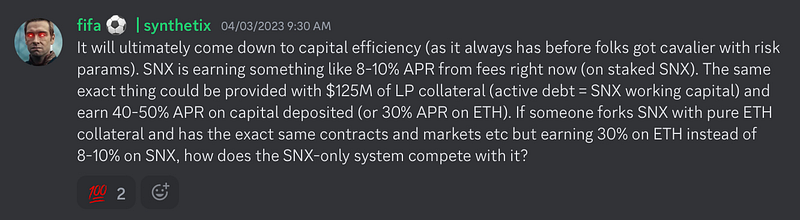

It may additionally be useful to incorporate Afif’s feedback right here:

There have been additionally a number of different vital feedback from members of the group, like Burt Rock, Hauntid, and JVK.

In V3, it might finally be doable to create markets with almost any collateral kind together with ETH (pending governance in fact). From there, it could be so simple as the Spartan Council voting on whether or not or not the debt pool would again that market.

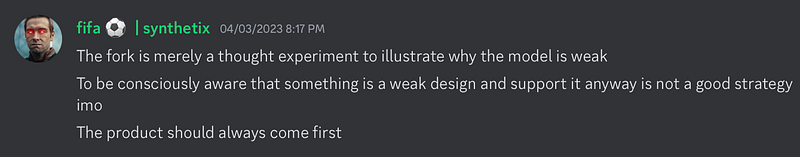

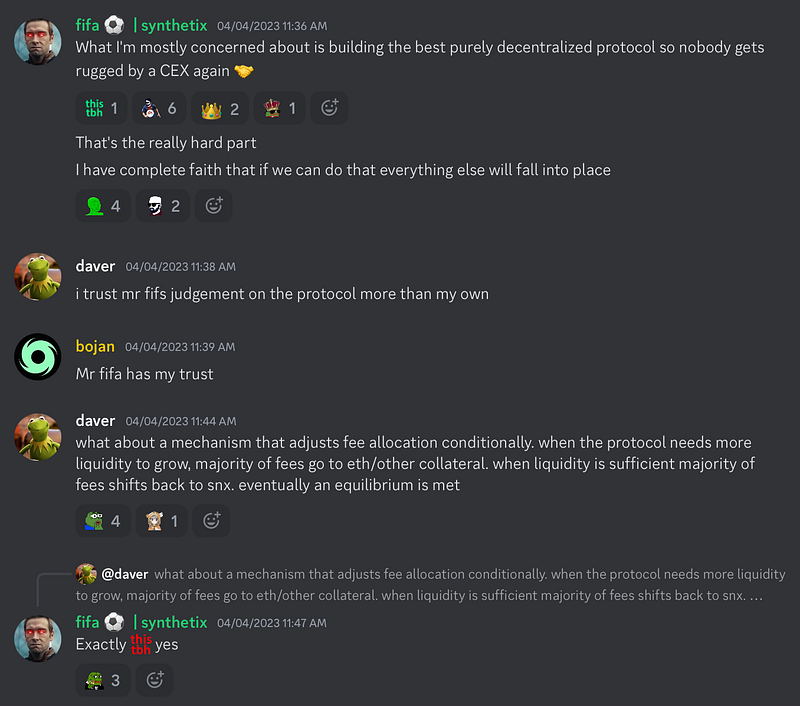

JVK additionally introduced up that being a longtime “blue-chip” DeFi protocol affords Synthetix a reputation-backed benefit {that a} potential fork must overcome with the intention to entice customers. He believes that is very true given all the current CEX mayhem:

Afif agreed with this, however reiterated that the main focus ought to be making the product the perfect that it might probably probably be. And Daver urged a configurable charge share relying on the protocol’s speedy liquidity wants.

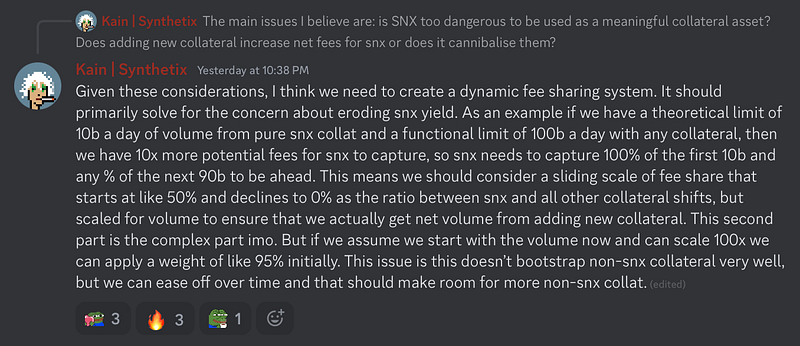

Kain then clearly introduced a number of the concepts hashed out earlier within the dialogue in a manner that appeared to resonate with everybody. He additionally agreed {that a} dynamic charge sharing system was probably the perfect path ahead.

Total, this was a reasonably productive group dialogue that’s going to be an ongoing matter of dialog. We’ll proceed to offer updates as they arrive, and monitor extra formal governance discussions as they occur!

[ad_2]

Source link