[ad_1]

The decentralized finance (DeFi) trade has confronted one other important setback. Curve Finance, a outstanding DeFi protocol, was exploited on July 30, resulting in losses surpassing $47 million. This incident was a consequence of a reentrancy vulnerability within the Vyper variations 0.2.15, 0.2.16, and 0.3.0 that a number of secure swimming pools on Curve Finance had been utilizing.

The Vulnerability

The first reason for the exploit was a malfunction within the reentrancy locks of particular variations of Vyper, a contract-oriented, pythonic programming language that targets the Ethereum Digital Machine (EVM). This programming language is a most well-liked alternative for Python builders transitioning into Web3 as a consequence of its similarity to Python.

The preliminary investigation reveals that these Vyper compiler variations don’t implement the reentrancy guard appropriately. Reentrancy assaults happen when a contract is locked, stopping a number of features from being executed concurrently. If not applied appropriately, this could probably drain all funds from a contract. Ancilia, a safety agency, has recognized 136 contracts utilizing Vyper 0.2.15, 98 contracts utilizing Vyper 0.2.16, and 226 contracts utilizing Vyper 0.3.0 with reentrancy safety.

Curve Hack

A number of DeFi initiatives had been affected by this exploit, resulting in important outflows. As an example, Ellipsis, a decentralized alternate, reported that a number of secure swimming pools with BNB had been exploited utilizing an previous Vyper compiler. Alchemix’s alETH-ETH noticed an outflow of $13.6 million. JPEGd’s pETH-ETH pool was exploited for $11.4 million, and Metronome’s sETH-ETH pool misplaced $1.6 million.

A lot of stablepools (alETH/msETH/pETH) utilizing Vyper 0.2.15 have been exploited because of a malfunctioning reentrancy lock. We’re assessing the state of affairs and can replace the group as issues develop.

Different swimming pools are protected. https://t.co/eWy2d3cDDj

— Curve Finance (@CurveFinance) July 30, 2023

Following these assaults, Michael Egorov, the CEO of Curve Finance, confirmed that over 32 million CRV tokens value greater than $22 million had been drained from the swap pool. This affirmation got here within the wake of a panic throughout the DeFi ecosystem, resulting in quite a few transactions throughout swimming pools and a rescue operation by white hats.

CoinMarketCap information exhibits that Curve Finance’s utility token Curve DAO (CRV) declined over 5% in response to the information. The liquidity of CRV has decreased considerably in current months, making it liable to violent worth swings.

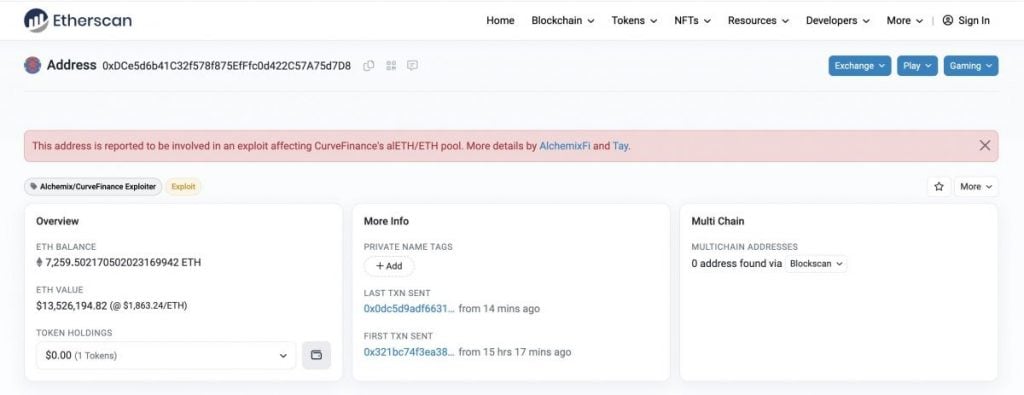

Regardless of the numerous harm, Curve Finance assured that crvUSD contracts and any swimming pools related to it weren’t affected by the exploit. Within the aftermath of the hack, Curve Finance confirmed the incident and admitted that they couldn’t safe the pool in time. A single transaction seen on the Etherscan confirmed the exploit.

Transaction on Etherscan

Context

This exploit comes as the newest in a collection of incidents focusing on Curve Finance. Only some days earlier, an attacker exploited the omnipool platform of Conic Finance, making off with $3.26 million in Ether (ETH). The perpetrator transferred virtually your complete stolen sum to a brand new Ethereum deal with in a single swift transaction.

We’re at the moment investigating an exploit involving the ETH Omnipool and can share updates as quickly as they’re out there.

— Conic Finance (@ConicFinance) July 21, 2023

The Curve Finance hack is part of a broader sample of assaults on DeFi protocols. Based on a report from the Web3 portfolio app, De.Fi, DeFi hacks and scams accounted for over $204 million in losses in simply the second quarter of 2023.

Reimbursement & Return

On account of the incident, the Curve founder acted promptly and repaid 4.63M USDT and deposited 16M CRV (equal to $10.12M) on Aave. At present, he has a collateral of 293M CRV (valued at $181M) and a debt of 59.68M USDT on Aave, with a well being price of 1.69.

Aave profile

In an sudden flip of occasions, a crypto consumer named c0ffeebabe.eth returned 2,879 ETH (roughly $5.4m) to the Curve deployer. This occasion has mitigated a number of the loss attributable to the hack.

Return Transaction on Etherscan

After #Curve was hacked, the founding father of #Curvefi repaid 4.63M $USDT and deposited 16M $CRV ($10.12M) on #Aave.

He at the moment has 293M $CRV ($181M) of collateral and 59.68M $USDT of debt on #Aave, with a well being price of 1.69.https://t.co/stkFvDrlnv pic.twitter.com/tzYlt9Vmfk

— Lookonchain (@lookonchain) July 31, 2023

The Aftermath

Investigators additionally recognized the hacker’s addresses and the quantity of funds exploited in relation to the Curve hack. The full quantity exploited up to now is round $52M.

Hacker’s Addresses:

0xdce5d6b41c32f578f875efffc0d422c57a75d7d8: 7,259 ETH ($13.5M), associated to AlchemixFi0x6ec21d1868743a44318c3c259a6d4953f9978538

From these occasions, it’s clear that DeFi protocols, whereas promising, nonetheless have their vulnerabilities. Protocols and customers alike ought to stay vigilant and proactive in implementing and following the very best safety practices.

Unprecedented Occasions

It has certainly been a loopy day in crypto. Whereas many crypto fanatics had been playing on Base, the Curve hack occurred, leaving 32M CRV tokens within the fingers of the hacker. Much more surprising was the potential for a $100M CRV liquidation on Aave at $0.42 USD, though the founder has been making efforts to repay the debt.

Loopy day in crypto.

Whereas degens are playing on Base, Curve will get hacked with 32M CRV tokens within the fingers of the hacker.

What’s worse, there is a $100M CRV liquidation on Aave at $0.42 USD, however the founder is at the moment repaying the debt.

🤞 pic.twitter.com/9s0JSrNYgt

— Ignas | DeFi Analysis (@DefiIgnas) July 30, 2023

Curve Hack Evaluation

Because the mud settles on the Curve Finance hack, the complete influence on the ecosystem is turning into clear. The assault struck a heavy blow to the DeFi ecosystem, particularly impacting the tokens that suffered direct penalties. As an example, a number of tokens misplaced over 30% of their worth as a result of CRV exploit.

The fast response by the Curve founder to repay a number of the misplaced funds and the sudden return of funds by a 3rd social gathering, together with the ironic twist of the hacker shedding the stolen funds, have barely mitigated the state of affairs. Nonetheless, the incident serves as a reminder of the potential vulnerabilities inside sensible contracts and the broader DeFi area.

It will be important for initiatives inside the DeFi area to repeatedly put money into safety measures, audit their sensible contracts, and create contingency plans for doable exploits. Customers should even be vigilant and take into account the danger elements when interacting with DeFi platforms.

The Curve Finance hack is a stark reminder that the revolutionary and high-reward potential of the DeFi sector additionally comes with important threat. With the sector’s maturation, the expectation is that builders and organizations will undertake strong safety measures as normal follow, thereby precluding the probability of such exploits sooner or later.

Learn extra:

[ad_2]

Source link

.gif?format=1500w)

.gif?format=1500w)