[ad_1]

newbie

Welcome to the world of hybrid crypto exchanges, an modern fusion of centralized and decentralized fashions designed to offer an optimized buying and selling expertise. These platforms intention to amalgamate the most effective options of each fashions — the effectivity and comfort of centralized exchanges (CEXs) with the strong safety and consumer management inherent in decentralized exchanges (DEXs). The result’s a complicated buying and selling system that mitigates the standard weaknesses of each sorts, positioning hybrid crypto exchanges as potential game-changers within the cryptocurrency panorama.

Howdy, I’m Zifa, your information by means of the ever-evolving world of cryptocurrency. Over two years in the past, I immersed myself within the fascinating world of crypto and by no means regarded again, exploring its myriad aspects and observing how blockchain expertise is progressively revolutionizing numerous features of our on a regular basis lives. Right now, we’ll dive deep into one of many foundational ideas on the planet of cryptocurrency — hybrid crypto exchanges. So, whether or not you’re a seasoned dealer or a curious newcomer, I invite you to affix me as we discover the intricate workings of those modern platforms and their potential influence on the way forward for digital belongings.

Varieties of Cryptocurrency Exchanges

Cryptocurrency exchanges are integral to the digital asset ecosystem, offering a safe and handy platform for purchasing, promoting, and buying and selling cryptocurrencies. So, let’s discover numerous forms of cryptocurrency exchanges in addition to their benefits and downsides that can assist you discover the most effective answer that fits your buying and selling wants.

Decentralized Exchanges (DEX)

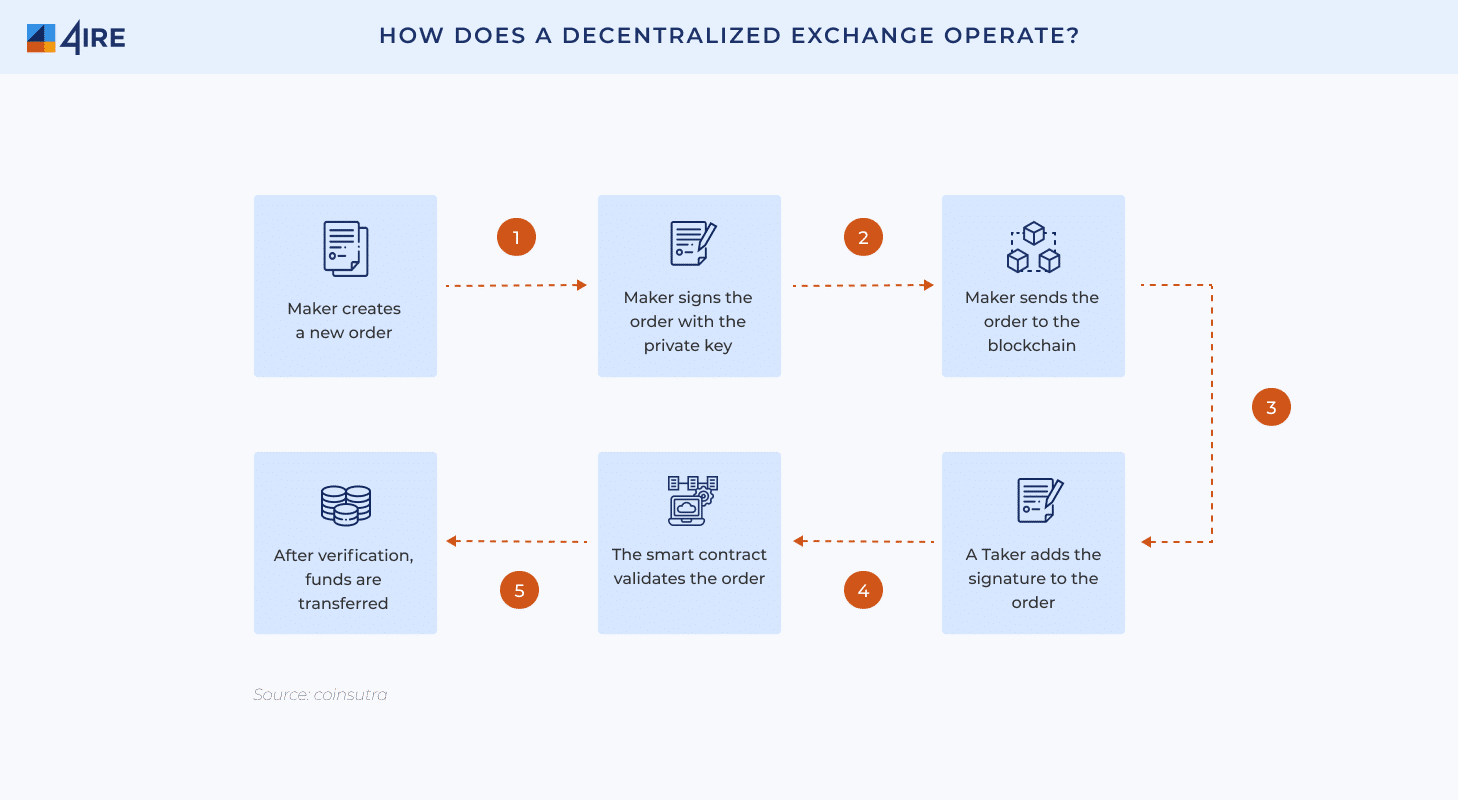

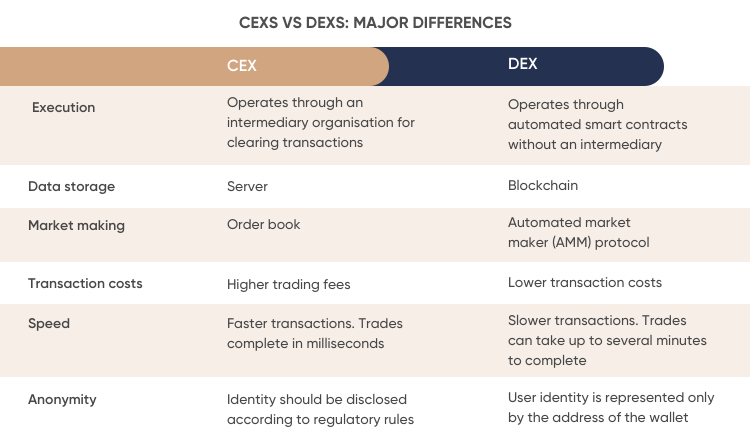

Decentralized exchanges (DEXs) are autonomous cryptocurrency buying and selling platforms that function with out the involvement of a government. These exchanges are constructed on high of public distributed ledger infrastructure, such because the Ethereum community, and permit customers to commerce digital belongings with out having to relinquish management of their non-public keys.

In contrast to centralized exchanges, the place trades are executed by means of an order e-book managed by the trade, DEXs function by permitting customers to work together with good contracts. These good contracts autonomously execute trades between customers based mostly on predefined situations, eliminating the necessity for intermediaries.

There are three forms of decentralized exchanges:

1. On-chain order books

The sort of DEX operates with an order e-book that’s saved and maintained completely on the blockchain. Whereas this offers a excessive stage of safety, it may be gradual and costly as a result of computational assets required to take care of the order e-book on the blockchain.

2. Off-chain order books

These exchanges work with an order e-book saved off the blockchain, usually on a centralized server. This strategy ends in improved pace and decreased price in comparison with on-chain order books however sacrifices a few of the safety advantages supplied by blockchain expertise.

3. Automated market makers (AMM)

Such DEXs function utilizing a mathematical algorithm to find out the value of belongings based mostly on their present provide and demand. AMMs are gaining recognition as a consequence of their ease of use and the truth that they don’t require an order e-book.

From my expertise within the subject, the decentralized nature of DEXs does certainly provide a sturdy stage of safety. Nevertheless, I’ve noticed it additionally comes with drawbacks, corresponding to decrease buying and selling quantity, restricted liquidity, user-unfriendly interfaces, and inadequate buyer assist. One other crucial side I’ve observed is the elevated market volatility and potential for fraudulent actions as a result of lack of centralized authority and regulation.

Centralized Trade (CEX)

Centralized exchanges (CEXs) are a kind of cryptocurrency trade managed by a centralized entity. Right here, the platform operator manages the order e-book and facilitates the trade of cryptocurrencies for fiat currencies or different digital belongings.

A number of the benefits of utilizing a CEX embody excessive buying and selling quantity, giant liquidity, and easy accessibility to a wide range of cryptocurrencies. Moreover, customers can profit from superior buying and selling instruments and options of the centralized platform, corresponding to margin buying and selling and superior charting choices.

Nevertheless, as my experience within the subject suggests, utilizing a CEX additionally carries sure drawbacks. Trusting an trade operator together with your funds can result in safety vulnerabilities if the platform is compromised. I’ve usually famous that top transaction charges can accumulate over time, and customers could face regulatory scrutiny and compliance necessities that may be troublesome to navigate.

When it comes to how a CEX operates, customers usually create an account and deposit digital belongings or fiat currencies into their accounts. Trades are then executed by means of an identical engine that matches purchase and promote orders. The trade costs a payment for every commerce executed, which is often a proportion of the entire transaction quantity.

Some examples of standard CEXs embody Binance, Coinbase, and Bitfinex. Binance is thought for its excessive buying and selling quantity, low charges, and user-friendly interface. Coinbase, alternatively, made its identify as a platform with glorious safety features, insurance coverage protections, and a user-friendly cell app. Bitfinex boasts superior buying and selling instruments and options, together with margin buying and selling and liquidity swaps.

To attenuate the dangers related to utilizing a centralized trade, customers ought to solely deposit quantities of cryptocurrency that they’ll afford to lose. I at all times suggest enabling two-factor authentication and utilizing chilly storage wallets for safe storage. Moreover, thorough analysis into the platform’s regulatory compliance is crucial to keep away from falling into regulatory grey areas.

Hybrid Exchanges

Rising as a treatment to the constraints inherent in each centralized and decentralized crypto exchanges, hybrid cryptocurrency exchanges characterize a harmonious mix of those two forms of platforms. They draw on the strengths of every, integrating the liquidity and user-friendliness of centralized exchanges with the safety and anonymity of decentralized ones, thereby overcoming the first challenges related to every.

Options of Hybrid Crypto Trade

A key function of hybrid exchanges is consumer management over funds because it eliminates the necessity to entrust belongings to a custodian. Which means that merchants can interact instantly with digital belongings of their wallets, that are linked to strong good contracts facilitating safe transactions. The decentralized side ensures that non-public data is well-protected and gives customers much-needed privateness of their transactions.

Including to those is the accessibility function that hybrid exchanges borrow from their centralized counterparts. Not solely do they provide user-friendly interfaces, but additionally they’re usually extra welcoming to newcomers, with buyer assist and steerage available. Moreover, they have an inclination to have higher liquidity than their purely decentralized counterparts, guaranteeing that customers can rapidly purchase or promote belongings when they should.

Lastly, hybrid exchanges usually incorporate further modern options like fiat integration, superior APIs, and Atomic Swap capabilities, which permit customers to trade numerous forms of tokens instantly and with ease. As such, these platforms characterize the subsequent technology of crypto buying and selling marketplaces, bridging the hole between conventional finance and the burgeoning world of decentralized finance (DeFi).

The Advantages of Utilizing a Hybrid Crypto Trade

Hybrid crypto exchanges strike a steadiness between the world of centralized and decentralized platforms, wooing customers with a singular array of advantages. These platforms cleverly merge some great benefits of blockchain expertise and real-time service entry, offering a seamless, built-in buying and selling surroundings.

One of many main advantages of hybrid exchanges is the consumer’s management and custody of their belongings, regardless of any third-party intervention or regulation. This independence heightens the safety and privateness of transactions whereas nonetheless adhering to the authorized tips regarding digital currencies.

Uniquely, hybrid exchanges shun the vulnerability related to scorching wallets, which are sometimes uncovered to internet-related cyber threats. As an alternative, they favor chilly storage, preserving customers’ digital wallets disconnected from the web, thus drastically lowering the chance of cyber-attacks.

Velocity and transparency are core attributes of hybrid exchanges, leading to immediate and clear-cut transactions. This makes them an interesting possibility for crypto merchants throughout the globe.

Lastly, the scalability of hybrid platforms primes them as potential future hubs for crypto trade, eliminating the fraudulent practices usually related to decentralized platforms. In essence, a hybrid crypto trade fosters a safe, environment friendly, and globally accessible surroundings for crypto buying and selling.

The Dangers of Utilizing Hybrid Cryptocurrency Trade Platforms

Nevertheless, merchants want to pay attention to the potential dangers when utilizing these platforms.

One of many greatest dangers related to utilizing a hybrid crypto trade is regulatory uncertainty. Since these platforms function in a considerably grey space, they could not have clear rules or compliance necessities. This may pose a threat to traders by way of authorized compliance and the protection of their investments.

One other important threat is safety issues. Hybrid cryptocurrency exchanges could retailer each fiat currencies and cryptocurrencies in scorching wallets, which makes them weak to hacks and safety breaches. Moreover, these exchanges could not have the identical stage of safety measures in place as centralized platforms or conventional monetary establishments.

Excessive transaction charges are yet one more threat related to hybrid exchanges. These platforms could cost greater charges than centralized or decentralized exchanges, which may considerably influence merchants’ funding returns. Moreover, merchants could lack management over their cryptocurrencies and funds on these platforms, resulting in potential loss or theft.

Lastly, hybrid exchanges could not grant the identical stage of anonymity as decentralized exchanges. This lack of privateness may pose a threat to traders’ private and monetary information.

Total, merchants should perceive the potential dangers of utilizing hybrid cryptocurrency exchanges. These dangers can considerably influence customers’ funding and monetary well-being. Due to this fact, it’s important to decide on a trusted platform and take mandatory precautions, corresponding to two-factor authentication and chilly storage.

What Are Examples of a Hybrid Cryptocurrency Trade?

Whereas there will not be many acknowledged names within the realm of hybrid cryptocurrency exchanges, a number of modern initiatives stand out as of the time of writing:

Qurrex

Qurrex is a complicated hybrid crypto trade that caters to brokers, high-frequency merchants, companies, and arbitrageurs. This platform leverages each on-chain and off-chain protocols to course of consumer orders by way of an digital communication community (ECN) — a system that robotically matches purchase and promote orders. Other than options like institutional-grade safety, strong liquidity, excessive transparency, and 24/7 multilingual technical assist, Qurrex additionally offers superior API, fiat integration, an aggregated order e-book, and a buying and selling facility for ERC-20 tokens.

Eidoo

Eidoo gives one other intriguing strategy to hybrid trade, with every consumer account linked to a sensible contract on the Ethereum blockchain. Which means that solely you possibly can entry or view the funds in your Eidoo account, which truly contributes the utmost privateness. Transactions are processed by way of good contracts with out the necessity for third events, and the trade options an built-in Atomic Swap functionality, enabling customers to swap tons of of ERC-20 tokens seamlessly.

As a disclaimer, I need to be aware that although these platforms exhibit potential, they continue to be comparatively new to the market, and it’s important to conduct your personal analysis (DYOR) earlier than participating with them. Like with any monetary enterprise, understanding the dangers and the undertaking’s fundamentals is essential.

The Affect of Hybrid Exchanges

The inherent scalability of hybrid trade platforms factors in direction of their potential to emerge as pivotal hubs in the way forward for cryptocurrency buying and selling. As consciousness and acceptance of cryptocurrencies broaden, they’re more and more seen as engaging funding avenues. The arrival of hybrid exchanges is remodeling the cryptocurrency panorama right into a safer, extra accountable, and information-rich surroundings for executing transactions.

From my vantage level, hybrid exchanges will not be simply platforms for trade, however they’re catalysts for a major change in how we understand and interact with digital belongings. By addressing the challenges of each centralized and decentralized fashions, they’re poised to play a major function within the evolution of crypto house. They stand to facilitate safe, swift, and globally accessible buying and selling, which is actually an thrilling growth on the planet of cryptocurrency.

Disclaimer: Please be aware that the contents of this text will not be monetary or investing recommendation. The data supplied on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native rules earlier than committing to an funding.

[ad_2]

Source link