[ad_1]

As the primary week of October unfolds, the fast-paced Bitcoin and crypto house is about for an additional blockbuster week, with a number of pivotal occasions on the horizon. From regulatory developments, and historic development analyses, to macroeconomic influences, the market is about to witness a whirlwind of occasions that would form the long run value trajectory.

#1 Launch Of Ethereum Futures ETFs

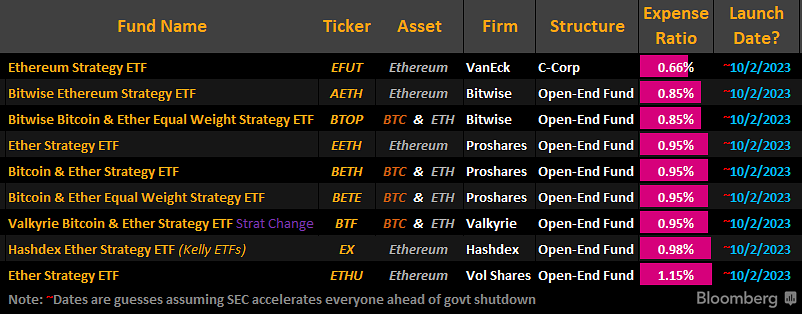

A slew of Ethereum futures ETFs is about to debut this week, as evidenced by latest bulletins and market speculations. Valkyrie, a famend asset supervisor, confirmed on Friday its plans to revamp its Bitcoin futures ETF right into a blended monetary product encompassing each BTC and ETH futures. In an identical vein, VanEck has introduced its distinctive ETF proposition.

Consultants at Bloomberg, who intently monitor the ETF market, have hinted at a possible launch on Monday. Nevertheless, an official nod from the SEC continues to be awaited. James Seyffart, an ETF analyst with Bloomberg, took to Twitter on Friday, commenting, “OKAY: This seems to be the complete checklist of Ethereum Futures ETFs that will probably be given SEC accelerated approval to launch on Monday… It’s gonna be a loopy day to say the least.”

Eric Balchunas, Senior ETF Analyst for Bloomberg, echoed related sentiments on Saturday, “Alright we obtained NINE funds able to go within the Ether Futures ETF Derby which begins at 9:30 am Monday. Gonna be a captivating experiment and nice foreshadow/undercard to the spot race.”

Whereas these approvals would possibly sound bullish for Ethereum, a glance again at Bitcoin’s Future ETF approval in late 2021 attracts a extra advanced image. The launch coincided with BTC’s peak value in 2021. Therefore, whether or not Ether (ETH) will expertise a post-approval value surge is unsure. It’s additionally noteworthy that the Ethereum futures will probably be settled in money, slightly than in precise ETH, additional complicating the worth projections.

#2 Bitcoin Heading Into “Uptober”

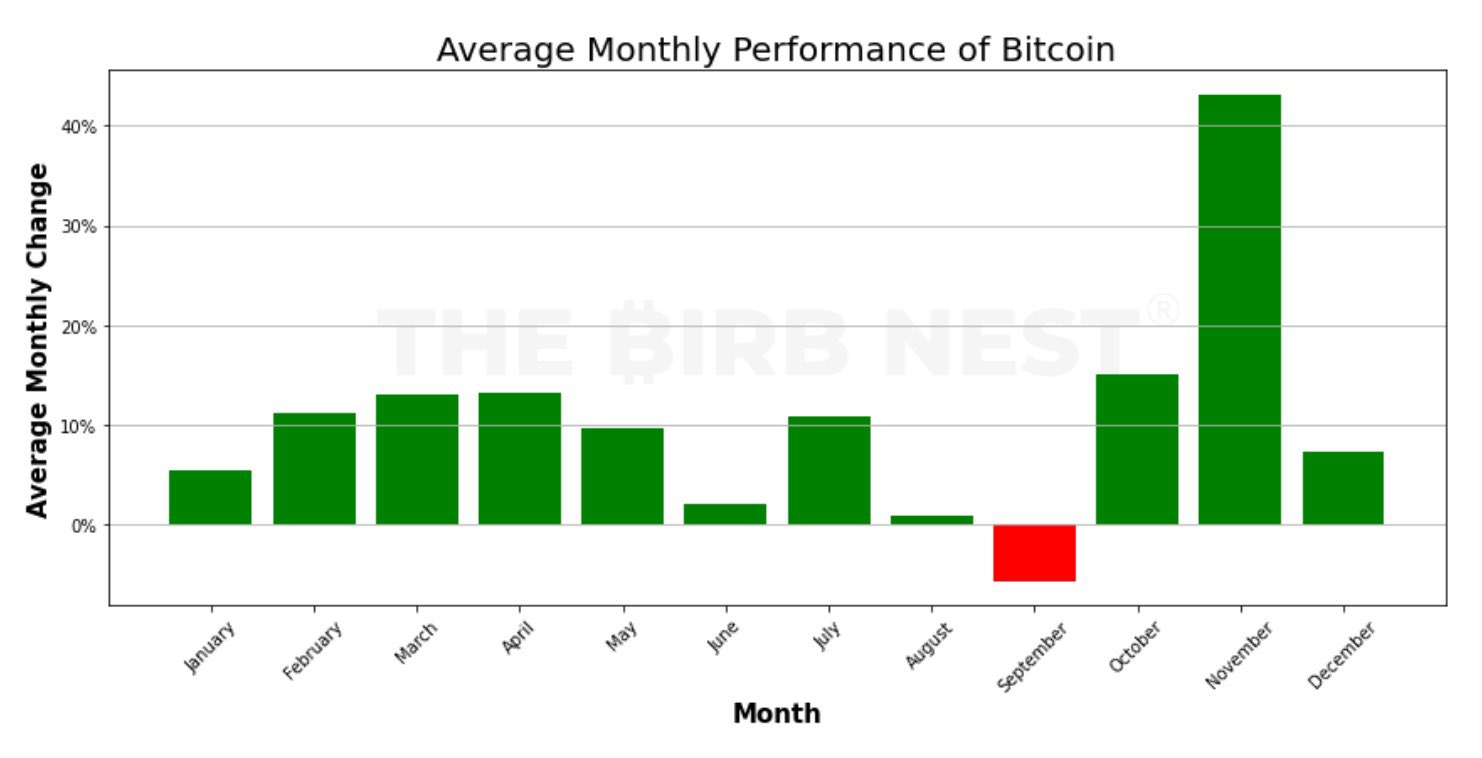

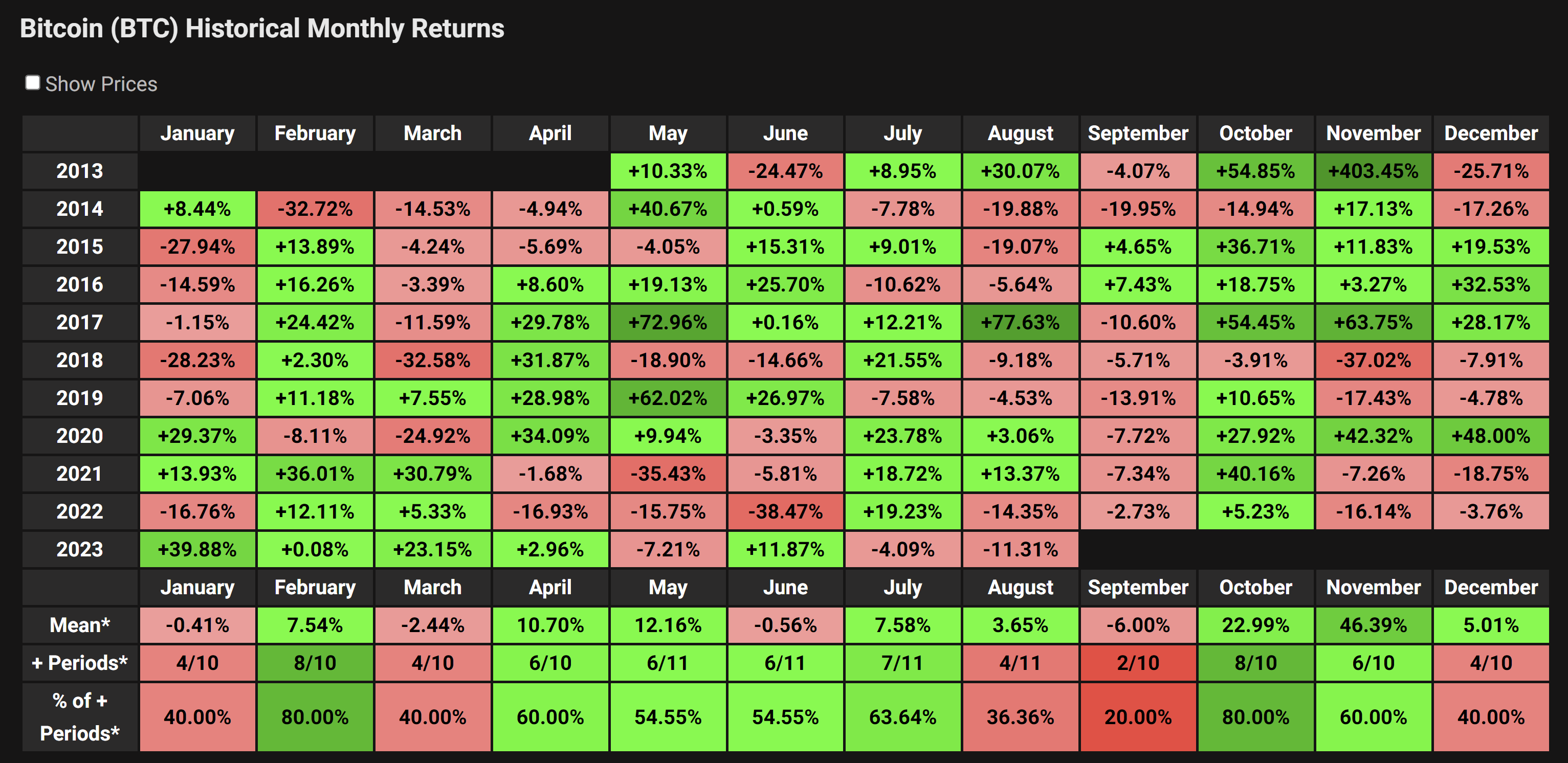

September concluded with Bitcoin fans celebrating an uncommon achievement. For the primary time in seven years, Bitcoin didn’t expertise a “Rektember” and ended the month in constructive territory, notching up a acquire of 4.27%. This uptick has ignited renewed hope and optimism, notably contemplating Bitcoin’s traditionally lackluster efficiency in September.

BTC’s latest efficiency, coupled with its historic knowledge, has prompted many market specialists to anticipate a buoyant October, now colloquially termed “Uptober.” Crypto Analyst Miles Deutscher weighed in on this dialogue via his latest tweet, emphasizing, “Traditionally, October + November are the most effective performing months for Bitcoin.”

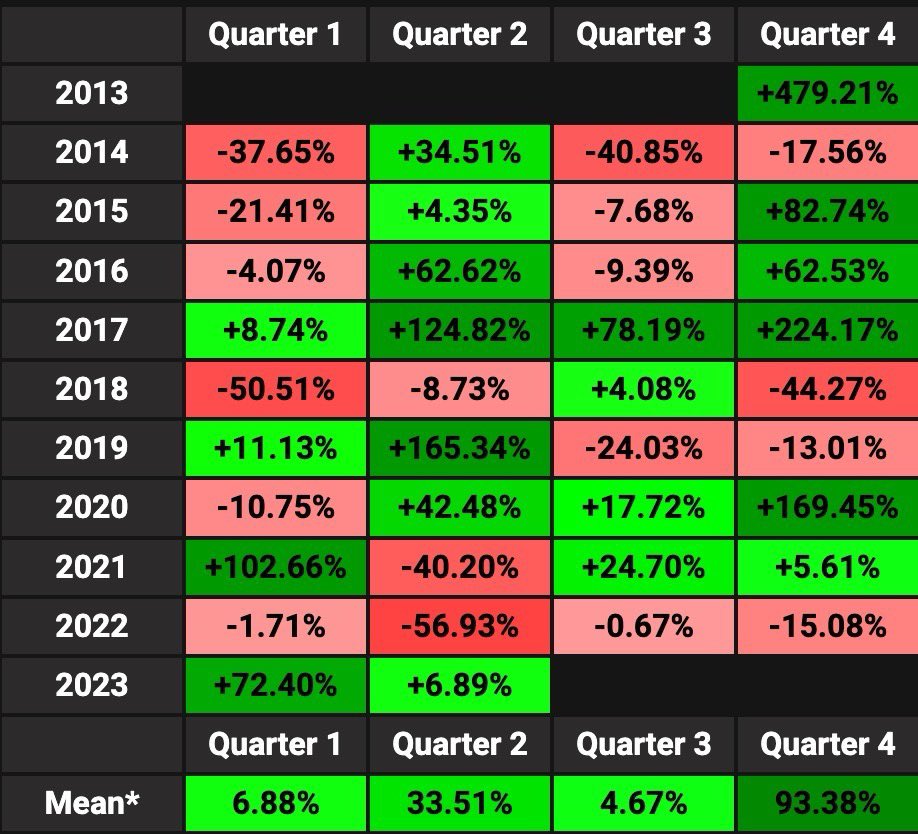

Such sentiments align with long-standing knowledge. Since its inception in 2013, Bitcoin’s fourth quarter (This fall) has persistently outperformed different quarters, recording a powerful common acquire of 93.38%. To place this into perspective, the following best-performing quarter, Q2, lags considerably, with a mean acquire of 33.51%.

In complete, BTC has skilled 6 “inexperienced” and 4 “pink” fourth quarters. Within the final bull market, in 2020, it was a whopping +169.45%.

But, it’s important to delve deeper into this knowledge. If we unpack Bitcoin’s historic efficiency since its inception in 2010, we discover an intriguing sample. Solely on two events has Bitcoin recorded income in each September and October consecutively.

Whereas September 2023 broke its seven-year jinx, it stays to be seen whether or not October will observe go well with. Traditionally, most BTC cycles have painted September pink, adopted by a inexperienced October. Given this 12 months’s inexperienced September, it poses an important query for merchants and traders alike: what’s the likelihood of witnessing two consecutive months of beneficial properties?

3. Macro Occasions This Week

This week can also be dotted with vital macroeconomic occasions that would considerably affect the Bitcoin and crypto market. Federal Reserve (Fed) chair Jerome Powell is about to talk on Monday, adopted by the discharge of ISM manufacturing knowledge. Because the week progresses, Tuesday will witness the revealing of the JOLTS jobs knowledge, whereas Wednesday has the OPEC assembly scheduled. The week culminates on Friday with the September jobs report, anticipated to be the cornerstone occasion.

The US employment report for September is extremely anticipated. Preliminary forecasts counsel the employment numbers might settle round 150,000, a lower from August’s 187,000. An anticipated drop in unemployment charges from 3.8% to three.7% and a marginal improve in common hourly earnings (0.3%, up from 0.2%) are additionally on the playing cards. Any surprising surge in these metrics might elevate the US greenback (DXY), conversely negatively weighing in on Bitcoin and crypto costs.

Bonus: Extra Crypto Tales In The Week Forward

The forthcoming week can also be brimming with extra intriguing crypto occasions and bulletins which might be eagerly awaited by merchants and traders, as outlined by crypto analyst TheDeFinvestor. The highlight will probably be on Cosmos (ATOM) as they unveil the Cosmoverse convention, a big gathering within the Cosmos group scheduled to begin on October 2.

Furthermore, the unlocking of roughly $16.6 million value of SUI on October 3 is on the horizon. This represents about 4% of its circulating provide. The ramifications of such a considerable launch could possibly be large. The start of the Sam Bankman-Fried (SBF) trial on October 3 is one other noteworthy occasion, poised to draw a substantial quantity of consideration.

The realm of DeFi can also be buzzing with speculations surrounding dYdX. On condition that dYdX V4 is developed on a Cosmos chain, there’s appreciable conjecture that the staff would possibly disclose the launch date of dYdX V4 throughout the Cosmosverse convention on October 2-3. Whereas this stays speculative, the plausibility of such an announcement throughout a serious convention makes it a topic of eager curiosity for stakeholders.

Moreover, Chainlink’s much-anticipated Smartcon convention is about to start on October 2. The group is abuzz with expectations of serious bulletins regarding Chainlink’s developments, particularly with regard to the partnership with SWIFT.

At press time, BTC traded at $28,288.

Featured picture from Shutterstock, chart from TradingView.com

[ad_2]

Source link