[ad_1]

For Bitcoin (BTC), the most important cryptocurrency out there, the month of September has seen an absence of definitive energy from each bulls and bears, leading to a interval of sideways chop and fast bouts of volatility.

Materials Indicators, a distinguished crypto evaluation agency, sheds mild on the prevailing market situations and highlights the intricacies of short-term worth motion (PA) towards the backdrop of the macro sentiment.

Unpredictable Market Situations Prevail As BTC Seeks Path

Regardless of a bearish macro sentiment, the place a broader downtrend is anticipated, short-term worth motion typically deviates from the macro pattern. This phenomenon explains the occasional short-term pumps and rallies noticed even inside a prevailing downtrend.

Materials Indicators emphasizes the significance of understanding these dynamics and the potential implications they maintain for Bitcoin.

Yesterday’s efficiency of the main cryptocurrency might have come to an in depth, however Materials Indicators level to indications that one other rally could possibly be on the horizon.

The agency highlights the Development Precognition A1- indicator developed and used to identify micro, and macro developments by the firm- continues to exhibit a slight uptick in bullish momentum throughout the day by day (D), weekly (W), and month-to-month (M) charts, as seen above.

This pattern suggests the potential for a resurgence in Bitcoin’s worth, albeit with the necessity for warning and additional evaluation.

As of the time of writing, Bitcoin is presently buying and selling at $25,800, persevering with its extended interval of sideways worth motion because the begin of the month. Nevertheless, it’s value noting that Bitcoin has been unable to regain the important $26,000 stage, which holds important significance for the cryptocurrency.

Reclaiming this stage is essential so as to invalidate any potential bearish stress and mitigate the potential for Bitcoin experiencing an additional decline in its worth.

Surge In New Bitcoin Addresses Indicators Rising Curiosity

Amidst ongoing uncertainty and sideways worth motion, an intriguing pattern has emerged that sheds mild on the increasing curiosity in Bitcoin.

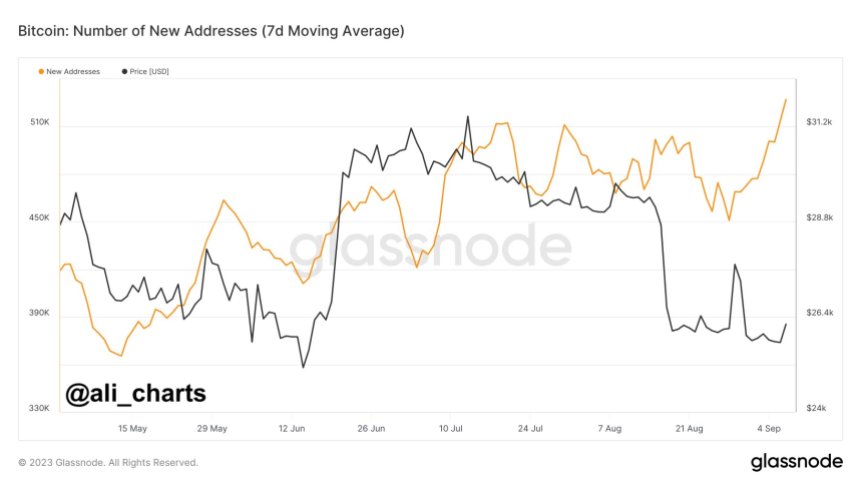

Notably, roughly 527,000 contemporary Bitcoin addresses are being created each day, reaching a brand new yearly excessive. Famend crypto analyst Ali Martinez delves into the importance of this surge and its implications for the cryptocurrency market.

The surge in new Bitcoin addresses suggests a rising curiosity and engagement with the digital foreign money, even throughout a interval when its worth has witnessed occasional drops.

This surge in handle creation signifies that an rising variety of people are exhibiting curiosity in Bitcoin, doubtlessly attracted by its underlying know-how, decentralized nature, and potential for monetary independence.

For long-term buyers and advocates of Bitcoin, this surge in handle creation serves as a constructive signal, reflecting sustained curiosity and belief within the cryptocurrency’s community. It demonstrates that people usually are not deterred by short-term worth volatility and are dedicated to collaborating within the Bitcoin ecosystem for the lengthy haul.

By actively creating new Bitcoin addresses, people are basically establishing a connection to the community and positioning themselves to have interaction in varied Bitcoin-related actions, together with sending and receiving funds, collaborating in decentralized purposes (DApps), and exploring the broader cryptocurrency ecosystem.

Ali Martinez emphasizes that this upward pattern in handle creation is important because it suggests an increasing person base and a possible inflow of recent contributors into the Bitcoin market.

As extra people be a part of the community, it strengthens the general resilience and legitimacy of Bitcoin, additional solidifying its place as a distinguished participant within the world monetary panorama.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link