[ad_1]

The present state of Bitcoin’s choices and futures markets is witnessing a notable shift, reflecting a broader transformation within the crypto buying and selling panorama.

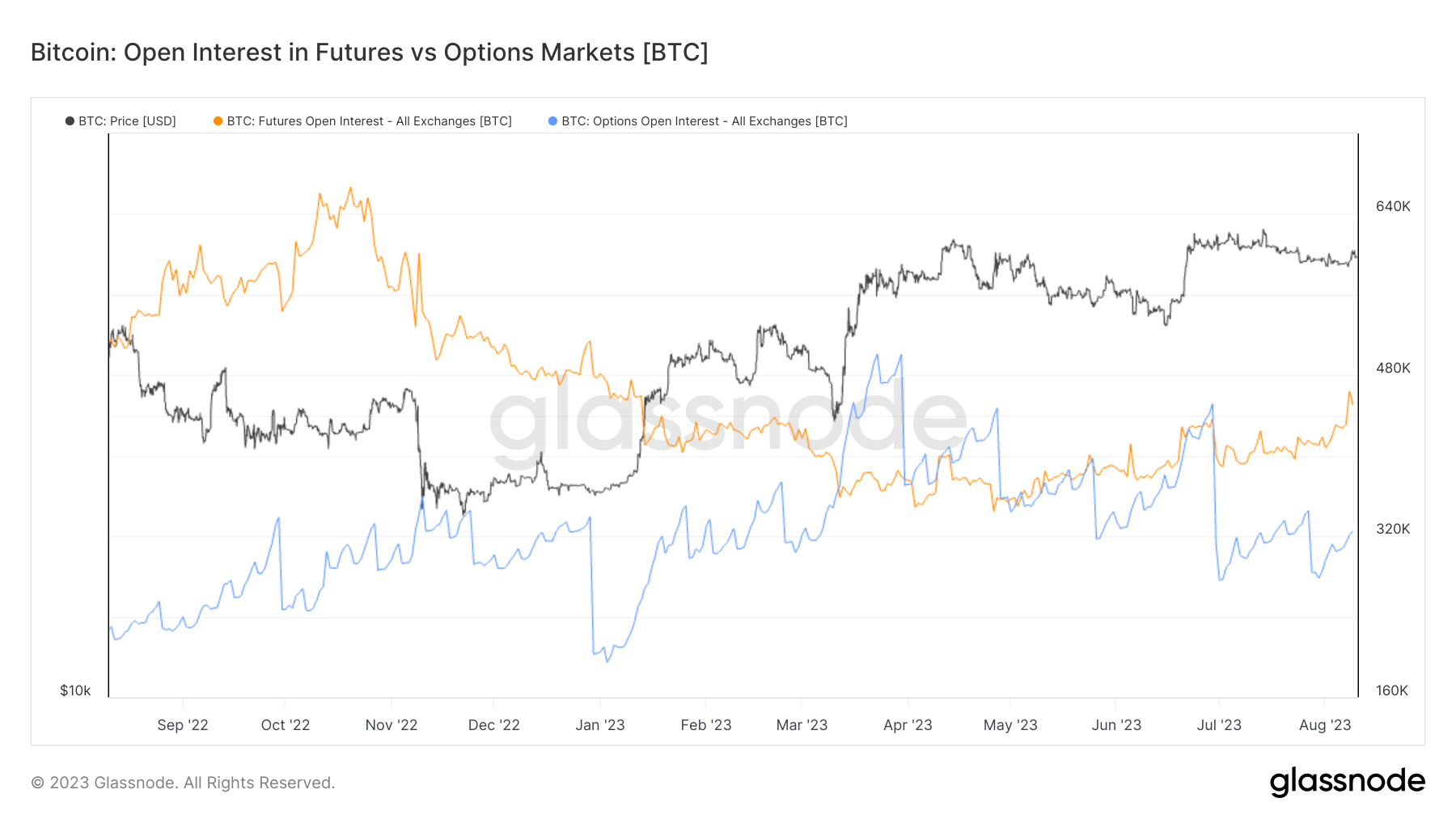

Over the past 12 months, Bitcoin choices markets have seen a big uptick in development, with open curiosity greater than doubling. This development in choices buying and selling signifies an elevated curiosity in strategic monetary merchandise that provide flexibility and threat administration capabilities.

Choices now rival futures markets when it comes to open curiosity magnitude, signaling a shift in buying and selling methods and probably an indication of market maturity.

Alternatively, futures open curiosity has been in regular decline for the reason that collapse of FTX in November 2022.

This decline could also be interpreted as dropping confidence within the futures market, elevating considerations about stability and threat administration practices. Nevertheless, 2023 has seen a slight enhance in futures open curiosity, indicating a cautious return of merchants, however the total pattern stays unfavourable in comparison with the choices market.

The open curiosity on Bitcoin futures is at present 420,000 BTC, whereas the open curiosity on Bitcoin choices is 312,000 BTC.

The expansion in Bitcoin choices buying and selling displays a extra strategic and risk-averse strategy to buying and selling Bitcoin. Choices, which offer the best however not the duty to purchase or promote an asset at a selected value, are favored over futures, which obligate the client to buy or the vendor to promote the asset at a predetermined future date and value.

This shift has far-reaching implications for market construction, regulation, and total market habits. The rise in choices buying and selling may result in completely different value dynamics, affecting the general volatility of Bitcoin’s value.

Choices present leverage, which might amplify each beneficial properties and losses, attracting extra speculative buying and selling. Whereas this could enhance liquidity, it may additionally enhance short-term volatility as merchants shortly enter and exit positions.

Nevertheless, it’s vital to notice that choices may also act as a stabilizing pressure for the broader crypto market. As choices are sometimes used as a hedging device to guard towards hostile value actions, they’ll successfully set a ground on potential losses, probably mitigating sharp declines throughout market downturns.

The shift between futures and choices may additionally change the aggressive panorama of exchanges providing these merchandise. These specializing in choices would possibly see development, whereas futures-centric platforms would possibly face challenges.

The info may additionally mirror modifications in investor habits, with maybe extra institutional participation in choices as a threat administration device and probably a lower in speculative buying and selling in futures.

The put up The altering panorama of Bitcoin futures and choices markets appeared first on CryptoSlate.

[ad_2]

Source link