[ad_1]

Be a part of Our Telegram channel to remain updated on breaking information protection

The non-fungible token market has seen an unimaginable progress in recent times, attracting buyers and artists to the house to create and commerce digital property. Nonetheless, the NFT market has plunged in current weeks, leaving many NFTs shielding greater than 70% of their flooring costs. Beneath we’ll look in-depth at whether or not NFTs are actually dying or they’re simply taking a breather:

The Rise Of NFTs

Non-fungible tokens got here into the highlight someday in 2021, creating an enormous frenzy and curiosity amongst crypto merchants and buyers. On the time, the nascent NFT sector attracted most establishments, companies, and superstar buyers, together with Cristiano Ronaldo and Paris Hilton.

The NFT mania reached its peak season when an NFT of former Twitter boss Jack Dorsey’s first tweet offered for $2.9 million. The tweet “Simply establishing my twttr” — which Dorsey posted in March 2006 — was bought by Malaysia-based entrepreneur Sina Estavi on the Valuables platform.

In August 2021, Ringers #879 turned one of many high most costly NFTs ever offered at 1,800 ETH ($5.9 million) earlier than just lately reselling at $6.2 million. In 2022, Bored Aped Yacht Membership and CryptoPunks NFTs gained traction within the NFT market, additionally turning into one of the vital traded costly NFTs. Sure bored Ape NFT collections even offered for over $3 million.

Earlier this yr, NFTs retested one other market hype earlier than being taken down by the meme cash mania. Memecoins are crypto tokens, typically depicted with comical or animated memes, that are supported by enthusiastic on-line. The meme cash are popularly identified out there as shitcoins.

The NFT Recession

Since most meme cash do not need intrinsic worth when it comes to utility, the memecoin season didn’t final for lengthy. Within the second quarter of this yr, the non-fungible token had taken again market dominance, with Bitcoin ordinals turning into one of the vital traded NFTs. Bitcoin NFTs have impressed the evolution of Ethscriptions, one other sort of NFTs hosted on the Ethereum community.

A SHORT CLIP: What’s a protocol?

From July 5 Areas, edit by @_mackinac pic.twitter.com/bq9YPIXRGM

— Middlemarch (@dumbnamenumbers) July 15, 2023

Sadly, the non-fungible token market has suffered one other market downturn. The current NFT droop started in mid-June and left many NFTs in large losses. The Bored Ape Yacht Membership, an NFT assortment from digital asset incubation agency Yuga Labs, is an ideal instance of NFTs impacted by the current market downturn.

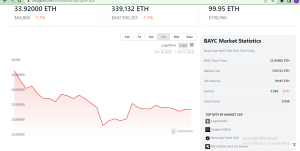

Bored Ape NFTs:Supply: CoinGecko.com

Bored Ape Yacht Membership NFT assortment just lately went down from a flooring worth of over 100 ETH to now 34 ETH. Azuki, an NFT assortment from digital asset agency Chiru Labs that includes a restricted version of 10,000 NFTs, is one other NFT assortment that has gone down miserably in current weeks. The NFT assortment fell from 15 ETH to now 7 ETH.

In 2022, Franklin, an NFT collector, and crypto influencer, purchased his Bored Ape Yacht Membership at round $3 million. On the time of publishing, his Bored Ape NFT assortment has a greatest supply of 34 WETH ($65,000.) What has gone fallacious within the NFT market? Are NFTs dying or simply taking a breather?

This NFT was as soon as value $3 million.

Now it’s solely value $65,000.

What went fallacious? pic.twitter.com/DKxsmD6mgI

— Franklin (@franklinisbored) July 17, 2023

What Went Flawed?

Regulatory uncertainty within the broader crypto trade is a possible candidate partially answerable for this newest crash. Prior to now a number of weeks, the crypto market has suffered intense regulatory scrutiny, with high exchanges resembling Coinbase and Binance even going through authorized fees. The regulatory uncertainty has created FUD, dragging the NFT market down. It has additionally pushed the flagship crypto Bitcoin down under $30,000.

The platforms and marketplaces the place NFTs commerce is one other issue attributed to the current market crash. It’s value noting that Blur and OpenSea have been rivaling for market dominance. Essentially the most main level of rivalry in regards to the Blur NFT market allegedly manipulating the NFT market comes from its native token, $BLUR.

Lately, reviews emerged {that a} handful of outstanding merchants and buyers might need been utilizing the platform’s incentivization system to affect NFT costs. Regardless of the current NFT downturn, many buyers are nonetheless bullish that the NFT market will once more stand on its ft.

NFT Marketplaces are those tanking the NFT market

I am totally satisfied @xerocooleth is correct

Here is why

{The marketplace} wars usually are not fought over quantity

They’re fought over having the bottom flooring

Whoever controls the ground controls the market & future quantity

This implies…

— trevor.btc (@TO) July 4, 2023

Associated NFT Information:

Wall Road Memes – Subsequent Large Crypto

Early Entry Presale Reside Now

Established Group of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Finest Crypto to Purchase Now In Meme Coin Sector

Group Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be a part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link