[ad_1]

The Curve over-the-counter (OTC) battle continues to brew. Numerous entities have purchased and obtained CRV, Curve’s native token, sparking hypothesis in regards to the protocol’s future. Let’s dissect these transactions to know the implications they could carry for the Curve ecosystem.

Distributing CRV: The Whos and Hows

Substantial quantities of CRV have shifted palms in a collection of high-profile transactions. Right here’s a rundown:

17.5M CRV went to 0xf51.Justin Solar obtained 5M CRV.4.25M CRV was transferred to DCFGod.Ox4d3, DWF Labs, and Cream: Multisig every obtained 2.5M CRV.1.25M CRV went to 0xcb5.3.75M CRV was despatched to machibigbrother.eth.An quantity of 250k CRV was moved to 0x9bf.

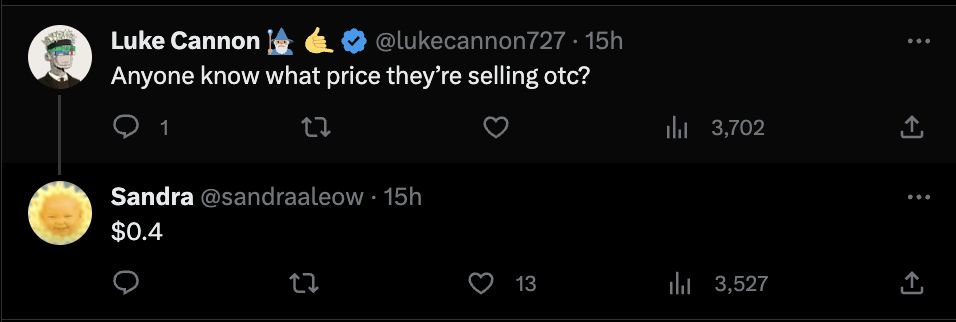

The Curve OTC Struggle updates:

17.5M CRV to 0xf51 5M CRV to Justin Solar 4.25M CRV to DCFGod 2.5M CRV to Ox4d32.5M CRV to DWF Labs 2.5M CRV to Cream: Multisig 1.25M CRV to 0xcb53.75M CRV to machibigbrother.eth250k CRV to 0x9bf

— Sandra (@sandraaleow) August 1, 2023

Moreover, 2.5M CRV went to “erwwer” on OpenSea and one other 10M CRV went to DWF Labs. As well as, a switch of two.5M CRV went to c2tp.eth.

Curiously, machibigbrother.eth locked up 3.75M CRV (value roughly $2.2M) till 01/02/2024, which you’ll confirm through this transaction hyperlink.

Lockup Interval and Market Situations

These transactions include a 3 to 6-month lockup interval, that means these CRV tokens won’t enter the market instantly. This era may stabilize the CRV worth quickly.

Nevertheless, if the CRV worth climbs to $0.80, merchants may promote these tokens on the open market, presumably affecting the value.

Notably, Wintermute, a famend world algorithmic market maker, didn’t take part in these OTC offers.

Over-the-Counter: Why?

The first query that arises from all these actions is: Why OTC? OTC transactions supply a number of advantages. They’re discrete, permitting giant quantities of tokens to alter palms with out instantly affecting the market worth. OTC offers additionally supply privateness, maintaining the particular transaction particulars, together with the value, from public view.

Whereas the precise promoting worth for these OTC offers stays undisclosed, hypothesis places it round $0.4. This OTC technique seems to be a response to the turbulent market situations, aiming to reduce the value influence of huge token gross sales.

The Broader Image

Whereas these transactions proceed to unfold, it’s essential to know their broader influence on the Curve ecosystem and the DeFi house. The long-term results of those OTC transactions, and the methods concerned, will play a vital position in shaping Curve’s future trajectory.

We’ll proceed to watch these developments and supply additional insights because the Curve OTC battle persists. As all the time, members within the DeFi house ought to train warning and conduct their due diligence when coping with such risky conditions.

Learn extra:

[ad_2]

Source link