[ad_1]

Polygon’s MATIC token skilled fleeting 24-hour beneficial properties that provided a momentary glimmer of hope for its traders. Nevertheless, this uptick was juxtaposed in opposition to lingering weaknesses within the bullish sentiment, prompting questions in regards to the potential for additional draw back.

Within the final 5 days, MATIC launched into a trajectory marked by a comparatively slim worth vary, predominantly oscillating between $0.537 and $0.56. This section of consolidation led to a visual discount in market volatility, consequentially leading to a discernible drop within the open curiosity metric all through the week.

This deceleration in market exercise not solely hinted at speculators’ ambivalence in the direction of predicting the token’s subsequent trajectory but in addition steered that merchants would possibly must train warning and persistence because the market seeks clearer alerts.

Analyzing MATIC’s Present Local weather

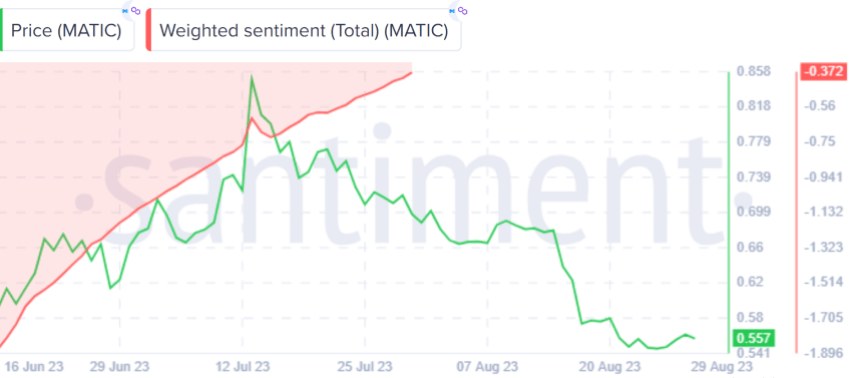

Beneath the floor of those worth fluctuations and speculative hesitations, a collection of attention-grabbing developments unfolded. The sentiment prevailing in social discussions round MATIC’s worth exhibited a noteworthy shift in the direction of negativity.

Insights gleaned from Santiment knowledge revealed a gradual decline in MATIC’s Weighted Sentiment that commenced round August 25, in the end settling at a present worth of -0.37 as of at this time.

Supply: Santiment

Moreover, delicate indicators hinted at underlying accumulation dynamics taking form. The typical coin age exhibited an upward trajectory, indicative of the gradual accumulation of MATIC tokens throughout the community. Coinciding with this development, the amount of provide held on exchanges witnessed a decline over the previous week, as soon as once more underscoring the narrative of token withdrawal and strategic accumulation.

MATIC Present Valuation And Outlook

Regardless of the drop within the token’s social sentiment ranking, MATIC nonetheless registered a 1.5% surge over the previous 24 hours, and buying and selling at $0.559, in accordance with crypto market tracker CoinGecko. Over a broader timeframe of seven days, the token’s incremental acquire stands at a modest 0.6%.

In the meantime, in a well timed and pivotal announcement, Polygon’s Co-Founder Sandeep Nailwal unveiled insights into the forthcoming migration of MATIC to a brand new POL Token. Of notable significance on this replace was the reassurance prolonged to customers – a seamless transition to POL was promised with out the danger of forfeiting rewards earned from ongoing MATIC staking actions.

Ideally, as a person it is best to get 1/2 click on improve to staked POL from staked MATIC. I feel as soon as the improve is accredited by the governance, solely then all of us would have extra data in regards to the mechanism. Some fundamental data relating to how the mechanism would appear like was shared within the…

— Sandeep Nailwal | sandeep. polygon 💜 (@sandeepnailwal) August 28, 2023

This announcement takes on added significance after months of uncertainty that adopted Polygon’s 2.0 tokenomics revelation in July 2023. Nailwal’s clear communication might probably inject a dose of confidence into the investor neighborhood and stimulate heightened engagement inside the community over the following days.

MATIC market cap at present at $5.1 billion. Chart: TradingView.com

Whereas MATIC showcased marginal beneficial properties over a 24-hour interval, an air of fragility hung over the bullish narrative. The tight worth vary, waning social sentiment, and complicated indicators known as for a measured strategy from merchants.

However, the approaching shift to POL Token, as detailed by the Polygon’s co-founder, might probably emerge as a stabilizing affect, rekindling investor belief and invigorating participation inside the community.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing includes danger. While you make investments, your capital is topic to danger).

Featured picture from G2 Studying Hub

[ad_2]

Source link